Author: Bpay News

In a groundbreaking move, Chainlink has announced a strategic partnership with several major financial institutions to address a significant issue in the corporate actions space, which is estimated to cost the industry a staggering $58 billion annually. Corporate actions, which include events like mergers, dividends, and stock splits, are crucial for investors and companies alike, yet they often suffer from inefficiencies and lack of transparency. Historically, the management of corporate actions has been plagued by outdated processes and fragmented data sources, leading to errors and delays that can have severe financial implications. Chainlink, known for its decentralized oracle network, aims…

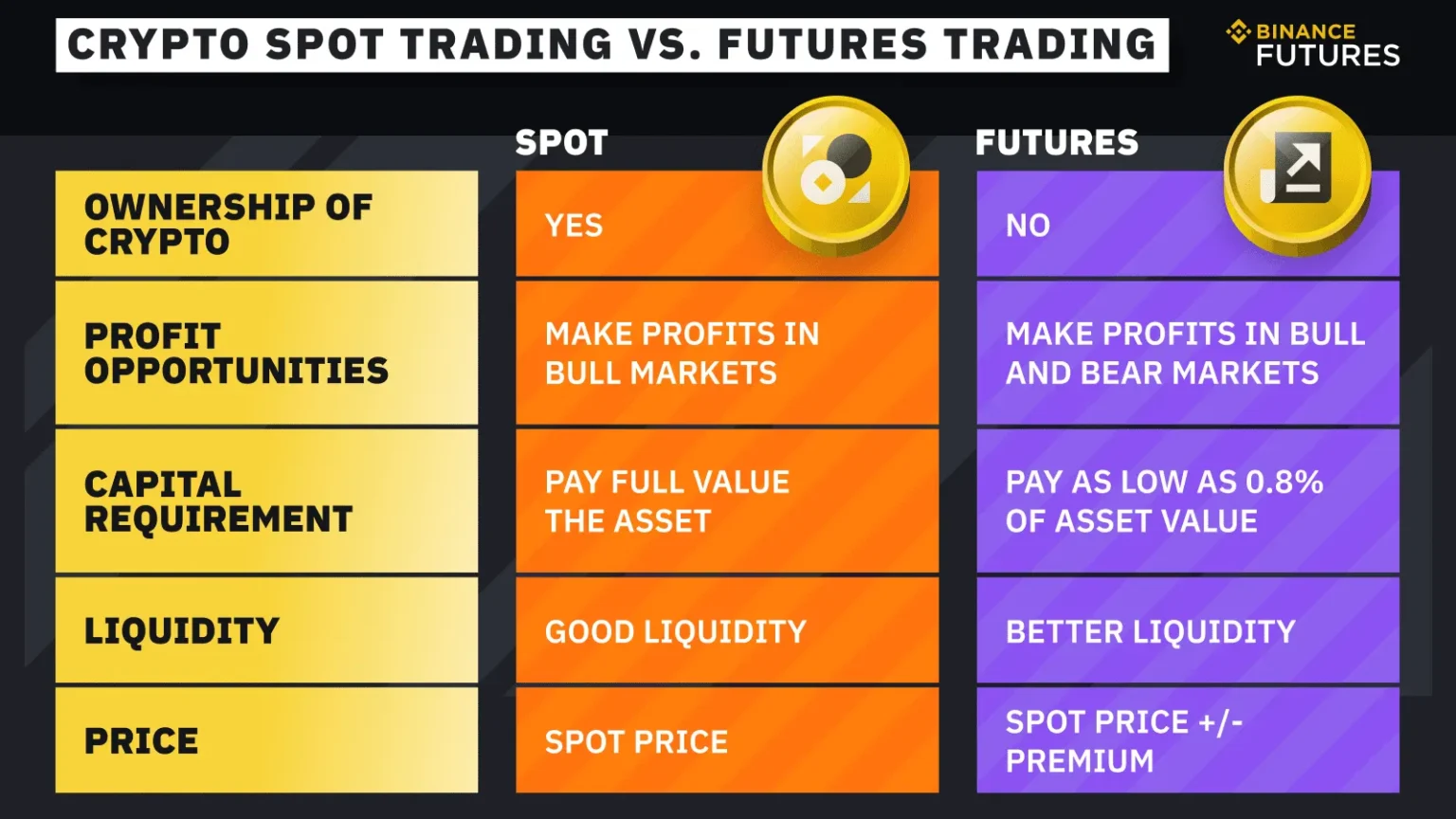

In a recent announcement, Binance, one of the leading cryptocurrency exchanges globally, has postponed the launch of its highly anticipated Futures and Spot Trading services until 21:30. This delay has sparked a wave of discussions among traders and investors, eager for the new features that promise to enhance their trading experience. Binance has been a pioneer in the cryptocurrency space, constantly evolving its offerings to cater to the growing demands of its user base. Futures trading allows investors to speculate on the future price of cryptocurrencies, while spot trading enables immediate transactions at current market prices. Both services are crucial…

