Bank of America cryptocurrency allocation marks a significant step in the financial landscape, as the bank now actively encourages its wealth management clients to consider integrating digital assets into their investment portfolios. By advising an allocation of 1-4% of funds to cryptocurrencies, Bank of America is acknowledging the growing importance of cryptocurrency funds in modern investment strategies. This proactive approach not only highlights the bank’s commitment to innovation but also positions them as a leader in crypto investment strategies within the financial sector. With an increased focus on digital assets allocation, clients can benefit from diversified portfolios that embrace both traditional and emerging investments. Bank of America advice reflects a shift in wealth management investment, paving the way for more investors to explore the potential of the cryptocurrency market.

The recent initiatives by Bank of America to incorporate digital currencies into wealth management strategies signify a broader trend in the financial industry. By suggesting clients to invest a portion of their capital in virtual currencies, the bank is redefining what it means to allocate resources effectively in today’s economy. This move signals a growing acceptance of alternative assets, pushing the narrative that cryptocurrencies can be a valuable component of a comprehensive financial plan. As traditional banks begin to embrace the evolution of digital finance, the opportunity for investors to diversify their portfolios with these innovative assets increases. This development opens the door for clients to explore a new realm of investment possibilities, tapping into the dynamic and rapidly evolving cryptocurrency market.

Bank of America’s Cryptocurrency Allocation Guidelines

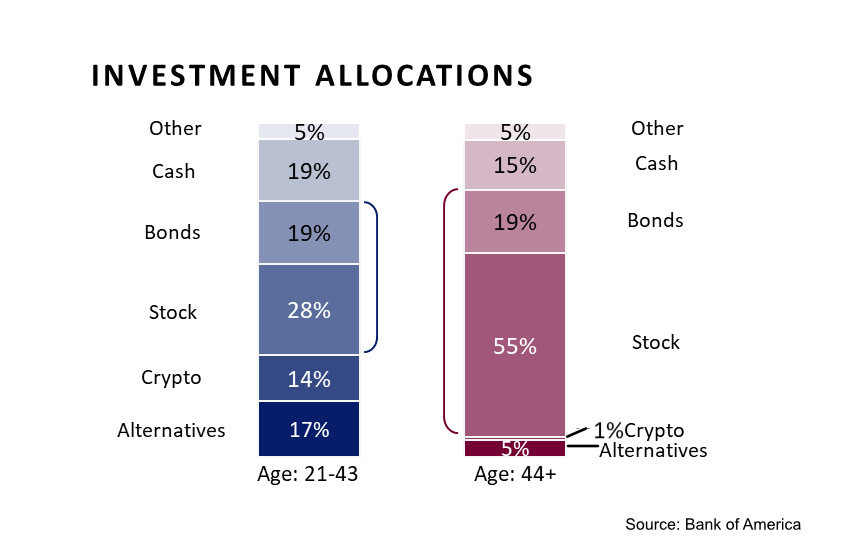

Bank of America has recently taken a significant step in the world of digital assets by advising its wealth management clients to allocate between 1-4% of their investment funds to cryptocurrencies. This marks the bank’s first direct acknowledgment of digital assets within its investment strategies. By incorporating cryptocurrency funds into their portfolios, clients can potentially harness the benefits of high volatility and growth that the digital asset market can offer.

This prudent allocation aligns with modern investment practices that emphasize diversification. Bank of America’s recommendation to dedicate a small percentage of a portfolio to cryptocurrencies encourages wealth management clients to explore the evolving landscape of digital currencies while maintaining a balanced and risk-averse approach. With expert guidance from Bank of America advisors, clients can better navigate crypto investment strategies effectively.

Understanding Digital Assets Allocation in Wealth Management

Digital assets, including cryptocurrencies, have become integral components of contemporary wealth management strategies. The recommendation from Bank of America indicates a growing recognition of the importance of these alternative investment vehicles. Wealth management professionals are increasingly incorporating digital assets allocation into their overall investment strategies to meet the diverse needs of their clients.

By strategically integrating cryptocurrency funds, financial advisors can help their clients capitalize on emerging market trends while mitigating risks associated with ownership of volatile assets. This type of investment is generally best suited for individuals who are willing to embrace a blend of traditional wealth management investment approaches with more innovative solutions, thus enhancing their overall portfolio performance.

The Growth of Cryptocurrency Funds in Investment Portfolios

As demand for cryptocurrency funds continues to rise, investors are recognizing the potential returns offered by these digital assets. The surge in interest has prompted banks like Bank of America to help clients understand how a small allocation to cryptocurrencies can fit within broader investment goals. This growth also highlights the evolving nature of financial markets in which cryptocurrencies are no longer seen as fringe investments but as viable options for wealth accumulation.

Wealth management clients who allocate 1-4% of their funds to cryptocurrency can expect a more diversified portfolio. Diversification is key in today’s economy, and including digital assets in investments helps in hedging against traditional market fluctuations. Over time, this can lead to enhanced risk-adjusted returns and open doors to new investment strategies that leverage the unique characteristics of cryptocurrencies.

Analyzing Crypto Investment Strategies for Wealth Management Clients

Navigating crypto investment strategies can feel daunting for many wealth management clients, especially given the market’s inherent volatility. Bank of America provides invaluable advice on how to implement effective strategies that capitalize on the opportunities presented by digital assets. Clients can work closely with advisors to develop a personalized investment plan that aligns with their financial goals and risk tolerances.

Through active monitoring and ongoing education, investors can better understand market dynamics and make informed decisions regarding cryptocurrency allocation. Bank of America emphasizes the importance of staying informed about market trends and regulatory changes to successfully manage risks associated with crypto investments. Thus, clients who adopt these strategies can position themselves for success in the rapidly evolving landscape of cryptocurrency.

