Author: Bpay News

Bitcoin has fallen back to $110,000 after hawkish comments from Federal Reserve Chair Jerome Powell. The remarks have raised concerns among investors regarding future monetary policy. Powell’s statements suggest a potential tightening of financial conditions, which has historically impacted cryptocurrency markets. As a result, Bitcoin’s volatility continues, reflecting broader market reactions to regulatory and economic signals. Investors are closely monitoring the Fed’s stance as it influences market dynamics.

Federal Reserve’s Recent Rate Cut: Implications for the Cryptocurrency Market In an unexpected move that could reshape investment landscapes, the Federal Reserve has once again slashed interest rates. This decision, driven by a need to stimulate economic growth amidst various global economic pressures, has left investors speculating about the potential impact on various asset classes, including cryptocurrencies. Will this monetary policy adjustment lead cryptocurrencies like Bitcoin, Ethereum, and others to rally, or will it cause a stall in the momentum that these digital assets have been experiencing? Background on Federal Reserve’s Decision The Federal Reserve’s decision to cut interest rates…

December Rate Cut Federal Reserve Chair Jerome Powell’s recent comments suggest that a rate cut in December is not guaranteed, causing volatility in the financial markets. Investors reacted strongly to Powell’s assertion that the decision regarding interest rates remains uncertain. His remarks highlighted the Fed’s cautious approach toward monetary policy and the ongoing assessment of economic conditions. Analysts noted that such statements could influence market expectations and investment strategies leading into the end of the year. The financial community is closely monitoring any developments or signals from the Fed regarding future rate changes as economic data continues to unfold.

liquidated network In the last hour, the entire network has experienced liquidations totaling $2.95 billion. This significant amount reflects a rapid movement of assets within the network. Liquidation events can impact market stability and investor sentiment. The process involves converting assets into cash or collateral to cover losses, often triggered by market volatility. Such a large-scale liquidation could influence trading strategies and market dynamics in the near term.

$BTC Long Position A notable trading entity known as the “100% Win Rate Whale” has raised its long position in Bitcoin to $1.14 billion, with an entry price of $110,123.0. The whale’s substantial position indicates a strong confidence in Bitcoin’s price trajectory, reflecting the ongoing interest in digital assets. The increase in long positions is often seen as a bullish signal in the cryptocurrency market, as it suggests expectations of further price rises. This action contributes to the overall volatility and dynamics within the Bitcoin trading environment, drawing attention from other traders and investors alike.

Federal Reserve Chair Jerome Powell stated that the inflation rate is nearing the 2% target, while monetary policy continues to be somewhat tight. Powell’s remarks highlight the current economic landscape, where inflationary pressures are closely monitored. He indicated that while progress has been made toward the target, the Federal Reserve remains cautious in its approach to monetary policy. This caution reflects ongoing concerns about the overall economic environment and the potential need for further adjustments. Policymakers are balancing the goal of controlling inflation with the implications of their decisions on economic growth.

Title: Fed Cuts Rates by 25 bps Amid Lingering Macro Challenges Date: October 3, 2023 Introduction: In a significant monetary policy decision, the Federal Reserve announced a 25 basis point cut in interest rates, attempting to bolster the U.S. economy amid increasing signs of a global slowdown. While markets had largely anticipated the cut, investors and policymakers are now facing another, perhaps more daunting, macroeconomic challenge that could derail economic progress: the looming threat of a global debt crisis. Understanding the Rate Cut: The Federal Reserve’s decision to lower interest rates is primarily aimed at stimulating economic activity by making…

$SOL has fallen below the $190 mark, experiencing a loss of 4.2% over the last 24 hours. The decline reflects ongoing volatility in the cryptocurrency market. Analysts are monitoring the situation as market dynamics shift, impacting investor sentiment. This dip in value comes amid broader fluctuations seen across various cryptocurrencies, raising concerns among traders about potential further losses.

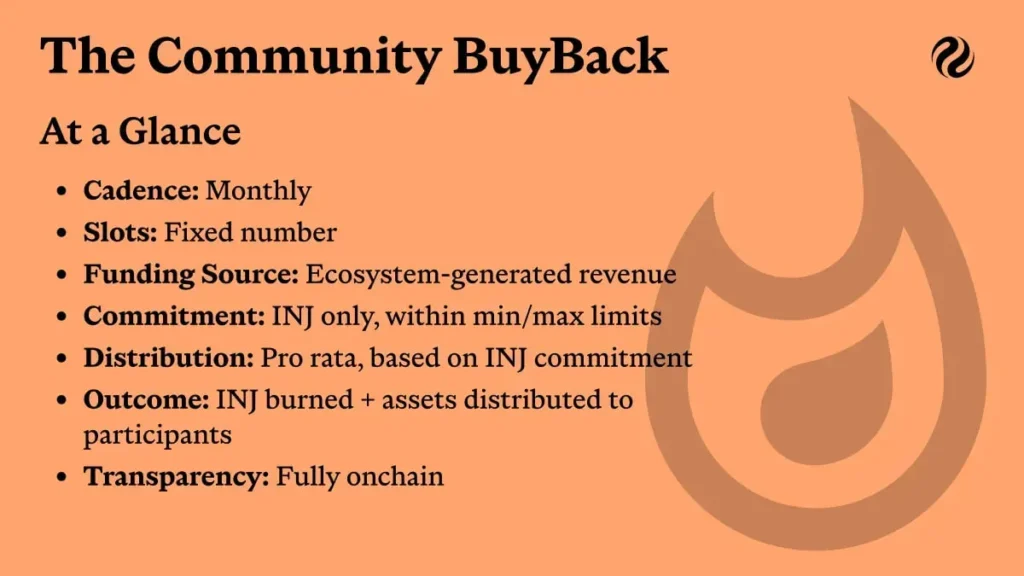

Injective (INJ) Completes Its First Community-Driven Buyback Worth $32 Million Injective Protocol has made headlines in the cryptocurrency sector by completing its inaugural community-based buyback, amounting to a substantial $32 million. This significant financial move is not just a display of the protocol’s robust economic health but also a testament to its commitment to fostering community involvement and ensuring the token’s stability and growth potential. What is Injective Protocol? Injective Protocol is recognized for its decentralized finance (DeFi) services which offer a fully decentralized exchange platform that is entirely permissionless, allowing users to trade on any derivative market of their…

Bitcoin has dipped below $113,000 as traders prepare for a potential rate cut by the Federal Reserve. Caution prevails among investors during a crucial week filled with tech earnings and economic indicators. The recent market movements reflect growing uncertainty regarding the central bank’s monetary policy. Analysts suggest that traders are closely monitoring any signals from the Fed that could impact the broader financial landscape. As various tech companies report their earnings, the outcome may influence market sentiment and Bitcoin’s performance in the coming days.