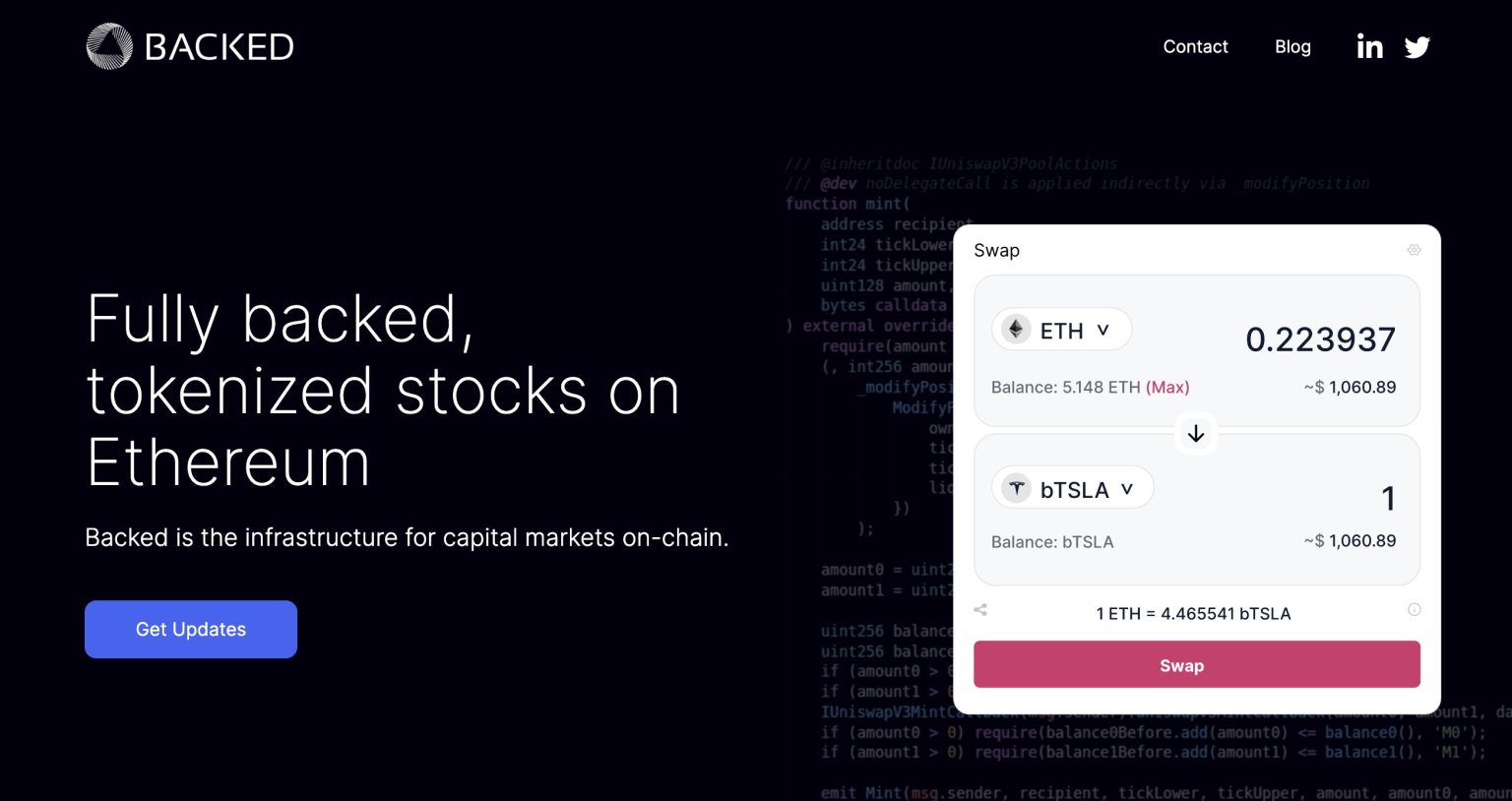

BackedFi stands at the forefront of innovation in the realm of Solana stock tokenization, boasting an impressive asset scale nearing $1 billion. This groundbreaking platform has successfully enabled the tokenization of stocks, showcasing the potential of crypto asset management within traditional markets. On January 4, 2026, Solana Daily highlighted that BackedFi’s RWA on-chain platform has achieved remarkable milestones, including the seamless tokenization of valuable assets on the Solana network. By bridging the gap between traditional equity and the burgeoning world of digital finance, BackedFi is reshaping the landscape of investment. With increasing interest in tokenized stocks, BackedFi offers investors a unique opportunity to engage with their favorite equities through a secure and efficient platform.

