Author: Bpay News

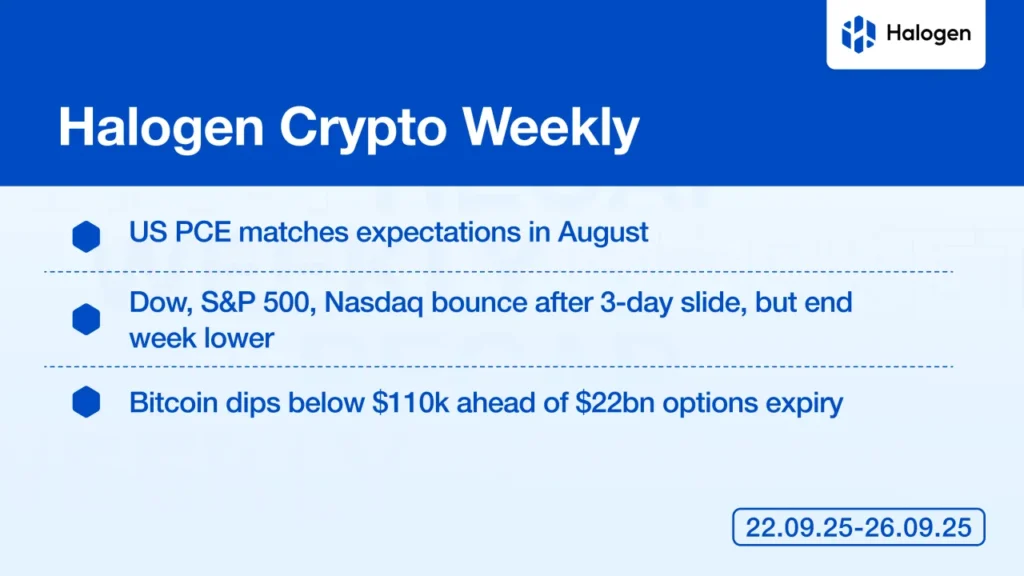

In a notable turn of events, Binance Coin (BNB) has seen a significant surge of 3.5%, driven by growing speculation surrounding potential interest rate cuts by the Federal Reserve. This rally has propelled BNB past critical resistance levels, sparking optimism among investors and traders alike. The backdrop of this rally is rooted in the broader economic landscape, where concerns about inflation and economic growth have led to discussions about monetary policy adjustments. The Federal Reserve’s recent statements have hinted at a more accommodative stance, which has fueled hopes that rate cuts could be on the horizon. Lower interest rates typically…

The CME Group, one of the world’s largest derivatives exchanges, has announced its plans to launch 24/7 trading for cryptocurrency futures and options starting in early 2026. This groundbreaking move aims to meet the growing demands of traders and investors seeking more flexible trading hours in the rapidly evolving cryptocurrency market. Historically, the CME Group has played a pivotal role in bringing traditional financial instruments to the digital currency space, launching its first Bitcoin futures contracts in December 2017. Since then, the interest in cryptocurrencies has surged, with more participants looking to hedge against volatility and capitalize on price movements.…

In a surprising turn of events, spot gold prices experienced a significant drop of over $20 in intraday trading, plunging below the critical threshold of $1850 per ounce. This decline has raised eyebrows among investors and market analysts alike, as gold has traditionally been viewed as a safe haven during periods of economic uncertainty. The recent dip in gold prices can be attributed to a combination of factors, including a strengthening U.S. dollar and rising interest rates. As the Federal Reserve continues to signal its commitment to combating inflation, higher interest rates can diminish the appeal of non-yielding assets like…

In a notable turn of events, Bitcoin, the leading cryptocurrency, briefly fell below the $119,000 mark, marking a 0.44% decrease in value over the past hour. This fluctuation is part of a broader trend observed in the cryptocurrency market, which has been characterized by volatility and rapid price changes. Bitcoin, often seen as a barometer for the entire cryptocurrency market, has experienced significant price swings in recent months. Investors and analysts closely monitor these movements, as they can indicate shifts in market sentiment and investor confidence. The recent dip below 9,000 has raised eyebrows, particularly among traders who are always…

Lael Brainard, a key figure at the Federal Reserve, has recently raised alarms regarding the current inflation rate, which has surpassed the Fed’s target and is showing signs of an upward trend. This statement comes at a crucial time as the U.S. economy grapples with various challenges, including supply chain disruptions, rising energy prices, and increased consumer demand as the post-pandemic recovery continues. Historically, the Federal Reserve aims to maintain an inflation rate around 2% to ensure price stability and sustainable economic growth. However, recent data indicates that inflation has not only exceeded this target but is also on a…

In a significant development for the cryptocurrency sector, a congressional panel has recently addressed the pressing issue of digital asset taxation, marking a pivotal moment for the industry. This comes in the wake of growing concerns about how cryptocurrencies are treated under current tax laws, which many argue are outdated and do not reflect the rapid evolution of digital assets. The panel’s discussions highlighted the need for clearer guidelines and regulations that can accommodate the unique characteristics of cryptocurrencies. As the market continues to expand, the lack of a coherent tax framework has created confusion among investors and businesses alike.…

The landscape of cryptocurrency exchange-traded funds (ETFs) is on the brink of a significant transformation, as the U.S. Securities and Exchange Commission (SEC) appears poised to implement a new common standard for all cryptocurrency ETFs. This potential shift raises questions about the relevance of previous approval deadlines for existing ETFs. Historically, the SEC has been cautious in its approach to cryptocurrency ETFs, primarily due to concerns over market manipulation, investor protection, and the overall volatility of digital assets. As a result, the approval process has been lengthy and fraught with uncertainty. However, the SEC’s consideration of a unified standard could…

In a groundbreaking move for the cryptocurrency and stock markets, FG Nexus, a Nasdaq-listed company, has announced its partnership with Securitize to tokenize its stock offerings on the Ethereum blockchain. This innovative collaboration aims to leverage the benefits of blockchain technology to enhance liquidity, transparency, and accessibility for investors. FG Nexus, which currently holds an impressive 47,000 ETH, is at the forefront of integrating traditional finance with the burgeoning world of digital assets. Tokenization refers to the process of converting ownership of real-world assets, such as stocks, into digital tokens that can be traded on blockchain platforms. This method not…

The Chicago Mercantile Exchange (CME) Group is making waves in the financial markets with its announcement to launch 24/7 cryptocurrency futures and options trading. This move represents a significant advancement in the accessibility and flexibility of trading in the digital asset space, catering to a growing demand from investors and traders around the globe. The CME Group, known for its innovative approach to derivatives trading, has been at the forefront of integrating cryptocurrencies into traditional finance. By offering around-the-clock trading, the CME aims to provide a platform where participants can engage in cryptocurrency trading at any time, reflecting the continuous…

In the fast-paced world of cryptocurrency trading, emotions often dictate decisions. A recent incident involving a trader, referred to as FOMO, highlights the dangers of panic selling. FOMO purchased 2Z, a digital asset, at a significantly higher price, only to face a staggering 41.8% loss when the market turned against them. This scenario is not uncommon; many traders find themselves caught in the whirlwind of market fluctuations, leading to hasty decisions driven by fear. The term “FOMO,” or “Fear of Missing Out,” encapsulates the anxiety that traders experience when they see others making profits. This fear can lead to impulsive…