Author: Bpay News

The cryptocurrency market is known for its volatility, and Bitcoin, as the leading digital asset, often sets the tone for the entire sector. Recent analyses suggest that if Bitcoin’s price exceeds the $121,000 mark, we could witness a significant event in the trading landscape: a cumulative short liquidation intensity on mainstream centralized exchanges (CEX) reaching an astounding $1.023 billion. Short selling, a strategy where traders bet against an asset by borrowing and selling it with the hope of buying it back at a lower price, can lead to substantial losses if the market moves against these positions. When Bitcoin rallies…

In a bold new prediction, Citibank has made headlines by forecasting that Bitcoin, the leading cryptocurrency, will soar to $133,000 by the end of this year and potentially reach an astounding $181,000 by the close of 2024. This projection comes amid an increasing mainstream acceptance of cryptocurrencies and growing institutional interest, hinting at a potentially transformative period for digital assets. Citibank’s optimism stems from various factors driving the Bitcoin market. First, the ongoing inflationary pressures in many economies are pushing investors to seek alternative stores of value. Bitcoin, often likened to digital gold, is viewed as a hedge against inflation.…

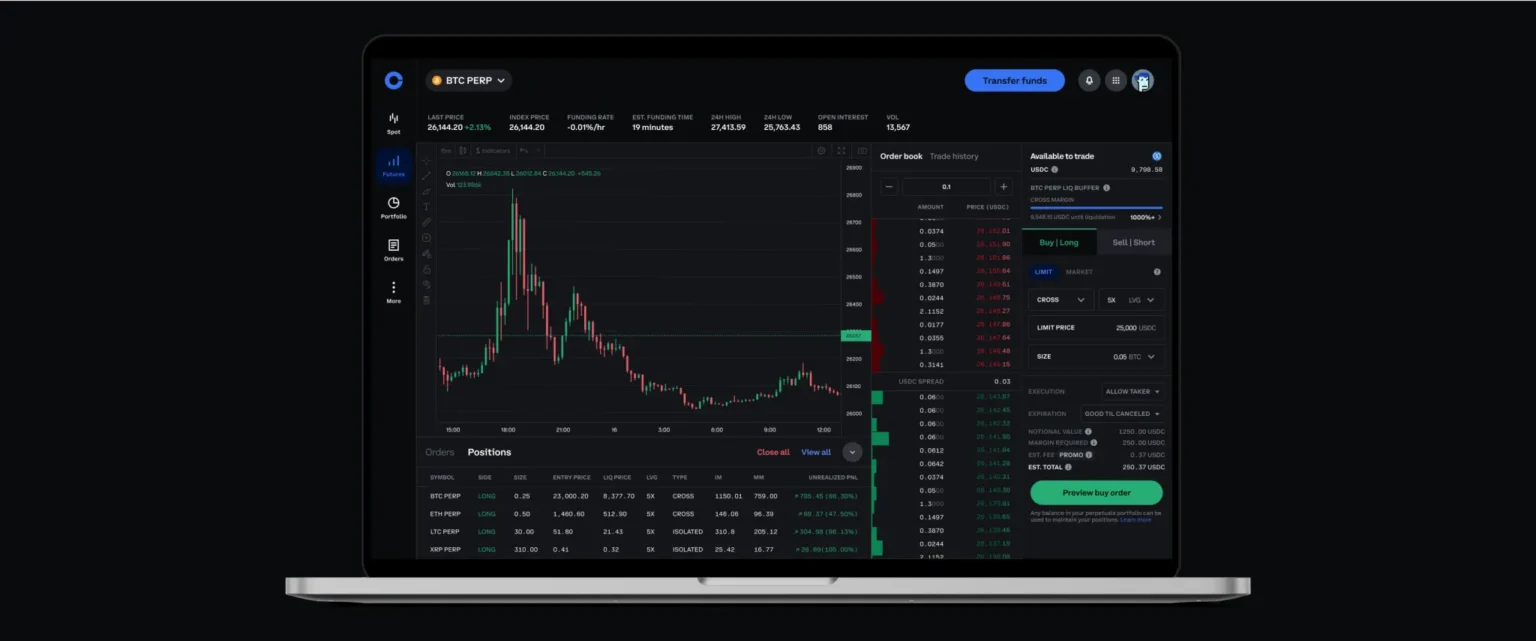

In an exciting development for cryptocurrency traders, Coinbase has announced the launch of its 2Z Futures Trading platform. This innovative feature is poised to enhance the trading experience for users by allowing them to engage in futures trading with a focus on two key cryptocurrencies. As the digital currency market continues to evolve, Coinbase’s initiative reflects its commitment to providing advanced trading options that cater to the growing demand for more sophisticated financial instruments. Futures trading allows investors to speculate on the future price of cryptocurrencies, enabling them to hedge against market volatility or capitalize on price movements. With the…

