In a significant move for traders, Binance is set to update its collateral asset ratios, impacting the full-margin leverage available on the platform. This update, scheduled for January 12, 2026, will redefine how assets like ARB, ADA, CFX, TRX, ASTER, XPL, and ZEC can be utilized in cryptocurrency trading. As these collateral ratios shift, users must stay informed to navigate the possible margin level adjustments effectively. With changes come potential risks, making it essential for traders to understand the implications of this Binance margin update. Overall, keeping an eye on these updates will help mitigate cryptocurrency trading risks and enhance trading strategies for optimized performance.

As we delve into the forthcoming revisions at Binance, it’s crucial to understand the significance of collateral ratios in the trading landscape. The upcoming adjustments to the asset ratios will have direct implications on margin levels utilized in leveraged trading, particularly in professional modes. Traders should be prepared for the changing dynamics following the Binance update on January 12, 2026, especially concerning the assets affected. Efficient management of these changes can aid in minimizing liquidation risks and optimizing trading outcomes. Thus, being aware of these updates is vital for anyone looking to maintain an edge in cryptocurrency investments.

Understanding Binance Collateral Asset Ratios

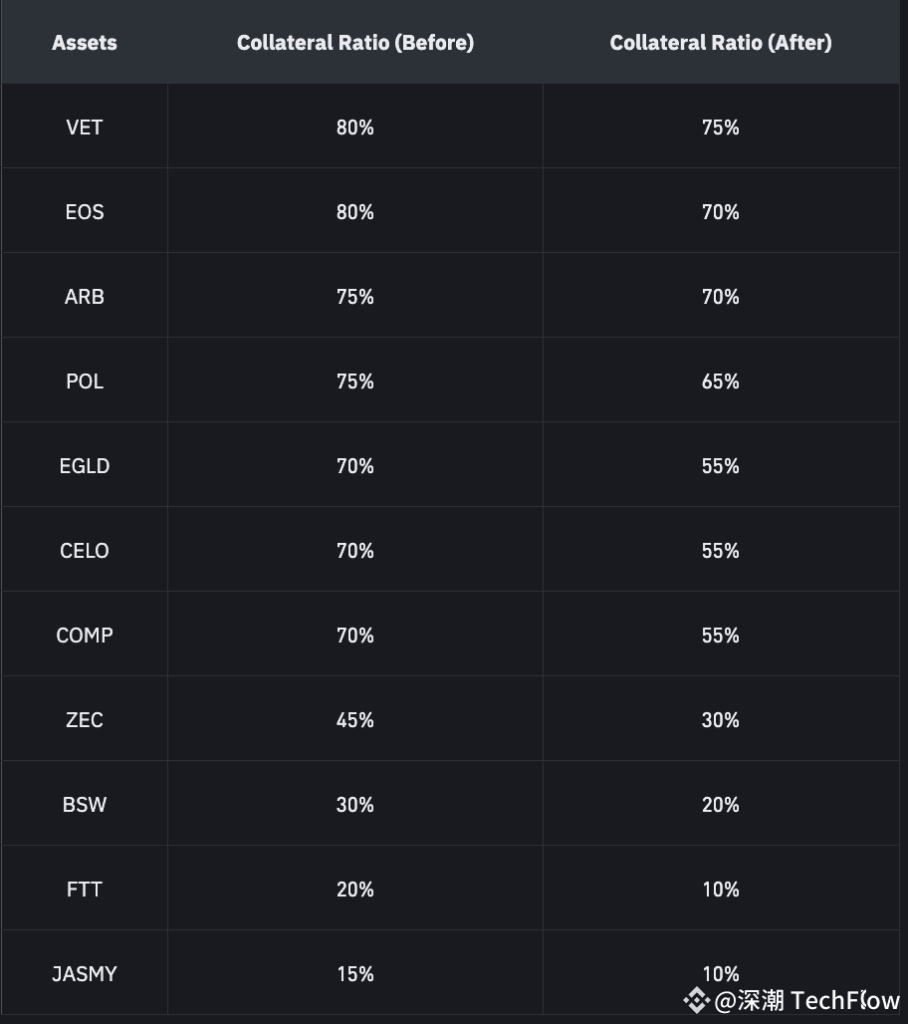

Binance collateral asset ratios play a crucial role in the risk management framework of cryptocurrency trading. These ratios determine how much capital a trader must hold in their account relative to the assets they are borrowing. As Binance prepares to update these ratios on January 12, 2026, users should be aware that this change may impact their trading strategies significantly. Knowing the updated collateral ratios for assets like ARB, ADA, and TRX, among others, allows traders to make informed decisions regarding their positions and leverage.

