Author: Bpay News

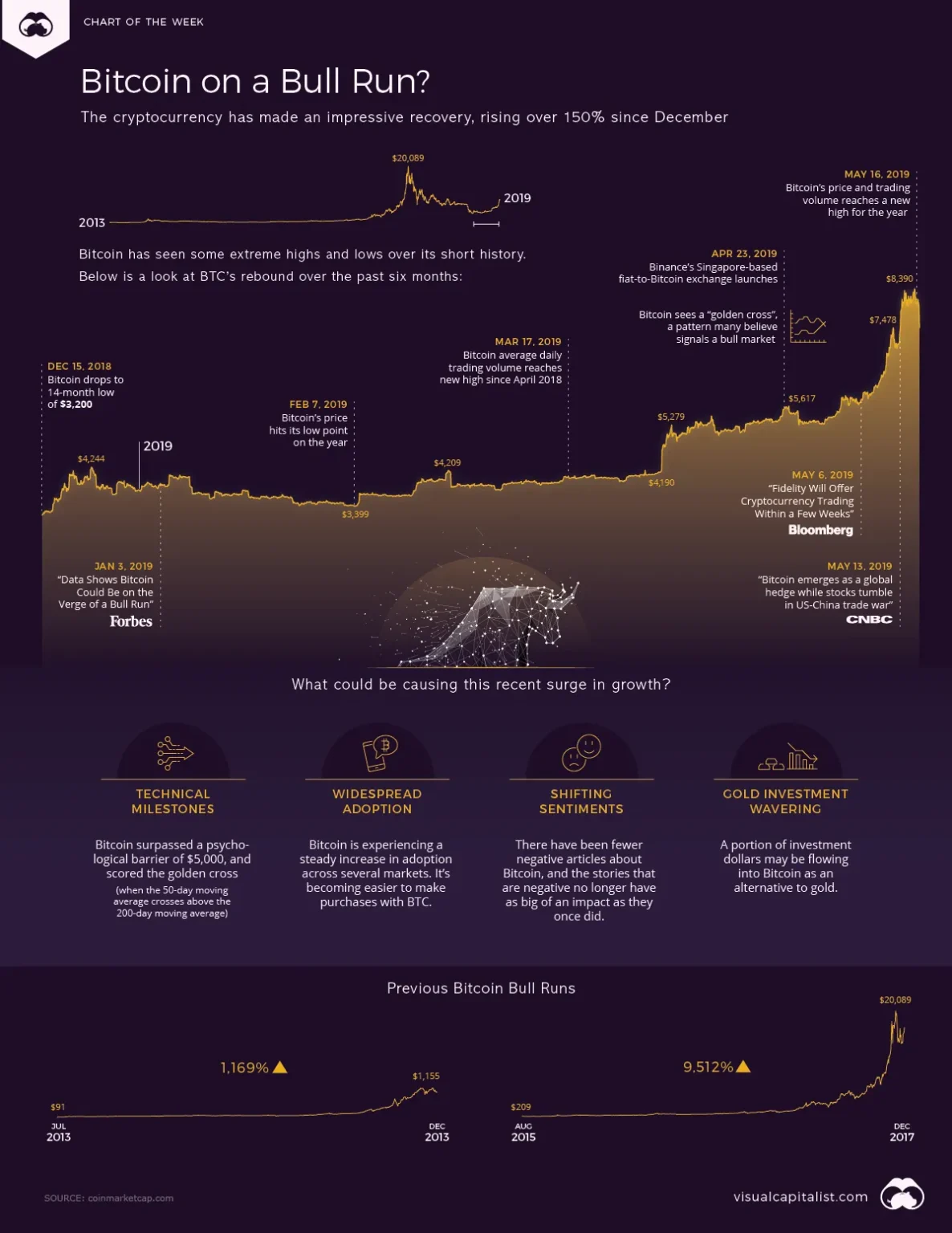

As the cryptocurrency market continues to evolve, Bitcoin is once again capturing the spotlight, with predictions suggesting it could reach an astonishing $200,000 by the end of the year. This surge is largely attributed to the influence of whales—large holders of Bitcoin—and the anticipated approval of exchange-traded funds (ETFs) that could significantly bolster market confidence. Historically, Bitcoin has demonstrated its volatility, with dramatic price swings that can be influenced by various factors. However, the current sentiment among investors is markedly bullish. Whales, who often have the capacity to manipulate market prices, are reportedly accumulating Bitcoin in large quantities, signaling a…

