Author: Bpay News

In the ever-evolving world of cryptocurrency, trading platforms often reflect the dynamic shifts in market interest and investor behavior. Recently, Upbit, one of South Korea’s leading cryptocurrency exchanges, recorded a notable surge in trading volumes, with three cryptocurrencies taking the lead: USDT (Tether), FF (Fantom), and XRP (Ripple). This sudden spike invites a closer examination of the factors driving these changes. USDT, a stablecoin pegged to the US dollar, serves as a vital tool for traders looking to navigate the volatile market while maintaining a stable value for their assets. Its significant presence in trading volumes often indicates a bullish…

Bybit, a prominent player in the cryptocurrency exchange space, has proudly announced the full launch of its incubated decentralized exchange (DEX), Byreal, on the Solana blockchain. This milestone marks a significant expansion in the DeFi landscape, aiming to provide users with a seamless trading experience characterized by speed, low fees, and enhanced security. Solana has gained recognition for its high throughput and scalability, enabling decentralized applications to operate efficiently. Byreal leverages these strengths to offer traders an innovative platform that minimizes transaction costs while maximizing speed. The launch is poised to attract both seasoned traders and newcomers to the world…

In the ever-evolving landscape of the financial markets, pre-market trading often sets the tone for the day ahead. Recently, the US market has experienced a notable downtrend, particularly affecting crypto-related stocks and concept stocks. One of the most significant movements was observed in BMNR, which fell by 1.80%, reflecting broader market sentiments. The decline in BMNR and similar stocks can be attributed to a combination of factors. Firstly, the ongoing volatility in the cryptocurrency market has created uncertainty among investors. With regulatory scrutiny increasing and market sentiment fluctuating, many are reevaluating their positions in crypto-related investments. This cautious approach is…

The cryptocurrency landscape is undergoing a significant transformation as U.S. regulatory bodies, particularly the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), are moving towards a unified approach on policies affecting the digital asset space. This collaboration is pivotal as it seeks to establish a clearer regulatory framework for crypto markets, fostering an environment conducive to innovation and investor protection. Chairman Atkins of the new regulatory task force recently emphasized the importance of a cohesive regulatory strategy, stating that both the SEC and CFTC recognize the growing influence of cryptocurrencies in financial markets. Since the rise…

Societe Generale, a prominent French financial institution, has taken a significant step into the world of cryptocurrencies by deploying stablecoins pegged to the Euro and the US Dollar on the decentralized exchange Uniswap. This move marks a pivotal moment for the bank’s crypto arm, showcasing its commitment to integrating digital assets into traditional finance. Stablecoins have gained popularity for their ability to maintain a stable value, making them a preferred choice for investors seeking to mitigate volatility in the cryptocurrency market. By launching its Euro and Dollar stablecoins, Societe Generale aims to facilitate seamless transactions and enhance liquidity for users…

In a surprising turn of events, Sui has experienced a pullback in its trading value, currently sitting at $3.23 after a 2.31% decline. This comes on the heels of a remarkable 115% surge in September, a month that marked significant growth for the decentralized finance (DeFi) sector. The surge was particularly notable as it coincided with Sui’s ecosystem reaching an all-time high in total value locked (TVL), which hit an impressive $1 billion milestone. The rise in Sui’s value can be attributed to a growing interest in DeFi projects and the overall bullish sentiment in the cryptocurrency market during September.…

The financial landscape is rapidly evolving, and stablecoins are at the forefront of this transformation. As digital currencies designed to minimize price volatility, stablecoins bridge the gap between traditional fiat currencies and the world of cryptocurrencies. Their unique structure not only enhances payment efficiency but also addresses critical issues surrounding security and compliance. In recent years, stablecoins have gained traction due to their ability to facilitate faster transactions with lower fees compared to traditional banking systems. This efficiency is especially appealing for cross-border payments, where users can circumvent hefty transaction fees and lengthy processing times. However, the journey towards widespread…

In a bold forecast, UBS has projected that gold prices could reach an astonishing $4200 per ounce by mid-2026. This prediction comes amidst a backdrop of economic uncertainty and rising inflation, factors that traditionally drive investors toward the safe haven of gold. The precious metal has long been viewed as a hedge against economic instability, and with global markets facing potential turbulence, its appeal is only expected to grow. UBS analysts point to several key factors contributing to this optimistic outlook. First, the ongoing geopolitical tensions and unpredictable monetary policies worldwide are likely to spur demand for gold as a…

