Author: Bpay News

In a remarkable turn of events, Binance Coin (BNB) has surged past the $1100 mark, achieving a new all-time high with a notable 24-hour increase of 6.62%. This impressive rally comes amid a broader bullish trend in the cryptocurrency market, reflecting growing investor confidence and heightened demand for digital assets. Launched in 2017 by the Binance exchange, BNB was initially created as a utility token to facilitate trading fee discounts on the platform. Over the years, it has evolved beyond its original purpose, becoming a key player in the decentralized finance (DeFi) space and a preferred choice for various applications,…

Bitcoin, the leading cryptocurrency, is known for its volatility and dramatic price swings. Recently, market analysts have identified a critical threshold for Bitcoin: if its price falls below $118,000, the cumulative long liquidation pressure on major centralized exchanges (CEXs) could soar to an alarming $1.55 billion. This scenario raises significant concerns for investors and traders alike, as it highlights the potential for a sharp decline in Bitcoin’s value. Liquidation occurs when leveraged positions are forcibly closed by exchanges to prevent further losses, often leading to a cascade of sell-offs. In a market where many traders are betting on Bitcoin’s price…

In a significant development for the cryptocurrency community, Binance has announced its support for the upcoming network upgrade and hard fork of Polygon ($MATIC). This upgrade is poised to enhance the scalability, security, and overall functionality of the Polygon network, which has gained immense popularity as a Layer 2 scaling solution for Ethereum. Polygon, originally known as Matic Network, has been instrumental in addressing Ethereum’s congestion issues by providing faster and cheaper transactions. The upcoming upgrade aims to implement several improvements, including enhanced interoperability with Ethereum and other blockchains, which will further solidify Polygon’s position as a leading player in…

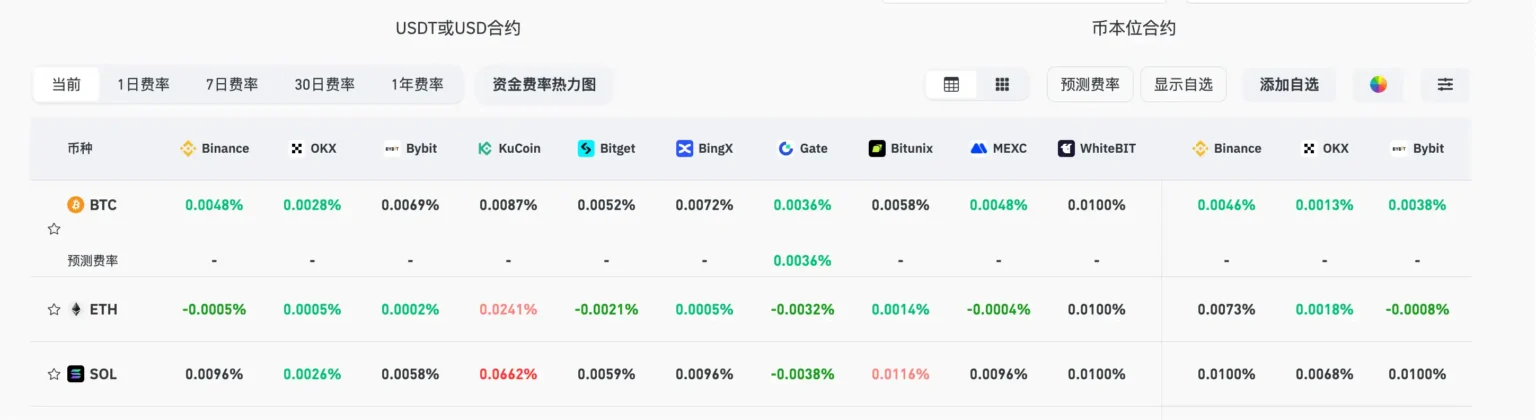

As the world of cryptocurrency continues to evolve, one important aspect investors closely monitor is the funding rates displayed by centralized exchanges (CEX) and decentralized exchanges (DEX). Recently, the consensus from these platforms signals a neutral market state, indicating that traders are neither overwhelmingly bullish nor bearish in their sentiment. Funding rates play a crucial role in determining the cost of holding leveraged positions in the crypto market. They essentially reflect the balance between buyers and sellers: when there are more longs than shorts, the funding rate tends to increase, and vice versa. A neutral funding rate suggests that the…

Polymarket, a prominent player in the prediction market space, has made its much-anticipated return to the U.S. market, reigniting interest in the potential of prediction markets. These platforms allow users to bet on the outcomes of various events, ranging from political elections to sports results, creating a dynamic environment for speculation and insight into public sentiment. Prediction markets have gained traction over the years as alternative forecasting tools. They harness the wisdom of crowds, enabling participants to leverage their knowledge and insights to predict future events more accurately than traditional polling methods. Polymarket’s re-entry into the U.S. signifies a growing…