The adjustments scheduled for January 12 include notable cryptocurrencies such as CFX, ASTER, and XPL, which are essential for many traders on the platform. Keeping track of these updates and understanding their implications is vital for mitigating potential risks associated with margin trading. High collateral ratios can lead to increased capital requirements, influencing how traders manage their portfolios and approach market volatility.

Binance Margin Update for Different Cryptocurrencies

The upcoming Binance margin update also highlights changes for specific cryptocurrencies, affecting how traders utilize their margin accounts. For example, the full-margin leverage option will be impacted by the new collateral ratios, emphasizing the need for users to be cautious. It is important to review the updated margin policies and how they apply to popular assets like ADA and ZEC as they may require different strategies for effective trading.

Traders should also consider the implications of this update on their risk exposure, especially when utilizing leverage. Understanding the nuances of the liquidity and market depth of specific cryptocurrencies affected by the margin update allows traders to better manage their risk. With a clearer picture of Binance’s updated collateral asset ratios, users will be in a stronger position to navigate the crypto market’s inherent volatility.

Tips for Managing Risks with New Collateral Ratios

As Binance announces updates to collateral asset ratios, effective risk management becomes paramount for traders. The adjustment of ratios affects margin levels, which can lead to increased liquidation risks for those unprepared for the changes. Traders are advised to reassess their positions, particularly prior to the update, to ensure that their account balances meet the new requirements set forth by Binance.

Additionally, staying informed about market conditions and adjusting strategies accordingly will be essential for traders looking to maintain their positions during this transition. Utilizing stop-loss orders and setting alert notifications for dramatic price movements can further aid in managing risks associated with these collateral ratio adjustments. This proactive approach will allow traders to minimize potential losses and capitalize on market opportunities.

The Importance of Updating Trading Strategies

With the upcoming changes to Binance’s collateral asset ratios, it becomes essential for traders to revisit and revise their trading strategies. Strategic adjustments can ensure that traders are not caught off guard by the new collateral requirements that will come into play on January 12, 2026. This is an opportune moment to adapt to the altered market dynamics, especially with the full-margin leverage option being affected.

Moreover, traders should not only focus on compliance with the new ratios but also leverage market intelligence to refine their overall trading approach. Incorporating historical market data, technical analysis, and understanding the associated risks with cryptocurrencies will enhance their decision-making processes. By aligning their strategies with the latest Binance update, traders can improve their chances of success in an ever-evolving market.

Preparing for the January 2026 Update

As we approach the January 12, 2026, update, preparation is key for Binance users. The introduction of new collateral ratios requires a proactive stance, and traders should start adjusting their margin accounts sooner rather than later. Reviewing current holdings and liquidity of cryptocurrencies like ARB and TRX will be critical to ensure optimal alignment with the new regulations.

Additionally, Binance users are encouraged to familiarize themselves with the specifics of the update to make informed decisions. Engaging with community discussions and analyzing responses from market experts can provide valuable insights into the upcoming changes. Such foresight will help users navigate the expected challenges associated with liquidity and trading risks, ensuring a smoother transition during the update.

Navigating Cryptocurrency Trading Risks

Cryptocurrency trading inherently involves various risks, and the changes to Binance’s collateral asset ratios will introduce new dynamics for traders to consider. Understanding these risks involves recognizing the effects of increased margin requirements and how they relate to potential liquidation scenarios. As collateral ratios are adjusted, traders must be ready to adapt their strategies based on the updated risk profiles.

Moreover, educating oneself about the benefits and risks of using full-margin leverage can significantly impact trading outcomes. Keeping abreast of relevant information, such as the Binance margin update and market shifts, can empower traders to make strategic decisions. By employing thorough risk management practices, experienced and novice traders alike can better navigate the complexities of cryptocurrency markets.

