Author: Bpay News

The market showed a muted response to the interest rate decision, as Bitcoin briefly surpassed $112,000 before retreating, while Ethereum maintained its position above $4,000. Bitcoin’s price movement was notable, as it initially experienced an uptick that took it over the $112,000 mark. However, this surge was short-lived, with Bitcoin declining shortly after reaching this peak. In contrast, Ethereum demonstrated more stability during this period. It consistently traded above the $4,000 threshold, reflecting resilience amidst market fluctuations. The overall reaction of both cryptocurrencies indicates a cautious sentiment among investors in response to the interest rate decision. While Bitcoin experienced volatility,…

The Federal Reserve’s interest rate decision is currently characterized by a “hawk-dove dance,” marking a notable shift not seen in many years. This dynamic reflects a balancing act between those advocating for higher interest rates to combat inflation and those favoring lower rates to support economic growth. The interplay between these opposing views is critical as the Fed navigates its monetary policy in a complex economic landscape. Analysts are closely observing the Fed’s approach, as it could have significant implications for financial markets and the broader economy. The outcome of this decision-making process will likely influence future economic conditions and…

Crypto Market Loses $100 Billion in Market Cap While S&P Hits New Highs In a surprising divergence of market trends, the cryptocurrency market has experienced a notable loss, shedding approximately $100 billion in market capitalization. This drop contrasts sharply with the performance of traditional stock markets, where the S&P 500 index has continued to reach new highs. Underlying Factors The decline in the cryptocurrency market capitalization could be attributed to a variety of factors. Increased regulatory scrutiny across major economies has played a significant role. Governments and financial institutions are taking a harder stance on cryptocurrencies due to concerns over…

Federal Reserve Chair Jerome Powell is scheduled to hold a monetary policy press conference at 2:30 PM, which has garnered significant market attention regarding future rate cuts. Investors and analysts are keenly awaiting insights into the Fed’s direction on interest rates. The upcoming conference is expected to clarify the central bank’s stance on monetary policy and its implications for the economy. Market participants are particularly focused on any signals regarding the trajectory of potential rate cuts, which could influence financial markets and economic forecasts.

What To Expect From Solana Price In November 2025? As we approach November 2025, the cryptocurrency market, especially Solana, is the center of considerable attention. Solana, known for its high-speed blockchain and the promise of scalability and low transaction costs, has had a journey marked by both innovative milestones and notable challenges. With stakeholders across the globe keeping a keen eye on its trajectory, let’s explore the factors that could influence the price of Solana (SOL) in November 2025, the potential market trends, and developments on the horizon. Historical Performance and Growth Trajectory To understand the potential future of Solana’s…

Following the Federal Reserve’s announcement regarding interest rates, the spot gold price experienced a brief decline, reaching $3979.9 per ounce. This fluctuation in gold prices is often influenced by changes in interest rates, as they can affect investor behavior and market dynamics. The reaction of gold prices to such announcements reflects the ongoing relationship between monetary policy and commodity markets. Investors typically monitor these developments closely, as they can signal shifts in economic conditions and affect asset allocation strategies.

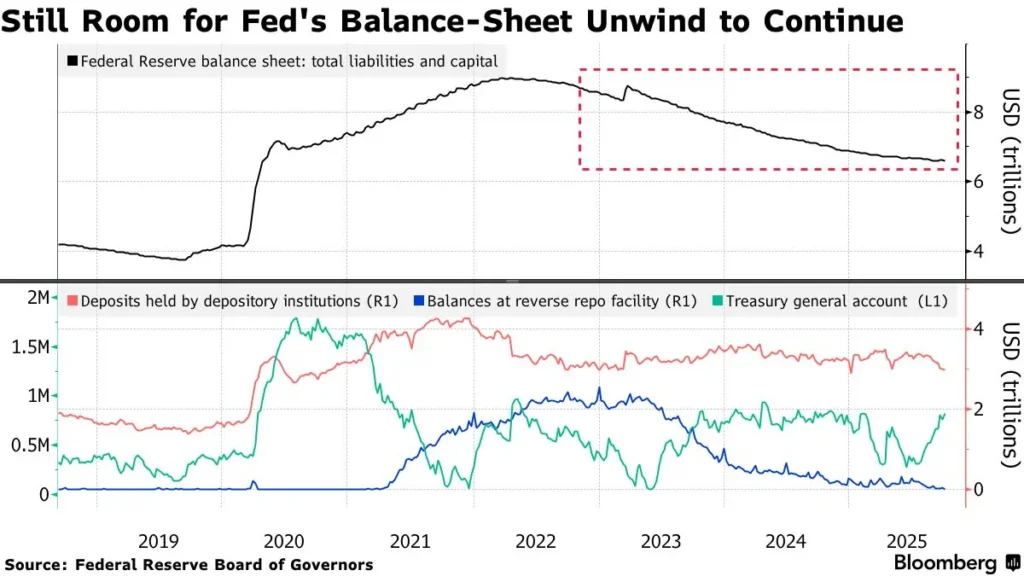

Federal Reserve’s Decision The Federal Reserve announced a rate cut and the cessation of balance sheet reduction, with two dissenting votes indicating rising discord among members. The decision reflects a significant shift in monetary policy as the Fed aims to address current economic conditions. The move to halt balance sheet reduction comes amid discussions about the potential impacts on financial markets and the economy. The dissenting votes highlight differing perspectives within the Federal Reserve, signaling challenges in achieving consensus on future policy directions. The announcement marks a pivotal moment in the Fed’s approach to managing economic stability.

The Federal Reserve has reduced interest rates by 25 basis points as part of its planned monetary policy adjustments. This decision reflects the central bank’s ongoing strategy to manage economic conditions effectively. The reduction aims to stimulate economic growth and support various sectors by making borrowing cheaper. Market participants and analysts have closely monitored this development, as it influences lending rates and investment decisions across the economy. The Federal Reserve’s actions are part of a broader approach to address economic challenges and uncertainties.

The Federal Reserve has officially declared the conclusion of its quantitative tightening measures. This marks a significant shift in the central bank’s monetary policy approach. Quantitative tightening involved the gradual reduction of the Fed’s balance sheet, which was expanded during previous economic stimulus efforts. The decision to end these measures reflects changing economic conditions and aims to support financial stability. Analysts are closely monitoring the implications of this policy shift for the economy and markets.

Federal Reserve Board Governors Milan and Schmidt have expressed their dissent regarding a recent resolution. Their disagreement highlights differing perspectives within the board. The resolution in question has sparked varied opinions among the governors. Milan and Schmidt’s dissent raises important questions about the direction of policy decisions at the Federal Reserve. Their stance reflects a broader debate over the implications and effectiveness of the resolution.