Author: Bpay News

The spot gold price is a critical indicator in the financial market, reflecting the current value of gold available for immediate purchase.Recently, the current spot gold price has soared to $4,800 per ounce, marking a significant rebound and generating buzz among investors and analysts alike.

In a notable turn of events, an Ethereum whale sells ETH, parting with a staggering 27,800 ETH to curb potential losses amid the current market fluctuations.This strategic move comes as the price of ETH reached $2050, prompting the whale to take decisive action to protect its assets.

In the highly volatile cryptocurrency market, the phenomenon of “Whales in Standoff” highlights a fascinating conflict between two dominant players in Ethereum trading.One significant whale, identified as 0x20c, is reveling in the gains from ETH short positions, boasting unrealized profits exceeding 21 million USD.

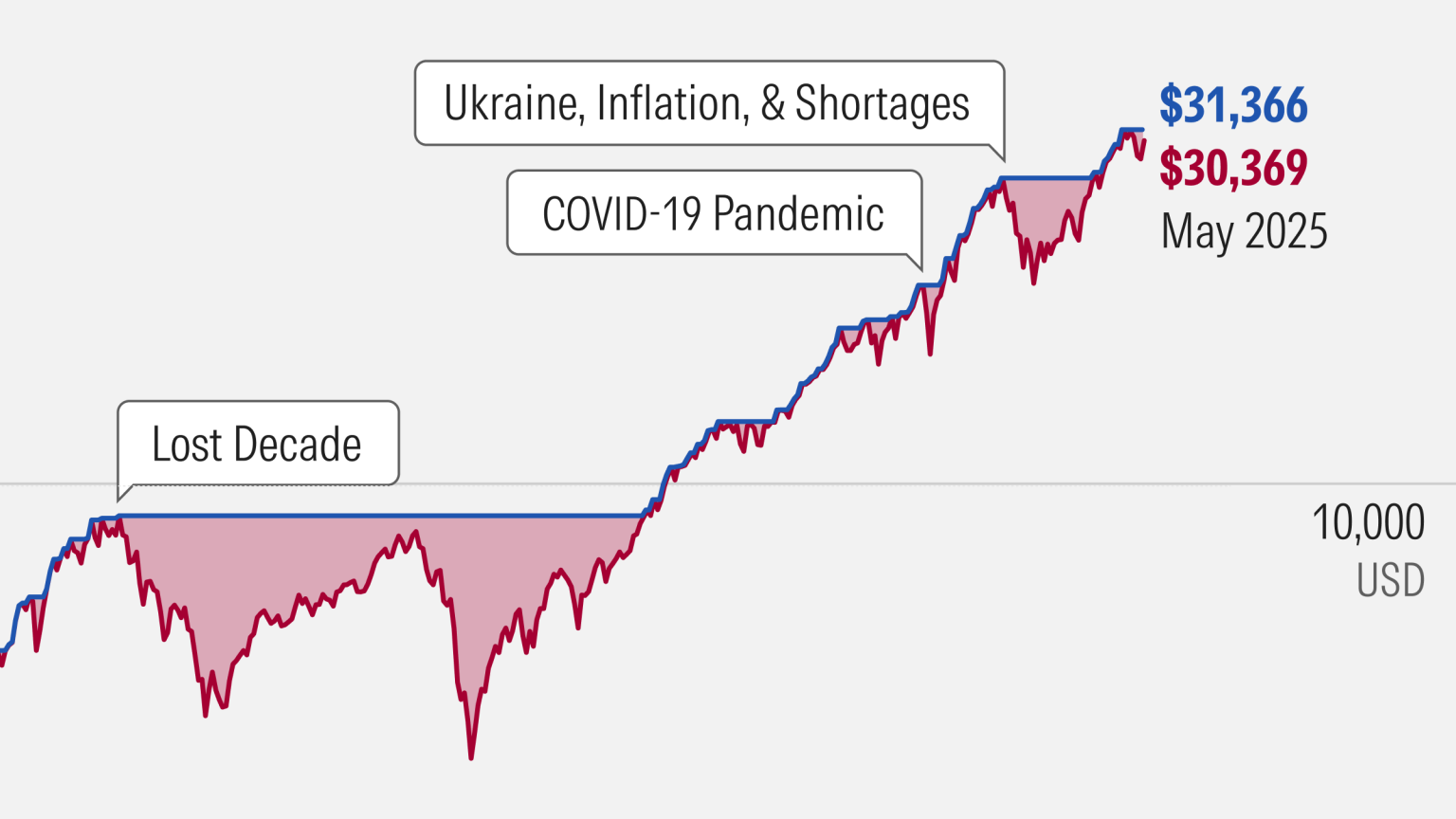

The U.S.stock market decline has triggered a wave of concern among investors, as major indices struggled to maintain upward momentum.

As investors keep a close eye on the crypto market, the Bitcoin price forecast is drawing significant attention amid recent fluctuations.Currently sitting at 65,027.4 USDT, BTC has shown resilience, managing to break through the crucial 65,000 USDT mark despite a 24-hour decline of 9.71%.