In a remarkable display of blockchain technology’s efficiency, Circle has minted a staggering $500 million in USDC on the Solana network within a mere five minutes. This rapid issuance not only underscores the growing adoption of stablecoins but also highlights Solana’s capabilities as a high-performance blockchain. USDC, a stablecoin pegged to the US Dollar, has gained immense popularity as a reliable digital currency for various transactions, ranging from remittances to trading. Its reliance on transparency and regulatory compliance has made it a preferred choice for many users in the crypto space. By minting such a significant amount in a short…

In a recent announcement that has caught the attention of traders worldwide, Binance has confirmed that the launch of its Futures and FTX Spot Trading will be delayed until 9:30 PM. This decision comes amid increasing interest in cryptocurrency trading, with many investors eager to capitalize on the volatile market conditions. Binance, one of the largest cryptocurrency exchanges globally, has been at the forefront of digital asset trading. The introduction of Futures and Spot Trading on FTX is seen as a significant step in enhancing trading options for users, allowing them to engage in more sophisticated trading strategies. However, the…

In a significant move within the cryptocurrency market, FG Nexus has increased its Ethereum holdings by 747 ETH, bringing its total to an impressive 50,770 ETH. This strategic decision underscores the growing confidence in Ethereum as a leading blockchain platform and highlights FG Nexus’s commitment to expanding its digital asset portfolio. Ethereum, launched in 2015, has evolved from a simple blockchain to a robust decentralized platform that supports a wide range of applications, including smart contracts and decentralized finance (DeFi). With the rise of Ethereum 2.0 and the transition to a proof-of-stake consensus mechanism, many investors view ETH as a…

In an exciting development for the cryptocurrency landscape, Circle has announced its plans to mint an impressive 250 million USDC on the Solana blockchain. This move is seen as a significant step in bolstering liquidity and expanding the reach of USDC, one of the most widely used stablecoins in the market. The decision to mint this substantial amount of USDC is rooted in the growing demand for digital currencies across various sectors. Solana, known for its speed and efficiency, has emerged as a popular choice for developers and businesses looking to build scalable decentralized applications (dApps). By launching on Solana,…

In recent weeks, digital asset funds in the United States have experienced a significant surge in outflows, indicating a growing concern among investors regarding the stability of the cryptocurrency market. This trend comes at a time when major cryptocurrencies like Bitcoin and Ethereum are facing notable declines, prompting many investors to reassess their positions. While the US market grapples with these challenges, countries like Switzerland and Canada have shown remarkable resilience, maintaining a more stable inflow of investments into digital assets. This divergence highlights the varying levels of confidence in cryptocurrency markets across different regions. The outflows from US digital…

In a significant move signaling its commitment to the burgeoning world of decentralized technology, US-listed company Helius has officially filed an amendment to its company registration, opting for a new name: “#Solana Company.” This decision highlights Helius’s strategic pivot towards leveraging the Solana blockchain, renowned for its high throughput and scalability, characteristics that have made it a favored choice among developers and businesses in the crypto space. The rebranding is not just a superficial change; it reflects Helius’s intent to align more closely with the Solana ecosystem, which has gained traction for its lower transaction fees and rapid processing speeds…

Cryptocurrency trading continues to evolve at a rapid pace, with platforms constantly introducing innovative financial products to enhance trading strategies. In a recent announcement, Binance, one of the largest cryptocurrency exchanges worldwide, has unveiled its plans to launch FF U-Settled Perpetual Contracts. This new trading option is particularly exciting for traders as it supports an impressive leverage of up to 75 times. Perpetual contracts are a type of derivative that allow traders to speculate on the future price of a cryptocurrency without owning the underlying asset. The inclusion of “U-Settled” indicates that the contracts will be settled in a stablecoin,…

In a recent report by CoinShares, the digital asset investment landscape faced a significant downturn, with a net outflow of $812 million recorded last week. This substantial withdrawal highlights the growing volatility and uncertainty surrounding cryptocurrencies and related investment products. The digital asset market has been under pressure due to a combination of factors, including regulatory scrutiny, market fluctuations, and shifting investor sentiment. As central banks around the world grapple with inflation and economic recovery, many investors are reassessing their portfolios, leading to a cautious approach towards high-risk assets like cryptocurrencies. CoinShares’ report indicates that Bitcoin, the leading cryptocurrency, experienced…