Author: Bpay News

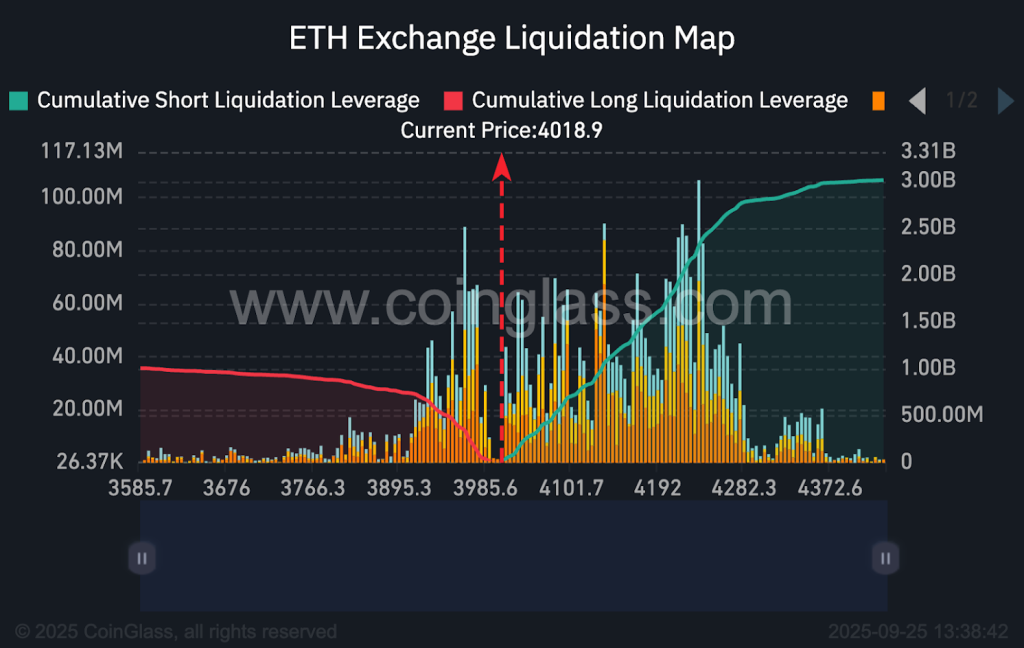

Ethereum liquidation has become a prominent concern as the cryptocurrency market faces significant volatility.As major players like Trend Research grapple with massive sell pressure, the implications of Ethereum’s price fluctuations are felt across the industry.

Rumors surrounding Sun Yuchen’s ex-girlfriend have recently captured public attention, sparking a frenzy of speculation across social media platforms.In a digital landscape flooded with online rumors, the entrepreneur took a decisive stance by declaring these allegations as completely unfounded.

Cryptocurrency liquidations have become a hot topic as the digital asset landscape continues to experience wild fluctuations.In just the past hour, nearly 100 million dollars worth of liquidations swept through the market, underscoring the intense volatility that defines the cryptocurrency space.

South Korea crypto market regulations are undergoing significant changes as the nation steps up its response to cryptocurrency volatility and trading irregularities.The recent introduction of advanced surveillance mechanisms, including the use of artificial intelligence, marks a pivotal moment in how the financial authorities oversee digital asset exchanges.

CFTC prediction markets are emerging as a fascinating intersection of legal innovation and trading, especially under the visionary leadership of Mike Selig, the current chairman of the U.S.Commodity Futures Trading Commission.

In a significant move that has captured cryptocurrency news headlines, Vitalik Buterin, co-founder of Ethereum, has conducted an ETH sale involving nearly 3,000 Ether, valued at approximately $6.6 million.This transaction comes shortly after Buterin announced plans to withdraw some of his Ethereum holdings to support privacy-focused technology initiatives.

The recent Bitcoin price crash has sent shockwaves through the crypto community, erasing an impressive 15 months of gains and plunging below the crucial $70,000 mark.This dramatic decline, driven by a staggering $840 million in liquidations, underscores the heightened volatility that the crypto market currently faces.

