Author: Bpay News

In recent weeks, the cryptocurrency landscape has witnessed a significant shift, with Bitcoin asserting its dominance over the altcoin market. As of now, Bitcoin’s market dominance has risen to an impressive 58.88%, a figure that underscores its position as the leading cryptocurrency. This surge in dominance comes at a time when many altcoins are struggling to gain traction, leading to a stark contrast in performance between Bitcoin and its alternatives. Bitcoin, often referred to as the original cryptocurrency, has maintained its status as a safe haven for investors amidst market volatility. Its established reputation, coupled with increasing institutional interest, has…

In the ever-evolving world of cryptocurrency, the movements of large investors, often referred to as “whales,” can significantly influence market trends. Recently, a notable whale has made headlines by accumulating a staggering 29,800 ETH (Ethereum) over a period of four months, with an average purchase price of $3,794 per coin. This strategic accumulation raises eyebrows and sparks curiosity about the potential implications for the Ethereum market. Whales are typically individuals or entities that hold large amounts of cryptocurrency, and their trading activities can create ripples in the market. The accumulation of such a significant amount of ETH suggests a bullish…

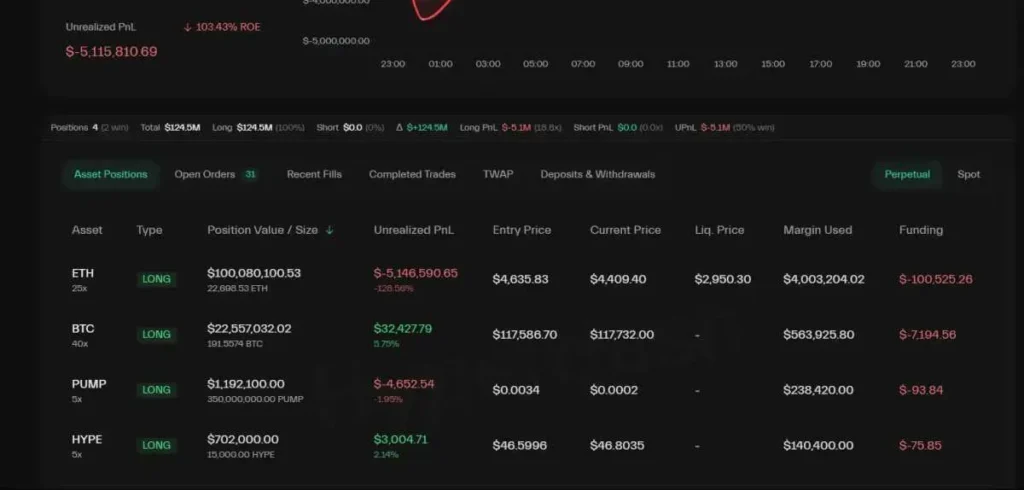

In the volatile world of cryptocurrency trading, fluctuations in market positions can lead to significant financial impacts. Recently, a notable trader known as “Buddy” has experienced a dramatic shift in his long position, with unrealized losses narrowing to $9.5 million. This is a remarkable recovery from a staggering peak loss that exceeded $20 million just weeks prior. The cryptocurrency market is notorious for its rapid price swings, which can create both opportunities and risks for traders. Buddy’s situation exemplifies the challenges faced by many in the industry, where a single market movement can drastically alter one’s financial standing. Long positions,…

In a surprising turn of events, trader James Wynn, previously known for his controversial trading strategies, has opened a new short position on HYPE after experiencing a significant downturn in his trading portfolio. This move comes on the heels of Wynn’s recent decision to fully close his long position on Aster at a stop-loss, indicating a strategic pivot in his trading approach. Wynn’s reputation as a “bankrupt” trader stems from his high-risk tactics that have often led to substantial losses. However, his latest actions suggest a calculated risk as he seeks to capitalize on potential downward trends in the HYPE…

In the ever-evolving world of cryptocurrency, significant movements by large investors, often referred to as “whales,” can have a substantial impact on market dynamics. Recently, a notable whale has made headlines by increasing its position in Ethereum (ETH) by acquiring a staggering 29,800 ETH at an average price of $3,794. This strategic move took four months to complete, highlighting the careful planning and timing often involved in such large-scale transactions. Ethereum, the second-largest cryptocurrency by market capitalization, has been a focal point for investors due to its robust smart contract capabilities and growing adoption in decentralized finance (DeFi) and non-fungible…

OpenAI has reported significant financial growth in the first half of this year, generating an impressive $4.3 billion in revenue. This figure represents a remarkable 16% increase compared to the same period last year, reflecting the escalating demand for advanced AI solutions across various sectors. The backdrop of this surge in revenue can be attributed to OpenAI’s continuous innovation in artificial intelligence technologies and applications. The organization’s flagship product, ChatGPT, has gained widespread adoption in both consumer and enterprise markets. Companies are increasingly integrating AI tools to enhance efficiency, automate processes, and improve customer engagement, driving up demand for OpenAI’s…

In a significant move that has caught the attention of the cryptocurrency community, a prominent investor, often referred to as a “whale,” has withdrawn a staggering 2.16 million ASTER tokens from a centralized exchange (CEX). This withdrawal, valued at approximately $4.24 million, signals the potential for large-scale shifts in market dynamics and investor sentiment surrounding ASTER. The ASTER token has been gaining traction in recent months, bolstered by its unique use case and growing applications within the cryptocurrency ecosystem. With its popularity on the rise, large transactions like this one underscore the confidence that heavy investors have in the token’s…

The cryptocurrency market is known for its volatility, and Bitcoin, the leading digital currency, often sets the tone for price movements across the sector. Recently, analysts have pointed out that if Bitcoin’s price surpasses $116,000, it could lead to a massive $1.08 billion in cumulative short liquidations on mainstream centralized exchanges (CEX). Short selling is a trading strategy where investors bet against an asset, hoping its price will decline. However, if the price rises significantly, short sellers are forced to buy back their positions to limit losses, which can further drive the price up—a phenomenon known as a short squeeze.…

The landscape of cryptocurrency regulation is evolving rapidly, and the SEC’s Crypto Special Working Group is at the forefront of these discussions. Recently, the group has engaged in talks with significant players in the financial industry, namely the New York Stock Exchange (NYSE) and the Intercontinental Exchange (ICE). This collaboration aims to address the pressing concerns surrounding crypto regulations, ensuring that the burgeoning market operates within a secure and compliant framework. The SEC’s initiative comes amid increasing scrutiny of the cryptocurrency space, particularly following the surge in popularity and investment in digital assets. With the rise of decentralized finance (DeFi)…

In a high-profile case that has captured the attention of the cryptocurrency community, Qian Zhimin, the alleged mastermind behind a $60,000 Bitcoin money laundering operation, has only admitted to two charges against him. This case highlights the ongoing challenges law enforcement faces in tackling the complexities of cryptocurrency-related crimes. Qian’s legal team has argued that the significant increase in the value of cryptocurrencies could potentially offset the losses suffered by victims of the alleged money laundering scheme. With Bitcoin and other digital currencies experiencing remarkable growth over the past few years, the defense posits that the appreciation in value may…