Author: Bpay News

Bitcoin price recovery has sparked fresh excitement in the cryptocurrency market, as traders react to a sudden ease in tariff threats following President Donald Trump’s announcement.This unexpected announcement, which alleviates concerns around geopolitical risks, prompted a notable surge in Bitcoin, pushing its price above $90,000 after a significant dip to $87,300.

The recent BitGo IPO has sparked significant interest in the financial world, marking a pivotal moment for the digital asset industry.With an impressive $213 million raised and a market valuation soaring to $2.08 billion, BitGo’s entry into the public market reinforces its position as a leader in providing digital asset infrastructure services.

Generation Z’s trust in crypto is reshaping the financial landscape as younger generations gravitate toward digital currencies over traditional banking systems.A recent survey reveals that this cohort demonstrates a significant inclination towards crypto assets trust, with nearly half having used crypto exchanges.

Vietnam digital asset licensing has officially begun, signaling a pivotal moment for the country’s evolving crypto landscape.The Ministry of Finance’s Decision No.

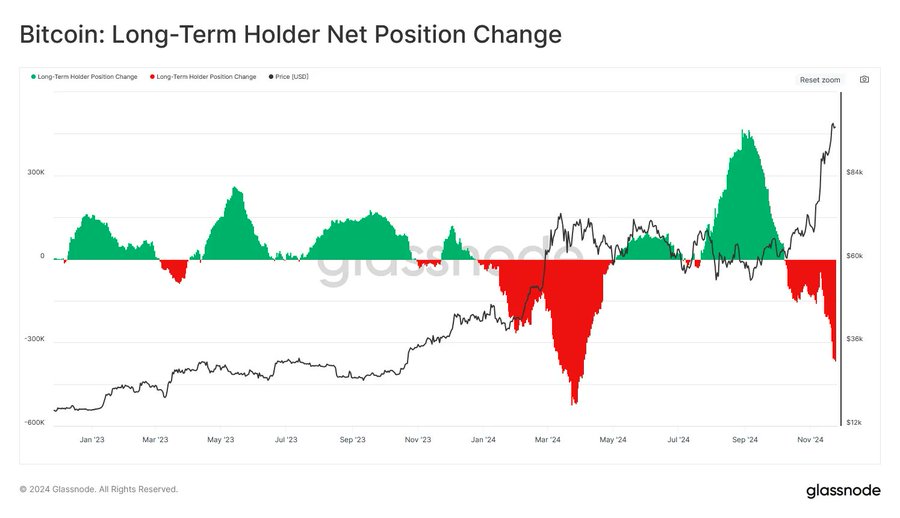

Long-term Bitcoin holders, individuals who have maintained their investments for over two years, are currently shaping the dynamics of the Bitcoin market as we approach 2024 and 2025.Recent analysis reveals that these investors have reached unprecedented levels of sales, setting a new record amidst a notable Bitcoin selling trend that diverges from previous cycles.

The Ethereum spot ETF has recently been at the forefront of crypto investment trends, showcasing significant market movements.Just yesterday, the total net outflow hit $298 million, with BlackRock’s ETHA significantly leading the pack, contributing a staggering $250 million to that figure.

As the technological landscape evolves, the quantum threat to Bitcoin is becoming an increasingly urgent concern.With the rise of quantum computing risks, industry experts are warning that Bitcoin security may be compromised sooner than many anticipate.

Bitcoin price analysis reveals a current market atmosphere where BTC continues to grapple below the significant $90k barrier.Despite a slight uptick of 1% in the last 24 hours, recent developments, including Donald Trump’s address at the World Economic Forum, have yet to provide the desired push for a sustained upward movement.

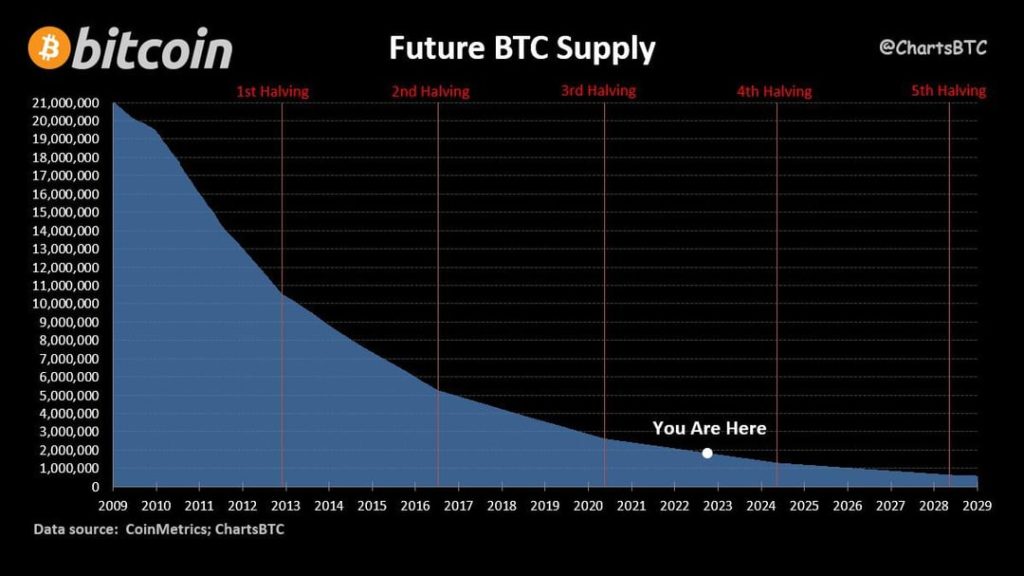

The Bitcoin supply cost percentile is a crucial metric for assessing the cryptocurrency’s market health, as it offers insights into price dynamics and trading behavior.Recently, Glassnode reported that Bitcoin’s value has dipped below the 0.75 supply cost percentile, a concerning indicator of growing distribution pressure within the market.

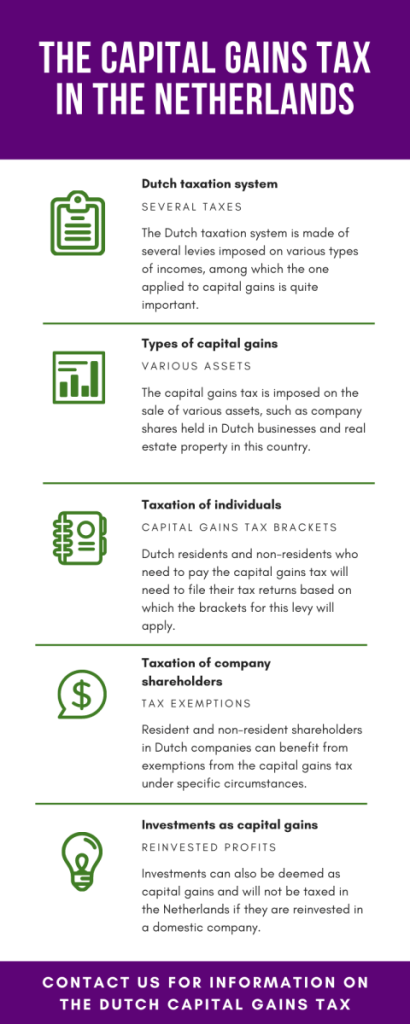

The Dutch capital gains tax is set to undergo significant changes as a proposal to tax unrealized gains on investments, including cryptocurrencies, gains traction among Dutch MPs.This shift is particularly noteworthy as it aligns with the government’s ongoing efforts to reform the Box 3 asset tax system, which currently allows many investors to escape taxation on unrecognized profits.