Sui, a blockchain platform known for its rapid growth, recently experienced a slight decline of 2.31%, trading at $3.23. This pullback follows an impressive 115% rally in September, which saw the total value locked (TVL) in its ecosystem soar to a historic $1 billion. The significant rise in TVL, which more than doubled from $383 million in August, highlights Sui’s expanding footprint in the decentralized finance (DeFi) sector. Major applications, like NAVI protocol and Scallop Lend, made notable contributions, each amassing over $165 million in assets. As traders capitalize on the recent surge, SUI’s price remains under pressure, having previously…

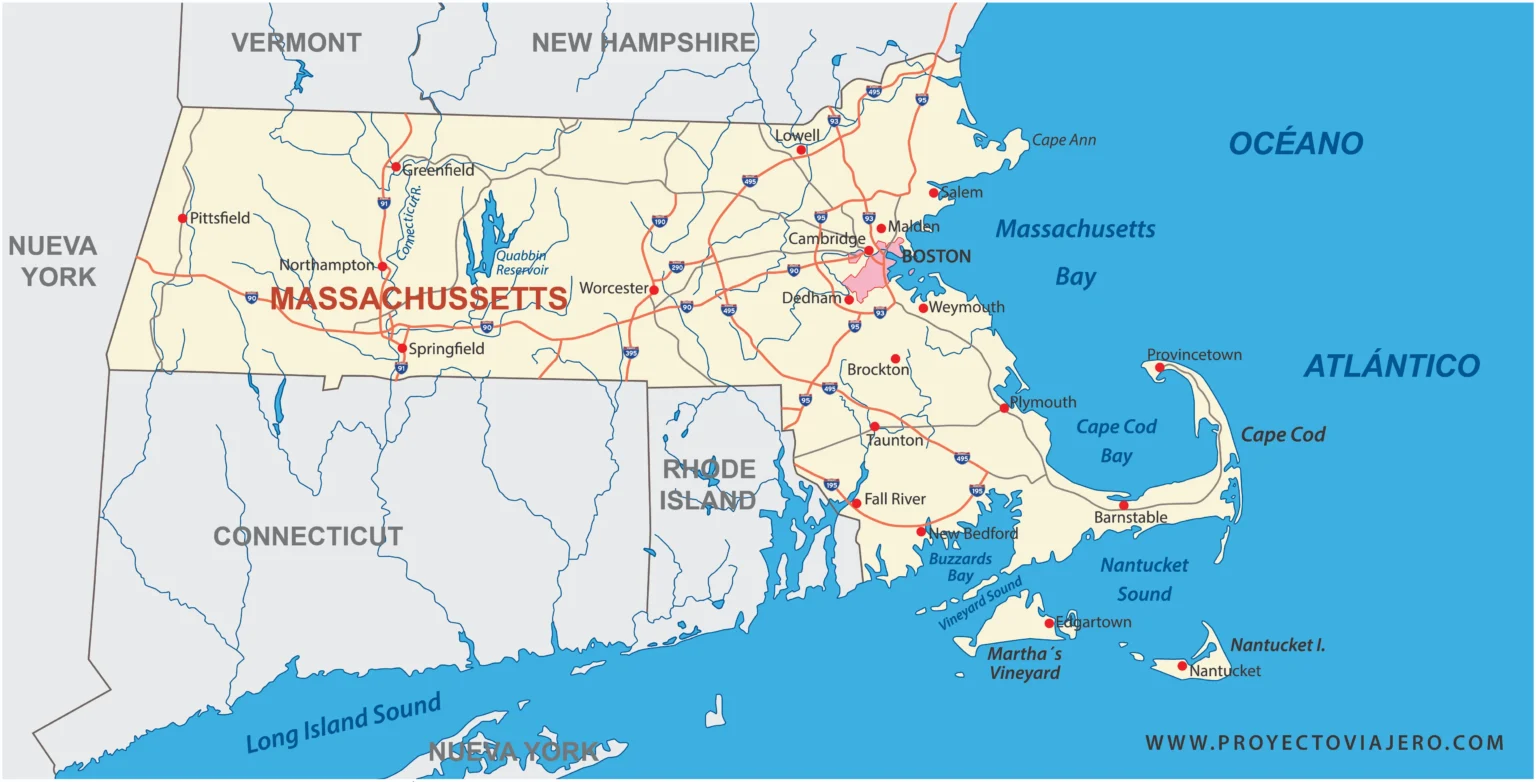

In a significant development for the financial landscape of state governance, Massachusetts lawmakers are preparing to debate a proposed bill that aims to establish a Bitcoin Reserve Fund. This initiative marks a pioneering step towards integrating cryptocurrency into state financial strategies, potentially setting a precedent for other states to follow. The proposal comes amid a growing recognition of Bitcoin and other cryptocurrencies as viable financial assets. Advocates argue that by creating a reserve fund, Massachusetts could leverage the volatility and potential growth of Bitcoin to enhance its financial portfolio. This move reflects a broader trend among states and institutions exploring…