Author: Bpay News

In a significant move for the cryptocurrency community, Binance has successfully completed the token swap from OMNI to Nomina (NOM). This transition marks a pivotal moment for users who held OMNI tokens, as they can now seamlessly convert their assets to the newly established Nomina token. The swap is part of Binance’s ongoing efforts to enhance user experience and streamline the trading process for its customers. The OMNI protocol, which was originally designed to facilitate the creation and trading of digital assets on the Bitcoin blockchain, has seen a decline in usage as newer technologies and platforms have emerged. Recognizing…

In the fast-paced world of cryptocurrency trading, high-leverage positions can lead to significant gains or devastating losses in a matter of moments. Recently, a notable incident involving an insider trader known as @qwatio captured the attention of the crypto community when their 95x short position on Bitcoin ($BTC) was liquidated after being open for only 1.5 hours. This event highlights the risks and volatility inherent in trading cryptocurrencies, particularly when using extreme leverage. Leverage in trading allows investors to control larger positions than their actual capital would permit. In this case, @qwatio aimed to profit from a decline in Bitcoin’s…

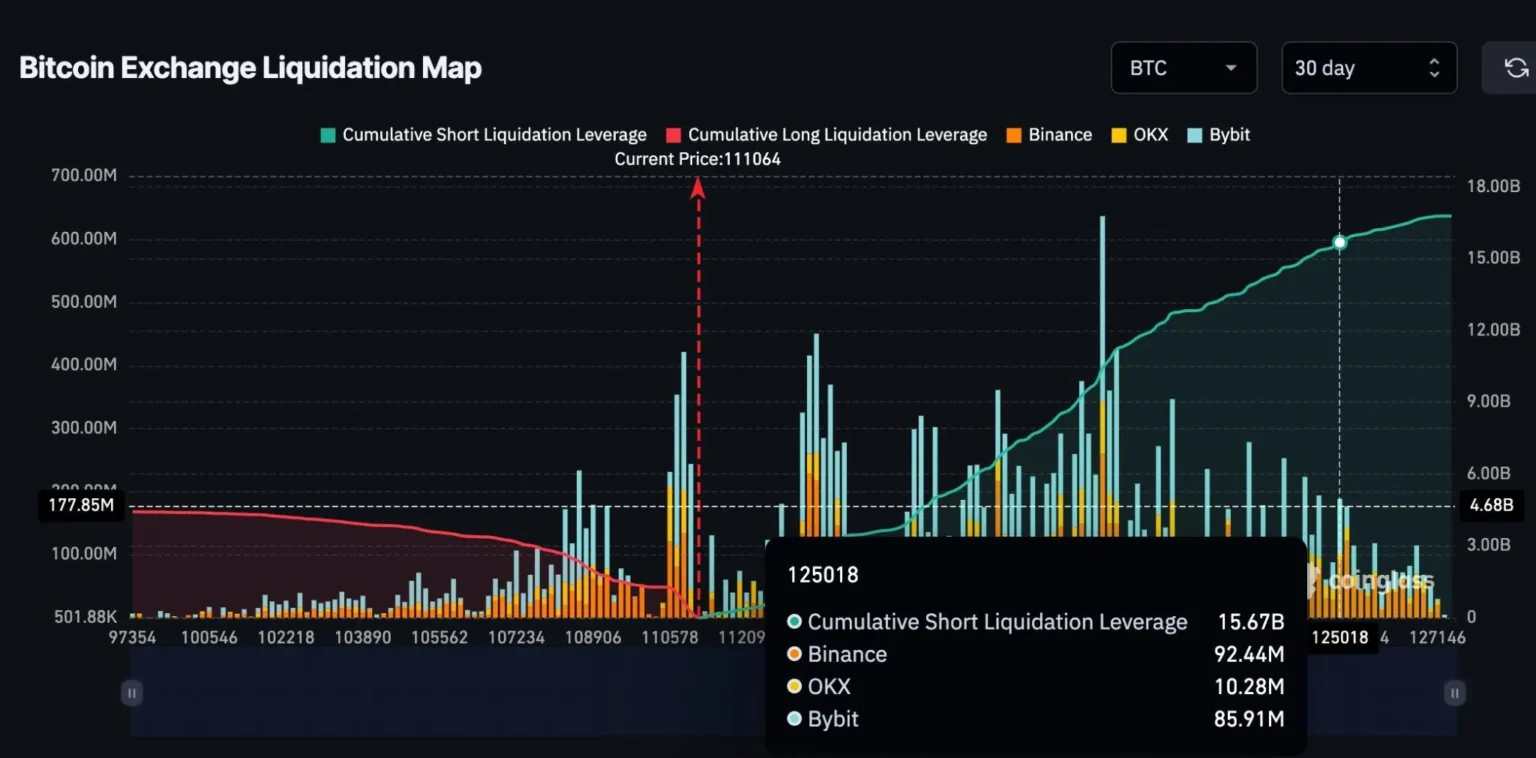

In a dramatic turn of events, the cryptocurrency market has witnessed a staggering $237 million in liquidations within just one hour, primarily fueled by a surge in short positions being wiped out. Liquidation refers to the process through which leveraged positions are automatically closed by exchanges to prevent further losses when a trader’s margin falls below a required level. This phenomenon is especially prevalent in the highly volatile crypto market, where price swings can be both rapid and severe. The driving force behind this recent liquidation wave seems to be a sudden bullish trend that caught many short sellers off…

In the ever-evolving world of cryptocurrency, stablecoins have emerged as a crucial component, providing a bridge between the volatility of digital assets and the stability of traditional currencies. Trader Eugene recently shared his insights on the stablecoin narrative, expressing confidence in his position in XPL, a cryptocurrency that aims to maintain a stable value. His belief is rooted in the notion that the stablecoin market will not collapse in the short term, a sentiment that resonates with many investors navigating the turbulent waters of crypto trading. Stablecoins are designed to minimize price fluctuations, often pegged to fiat currencies like the…

In recent weeks, Bitcoin (BTC) has shown encouraging signs of recovery, with its dominance in the cryptocurrency market making a notable comeback. According to data from Glassnode, this resurgence in BTC’s price correlates closely with an increase in its market dominance, suggesting a more sustainable rally compared to previous years. Bitcoin dominance is a key indicator of the market’s health, representing the percentage of the total cryptocurrency market capitalization that Bitcoin occupies. When BTC’s price rises alongside its dominance, it often signals that investors are favoring Bitcoin over altcoins, which can lead to a more stable market environment. This trend…

