Author: Bpay News

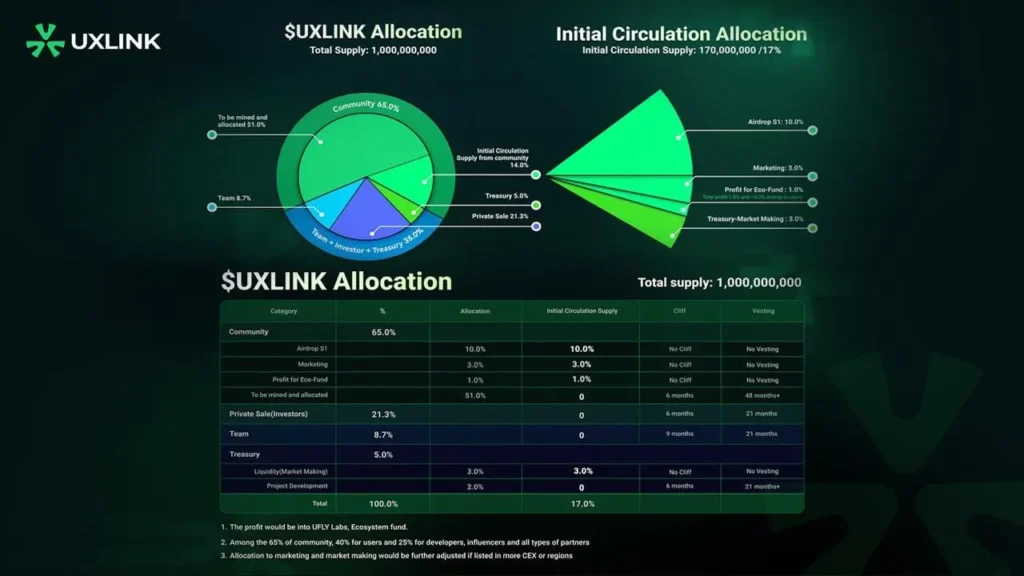

In a significant development for the cryptocurrency community, Gate has announced its support for the UXLINK token swap. This initiative marks a pivotal moment for UXLINK holders, allowing them to seamlessly transition to the new token standards while enjoying enhanced functionalities and benefits. The UXLINK token has been gaining traction in the market, known for its innovative approach to decentralized finance (DeFi). However, as with many digital currencies, the need for upgrades and improvements is crucial for maintaining competitiveness within the ever-evolving crypto landscape. The token swap initiative aims to address this need by offering better scalability, security, and user…

In an exciting development for cryptocurrency enthusiasts and investors, Metaplanet has announced that it will release its Bitcoin performance metrics on October 1st. This initiative marks a significant step towards transparency in the rapidly evolving world of digital currencies. By committing to quarterly disclosures, Metaplanet aims to provide stakeholders with valuable insights into its Bitcoin holdings and performance trends. The decision to share performance data comes at a time when Bitcoin continues to capture the attention of both institutional and retail investors. As the largest cryptocurrency by market capitalization, Bitcoin’s price movements can significantly influence market sentiment and investment strategies.…

In an exciting development for the blockchain and gaming industries, Republic is set to tokenize the equity of Animoca Brands, a leading player in the gaming and digital entertainment space. This initiative will leverage the Solana network, known for its high throughput and low transaction costs, making it an ideal platform for such innovative financial solutions. Animoca Brands has been at the forefront of the gaming revolution, integrating blockchain technology into its products to enhance user experience and ownership. By tokenizing its equity, the company aims to democratize investment opportunities, allowing more individuals to participate in its growth story. This…

In a bid to combat money laundering and enhance financial security, Turkish legislation is set to implement measures that could freeze both cryptocurrency and traditional bank accounts. This move comes as part of a broader effort to align with international standards and crack down on illicit financial activities. The Turkish government has been increasingly concerned about the rise of cryptocurrency, which, despite its benefits, presents challenges for regulatory bodies. The anonymity and decentralization inherent in digital currencies can facilitate money laundering, making it crucial for authorities to establish stricter controls. The proposed legislation aims to empower financial institutions to freeze…

The cryptocurrency market is known for its volatility, and Ethereum (ETH) is no exception. As the second-largest cryptocurrency by market capitalization, Ethereum has garnered significant attention from traders and investors alike. Recently, analysts have been closely monitoring a critical price level: $4300. If Ethereum manages to break this threshold, it could unleash a wave of short liquidations across major centralized exchanges (CEXs), potentially amounting to a staggering $9.01 billion. Short selling is a trading strategy where investors bet against an asset, anticipating that its price will decline. However, when the price rises instead, short sellers are forced to buy back…

In a notable development in the commodities market, spot gold prices have climbed to an impressive $3870 per ounce, marking a 0.95% increase during the trading day. This surge reflects ongoing investor interest in gold as a safe haven asset amidst economic uncertainties and fluctuating market conditions. Gold has long been regarded as a reliable store of value, particularly during times of inflation and geopolitical tensions. As central banks around the world navigate complex economic landscapes, many investors are turning to gold to hedge against potential risks. The recent uptick in gold prices can be attributed to several factors, including…

In a noteworthy turn of events, Buddy, a leading player in the digital asset space, has seen its net unrealized loss significantly decrease to $9.5 million. This reduction comes after the company previously faced an alarming peak of over $20 million in unrealized losses. The fluctuations in Buddy’s financial standing highlight the volatility commonly associated with the cryptocurrency market, which has seen dramatic shifts in investor sentiment and asset valuations. The unrealized loss refers to the decrease in value of assets that have not yet been sold. For Buddy, this figure is particularly pivotal, as it reflects both the challenges…

In the ever-evolving world of cryptocurrency, significant movements by major players often make headlines, and the latest actions of a prominent HYPE whale are no exception. Recently, this influential investor sold off 260,000 HYPE tokens, marking a staggering milestone as they have now liquidated over 90% of their total holdings. This strategic move has allowed them to cash out an impressive $220 million, raising eyebrows across the crypto community. The term “whale” refers to individuals or entities that hold substantial amounts of a particular cryptocurrency, and their trading decisions can significantly impact market dynamics. The HYPE token, which has garnered…

The Reserve Bank of Australia (RBA) has decided to keep interest rates steady, signaling a cautious approach to managing inflation amid a complex economic landscape. In its latest monetary policy meeting, the RBA opted to maintain the cash rate at 4.10%, a decision that reflects ongoing concerns about inflation and the broader economic climate. Inflation has been a significant challenge for central banks worldwide, and Australia is no exception. The RBA’s decision comes after a series of rate hikes aimed at curbing inflation, which surged to levels not seen in decades. By holding rates steady, the RBA aims to strike…

This week, the financial world is buzzing with the anticipated launch of the U.S. “Government Rent-Seeking” ETF, a unique investment vehicle designed to target companies that are significantly influenced by federal policies and decisions made by the President. This innovative exchange-traded fund (ETF) aims to tap into the lucrative market of firms that benefit from government contracts, subsidies, and regulations. The concept of rent-seeking refers to the practice where businesses seek to gain economic advantages through government intervention rather than through productive economic activity. This can include lobbying for favorable regulations, securing government contracts, or obtaining subsidies. The ETF is…