Author: Bpay News

In the dynamic world of cryptocurrency, Li Lin Bitcoin Ethereum has emerged as a significant topic of discussion, especially following recent statements by Huobi co-founder Du Jun.He asserted that Li Lin will not liquidate his Bitcoin to invest in Ethereum, highlighting a strategic approach to digital asset management.

Trend Research Ethereum has made headlines by selling a substantial 20,770 ETH, which amounts to an impressive $43.57 million.This significant operation highlights the dynamic nature of Ethereum market trends as they fluctuate throughout 2023.

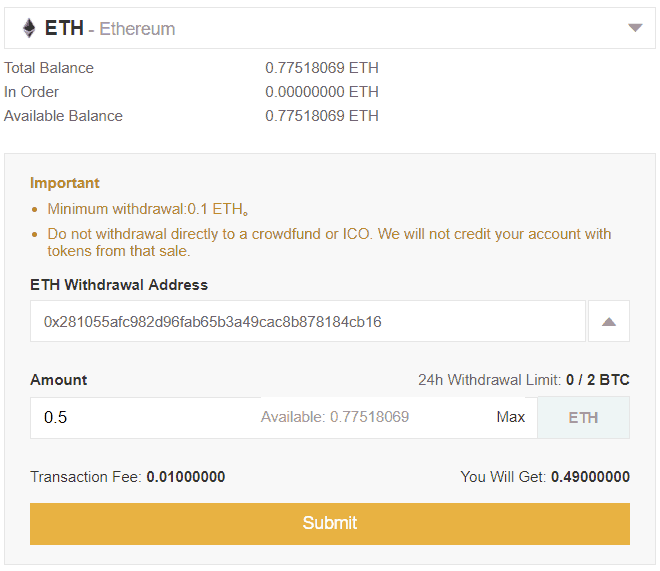

Yili Hua ETH liquidation has become a pivotal event in the crypto space, particularly as it marks the complete disbursement of Ethereum from the mentioned wallet.According to reports, at 10:49 AM, the on-chain address associated with Yili Hua concluded its operations by transferring the final 534 ETH to Binance, signaling a significant shift in its crypto assets.

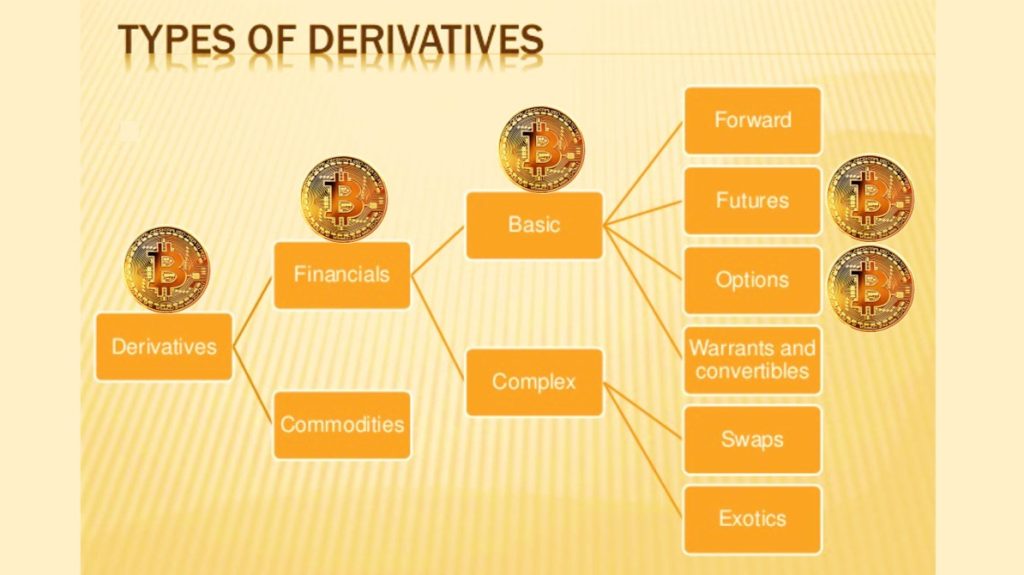

BTC derivatives have become a pivotal component in the ever-evolving cryptocurrency market, catching the attention of investors and analysts alike.They serve as instruments that can potentially amplify price fluctuations, a phenomenon recently highlighted by Arthur Hayes on the X platform.

The Darron Lee murder case has captured national attention after the former Chiefs linebacker was arrested in connection with the tragic death of his girlfriend in Ooltewah, Tennessee.According to authorities, deputies responded to a distress call at their residence, where they discovered a female victim who had reportedly met a violent fate.

In a significant move for the cryptocurrency market, ETH withdrawal from Binance has captured attention as an entity recently executed a staggering withdrawal of 53,544 ETH within just 24 hours.This event has triggered numerous discussions among analysts regarding the implications for crypto withdrawal trends, especially as large ETH withdrawals tend to influence market dynamics.

