Binance and MEXC Executives Discuss the Implications of Coinbase’s Recent Moves

In a remarkable convergence of insights, top executives from Binance and MEXC Global recently engaged in a detailed discussion about the strategic actions undertaken by one of their biggest competitors, Coinbase. This dialogue, held at a major industry conference attended by key figures across the cryptocurrency world, revolved around Coinbase’s recent initiatives, their impact on the market, and the potential shifts in the competitive landscape.

Coinbase’s Bold Strategies

Coinbase, one of the first major cryptocurrency exchanges, has recently unveiled a series of ambitious strategies aimed at expanding its market share and reinforcing its platform’s security and user interface. These initiatives come as a response to the evolving regulatory landscape and the increasing competition in the cryptocurrency exchange industry.

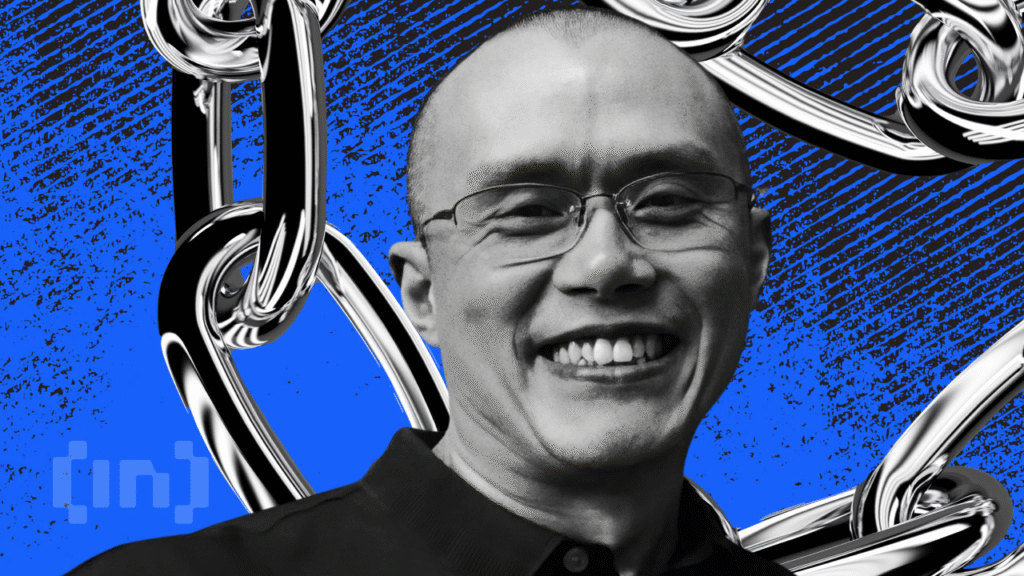

Perspectives from Binance

Changpeng Zhao, CEO of Binance, offered poignant insights into how Coinbase’s strategies impact the broader market. He noted, “Coinbase’s actions signify a larger shift within the crypto industry towards maturity and stability. Their focus on enhancing security protocols and user experience sets a standard we all strive to meet.”

Zhao further discussed how this could lead to heightened expectations from users and regulators alike, potentially increasing operational costs but also paving the way for more substantial growth and adoption rates. He expressed a positive outlook on these changes, emphasizing the need for industry leaders to not just adapt quickly but also innovate continuously.

Commentary from MEXC Global

John Chen, the Senior Vice President of MEXC Global, provided a complementary perspective, focusing on the competitive dynamics Coinbase’s initiatives introduce. “Coinbase’s recent endeavors, particularly their expansion into new markets and enhancement of user features, positions them as a formidable force. This pushes us at MEXC to think more creatively about our own offerings and market strategy.”

Chen highlighted the necessity for exchanges like MEXC to diversify their service offerings and enhance operational efficiencies to better meet the evolving needs of users. He underscored the importance of agility in business strategy and adaptation to the swiftly changing technological forefront of the crypto trading industry.

Industry Impact and Consumer Response

Both executives agreed that these developments are likely to influence consumer expectations regarding platform performance, user security, and overall service quality. They predicted an industry-wide ripple effect, prompting other exchanges to either step up their game or risk losing relevance.

Moreover, they discussed the potential reactions from global regulators, emphasizing that Coinbase’s proactive approach could set a new benchmark for compliance and transparency in operations, thus modifying the regulatory environment for all players.

Closing Thoughts

The strategic moves by Coinbase have undoubtedly sent waves through the cryptocurrency exchange community. As noted by the discussions between Binance’s Changpeng Zhao and MEXC Global’s John Chen, the implications of these strategies extend beyond competitive dynamics to potentially redefine operational, regulatory, and service norms within the industry.

Moving forward, the ability for exchanges to innovate while maintaining high compliance and security standards will likely dictate their market positions. As user demands evolve and regulatory pressures increase, only those platforms that manage to effectively align their growth strategies with these changes will thrive.