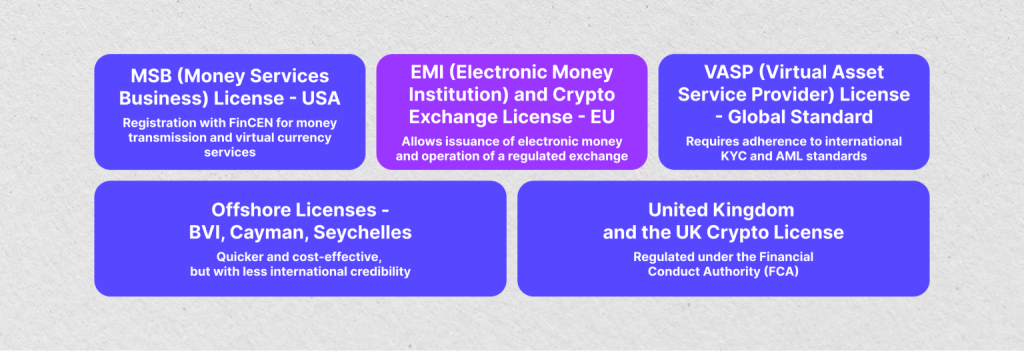

Crypto banking licenses are rapidly becoming a focal point for fintech transformation as the digital finance landscape evolves.In a bid to adapt to new banking regulations, many crypto firms are entering a competitive race to secure these licenses, which enable them to operate as recognized financial institutions.

