Author: Bpay News

The cryptocurrency market has always been a rollercoaster ride, with Bitcoin leading the charge as the most prominent digital currency. As we look ahead to the next few years, many analysts are speculating that Bitcoin could reach an astonishing $200,000 by the end of 2025. This forecast is bolstered by a specific cycle indicator that has historically pointed to explosive growth in the months to come. Bitcoin’s price movements are often influenced by market cycles, driven by factors such as supply and demand, technological advancements, and macroeconomic trends. The cycle indicator in question analyzes past price patterns and market behavior,…

Recent reports have highlighted a significant vulnerability within the Unity Game Engine that could potentially jeopardize the security of Android cryptocurrency wallets. Unity, a widely-used platform for game development, has gained immense popularity among developers for its versatility and user-friendly interface. However, this newfound vulnerability raises concerns, particularly for users who rely on Android wallets to store their digital assets. The issue stems from a flaw in the Unity engine that could allow malicious actors to exploit applications built on the platform. Given the increasing reliance on mobile wallets for cryptocurrency transactions, this vulnerability poses a serious risk. Cybercriminals could…

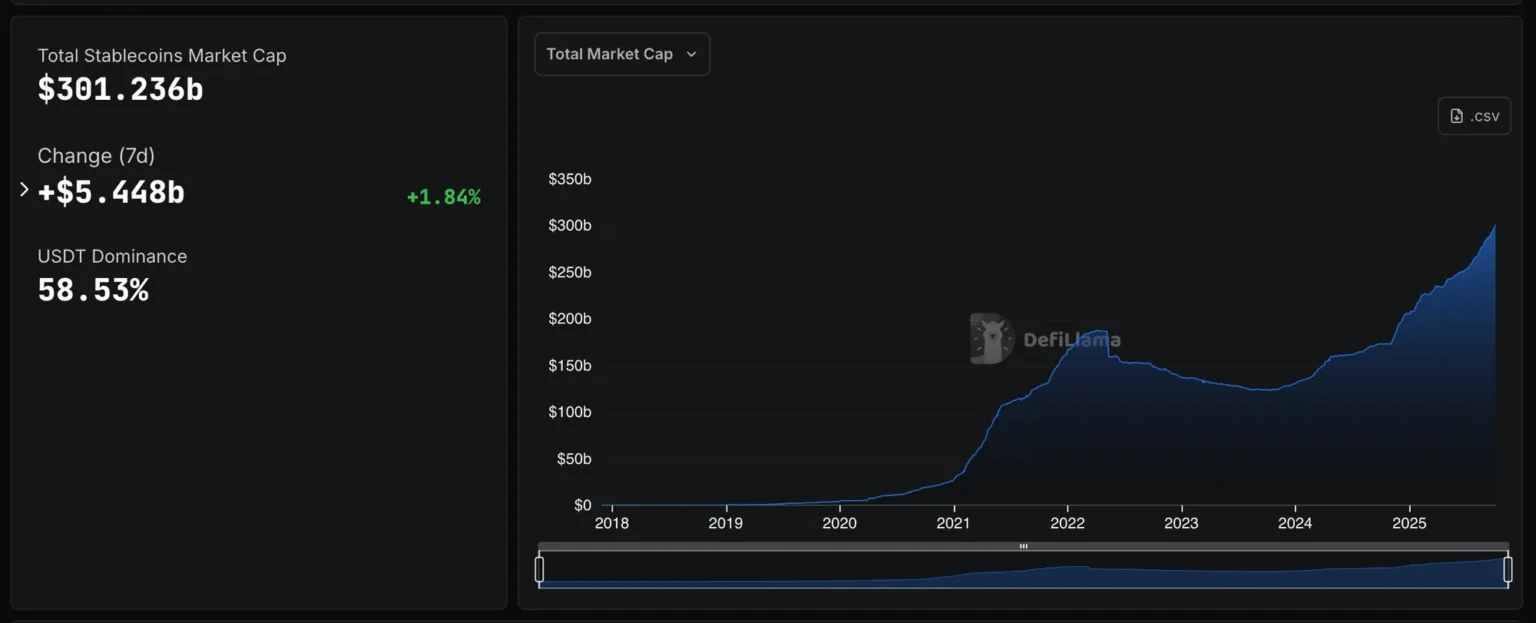

In a significant milestone for the cryptocurrency market, the total market capitalization of stablecoins has surpassed $300 billion, marking an all-time high. This surge reflects the growing acceptance and integration of stablecoins within the broader financial ecosystem, as they provide a stable alternative to the volatility often associated with traditional cryptocurrencies like Bitcoin and Ethereum. Stablecoins are digital currencies pegged to stable assets, typically fiat currencies like the US dollar. This peg allows them to maintain a consistent value, making them an attractive option for investors and traders looking to mitigate risk. The recent increase in market cap can be…

The recent U.S. government shutdown is raising eyebrows across financial markets, particularly in the cryptocurrency sector. Historically, government shutdowns have led to uncertainty in various economic domains, but this time, the repercussions seem amplified. As Bitcoin ($BTC) and Ethereum ($ETH) prices have surged in recent days, many analysts are drawing a direct correlation between the shutdown and the volatility reflected in these digital currencies. A government shutdown occurs when Congress fails to agree on budgetary measures, leading to the cessation of non-essential functions. The current impasse not only affects government services but also creates a ripple effect in investor confidence.…

