Author: Bpay News

In a significant move for the cryptocurrency market, the Worldcoin team has transferred 20.66 million WLD tokens to Kraken, a prominent cryptocurrency exchange. This transfer, valued at approximately $27.07 million, highlights the growing traction and liquidity of Worldcoin, a project designed to create a more inclusive global economy through digital currency. Worldcoin, which aims to provide a universal basic income through its innovative token distribution model, has been making waves in the crypto community since its inception. The recent transfer to Kraken is seen as a strategic decision to enhance the token’s accessibility and trading volume, thereby attracting more investors…

The cryptocurrency market is witnessing a notable moment for Aptos ($APT), which is currently trading at $4.25, reflecting a 3.71% increase. Despite this positive movement, the token is encountering significant resistance at the $4.78 level, a crucial threshold that traders are closely monitoring. This resistance point is pivotal as it could dictate the next movement for $APT, either leading to a breakout or a potential reversal. Technical indicators suggest that $APT is in a state of neutral momentum, indicating that while there is some upward movement, the overall market sentiment remains mixed. This state of consolidation often occurs when traders…

The NEAR Protocol, a prominent blockchain platform designed for decentralized applications and smart contracts, is currently experiencing a notable price action. Trading at $2.75, NEAR has observed a daily gain of 2.76%. This price movement comes as technical indicators present a complex picture, revealing both bullish and bearish trends in the market. On one hand, NEAR’s price is maintaining a solid position above key support levels, which signifies strength and resilience in its price structure. The ability of the asset to stay above this vital support suggests that there may be potential for further upward movement, particularly as traders look…

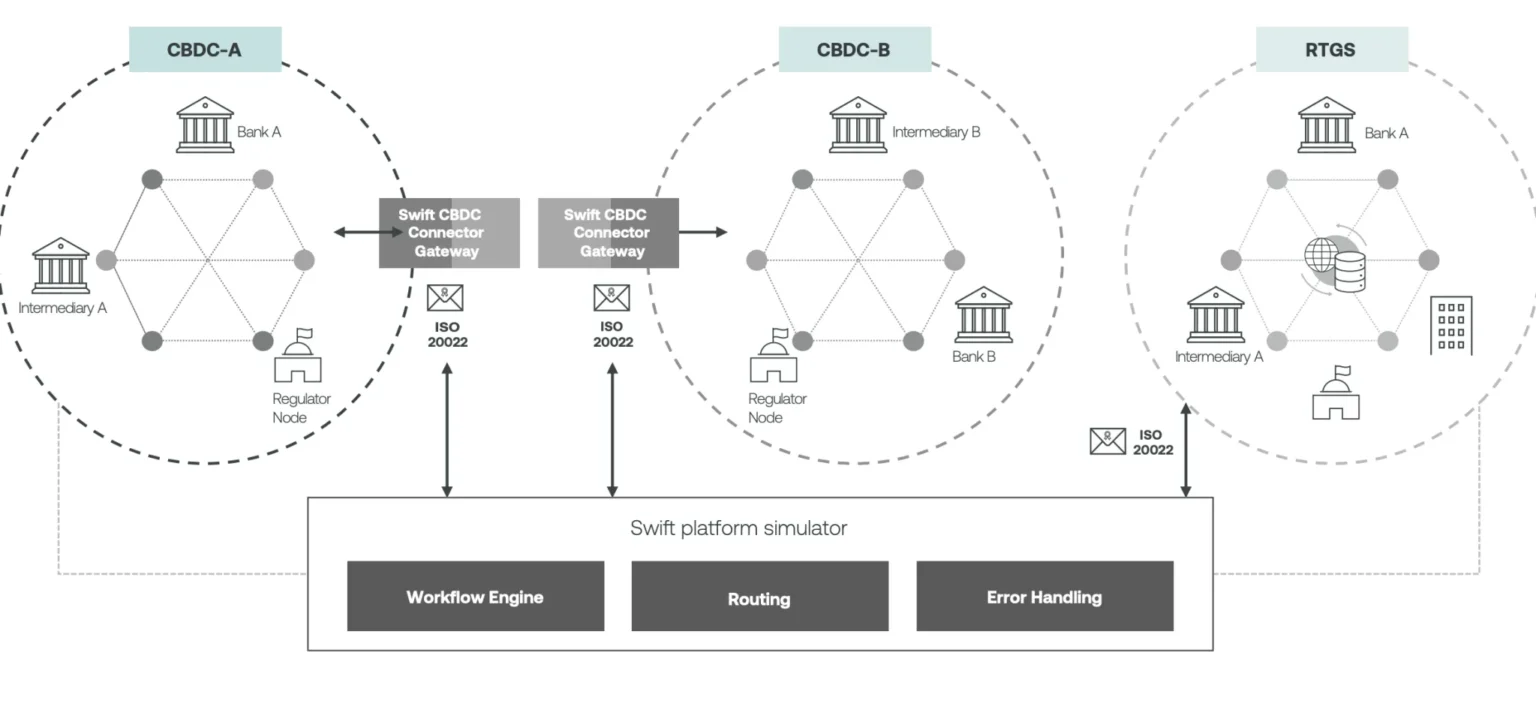

In a significant move to modernize the financial landscape, Swift has announced its plans to integrate a blockchain ledger into its infrastructure. This development aims to facilitate 24/7 cross-border payments for global financial institutions, marking a pivotal shift in how transactions are processed internationally. Historically, cross-border payments have been fraught with delays, high fees, and a lack of transparency. Traditional banking systems often operate on limited hours, which can hinder timely transactions and create inefficiencies. Swift, known for its messaging services that connect banks and financial institutions worldwide, recognizes the need for a more streamlined approach to international payments. By…

