Author: Bpay News

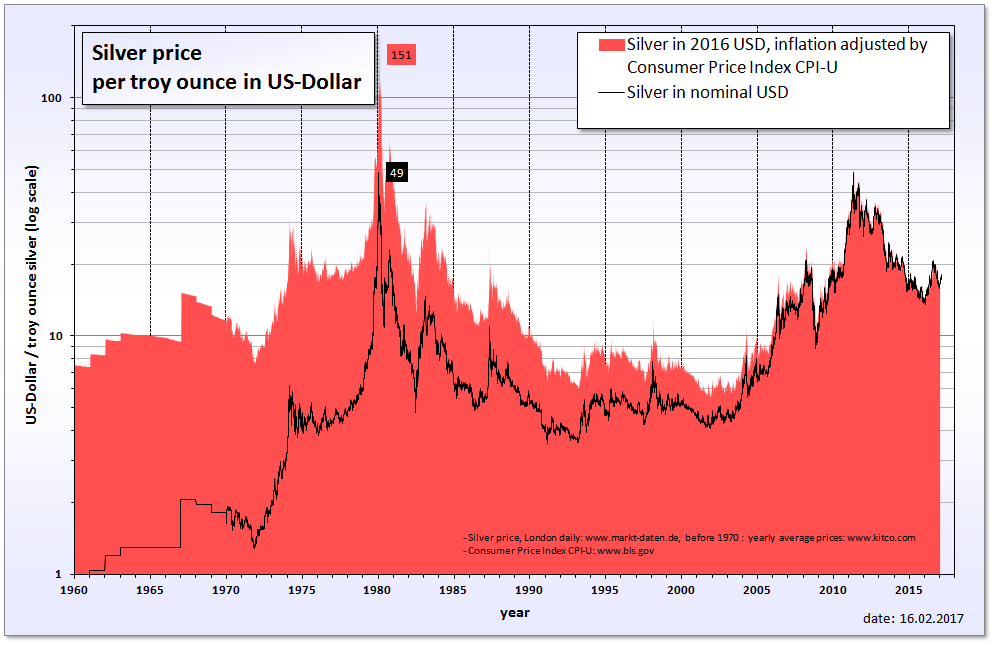

In recent trading sessions, silver prices have surged dramatically, recently eclipsing the $100 per ounce mark.This remarkable increase has sparked renewed interest among investors, particularly in light of current geopolitical tensions and economic uncertainties.

The USD1 market capitalization has recently made headlines as it has overtaken PayPal’s stablecoin PYUSD, signifying a pivotal shift in the cryptocurrency landscape.This development sparks excitement among investors and analysts, particularly in light of current cryptocurrency updates and stablecoin market trends.

Spot silver has reached astonishing heights, officially entering the “three-digit era” as it skyrocketed to $100 per ounce during recent trading.This remarkable surge, nearing 40% in just a few weeks, highlights a growing trend among investors favoring safe-haven assets amidst a weakening dollar.