Crypto capitulation is a term that has gained significant traction among investors as they search for signs indicating that the cryptocurrency market may have reached its nadir.Retail traders are keenly observing behavioral patterns, closely analyzing cryptocurrency trends to identify whether a mass sell-off of assets—often referred to as capitulation—has occurred.

Forward Industries, a notable player in the Solana treasury companies sector, is poised to implement an aggressive strategy to navigate potential industry funding constraints.According to Ryan Navi, the Chief Information Officer, the current market mispricing could present significant opportunities for the company, setting it apart in the competitive crypto treasury market.

Illinois Bitcoin Reserve stands at the forefront of innovative cryptocurrency legislation as the state introduces the groundbreaking “Community Bitcoin Reserve Act.” This visionary bill aims to establish a state-operated program that ensures the secure management of Bitcoin through advanced multi-signature cold storage solutions.By initiating the establishment of an Altgeld Bitcoin reserve, Illinois sets a precedent for how governments can responsibly engage with digital currencies.

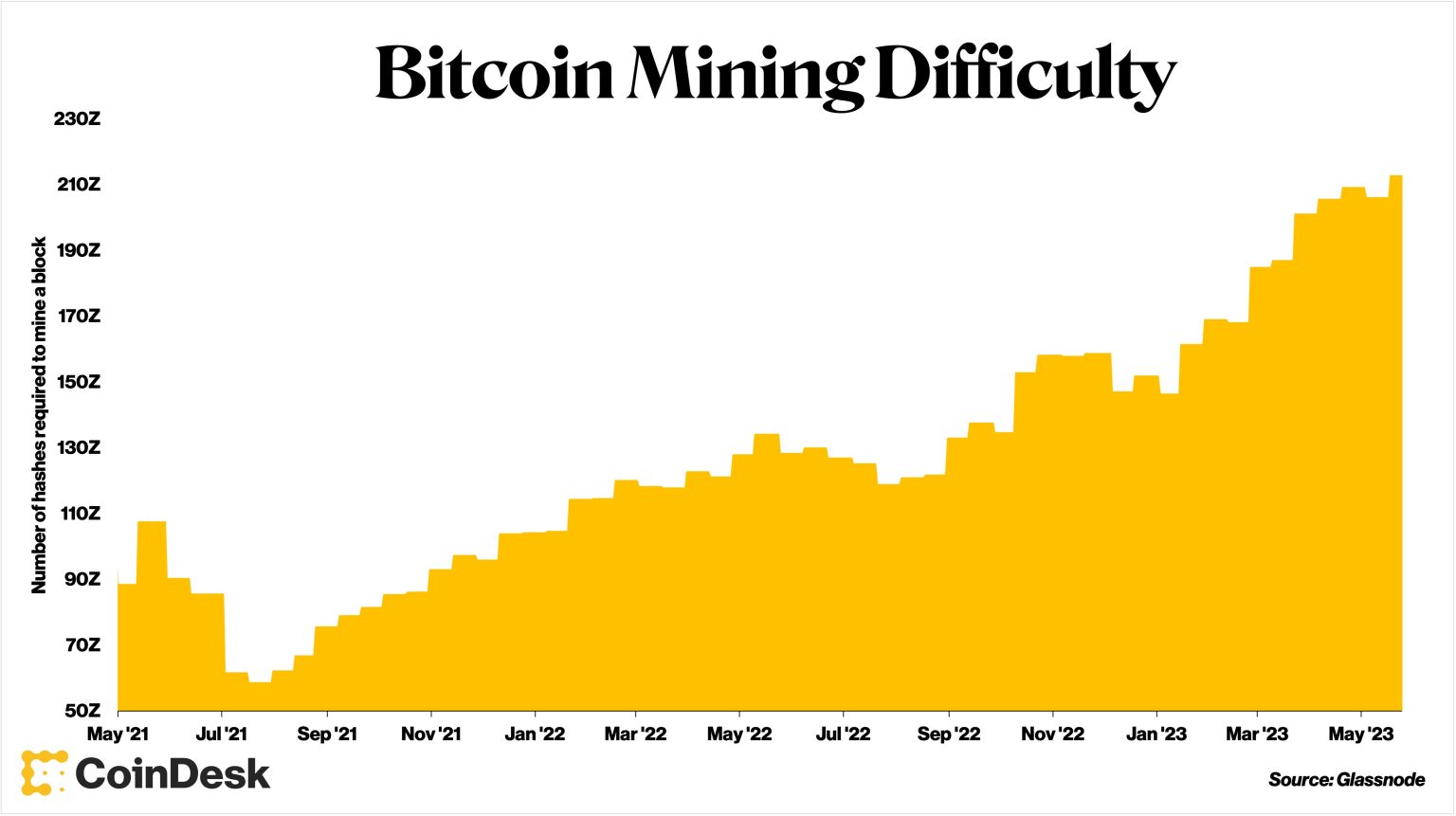

Bitcoin mining difficulty has recently undergone a significant transformation, marking the largest single drop since the summer of 2021.On February 8th, a mining difficulty adjustment at block height 935424 resulted in a decrease of 11.16%, lowering the overall mining difficulty to 125.86 trillion hashes.