Author: Bpay News

Gold on a Steady Decline, Is it Bitcoin’s Time to Shine? The allure of gold as the ultimate store of value has been a pervasive narrative for centuries. However, recent trends indicate a steady decline in its status and value, prompting both individual and institutional investors to seek alternative assets. Amidst this shift, the spotlight turns to Bitcoin, often referred to as “digital gold,” which might now be poised to claim some of gold’s long-held market territory. The Decline of Gold The decline of gold can be attributed to a combination of factors. Economically, a stronger US dollar and rising…

Swiss crypto firm Taurus has opened a new office in New York to enhance its operations in the United States. This move aims to target banks as interest in digital assets grows. The establishment of the New York office reflects Taurus’s commitment to expanding its footprint in the U.S. market. With the increasing demand for digital asset services, the firm seeks to position itself strategically among financial institutions. Taurus’s expansion comes at a time when banks are increasingly exploring opportunities in the digital asset space.

The x402 “Doer” checklist examines the key players in the finance and blockchain sectors who are influencing the x402 landscape. In the finance and blockchain industries, the term x402 is significant, representing a specific concept or framework. Understanding who drives x402 is essential for stakeholders to navigate these sectors effectively. The “Doer” checklist serves as a tool to identify and evaluate the individuals or entities that play a pivotal role in this context. This checklist is designed to highlight the characteristics and actions of those who are actively engaged in the x402 space. By analyzing their contributions, it becomes possible…

In the last hour, the network experienced total liquidations amounting to $223 million. This significant figure reflects the current market dynamics and trading activities. Liquidation events occur when positions are forcibly closed due to insufficient margin, often triggered by rapid price movements. The total amount indicates a substantial impact on traders and the overall market. Such liquidations can lead to increased volatility and affect trading strategies moving forward.

Title: Meme Coin Millionaire Bets Big on Secretum: The New Privacy Altcoin Sparking Investor Interest In a dramatic turn of events within the volatile cryptocurrency landscape, a former meme coin millionaire shifts his investment focus towards a new and innovative privacy-centric altcoin called Secretum. This new move illuminates the ever-evolving priorities and strategies among crypto enthusiasts who are constantly on the lookout for the next big opportunity. From Memes to Privacy The journey of this anonymous millionaire, previously engrossed in the lucrative yet unpredictable world of meme coins like Dogecoin and Shiba Inu, has taken a surprising pivot towards more…

Little Pepe (LILPEPE) is emerging as a prominent memecoin, often referred to as the ‘new PEPE,’ with a presale approaching sellout at $27 million. Little Pepe is characterized as a zero-tax, fast Layer 2 memecoin, which has contributed to its growing appeal among investors. The presale’s success indicates strong interest and confidence in the project. As the presale nears completion, many are watching closely to see how Little Pepe will position itself in the competitive memecoin market. Its unique features may attract a diverse range of investors looking for new opportunities. The rise of Little Pepe reflects a broader trend…

US prosecutors have stated that the establishment of cryptocurrency policy should be the responsibility of Congress rather than the courts. This position reflects a growing concern regarding the regulatory framework surrounding digital currencies. Prosecutors argue that legislative bodies are better equipped to create comprehensive and effective regulations that address the complexities of cryptocurrency. They emphasize that courts may lack the necessary expertise to navigate the rapidly evolving landscape of digital assets. The call for congressional action highlights the need for clear guidelines to ensure the responsible use and management of cryptocurrencies in the United States.

US stock index futures have reduced their losses, with S&P 500 index futures and Nasdaq index futures returning to flat levels. After previously showing declines, these key market indicators have stabilized. Trading activity indicated a cautious sentiment among investors as they assess various economic factors affecting the market. Analysts continue to monitor fluctuations in stock futures, which often reflect expectations about future corporate earnings and economic performance. Market participants are adapting their strategies in response to ongoing developments that could influence market direction.

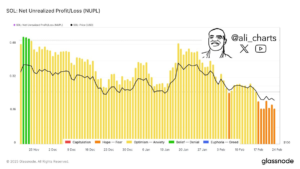

Bitcoin has dropped below the $108,000 mark, signaling a notable decline in its market performance. The cryptocurrency reached this low during a period of fluctuating trading activity. Market analysts are observing the factors contributing to this decrease, as investor sentiment shifts. The fall in Bitcoin’s value may have implications for the broader cryptocurrency market, as traders and investors react to the changing conditions. Current trends in the market highlight the volatility that often accompanies Bitcoin trading.

100% win rate whale A whale with a perfect win rate is currently experiencing over $7 million in unrealized losses on its long position. Despite the initial success, this significant drop highlights the potential volatility in trading strategies. Investors often watch such high-profile positions closely, as they can indicate broader market trends. The whale’s situation raises questions about risk management and the sustainability of a 100% win rate in the long term. Many traders may reassess their own strategies in light of these developments.