XRP, the digital asset associated with the Ripple network, is currently experiencing a notable price consolidation above key moving averages, signaling a potential bullish trend. As of now, XRP is trading at $3.02, reflecting a 1.94% increase over the past 24 hours. This upward movement has garnered attention from traders and investors alike, as technical indicators suggest that momentum is building towards the significant resistance level of $3.14. The cryptocurrency market has been characterized by volatility, but XRP’s recent performance indicates a shift in sentiment. The token’s ability to maintain its position above major moving averages is a positive sign,…

Binance Coin (BNB) has made headlines recently as it surged nearly 6%, climbing to an impressive $1,094.90 within just 24 hours. This notable price jump is attributed to a significant technical breakout, which has attracted the attention of traders and investors alike. The momentum is backed by strong trading volumes, indicating a robust interest in the cryptocurrency. The rise in BNB’s price follows a period of consolidation where it hovered below crucial resistance levels. Technical analysis suggests that this breakout signals a potential continuation of bullish momentum, as various indicators align favorably for further gains. The combination of positive market…

Ethereum, the second-largest cryptocurrency by market capitalization, is currently experiencing a notable surge in its price, trading at $4,474.66. This represents a 1.93% increase over the past 24 hours, highlighting the digital asset’s robust technical strength. Analysts are closely monitoring Ethereum’s performance as it consistently trades above key moving averages, which traditionally serve as indicators of bullish or bearish trends in the market. One of the most significant aspects of Ethereum’s current setup is its position relative to major moving averages. When a cryptocurrency trades above these averages, it often signals a strong upward momentum, suggesting that buyers are in…

In recent trading sessions, XRP has experienced a notable surge, gaining 3% as market dynamics shift in favor of this popular cryptocurrency. The catalyst for this upward movement can be attributed to developments surrounding SBI Lending and the potential introduction of exchange-traded funds (ETFs) that focus on digital assets. SBI Holdings, a prominent player in Japan’s financial landscape, has been making strides in the cryptocurrency sector, particularly with its lending services. By allowing users to lend their XRP holdings, SBI is not only promoting greater liquidity in the market but also encouraging more investors to engage with the digital asset.…

Bitcoin, the leading cryptocurrency, is currently trading at $119,968, marking a 1.25% increase in daily gains. This upward movement comes as Bitcoin nears a critical resistance level at $121,022—a threshold that many traders and analysts are closely monitoring. The recent bullish momentum is supported by strengthening technical indicators, suggesting that the cryptocurrency may be on the verge of breaking through this significant barrier. Historically, Bitcoin has experienced volatile price swings, but recent trends indicate a potential shift towards a more sustained upward trajectory. As more institutional investors and retail traders enter the market, the demand for Bitcoin continues to rise,…