In a remarkable turn of events, Bitcoin has surged past the $120,000 mark for the first time since mid-August, signaling renewed investor confidence and interest in the cryptocurrency market. This significant milestone comes amid a backdrop of increasing institutional adoption, regulatory developments, and a growing recognition of Bitcoin as a hedge against inflation. Historically, Bitcoin has experienced dramatic price fluctuations, but its recent ascent can be attributed to several key factors. First, major financial institutions have begun to integrate Bitcoin into their portfolios, recognizing its potential as a store of value. Additionally, the ongoing economic uncertainties, driven by inflation fears…

In an exciting development for cryptocurrency traders, Coinbase has announced the upcoming launch of 2Z contract trading, a feature that promises to enhance the trading experience for its users. This innovative trading option is designed to provide greater flexibility and opportunities for profit in the fast-paced world of digital assets. Coinbase, one of the leading cryptocurrency exchanges globally, has consistently aimed to improve its platform by introducing new features that cater to the evolving needs of traders. The introduction of 2Z contracts is a strategic move to attract both seasoned traders and newcomers to the platform. These contracts will allow…

In a significant move within the digital asset landscape, European firm CoinShares has announced its acquisition of London-based Bastion Asset Management. This strategic purchase comes at a time when the cryptocurrency exchange-traded fund (ETF) market is experiencing a surge in interest from institutional investors. With this acquisition, CoinShares aims to solidify its position in the rapidly expanding active cryptocurrency ETF sector. CoinShares, a prominent name in the digital asset realm, has been a pioneer in offering innovative investment products since its inception. Their latest acquisition of Bastion, known for its adept management of digital assets, signals their commitment to enhancing…

In a bold move that has captured the attention of investors and crypto enthusiasts alike, Citigroup has raised its year-end price target for Ethereum to an impressive $5,400. This revision reflects the bank’s growing confidence in the second-largest cryptocurrency by market capitalization, bolstered by recent developments in the blockchain space and increasing adoption of decentralized finance (DeFi) applications. Ethereum has been on a remarkable journey, marked by its transition to a proof-of-stake consensus mechanism with the Ethereum 2.0 upgrade. This shift not only enhances the network’s efficiency and security but also positions Ethereum as a sustainable option in the crypto…

In a significant move that could reshape the landscape of cryptocurrency regulation in the United States, former President Donald Trump has appointed the current head of the Federal Deposit Insurance Corporation (FDIC) to the position of official chairman. This appointment comes at a time when the regulatory environment surrounding digital currencies is rapidly evolving, and the implications of this decision could be far-reaching. The FDIC, which plays a crucial role in maintaining stability and public confidence in the nation’s financial system, has been increasingly involved in discussions about how to effectively regulate cryptocurrencies. With ongoing debates about the safety, legality,…

In a bold prediction that has captured the attention of investors and cryptocurrency enthusiasts alike, Citigroup has forecasted that Bitcoin could reach a staggering $133,000 by the end of this year and soar to $181,000 by the end of next year. This optimistic outlook comes amidst a backdrop of increasing institutional interest and adoption of cryptocurrencies, particularly Bitcoin, as a legitimate asset class. Bitcoin, often referred to as digital gold, has seen significant price fluctuations since its inception. However, the recent trend indicates a growing acceptance among both individual and institutional investors. With major financial institutions integrating cryptocurrency into their…

In a bold forecast, Citi has projected that Bitcoin could reach an astonishing $181,000 by the year 2026, driven primarily by the influx of capital from exchange-traded funds (ETFs). This prediction comes at a time when the cryptocurrency market is experiencing renewed interest and optimism, particularly following the recent developments surrounding Bitcoin ETFs. ETFs have become a hot topic in the financial world, as they offer a regulated and accessible way for traditional investors to gain exposure to cryptocurrencies without the complexities of directly purchasing and storing digital assets. The potential approval of Bitcoin ETFs by regulatory bodies has sparked…