Yili Hua has made significant waves in the crypto world, recently recharging Binance with an impressive 8,000 ETH, a transaction valued at around 15.1 million USD.This move follows Hua’s earlier decision to sell an additional 11,000 ETH, showcasing a strategic approach to Ethereum holding that has drawn the attention of on-chain analysts and crypto enthusiasts alike.

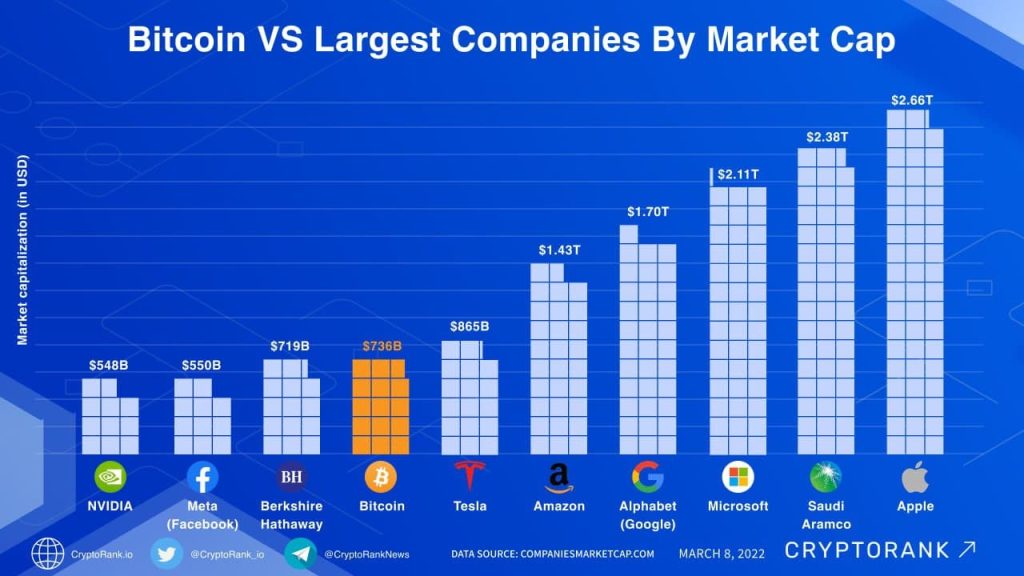

The Bitcoin market capitalization ranking has seen a significant decline, now sitting at 15th place in the global asset market.This drop highlights Bitcoin’s current market challenges as it competes against giants like Saudi Aramco and Tesla.

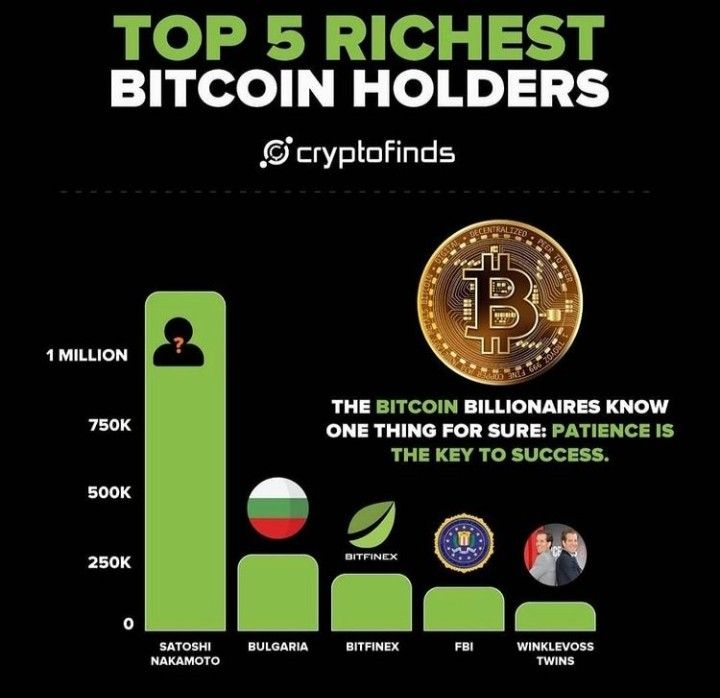

Bitcoin holders are currently facing a tumultuous phase in the crypto landscape, especially as recent sell-offs have put significant pressure on the market.In the past week alone, whale addresses—those possessing substantial amounts of Bitcoin—have sold off a staggering 81,068 BTC, pushing their total holdings to a nine-month low.

The recent surge in trading activity surrounding the BlackRock Bitcoin ETF has captured the attention of investors as Bitcoin undergoes a tumultuous phase, dropping 12% in just 24 hours.This spike in interest is evidenced by the iShares Bitcoin Trust’s record-breaking daily trading volume of $10 billion, despite the underlying cryptocurrency experiencing a significant price decline.

BTC short position profits have surged to remarkable levels, highlighted by the recent performance of the “Ultimate Bear” whale, which has achieved a staggering $71 million in total profits from its short-selling strategy.This impressive financial maneuver showcases the potential of shorting Bitcoin amidst fluctuating crypto market trends.