Author: Bpay News

ETH lending whale liquidation is making headlines as one prominent trader faces a dire situation in the volatile landscape of cryptocurrency.Recent developments have shown this whale, who has mortgaged an impressive 23,800 ETH—valued at $48.56 million—currently teetering on the brink of a forced liquidation, with a precarious liquidation price of $1,800.

WLFI has recently made headlines in the cryptocurrency world after successfully selling 73 Wrapped Bitcoin (WBTC) for an impressive $5.037 million.This notable transaction highlights the growing influence of the Trump family’s crypto project within the digital currency landscape.

The recent Aster token destruction marks a significant milestone in the cryptocurrency community, spotlighting the protocol’s commitment to sustainability and increasing token value.On February 5, at 21:00 Beijing time, Aster executed a complete destruction of 98,400,345.46 repurchased tokens, a process that crucially includes 53,920,060.26 tokens from the fourth phase and another 44,480,285.20 from the fifth phase.

The evolution from Web2 to Web3 gaming marks a significant turning point in the gaming landscape, as highlighted by Playnance’s recent announcement revealing its groundbreaking ecosystem.This innovative platform aims to onboard traditional Web2 users into the ever-expanding blockchain gaming ecosystem, enhancing their gaming experience with seamless on-chain transactions.

XRP has emerged as a resilient player in the tumultuous landscape of cryptocurrency, especially as Bitcoin and Ethereum face significant market challenges.While the broader crypto market has seen price drops, with XRP recently trading around $1.35, its underlying fundamentals present a more optimistic scenario.

Tron TRX performance has caught the attention of investors as it continues to display impressive resilience in the face of broader cryptocurrency market fluctuations.Over recent weeks, TRX has successfully outperformed Bitcoin (BTC), showcasing a modest decline of only 2.3% compared to Bitcoin’s steeper drop of 7.3%.

The European Central Bank interest rates have remained stable as the institution navigates complex economic conditions across the Eurozone.For the fifth consecutive meeting, the ECB has chosen to keep its key rates unchanged, aligning with financial market expectations and ensuring consistency in Eurozone monetary policy.

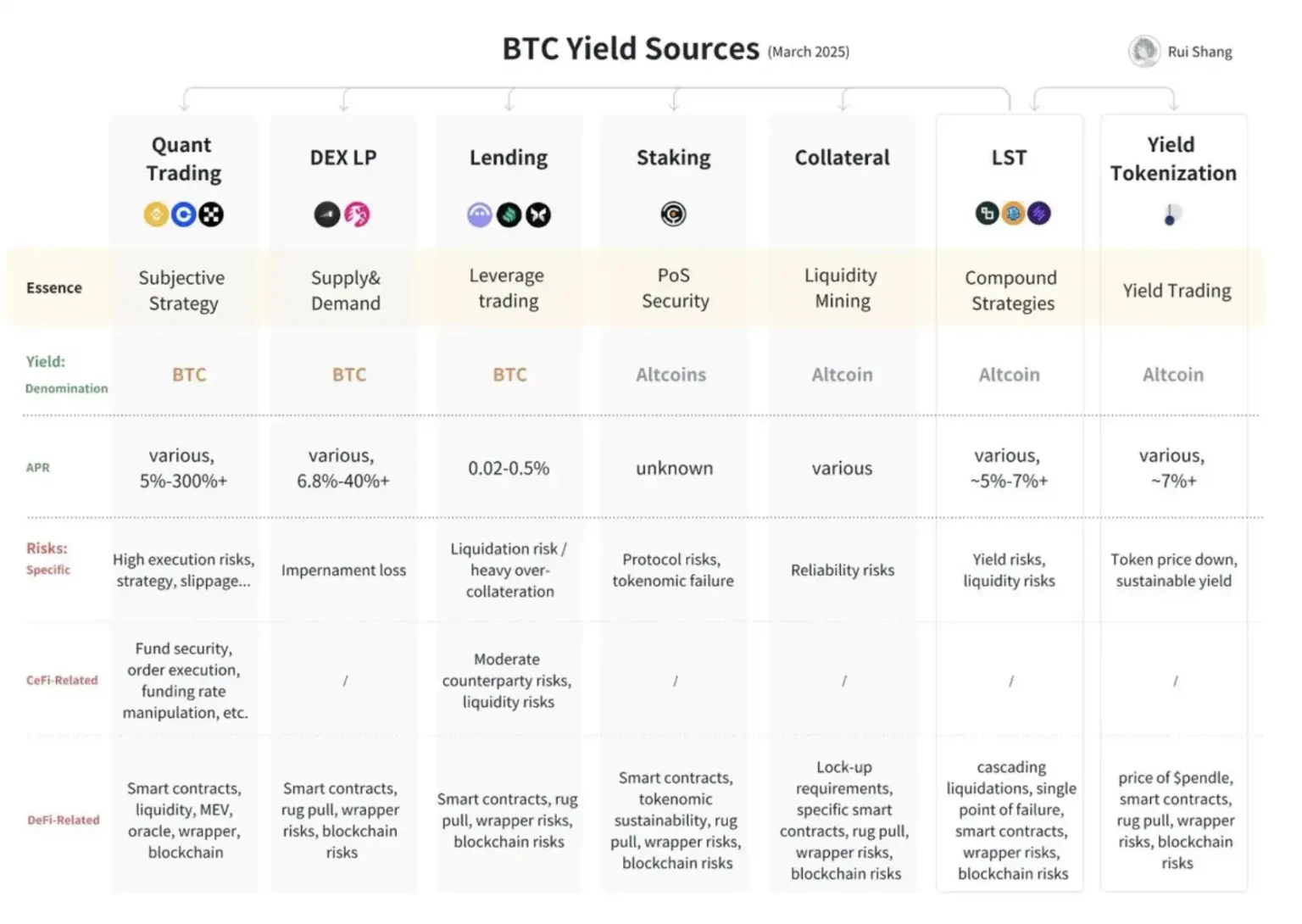

BTC yield strategies are gaining momentum as institutional investors increasingly gravitate towards methods reminiscent of traditional finance.Reports indicate a notable shift among these investors, who are now prioritizing lower-risk yield generation techniques that align with their conservative financial practices.

In a groundbreaking move for institutional Bitcoin payments, a recent $1 million Lightning transaction highlights the immense potential of the Bitcoin Lightning Network.This swift transfer between Secure Digital Markets (SDM) and the cryptocurrency exchange Kraken on January 28 marks the largest publicly reported Lightning transaction to date, illustrating the network’s scalability for high-value payments.

In a shocking turn of events, Bitcoin drops suddenly beneath the crucial $70,000 mark, igniting fears across the cryptocurrency landscape.This notable Bitcoin price drop has triggered a significant market selloff, erasing over $1 billion in trading positions and sending ripples through digital assets.