Author: Bpay News

The recent crypto market crash has shaken the foundations of what was once considered a flourishing digital asset landscape, erasing nearly $2 trillion in value within months.Triggered by macroeconomic pressures and investor speculation, this dramatic decline has left many wondering about the future of cryptocurrencies like Bitcoin and Ethereum, which have both faced significant price declines during this tumultuous period.

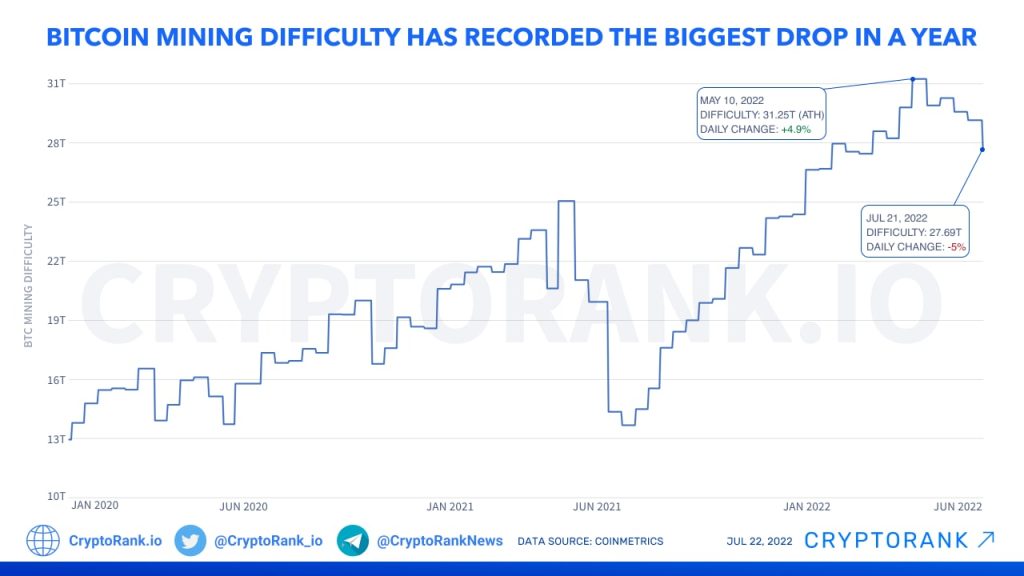

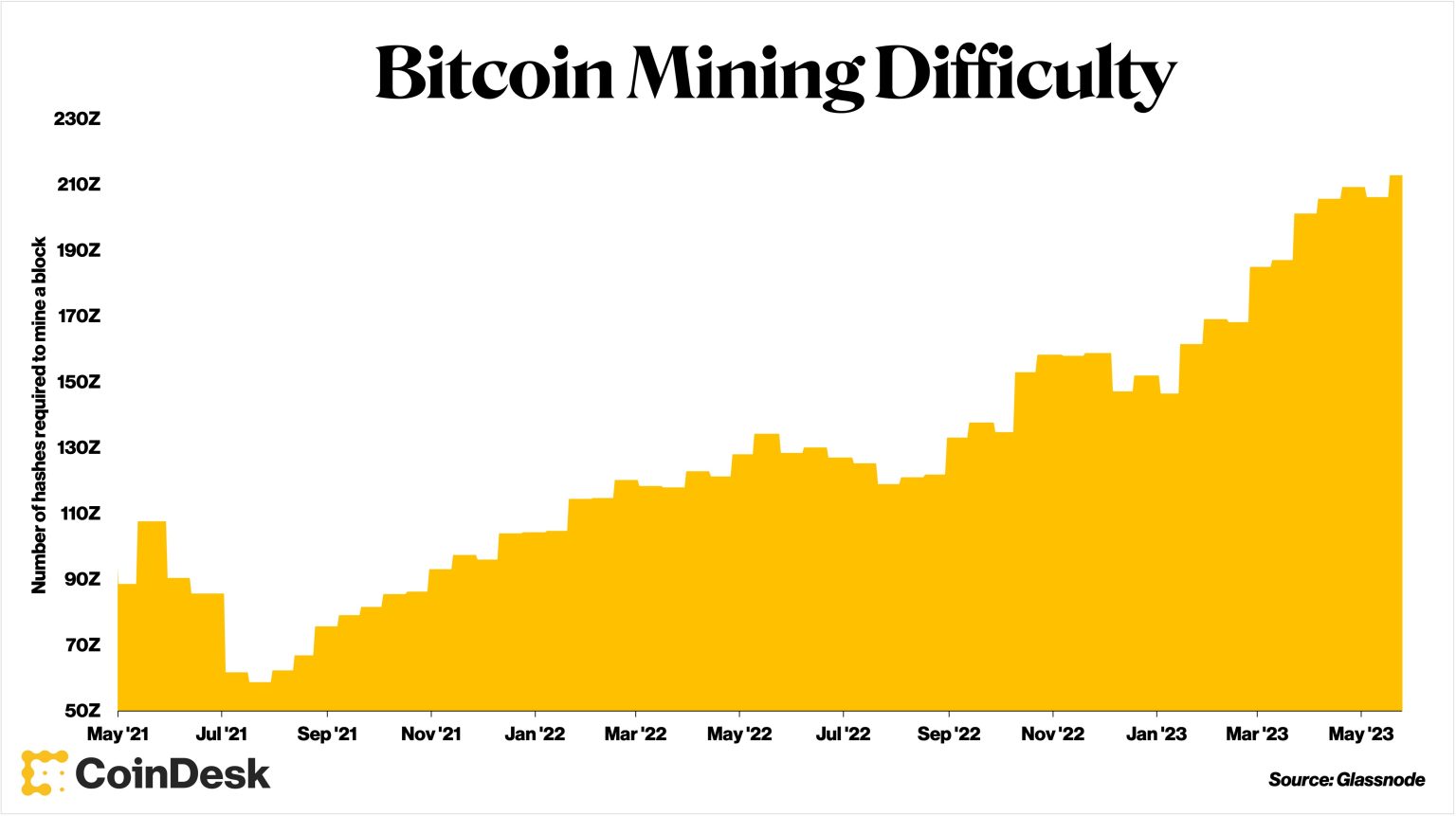

Recent developments in Bitcoin mining have seen a notable drop in mining difficulty, decreasing by approximately 11.16%.This substantial decline marks the sharpest adjustment since the significant mining challenges triggered by the China crypto mining ban in 2021.