In a significant development for Japan’s cryptocurrency market, a subsidiary of Nomura Holdings has unveiled plans to expand its presence in the digital asset exchange sector. This initiative comes as the country continues to embrace blockchain technology and digital currencies, positioning itself as a key player in the global cryptocurrency landscape. Nomura, a leading financial services group, has recognized the growing demand for cryptocurrency trading and investment options among Japanese consumers and businesses. With regulatory frameworks becoming more defined, the firm aims to leverage its expertise in traditional finance to introduce innovative solutions in the cryptocurrency space. This expansion is…

In a remarkable turn of events for cryptocurrency enthusiasts and investors alike, the United States witnessed a staggering net inflow of $6.272 billion into Bitcoin Spot Exchange-Traded Funds (ETFs) yesterday. This influx marks a significant milestone, highlighting the growing institutional interest and acceptance of Bitcoin as a legitimate investment vehicle. Bitcoin ETFs are designed to track the price of Bitcoin directly, allowing investors to gain exposure to the cryptocurrency without having to purchase it directly. This is particularly appealing to institutional investors who prefer regulated products. The recent surge in inflows could be attributed to a combination of factors, including…

In a significant development for the cryptocurrency investment landscape, yesterday marked a landmark moment for Ethereum as the US-based Ethereum Spot Exchange-Traded Fund (ETF) experienced a staggering net inflow of $307 million. This inflow not only indicates growing institutional interest in Ethereum but also reflects the broader acceptance of cryptocurrencies in traditional financial markets. Ethereum, the second-largest cryptocurrency by market capitalization, has been gaining traction as more investors seek exposure to digital assets. An ETF allows investors to buy shares that represent an underlying asset—in this case, Ethereum—without the complexities of direct ownership. The recent inflow suggests that institutional investors…