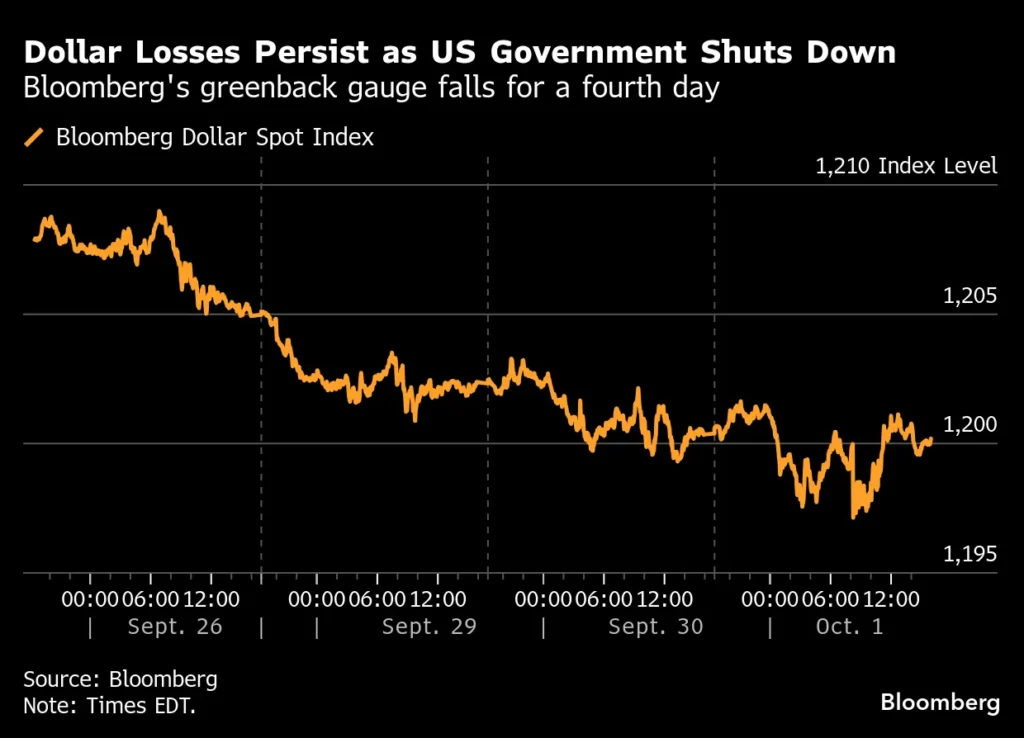

The United States is currently facing a federal government shutdown that has left many citizens wondering about its implications and duration. A government shutdown occurs when Congress fails to pass appropriations bills or a continuing resolution to fund government operations, leading to a halt in non-essential services. This situation often arises from political disagreements over budget allocations, policy priorities, or other contentious issues. As of now, the shutdown may extend into next week, creating uncertainty for federal employees and the public alike. Approximately 800,000 federal workers have been furloughed, while many others are working without pay. Essential services, such as…

Ethereum, the second-largest cryptocurrency by market capitalization, has been making headlines recently as it approaches a critical price point. Analysts are closely watching the $4600 mark, as a breakout above this level could trigger significant market movements. Specifically, if Ethereum surpasses this threshold, it is projected that the cumulative short liquidation strength on mainstream centralized exchanges (CEX) could reach an astonishing $847 million. Short selling is a common strategy in the cryptocurrency market, where traders bet against an asset, anticipating its price will decline. However, when the price rises unexpectedly, these short positions can be liquidated, forcing traders to buy…

The recent announcement regarding the delay of the US Non-Farm Payrolls (NFP) data has sent ripples through financial markets, raising concerns about increased volatility. The NFP report, a crucial economic indicator, provides insights into the health of the labor market by detailing the number of jobs added or lost in the economy, excluding farm workers and a few other job categories. It is a key metric that investors and analysts closely monitor, as it significantly influences monetary policy and market sentiment. The delay in the release of this data creates an information void, leaving traders and investors without critical insights…

In the rapidly evolving world of decentralized finance (DeFi), perpetual decentralized exchanges (perp DEXs) are increasingly gaining attention for their ability to offer user-friendly trading experiences and innovative features. Among the leading platforms, Hyperliquid has consistently distinguished itself as a top contender, even as newer players like Aster begin to make waves. Recent analyses by DeFi experts indicate that Hyperliquid remains the best-positioned perp DEX despite Aster’s recent surge in popularity. Hyperliquid has established a robust reputation due to its advanced liquidity management and trading mechanisms that cater to both novice and experienced traders. By offering low latency and high…