Bitcoin prices have been on a rollercoaster ride as market dynamics shift dramatically beneath the surface.Recent analyses reveal that while consumers are eager to acquire this leading cryptocurrency, factors such as leveraged trading and synthetic exposure are reshaping the landscape.

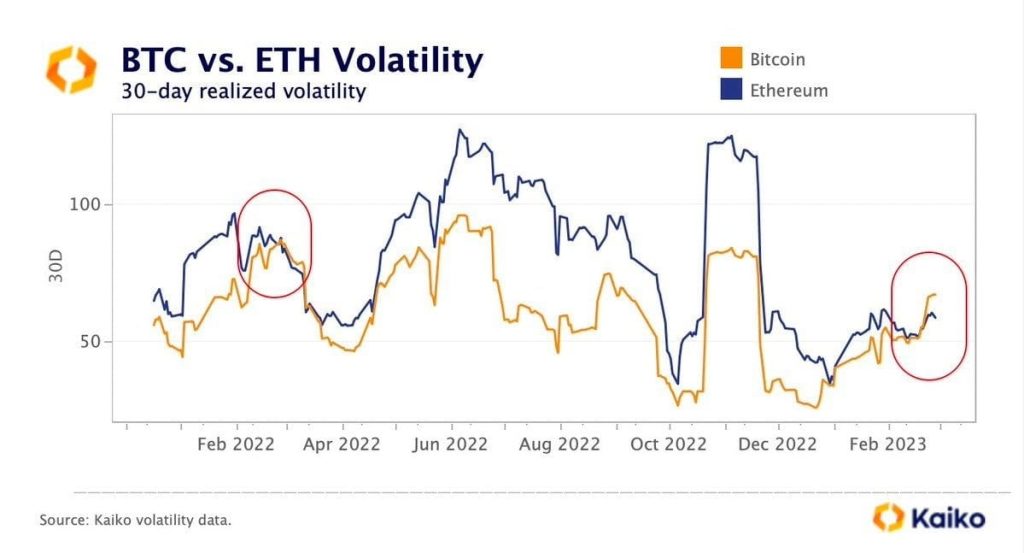

Abnormal volatility in BTC and ETH has become a hot topic among crypto enthusiasts and investors, particularly as the market navigates unpredictable price fluctuations.Recent market data reveals that both BTC and ETH have been experiencing significant swings, with single-minute amplitudes exceeding 3% during peak trading hours.