The Role of Market Sentiment in Trading Decisions

Market sentiment plays a pivotal role in determining the values of cryptocurrencies, and with the upcoming collateral ratio updates from Binance, this sentiment may shift. Traders need to be aware of how market perception can impact the collateral ratios and their trading positions. Monitoring social media platforms, trading forums, and news outlets will provide insights into what may influence market behavior leading up to the January 12 update.

As traders adjust their positions in response to prevailing sentiment, it is pertinent to balance emotional decision-making with sound trading principles. Therefore, understanding how external factors contribute to overall market trends will enhance the effectiveness of strategies utilized during the upcoming changes. Engaging with the broader trading community will also provide diverse perspectives, aiding in a more rounded approach to trading during this crucial time.

Final Thoughts on Binance’s January Update

The impending update to the collateral asset ratios on January 12, 2026, marks a significant milestone for Binance and its users. It provides an opportunity for traders to refine their strategies and harness the benefits of a more structured risk management framework. By staying informed and proactive, traders can enhance their preparedness, ensuring they maintain operational efficiency in their margin trading activities.

Ultimately, this update offers valuable insights into the shifting landscape of cryptocurrency trading. By understanding the implications of collateral ratios and adjusting trading strategies accordingly, traders can navigate the complexities of the crypto market with increased confidence. The combination of knowledge and adaptability will be essential for success in the evolving world of digital currencies.

Frequently Asked Questions

What are the new Binance collateral asset ratios for January 2026?

On January 12, 2026, Binance will adjust the collateral asset ratios for various cryptocurrencies, including ARB, ADA, CFX, TRX, ASTER, XPL, and ZEC. This update is vital for users engaged in trading with full-margin leverage as it will impact their margin levels.

How will the Binance collateral asset ratios update affect my trades?

The upcoming update to Binance’s collateral asset ratios on January 12, 2026, will influence the margin levels for users on full-margin leverage. Traders should be cautious as this adjustment could increase the risk of liquidation if not monitored closely.

What is the significance of collateral ratios in Binance’s full-margin leverage?

Collateral ratios are crucial in Binance’s full-margin leverage as they determine the amount of collateral needed to support leveraged trades. Changes to these ratios on January 12, 2026, will affect trading positions and associated risks in cryptocurrency trading.

When will Binance’s collateral ratios for various assets be updated?

Binance will update the collateral asset ratios for select cryptocurrencies on January 12, 2026, at 06:00 (UTC). This update is integral for maintaining the integrity of full-margin leverage trading.

What should I do to prepare for the Binance collateral ratios update in January 2026?

To prepare for the January 12, 2026 update of Binance collateral ratios, ensure your positions are monitored and adjust your margin levels accordingly to mitigate risks associated with full-margin leverage trading.

What are the risks involved with Binance’s collateral ratios and full-margin leverage?

The primary risks associated with Binance’s collateral ratios, particularly following the January 12, 2026 update, include increased margin calls and potential liquidation of positions. Traders must stay informed and adjust to the new collateral ratios to manage these risks effectively.

How can I stay informed about Binance collateral asset ratio updates?

To stay informed about updates to Binance collateral asset ratios, including those on January 12, 2026, users should regularly check Binance’s official announcements, follow the news on cryptocurrency trading risks, and monitor their trading positions closely.

What assets are affected by the January 2026 Binance collateral ratios update?

The January 12, 2026 update to Binance collateral asset ratios will affect assets such as ARB, ADA, CFX, TRX, ASTER, XPL, and ZEC, which are critical for traders using full-margin leverage.

| Key Point | Details |

|---|---|

| Update Date and Time | January 12, 2026, at 06:00 UTC |

| Assets Affected | ARB, ADA, CFX, TRX, ASTER, XPL, ZEC |

| Duration of Update | Approximately 30 minutes |

| Impact on Users | Adjustment of collateral ratios will affect margin levels in full-margin leverage professional mode, increasing liquidation risks. |

Summary

Binance collateral asset ratios will be updated on January 12, 2026, affecting several key cryptocurrencies. This change is crucial for users engaged in full-margin trading, as it can significantly influence their margin levels and pose potential liquidation risks. It is essential for traders to stay vigilant during this update to navigate possible market fluctuations effectively.