Author: Bpay News

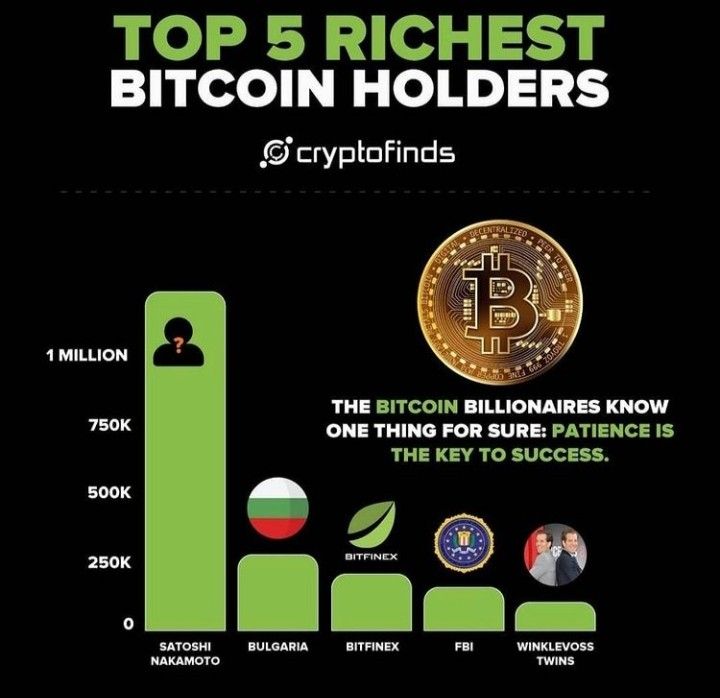

Bitcoin holders are experiencing a challenging time as recent trends show a significant shift in market dynamics.For the first time since October 2023, these long-term investors are selling their digital assets at a loss, a startling change that emphasizes the current risk-averse sentiment prevailing in the cryptocurrency landscape.