Bank of America Advice on Managing Cryptocurrency risks

With the rising interest in cryptocurrencies, risk management has become a central topic in wealth management. Bank of America provides actionable advice on how clients can mitigate the risks associated with investing in digital assets. By following established guidelines and engaging with knowledgeable advisors, clients can navigate the complexities of cryptocurrency investments more effectively.

Understanding market sentiment and employing disciplined trading strategies are vital for reducing exposure to potential losses. Bank of America also encourages clients to view cryptocurrencies as part of a broader investment strategy rather than standalone assets, helping them maintain a holistic approach to wealth management.

The Role of Wealth Management in Cryptocurrency Adoption

Wealth management plays a crucial role in the adoption and integration of cryptocurrencies into investment portfolios. As more clients express interest in digital assets, financial institutions like Bank of America are setting the standard in guiding them through this transition. By offering insights and tailored advice, wealth management professionals can help clients bridge the gap between traditional investments and the new age of digital currencies.

Moreover, wealth management services can provide clarity around the regulatory landscape and assist clients in making educated decisions regarding cryptocurrency investments. This holistic approach ensures that clients are not merely investing in cryptocurrencies, but are also considering the implications on their overall wealth strategy and long-term financial health.

Exploring the Future of Digital Assets in Investment Strategies

As we look ahead, the future of digital assets within investment strategies seems promising. With institutions like Bank of America leading the charge in acknowledging cryptocurrencies, it’s likely that more investors will begin to incorporate them into their portfolios. This shift could pave the way for greater acceptance and usage of cryptocurrencies as legitimate assets.

Investors who are proactive in exploring the future landscape of digital assets stand to benefit from early adoption. By staying informed about technological advancements and shifts in market behavior, wealth management clients can better prepare themselves to maximize their investment potential in cryptocurrency funds.

Wealth Management Investment and Cryptocurrency Trends

The integration of cryptocurrencies into wealth management investment strategies represents a significant trend in the financial landscape. Financial institutions are adapting to meet client demand for exposure to digital currencies, reflecting the broader societal acceptance of cryptocurrency as an investment vehicle. Bank of America’s recent guidance has paved the way for others in the industry to follow suit.

This trend signifies a growing commitment to innovation and diversification in wealth management. As more clients seek to understand how cryptocurrency can enhance their investment strategies, financial advisors can leverage growing knowledge to tailor recommendations and help clients navigate the complexities of these evolving assets.

The Importance of Education in Cryptocurrency Investment

Education plays an essential role in the investment process, particularly in the realm of cryptocurrencies. For wealth management clients, understanding the foundational concepts of digital assets is critical to making informed investment decisions. Bank of America is at the forefront of educating clients about cryptocurrencies, ensuring that its advisory teams provide up-to-date information on market trends and technology.

Through workshops, seminars, and informative resources, wealth management clients can gain a deeper understanding of the potential and pitfalls of cryptocurrencies. This emphasis on education not only empowers clients but also fosters a more informed dialogue between investors and their advisors, ultimately leading to more strategic investment outcomes.

Frequently Asked Questions

What is Bank of America’s stance on cryptocurrency allocation for wealth management clients?

Bank of America advises its wealth management clients to allocate between 1-4% of their investment funds to cryptocurrencies. This recommendation signifies the bank’s first direct acknowledgment of the importance of digital assets in diversifying an investment portfolio.

How does Bank of America suggest wealth management clients manage cryptocurrency funds?

Bank of America’s guidance on cryptocurrency allocation encourages clients to consider investing 1-4% of their wealth management portfolios in digital assets. This strategic advice aims to help clients navigate the growing landscape of crypto investment strategies.

What percentage does Bank of America recommend for cryptocurrency allocation in investment portfolios?

Bank of America recommends a cryptocurrency allocation of 1-4% for its wealth management clients. This allocation is part of a broader strategy to incorporate digital assets into their overall investment approach.

What are the benefits of cryptocurrency allocation in Bank of America’s investment advice?

According to Bank of America, including 1-4% of cryptocurrencies in wealth management portfolios can provide diversification benefits, potentially enhancing investment returns while managing risk associated with traditional assets.

Can clients trust Bank of America’s advice on digital assets allocation?

Yes, clients can trust Bank of America’s advice on digital assets allocation. The bank’s research highlights the growing relevance of cryptocurrencies in modern investment strategies, solidifying its position in wealth management.

What should investors consider when following Bank of America’s crypto investment strategies?

Investors should consider their risk tolerance, investment goals, and the volatile nature of cryptocurrencies when following Bank of America’s crypto investment strategies. Allocating 1-4% allows for potential growth while minimizing exposure to risk.

How has Bank of America’s view on cryptocurrency changed in recent times?

Recently, Bank of America has shifted its view to include cryptocurrencies explicitly in its wealth management advice, marking a significant step in recognizing digital assets as a viable investment option.

What are some potential risks of allocating to cryptocurrencies, according to Bank of America?

While Bank of America suggests a small allocation of 1-4% in cryptocurrencies, it also warns clients about the inherent volatility and risks associated with digital assets, advising to proceed with caution and informed decisions.

| Key Points |

|---|

| Bank of America advises wealth management clients to allocate 1-4% of funds to cryptocurrencies. |

Summary

Bank of America cryptocurrency allocation recommendations highlight a significant shift towards embracing digital assets for wealth management clients. By advising clients to allocate 1-4% of their portfolios to cryptocurrencies, the bank acknowledges the growing importance of these digital currencies as a viable investment strategy. This marks a pivotal moment as it is the first direct recognition of cryptocurrencies by a major financial institution, indicating a trend towards broader acceptance and integration of digital assets in traditional investment portfolios.