BackedFi, leveraging the capabilities of Solana’s technology, is revolutionizing how investors interact with traditional stock markets by allowing for the easy conversion of these assets into digital tokens. This influential RWA on-chain system provides a robust framework for crypto asset management, enabling users to trade, hold, and invest in tokenized versions of conventional stocks. As the market for digital assets expands, alternatives like the BackedFi platform play a crucial role in fostering efficient transactions and innovative investment strategies. By facilitating access to tokenized equities, it serves as a gateway for both seasoned and novice investors looking to diversify their portfolios in the crypto space. The growing trend toward stock tokenization highlights the shifting dynamics in finance, emphasizing the need for platforms that support this evolution.

Understanding Solana Stock Tokenization

Solana stock tokenization represents a transformative approach to how traditional assets are managed in the crypto economy. By enabling the creation of digital representations of U.S. stocks, platforms like BackedFi empower investors to gain exposure to conventional equity markets without the constraints typically associated with trading stocks. This innovation harnesses the speed and scalability of the Solana blockchain, allowing for fast transactions and low fees, which can enhance the overall trading experience for users.

The tokenization of stocks on the Solana network not only democratizes access to investments but also provides a seamless way to manage these digital assets. As traditional financial systems begin to embrace blockchain technology, Solana’s approach is leading the charge. The implementation of tokenized stocks signifies a new era in asset management, where fractional ownership and easy transferability of equities can attract a broader base of investors.

Frequently Asked Questions

What is BackedFi and how does it relate to Solana stock tokenization?

BackedFi is a pioneering platform on the Solana blockchain that specializes in stock tokenization. It enables users to invest in tokenized stocks, providing fractional ownership of U.S. stocks through an innovative RWA on-chain platform.

How does the BackedFi platform function for crypto asset management?

The BackedFi platform leverages the capabilities of the Solana network to facilitate seamless crypto asset management. Users can tokenize traditional stocks and manage their investments in a decentralized manner, enhancing accessibility and liquidity.

What are tokenized stocks and how does BackedFi utilize them?

Tokenized stocks are digital representations of traditional stocks that allow for fractional ownership and trading on blockchain platforms. BackedFi utilizes this technology to create a trading environment where users can buy, sell, and hold tokenized stocks efficiently.

What is the significance of RWA on-chain platforms like BackedFi?

RWA on-chain platforms, such as BackedFi, play a crucial role in bridging the gap between traditional finance and the blockchain ecosystem. They facilitate the tokenization of real-world assets, making it easier for investors to access and manage these assets through cutting-edge technology.

As of January 2026, what milestones has BackedFi achieved in stock tokenization?

As reported by Solana Daily, BackedFi has achieved remarkable success, reaching nearly $1 billion in asset scale through its stock tokenization efforts. This milestone underscores the platform’s impact on the Solana network and the growing interest in tokenized investments.

| Key Point | Details |

|---|---|

| Platform Name | BackedFi |

| Base Technology | Solana Blockchain |

| Asset Scale | Nearly $1 billion |

| Date of Announcement | January 4, 2026 |

| Source of Information | Solana Daily on X platform |

| Primary Service | Tokenization of Stocks |

Summary

BackedFi is rapidly establishing itself as a leading U.S. stock tokenization platform on the Solana network, having achieved nearly $1 billion in asset scale. This significant milestone highlights BackedFi’s innovative approach to integrating real-world assets (RWA) into the blockchain ecosystem, facilitating a new avenue for investors. As the platform continues to grow, it promises to enhance liquidity and accessibility within the financial markets.