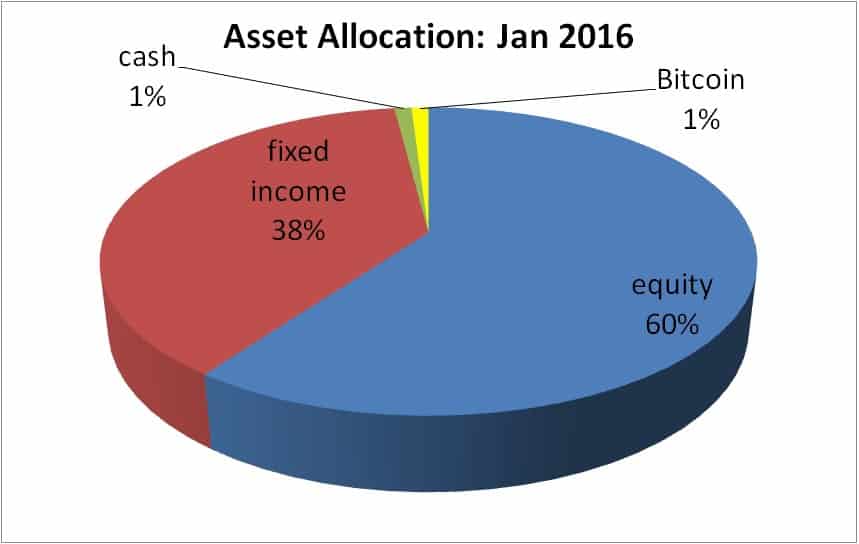

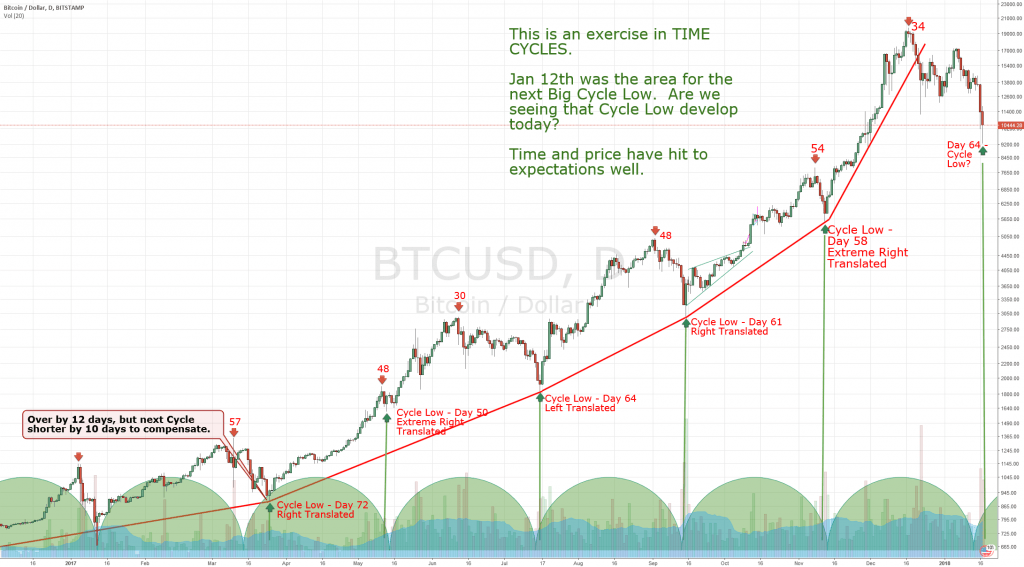

Bitcoin allocation has become a hot topic among investors as they navigate the complexities of the cryptocurrency landscape.In a world where financial strategies are rapidly evolving, understanding how to optimally allocate Bitcoin in your portfolio can significantly impact financial outcomes.

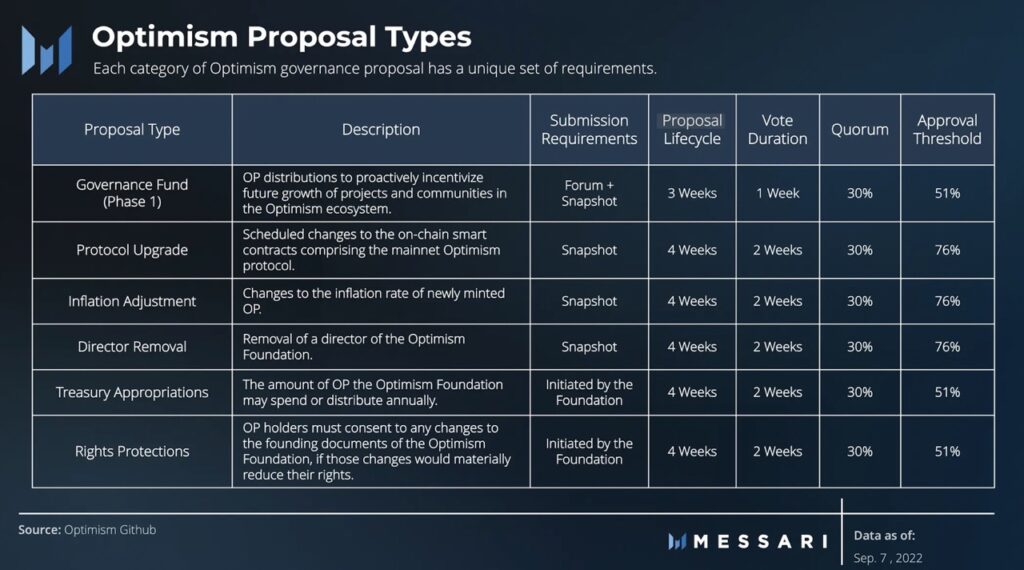

The Optimism DAO proposal marks a pivotal moment in the evolution of the Optimism Superchain network, suggesting that 50% of the revenue generated be directed towards a strategic buyback plan for OP governance tokens.This initiative aims to bolster community confidence and enhance the overall value of the cryptocurrency ecosystem.

