Goldman Sachs Forecasts a 25 Basis-Point Rate Cut from the Bank of England in December

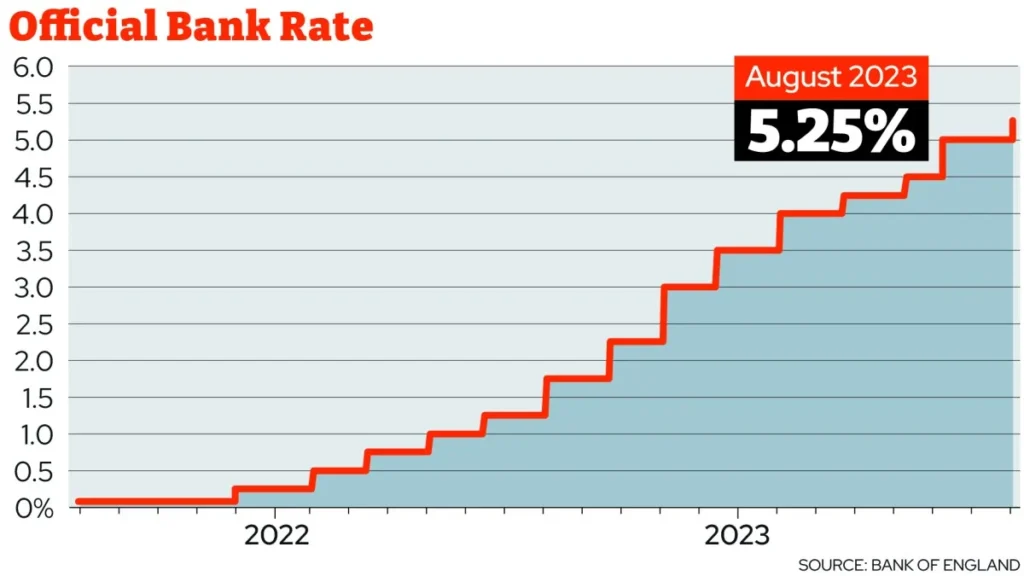

Goldman Sachs, the leading global investment bank, has projected a 25 basis-point reduction in interest rates by the Bank of England (BoE) coming this December. This forecast aligns with a series of adjustments in central bank policies around the world, as responses to evolving economic conditions.

Analysts from Goldman Sachs highlighted several factors influencing this expectation. Notably, inflation rates and economic growth dynamics in the United Kingdom are pivotal. Despite the inflationary pressures that have prompted previous rate hikes, recent data suggest that inflation may be starting to peak, albeit at high levels. Concurrently, signs of economic softening, burdened by high living costs and global economic uncertainties, underscore the possibility of easing monetary policies to support economic stability.

The envisioned rate cut could be seen as a strategic move to alleviate some of the inflation-induced pressures on households and businesses. Lower interest rates tend to encourage borrowing and spending, which could stimulate economic activity. However, this comes with the counter-risk of potentially adding fuel to the inflationary fire if not timed and scaled appropriately.

Economic experts from Goldman Sachs believe that by December, the data will have provided a clearer picture of the economic trajectory, enabling the BoE to make a more informed decision. The expected outcome falls into what appears to be a global trend of central banks’ navigation between curbing inflation and fostering economic growth amidst growing concerns of a potential global slowdown.

Market reaction to such predictions is generally mixed, as investors try to anticipate central bank moves. A potential rate cut might bolster equity markets as cheaper loans could boost consumer spending and corporate investments. On the other hand, the bond market might see yields falling, reflecting the anticipated drop in rates.

Forex markets could also see interesting moves, particularly in the GBP currency pairs. A rate cut generally leads to a depreciation of the currency, as lower interest rates decrease foreign investments in GBP-denominated assets, leading to lower demand for the currency.

It’s worth noting that while Goldman Sachs’ prediction carries considerable weight given its expertise and historical accuracy in economic forecasting, forecasting central banking decisions involves a complex array of variables and potential shocks. Factors such as sudden political changes, unexpected shifts in economic indicators, or international trade relationships can drastically sway the economic outlook and influence the BoE’s decisions.

In conclusion, if Goldman Sachs’ prediction holds true, the December rate cut by the Bank of England would represent a significant shift in its approach to managing the delicate balance between fostering economic growth and controlling inflation. Stakeholders, ranging from investors to everyday consumers, would need to stay tuned to evolving economic indicators, as these would guide the BoE’s final decision on the matter. As always, such macroeconomic adjustments would not only reshape domestic economic landscapes but also reverberate across global markets.