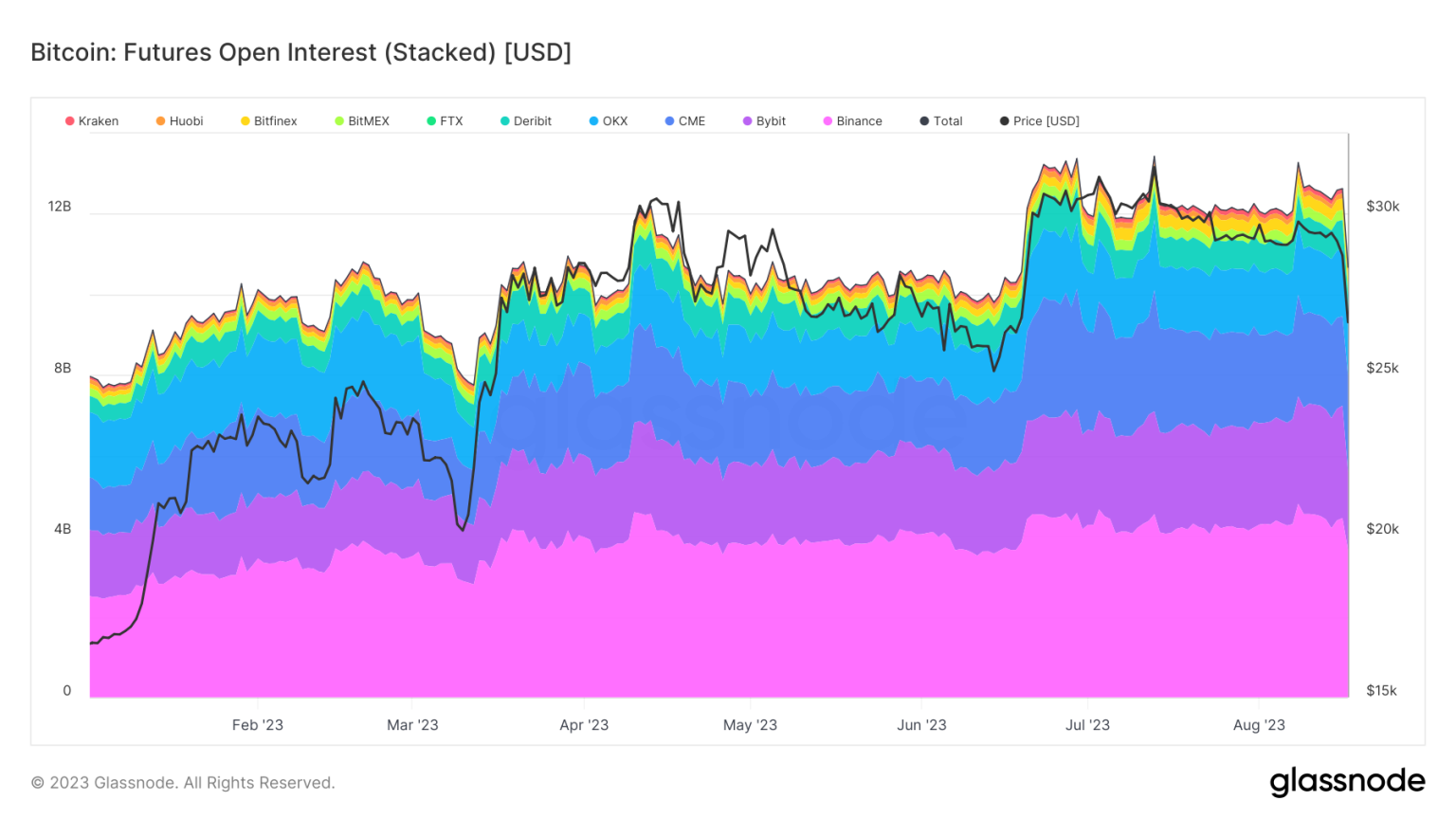

Bitcoin futures open interest has recently witnessed a significant decline, now dropping below the crucial $50 billion threshold, a level not seen since March 2025.This downturn is primarily attributed to shifting market sentiments and the ongoing volatility surrounding cryptocurrencies.

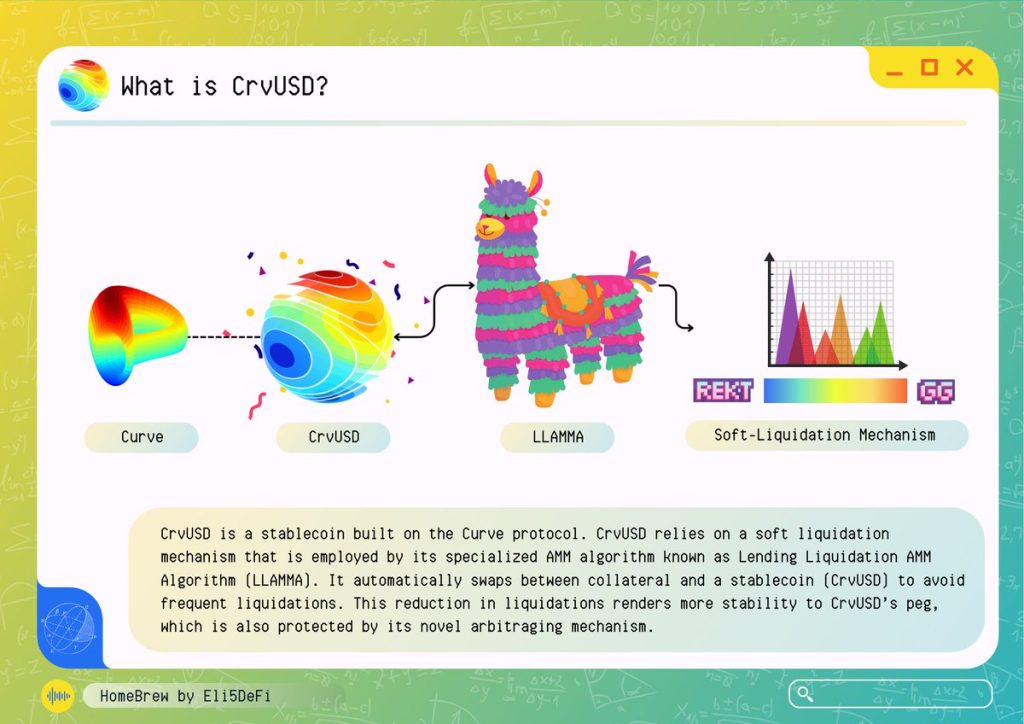

crvUSD stability is a critical component in the evolving landscape of the stablecoin market, particularly in relation to mainstream crypto assets such as Bitcoin.As highlighted by Michael Egorov, the founder of Curve, the substantial liquidity of crvUSD offers both opportunities and challenges, especially during periods of Bitcoin volatility.