Author: Bpay News

In the ever-evolving world of cryptocurrency, traders are constantly seeking opportunities to maximize their profits, and leveraging is one of the most popular strategies. Recently, prominent trader James Wynn made headlines by going long on PEPE, a meme-based cryptocurrency, with an impressive 10x leverage. This bold move has sparked interest and speculation within the crypto community. PEPE, inspired by the iconic internet meme of the same name, has gained traction as a fun and engaging digital currency. Initially launched as a joke, it has attracted a dedicated following and has seen significant price fluctuations, making it an appealing asset for…

Kalshi, a groundbreaking platform that allows users to trade on the future of various events, is set to make waves in the cryptocurrency space. Over the next 12 months, Kalshi aims to onboard its services to all major cryptocurrency applications, significantly broadening its reach and accessibility. This ambitious plan marks a milestone in the evolving landscape of digital finance, where trading platforms are increasingly merging with cryptocurrency functionalities. Founded to facilitate event trading, Kalshi has attracted attention not only for its innovative approach but also for its regulatory compliance. As the cryptocurrency market continues to grow and evolve, Kalshi’s entrance…

In a surprising turn of events, Bitcoin has surged past the $119,000 mark, marking a significant milestone for the cryptocurrency as the U.S. government shutdown takes effect. This unexpected rise in Bitcoin’s value has also triggered a rally in several altcoins, including XRP, Solana (SOL), and Ethereum (ETH), as investors seek refuge in digital assets amidst economic uncertainty. The backdrop of this surge is the ongoing government shutdown, which has left many investors anxious about traditional markets. With uncertainty looming over fiscal policies and government operations, cryptocurrencies have emerged as an attractive alternative for those looking to hedge against potential…

In the ever-evolving world of cryptocurrency, large transactions often signal significant market movements. Recently, a notable whale or institutional investor made headlines by purchasing a staggering 8,637 $ETH (Ethereum) within a single hour. This substantial acquisition has sparked curiosity and speculation among traders and analysts alike, as it raises questions about the motivations behind such a bold move. Ethereum, the second-largest cryptocurrency by market capitalization, has been gaining traction due to its robust platform for decentralized applications and smart contracts. As the ecosystem continues to mature, institutional interest in Ethereum has surged, with many investors recognizing its potential for long-term…

The cryptocurrency market continues to show signs of resilience, particularly with the Ethereum Spot Exchange-Traded Fund (ETF) making headlines. Recently, the Ethereum Spot ETF recorded a remarkable total net inflow of $80.79 million in just one day, marking the third consecutive day of positive inflows. This trend highlights a growing interest among investors in Ethereum, one of the leading cryptocurrencies in the market. ETFs have become increasingly popular as they offer a way for traditional investors to gain exposure to cryptocurrencies without the complexities of direct ownership. The Ethereum Spot ETF, in particular, allows investors to buy shares that are…