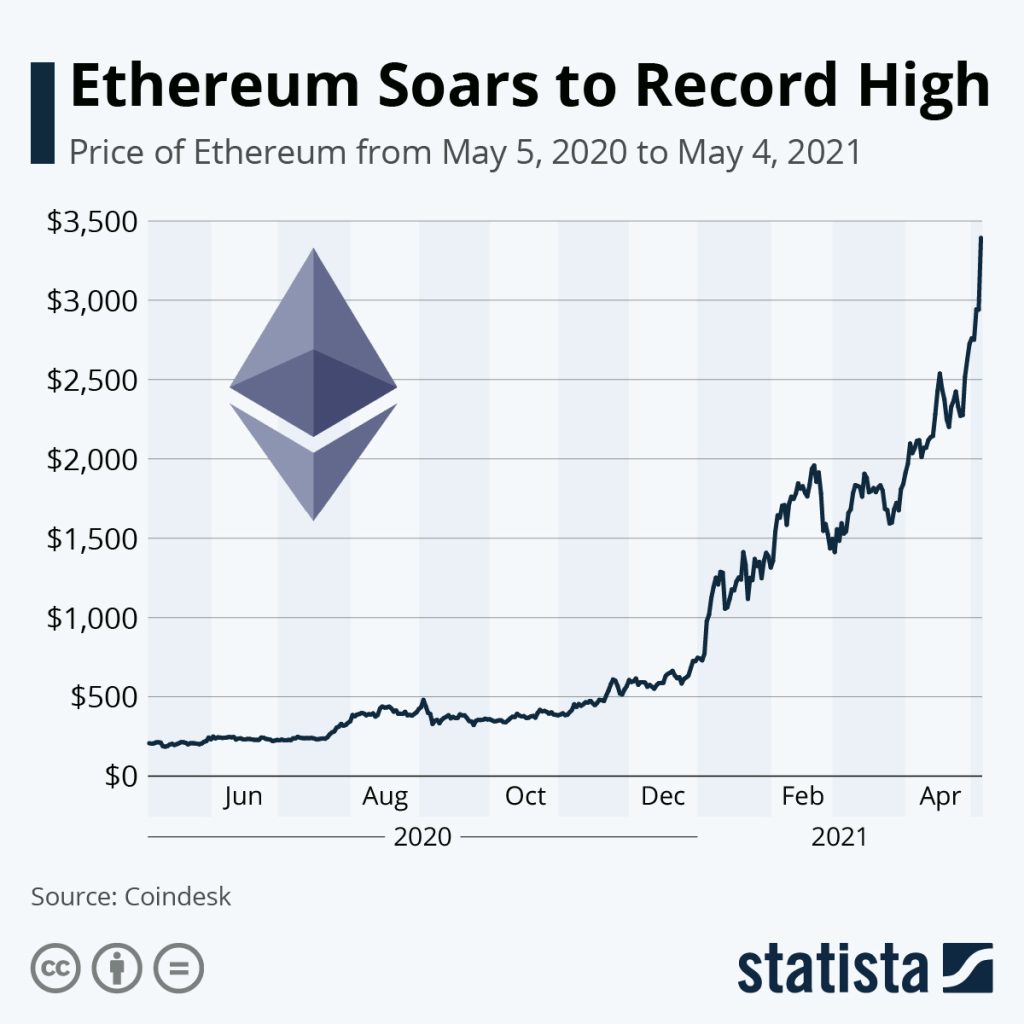

As we delve into the Ethereum price forecast, many investors are closely monitoring Ether’s fluctuations, especially given its recent struggles.Currently trading below $2,900 after a significant drop from $3,400, Ethereum’s potential to retest the $2,749 support level is becoming increasingly relevant in today’s market landscape.

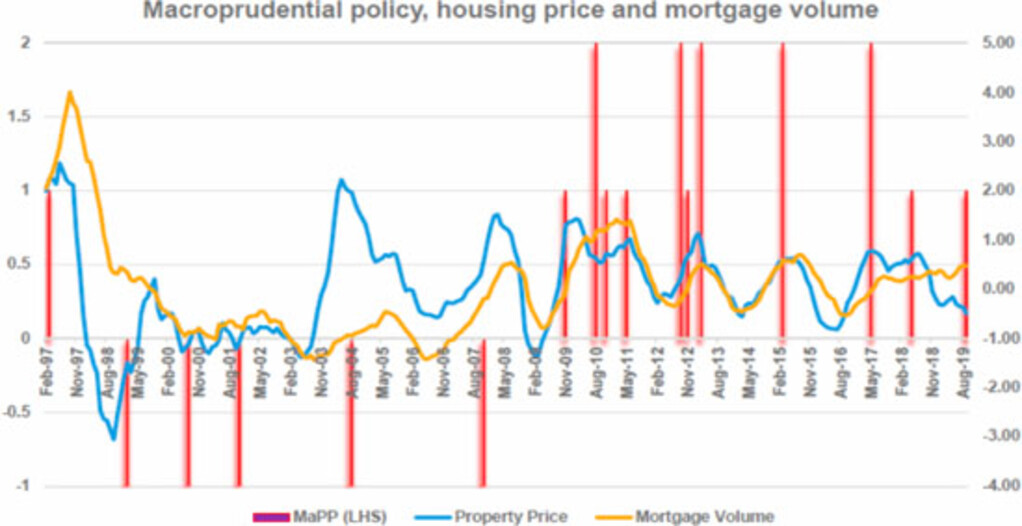

The People’s Bank of China macro-prudential policies play a crucial role in maintaining financial stability in China.In light of the upcoming 2026 financial policies, the central bank has reinforced its commitment to a comprehensive macro-prudential management system.

Cryptocurrency trading has emerged as an exciting yet challenging arena for investors aiming to capitalize on market volatility and fluctuating prices.Understanding the intricacies of digital currencies, such as Bitcoin and Ethereum, is crucial for devising effective investment strategies.