In the ever-evolving world of cryptocurrency, PUMP has made headlines by surging an impressive 27% in just the last 24 hours. Currently trading at $0.00681, this sudden spike has caught the attention of both seasoned investors and newcomers alike. But what’s driving this rapid increase in value? PUMP, a relatively new player in the crypto market, has been gaining traction due to its unique value proposition and community-driven initiatives. The project focuses on creating a decentralized platform that allows users to engage in various financial activities without the need for traditional banking systems. This appeal to decentralization resonates with many…

In a remarkable turn of events, Bitcoin has surged above $116,000, marking a significant milestone in its volatile journey. This price surge comes amidst a backdrop of increasing institutional interest and favorable regulatory developments that have reignited investor confidence in the cryptocurrency market. Historically, Bitcoin has been known for its dramatic price fluctuations, often influenced by market sentiment, technological advancements, and macroeconomic factors. The recent price jump can be attributed to a combination of these elements, including a surge in demand from institutional investors who are increasingly viewing Bitcoin as a viable hedge against inflation and a store of value…

Ethereum, the second-largest cryptocurrency by market capitalization, has recently made headlines by surging above the $4300 mark, reflecting a notable 24-hour change of +3.45%. This impressive uptick has sparked renewed interest among investors and traders, showcasing Ethereum’s resilience and potential for growth in a fluctuating market. The rise of Ethereum can be attributed to several factors, including increased institutional adoption, the growing popularity of decentralized finance (DeFi) applications, and the overall bullish sentiment surrounding cryptocurrencies. As more investors recognize the utility of Ethereum’s blockchain technology, which supports smart contracts and decentralized applications, the demand for Ether (ETH) continues to rise.…

In a significant development for the BNB Chain community, full control of a compromised account has been restored, bringing relief to many affected by the recent security breach. The incident, which raised concerns over the safety of digital assets on the blockchain, highlighted the vulnerabilities that can arise in the rapidly evolving cryptocurrency landscape. Following the breach, the BNB Chain team acted swiftly to investigate the incident and secure the network. Their efforts culminated in regaining access to the hacked account, a crucial step in mitigating the damage caused by the attack. The team has announced that all victims of…

In recent months, the cryptocurrency market has seen a significant shift as institutional investors increasingly turn their attention to futures trading. Notably, XRP futures have emerged as a key player in this trend, indicating a growing institutional adoption. The Chicago Mercantile Exchange (CME) Group has reported that XRP futures are witnessing heightened interest, signaling that institutions are beginning to recognize the potential of this digital asset. Meanwhile, Solana futures have also made headlines by reaching an impressive $1 billion in open interest within just five months. This remarkable achievement positions Solana ahead of both Bitcoin and Ether in terms of…