In recent months, we have witnessed significant crypto market adjustments that provide a glimpse into the future of digital currencies.According to the latest Coinbase report, these adjustments have led to a more robust and resilient market structure heading into 2026.

The concept of a **Bitcoin super cycle** has been gaining significant traction in the cryptocurrency community, largely due to predictions made by prominent figures.Recently, CZ, the founder of Binance, hinted that Bitcoin could be on the brink of such a cycle in an interview at Davos.

Ethereum trading has seen a notable surge recently, drawing the attention of investors and analysts alike.Standard Chartered’s analyst Geoff Kendrick suggests that buying ETH now may be a wise decision before the upcoming weekend, especially considering the favorable ETH investment trends.

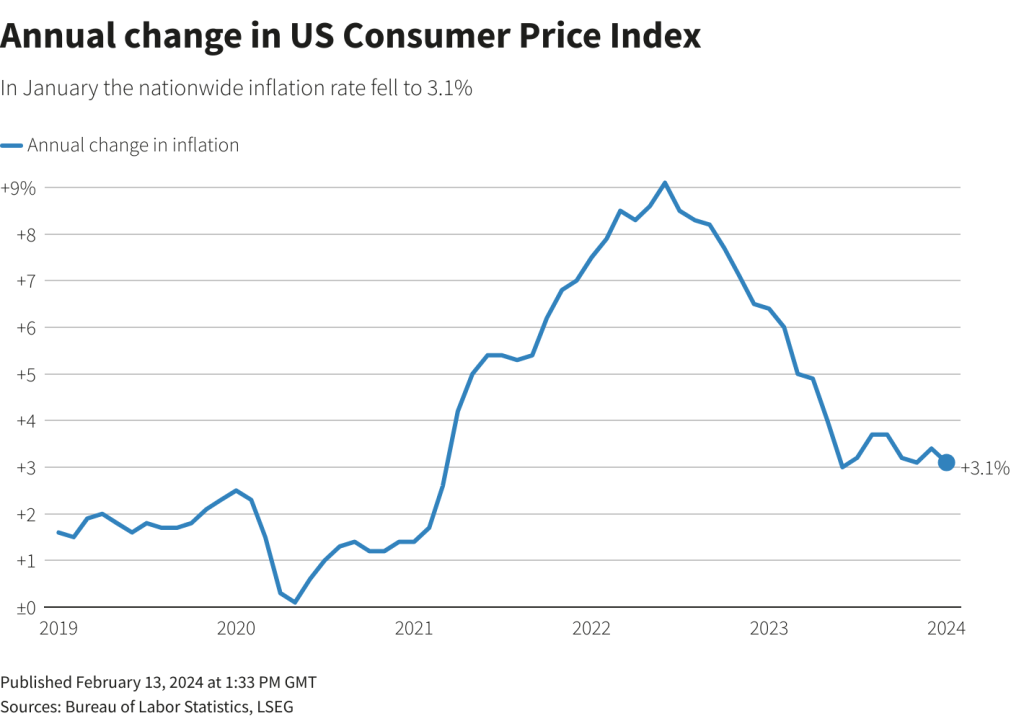

As we approach the new year, the expected inflation rate for January 2024 is drawing significant attention, particularly with a forecasted figure of 4%.This marks a slight decline from the previous expectation of 4.2%, reflecting ongoing adjustments in the economy.

In the midst of the ever-evolving landscape of cryptocurrency news, the recent activities surrounding the HYPE whale deposit have certainly captured the attention of traders and investors alike.On January 23, 2026, reports emerged detailing how a prominent whale unstaked a staggering 665,035 HYPE tokens, equivalent to 14.23 million USD, before making a significant deposit into the Bybit exchange.