As we look ahead to 2026, the discussion around the least reliable EVs is becoming increasingly urgent, highlighting the significant performance gaps that can be found among unreliable electric vehicles.While electric vehicles promise a cleaner and more sustainable future, many recent models have faced EV reliability issues that consumers should be aware of before making a purchase.

The current landscape of the cryptocurrency market has sparked significant interest in ETH price prediction, especially as Ethereum prices show remarkable resilience.As of the latest update, the current ETH price has soared past 2100 USDT, landing at 2101.61 USDT, showcasing a notable 5.6% increase over the last 24 hours.

Bitcoin mining difficulty has recently seen a notable decrease, dropping to 125.86 trillion hashes, which represents an 11.16% decline.This adjustment, reported by CloverPool, highlights the dynamic nature of the Bitcoin network and its hash rate, currently standing at an impressive 948.13 EH/s.

Evgeny Gaevoy, the CEO of Wintermute, has been vocal in addressing the swirling rumors surrounding institutional players in the cryptocurrency market.Amidst speculation about potential “institutional blow-ups” following the FTX collapse, Gaevoy expressed skepticism regarding their actual impact on the financial ecosystem.

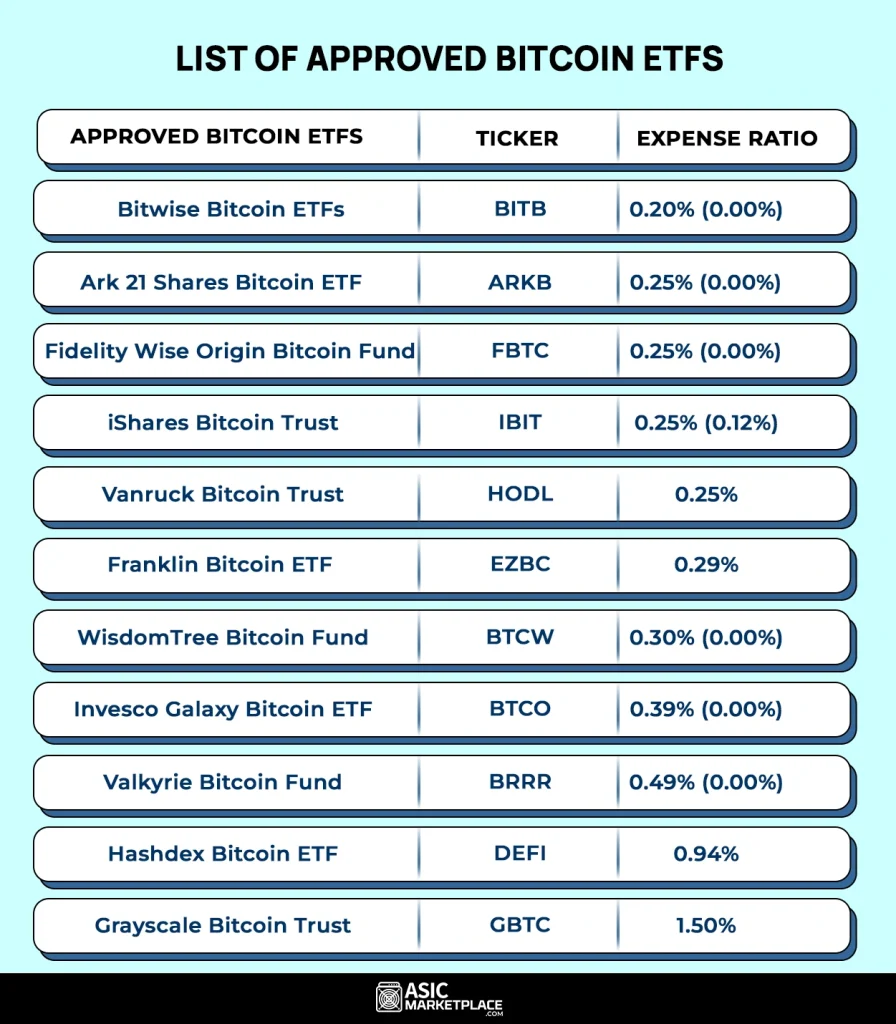

Bitcoin ETFs have emerged as a revolutionary financial instrument, bringing the world of cryptocurrency closer to traditional investing.As Eric Balchunas, a senior ETF analyst at Bloomberg, analyzes the Bitcoin market volatility, his insights suggest that investor structures within Bitcoin ETFs may be more robust than previously anticipated.