In a surprising turn of events in the cryptocurrency market, a notable PEPE whale has sold a staggering 3.14 trillion PEPE tokens, redirecting their investments towards Ethereum (ETH) and several emerging altcoins, including EIGEN, PUMP, and XPL. This significant move has caught the attention of traders and investors alike, stirring discussions about the future of these cryptocurrencies. The PEPE token, which gained popularity in the meme coin sector, has seen its fair share of volatility. Whales, or large holders of cryptocurrency, often influence market trends with their trading decisions. By selling such a large quantity of PEPE tokens, this whale…

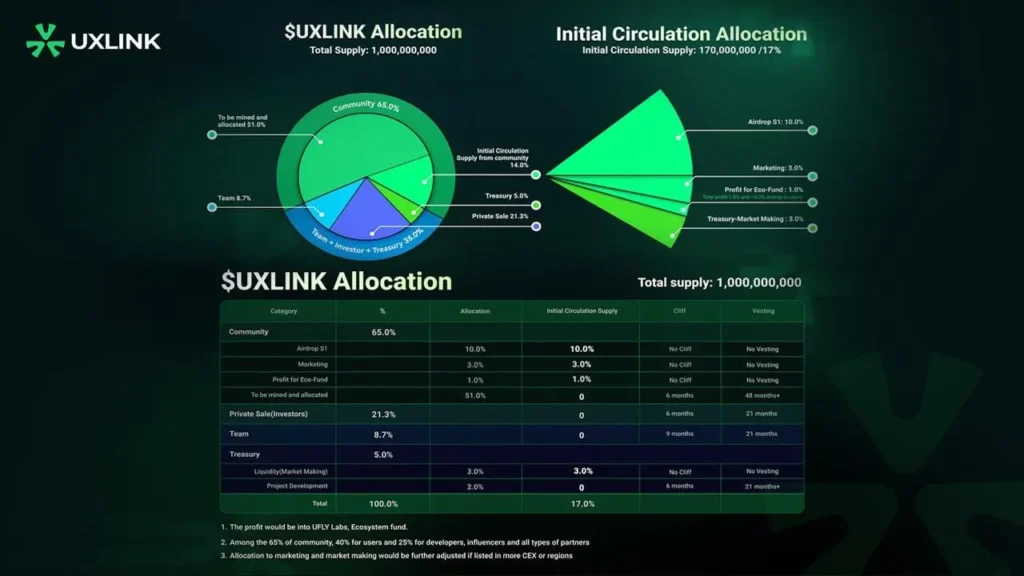

In a significant move, UXLINK has announced the initiation of a governance vote aimed at compensating users affected by recent disruptions. This decision comes in the wake of challenges that have impacted UXLINK’s trading activity on centralized exchanges (CEX), prompting the platform to take proactive steps to restore user confidence and trading capabilities. The governance vote is a crucial step in ensuring that the community has a voice in the compensation process. By engaging users in this decision-making process, UXLINK not only demonstrates its commitment to transparency but also fosters a collaborative environment where stakeholders can contribute to the platform’s…

The ongoing government shutdown has created significant disruptions across various sectors, and the financial markets are feeling the impact. One notable casualty is the U.S. Securities and Exchange Commission (SEC), which has been unable to make a ruling on the highly anticipated Canary Spot Litecoin (LTC) Exchange-Traded Fund (ETF). This delay has left investors and market analysts in a state of uncertainty regarding the future of cryptocurrency investments. The Canary Spot LTC ETF is designed to provide investors with a more accessible way to invest in Litecoin, one of the leading cryptocurrencies. ETFs have gained popularity as they allow individuals…

In a stunning turn of events, a popular meme coin has seen its market capitalization soar past $150 million, marking a significant milestone in the ever-evolving world of cryptocurrencies. This meteoric rise comes on the heels of an astonishing 24-hour price surge of over 700%, capturing the attention of investors and enthusiasts alike. Meme coins, often characterized by their humorous branding and community-driven initiatives, have gained immense popularity in recent years. This particular coin, which has been riding the wave of social media hype, has attracted a diverse group of investors looking to capitalize on its viral potential. The surge…

The Commodity Futures Trading Commission (CFTC) plays a crucial role in regulating the U.S. derivatives markets, ensuring transparency and protecting market participants from fraud and manipulation. Recently, the former Chairman of the CFTC revealed that the White House is considering multiple candidates for key positions within the agency. This development comes at a time when the CFTC is facing increasing scrutiny over its regulatory practices and the evolving landscape of digital assets. The CFTC has been at the forefront of regulating cryptocurrencies and other digital commodities, which have surged in popularity and complexity. As the market continues to grow, the…