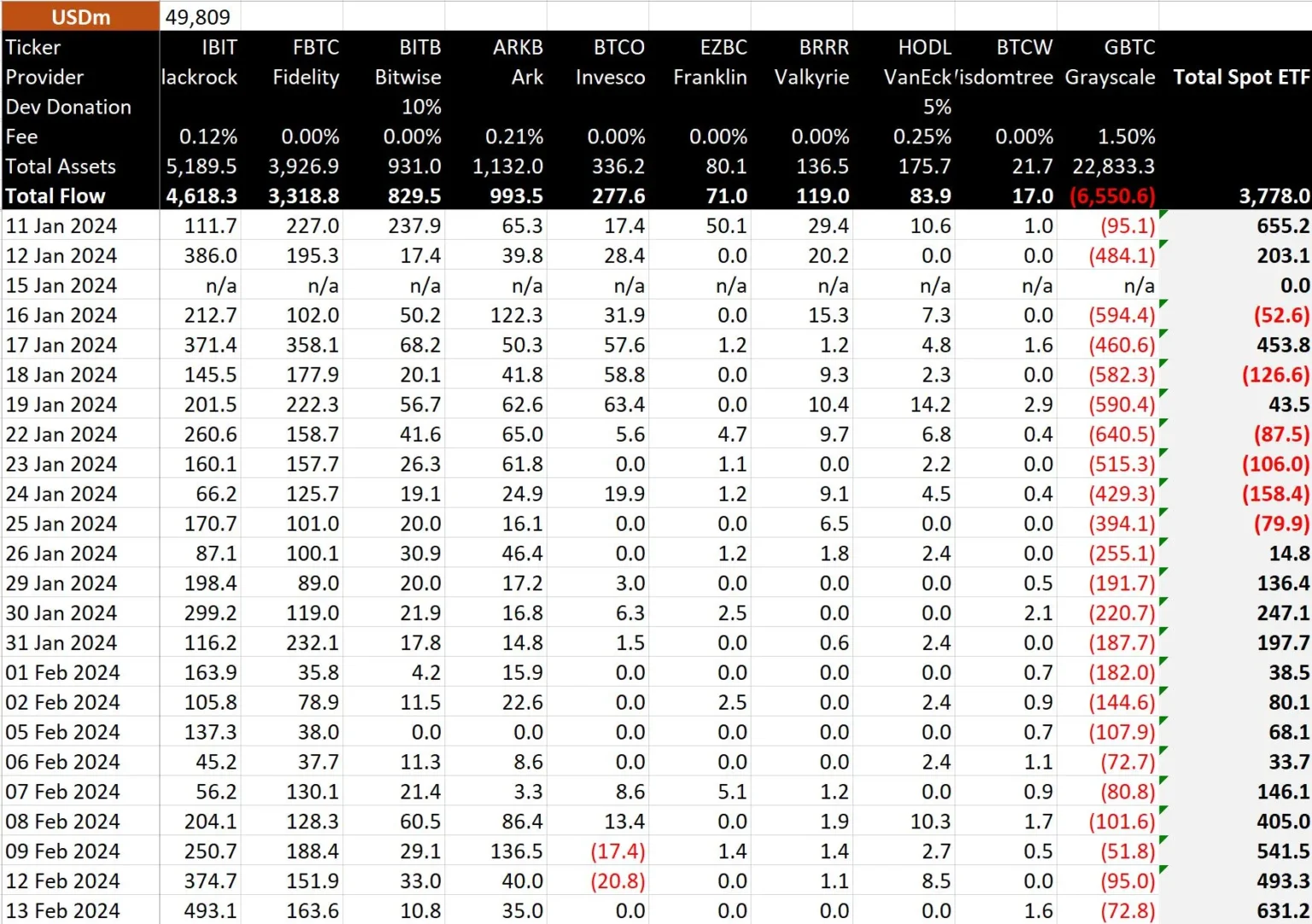

In a significant development for cryptocurrency investors, the Bitcoin Spot Exchange-Traded Fund (ETF) has recorded a remarkable net inflow of $676 million yesterday. This marks the third consecutive day of positive net inflows, signaling a growing confidence in Bitcoin as an investment vehicle. The rise of Bitcoin ETFs has been a game-changer in the cryptocurrency market, allowing traditional investors to gain exposure to Bitcoin without the complexities of direct ownership. ETFs are investment funds that are traded on stock exchanges, much like stocks, and they hold assets such as commodities or currencies. The Bitcoin Spot ETF specifically tracks the price…

In a surprising turn of events within the cryptocurrency market, YiLianhua’s Trend Research has made headlines by transferring a staggering 55,851 ETH to the Binance exchange in just 15 hours. This significant movement of Ethereum raises eyebrows and prompts speculation about the motivations behind such a large transaction. YiLianhua, known for its trend analysis and research within the crypto space, has been actively involved in monitoring and influencing market behavior. The recent transfer to Binance, one of the world’s largest cryptocurrency exchanges, suggests a strategic decision that could reflect a broader market sentiment or a response to current trading conditions.…

In a bold move to protect its agricultural resources, the UAE capital has imposed hefty fines on illegal cryptocurrency mining operations that are misusing farmland. Authorities have announced a staggering penalty of AED 100,000 for those found violating regulations, marking a dramatic 900% increase in fines. This crackdown reflects the UAE’s commitment to prioritizing food security over the burgeoning digital asset market. Cryptocurrency mining, which requires substantial energy and resources, has been increasingly scrutinized worldwide due to its environmental impact and the strain it places on local infrastructures. In the UAE, where agriculture is a vital part of the economy,…

Tether, the stablecoin that has become a cornerstone of the cryptocurrency market, recently reached a staggering valuation of $500 billion. This figure has raised eyebrows and sparked debates about the actual ownership and financial structure behind this influential digital asset. Tether, which is pegged to the U.S. dollar, has garnered immense popularity due to its utility in trading and liquidity in the crypto ecosystem. However, the lack of transparency regarding its reserves and shareholder structure has led to skepticism among investors and regulators alike. The untold stories of Tether’s secret shareholders reveal a complex web of financial interests. While Tether…

The cryptocurrency landscape is continuously evolving, and recent insights from the Head of Coinbase Research suggest that crypto treasury companies could be the catalyst for a new wave of mergers and acquisitions (M&A) in the industry. As businesses increasingly recognize the potential of digital assets, the role of treasury management in cryptocurrencies is becoming more significant. Historically, M&A activity within the crypto space has been sporadic, often driven by the need for technological advancement or market expansion. However, with the rise of crypto treasury firms—companies specializing in managing digital asset portfolios—there’s a growing belief that these entities can stimulate a…

/stack-of-ether-coins-with-gold-background-901948904-a546d2200ec44115a4c219bce36f88bf.jpg)