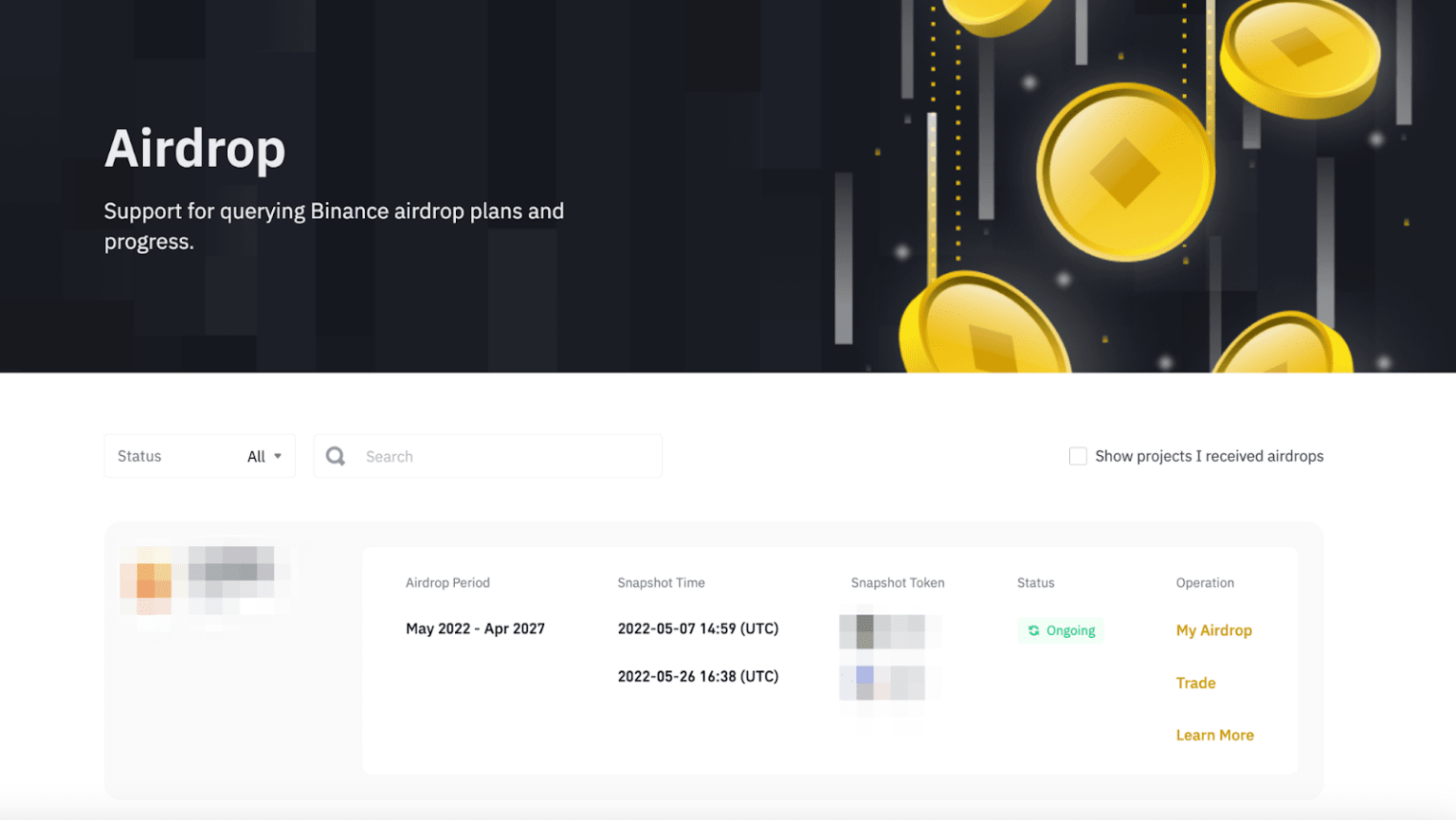

The Binance Bithumb airdrop incident has captured the attention of cryptocurrency enthusiasts and investors alike, as it involves a substantial mishap surrounding the misissued airdrop of 2000 Bitcoins.On social media, CZ, the CEO of Binance, reported that Binance played a critical role in assisting Bithumb to rectify this issue, which has since made waves in the Binance news landscape.