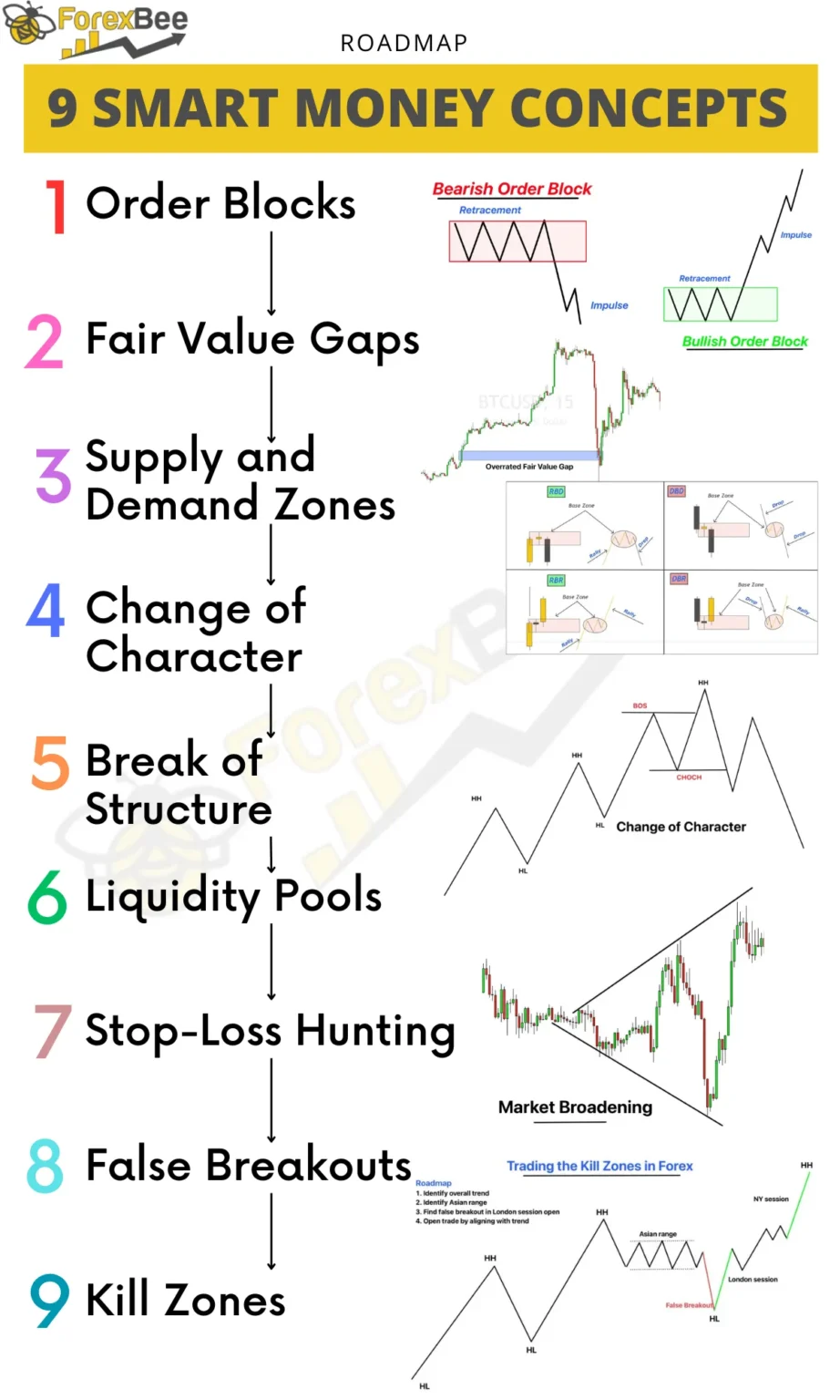

In the ever-fluctuating world of cryptocurrency, savvy investors often seize opportunities during market dips. A recent example highlights this strategy perfectly: a Smart Money address that made a significant purchase on September 26th has now successfully capitalized on its investment, netting an impressive profit of $3.09 million. The cryptocurrency market is notorious for its volatility, with prices swinging dramatically over short periods. On September 26th, many investors were cautious as prices dipped, creating a prime opportunity for those willing to take calculated risks. Smart Money, typically characterized by institutional investors and experienced traders, recognized this moment as a chance to…

In an exciting development for cryptocurrency traders, Bitget, a leading crypto exchange, has introduced its latest financial product: the U-based 2Z perpetual contract. This new contract offers traders the flexibility to use leverage ranging from 1x to an impressive 50x, opening up a world of possibilities for maximizing trading strategies and potential profits. Perpetual contracts are a popular financial instrument in the crypto trading space, allowing traders to speculate on the price movements of various assets without an expiration date. This means that traders can hold their positions for an extended period while benefiting from the advantages of leverage. The…

In a remarkable turn of events, the market capitalization of a popular meme coin has surged above $180 million, achieving an astonishing growth rate of nearly 1000% within just 24 hours. This meteoric rise has captured the attention of both seasoned investors and newcomers in the cryptocurrency space, highlighting the volatile yet exciting nature of meme-based digital currencies. Meme coins, often created as a joke or parody, have gained significant traction in recent years, fueled by social media hype and community-driven initiatives. The latest surge can be attributed to a combination of factors, including increased online discussions, endorsements from influential…