In today’s volatile financial landscape, gold as a fear index has emerged as a crucial indicator for investors navigating uncertainty.As the Trump administration implements policies that create market instability, the surge in gold prices reflects a growing trend where investors turn to gold as a safe haven.

In the ever-evolving landscape of cryptocurrency, the activities of an ETH insider whale often command attention and spark intrigue.Recently, monitoring by Lookonchain revealed that this prominent market player, dubbed the “1011 insider whale,” has made headlines by acquiring 22,000 ETH, amounting to an impressive $63.56 million.

In a strategic move that has captured the attention of the crypto community, Coinbase is considering a potential equity investment in Coinone, South Korea’s third-largest crypto exchange.This development comes as Coinone explores various options, including the possible sale of a portion of its controlling shareholder’s stake held by A Cha.

In a landmark move that signals a growing acceptance of digital assets among institutional investors, BlackRock has made a significant Bitcoin deposit by allocating 1,814.76 BTC to Coinbase Prime.This strategic investment, valued at nearly $160 million, aligns with rising crypto market trends and reflects the asset management giant’s commitment to engaging in BTC ETH investment.

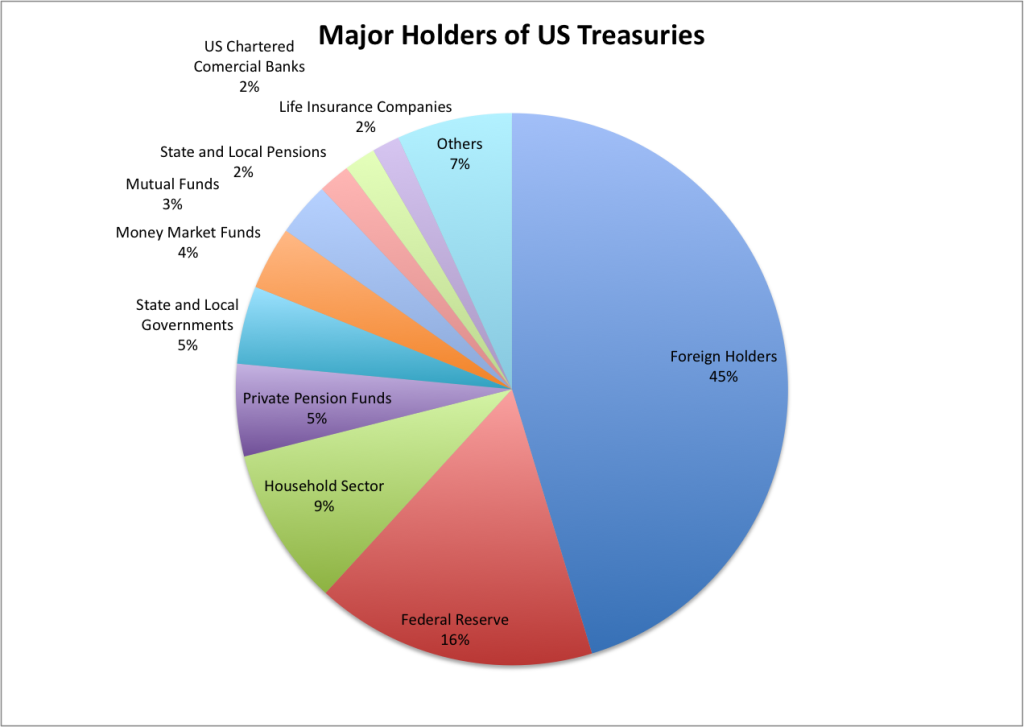

U.S.Treasuries remain a cornerstone for investors in today’s financial landscape, reflecting a strong preference for safety amid economic uncertainties.

The Bitcoin price drop has captured the attention of investors and analysts alike, as it plunged 30% following recent interventions from the Japanese yen.This sharp decline mirrors previous patterns, where BTC has historically experienced significant sell-offs amid yen fluctuations, only to rebound dramatically thereafter.