Author: Bpay News

Quantum computing and blockchain are two groundbreaking technologies that are poised to redefine the digital landscape.As Coinbase takes a proactive step by forming the Coinbase Independent Advisory Committee on Quantum Computing and Blockchain, the intersection between these fields gains significant attention.

In a bold move, Trump Europe retaliation has emerged as a pivotal issue in U.S.-European relations, raising eyebrows in financial markets and political circles alike.U.S.

In a groundbreaking shift, the Netherlands is set to tax unrealised Bitcoin gains, a major development for cryptocurrency investors, as the new rules under the “Wet werkelijk rendement Box 3” come into effect on January 1, 2028.This reform indicates an important turn in the Netherlands Bitcoin tax landscape, as individuals will now face potential tax liabilities on their cryptocurrency holdings, regardless of whether they have sold their assets.

As we enter a transformative era, **digital asset financial reserves** have emerged as a crucial focal point for companies navigating the evolving landscape of cryptocurrency.Industry analysts from Pantera Capital predict that by 2026, businesses in this space will undergo significant restructuring, with a select few remaining strong amid the challenges of the crypto market.

Embarking on a transformative journey, LOVEVoyage stands at the intersection of romantic travel experiences and innovative blockchain technology.Launched on the RWAX platform, this groundbreaking project brings real-world allure to its audience through the captivating tales of the “Heartfelt Love Journey.” Within a remarkable ten minutes, LOVEVoyage garnered a market value of $3 million, marking it as a vibrant player in RWA projects.

The Pancakeswap price forecast indicates a promising upward trajectory for the CAKE token, which has surged 4.5% and is heading towards the key psychological level of $2.This notable increase is fueled by positive Pancakeswap derivatives data, reflecting a bullish trend among traders, as more market participants are betting on CAKE’s price rise rather than a decline.

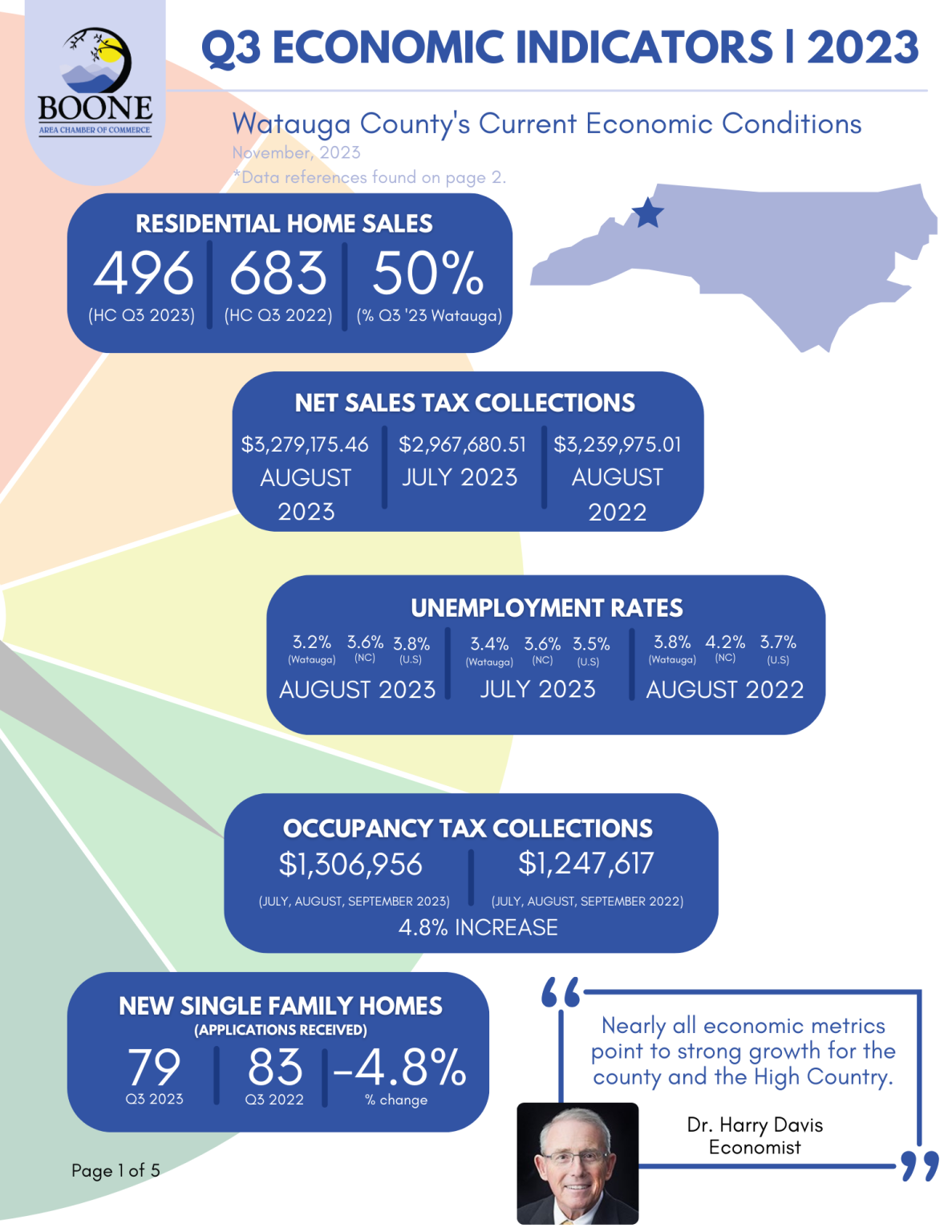

In analyzing the U.S.Q3 economic indicators, a clear picture emerges of the nation’s financial health during the third quarter.

In the ever-evolving landscape of cryptocurrency investments, the “Noble Stock Trader” has emerged as a notable contender.After just eight days, a savvy trader who originally invested $100 in this meme coin is now basking in astonishing unrealized profits nearing $98.2K.

Crypto treasuries are rapidly evolving as 2026 approaches, with influential firms like Pantera Capital forecasting a year of intense consolidation within the industry.As digital asset treasury companies mature, a distinct shift is expected, where large entities gain overwhelming control over Bitcoin and Ether treasuries, leaving smaller counterparts vulnerable to acquisition or failure.

The emergence of a Russian ruble-backed stablecoin represents a significant shift in the financial landscape, especially in light of ongoing geopolitical tensions.This innovative currency, which has processed over $100 billion in on-chain transactions within just a year, has been tailored to operate within sanctioned financial networks, offering a unique solution to businesses seeking to navigate restrictive economic measures.