In the ever-evolving world of cryptocurrency, significant movements often signal shifts in market sentiment or investor confidence. Recently, a new Ethereum wallet has made headlines by accumulating a staggering 1200 $ETH, with an average purchase price of $4104. This development raises eyebrows and prompts discussions about the implications for the broader crypto market. Ethereum, the second-largest cryptocurrency by market capitalization, has been a focal point for investors due to its robust smart contract capabilities and the growing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs). The accumulation of such a large amount of ETH by a single wallet suggests…

The cryptocurrency market is known for its volatility, and Stellar’s native token, $XLM, is no exception. Recently, $XLM has shown mixed signals as it tests a crucial resistance level at $0.37. This price point has become a focal point for traders and investors alike, as it could dictate the token’s trajectory for the month of October. As of now, $XLM has experienced a notable increase of 2.99%, bringing its price to the critical $0.37 mark. However, the mixed technical signals suggest that the path ahead may not be straightforward. Traders are closely monitoring the situation, particularly the resistance level at…

In a significant development for the cryptocurrency community, TRON Inc. has announced a substantial injection of $110 million into its treasury, bringing the total to an impressive $220 million. This move comes at a crucial time as the price of TRON’s native token, $TRX, is currently trading at approximately $0.33. The increase in treasury funds is expected to bolster TRON’s ongoing projects and enhance its market position. The recent injection has sparked interest among investors and analysts alike, particularly as technical analysis of $TRX reveals a critical support test at the lower Bollinger Band. This indicator suggests that $TRX is…

The world of NFTs (non-fungible tokens) has seen a meteoric rise in popularity, with various digital assets capturing the attention of collectors and investors alike. Among these emerging projects is the Hypurr NFT, which has recently gained traction within the community. The question on many minds is whether this unique digital asset will become the community mascot once it reaches a valuation of $40,000. Hypurr NFT stands out not just for its artistic appeal but also for its potential to symbolize the spirit of the community it represents. As NFTs continue to evolve, they often take on roles beyond mere…

Litecoin (LTC), one of the prominent players in the cryptocurrency market, has recently experienced a notable downturn, dipping below critical simple moving averages (SMAs). As of now, the price hovers around $106.03, a level that traders are closely monitoring. This movement is significant as it reflects broader market trends and investor sentiment in the volatile crypto landscape. Technical analysis shows a mixed bag of signals for Litecoin. The relative strength index (RSI), a popular momentum indicator, is approaching the oversold territory, which often suggests that the asset might be due for a price correction or reversal. Traders often look to…

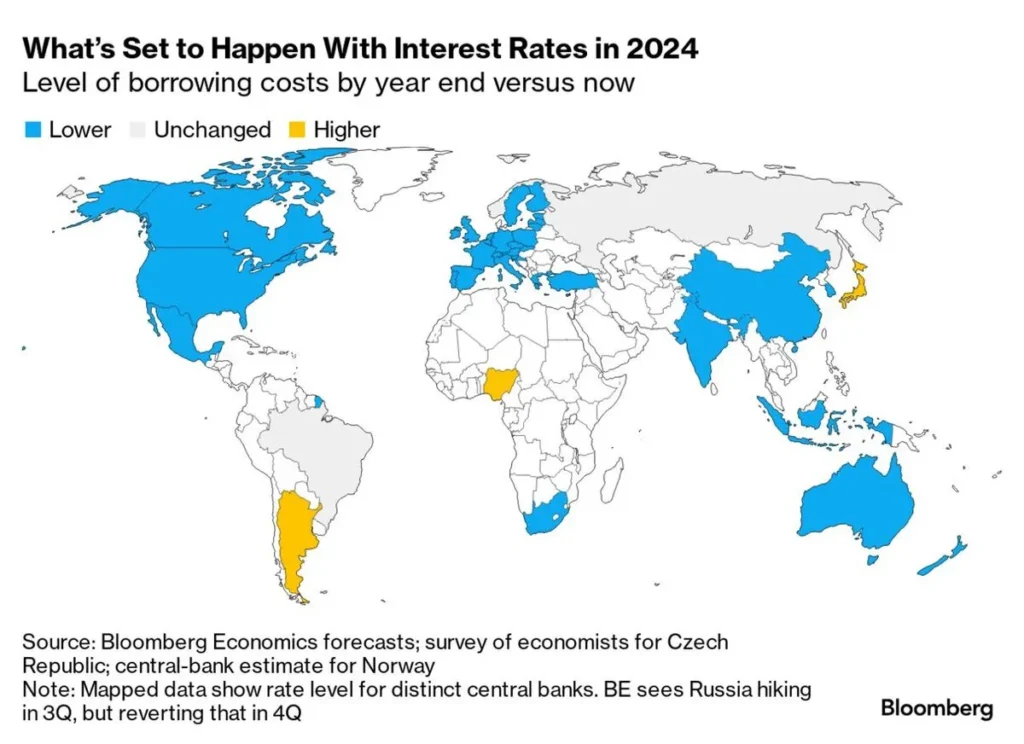

Over the past year, there has been a significant shift in monetary policy across the globe, as central banks have collectively cut interest rates 168 times. This trend reflects a broader strategy to stimulate economic growth in the face of various challenges, including inflationary pressures and economic slowdowns. Among the notable players in this monetary easing movement is the Federal Reserve, which has joined other central banks in lowering interest rates to support both businesses and consumers. Interest rate cuts are typically employed by central banks to make borrowing cheaper, encouraging spending and investment. As businesses find it easier to…