Author: Bpay News

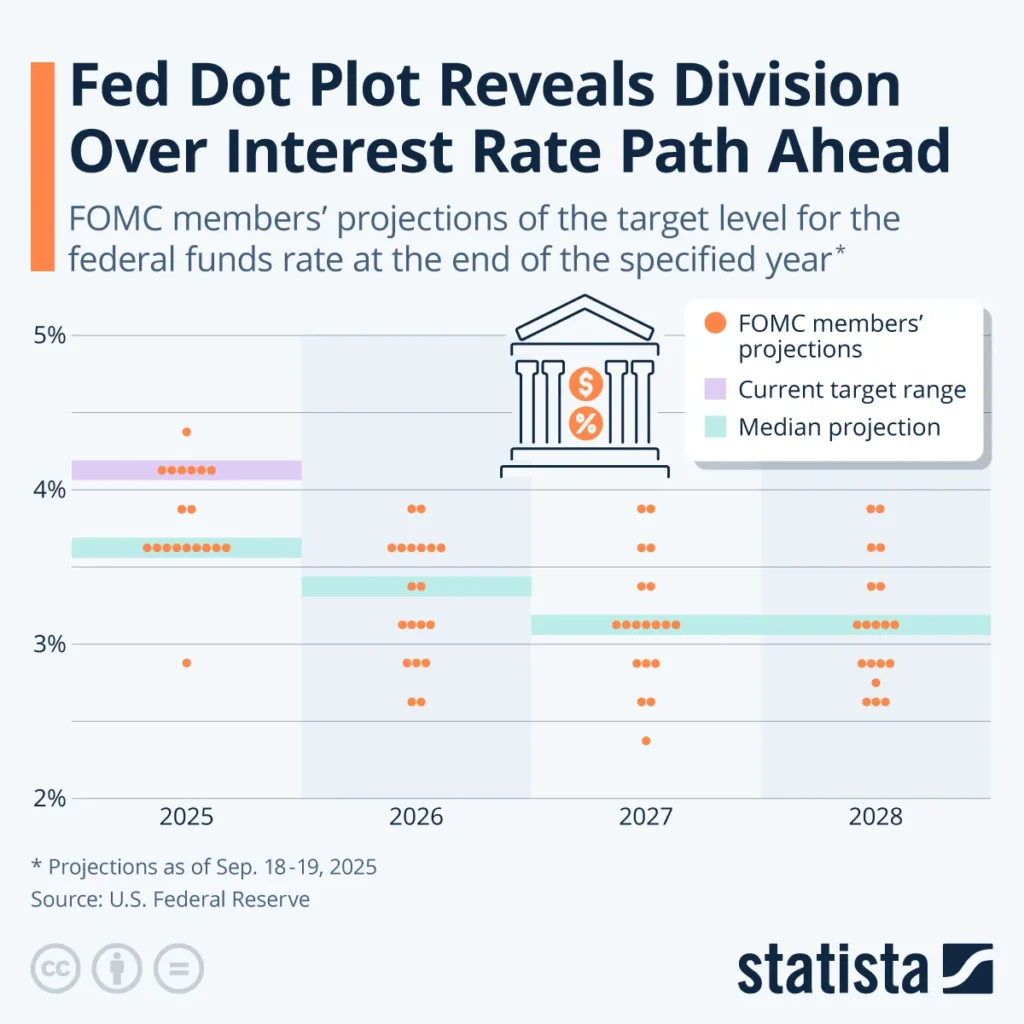

The Federal Reserve, the central banking system of the United States, is gearing up for its next Federal Open Market Committee (FOMC) meeting, a pivotal gathering where key decisions regarding monetary policy will be made. As markets anticipate the outcomes, there is growing concern about whether the Fed will have adequate data to inform its decisions. The FOMC meets several times a year to discuss economic indicators such as inflation rates, employment figures, and overall economic growth. These data points are crucial as they influence the Fed’s decisions on interest rates and other monetary policies that aim to stabilize the…

In a recent message, Vitalik Buterin, co-founder of Ethereum, emphasized the necessity for a more cautious approach when implementing major protocol changes in the future. Ethereum has gained immense popularity and adoption due, in part, to its ability to evolve and adapt; however, such rapid changes can also lead to unforeseen consequences. Historically, Ethereum has undergone significant upgrades, such as the transition from a proof-of-work to a proof-of-stake consensus mechanism in the much-anticipated Ethereum 2.0 upgrade. While these changes are often geared toward improving scalability, security, and efficiency, they have also faced criticism for leading to network instability and community…

The final reading of the US Markit Services Purchasing Managers’ Index (PMI) for September has been released, showing a robust figure of 54.2. This result not only reflects a healthy expansion in the services sector but also exceeds analysts’ expectations, which had predicted a lower reading. The PMI is a critical economic indicator that gauges the health of the services sector, which constitutes a significant portion of the US economy. A PMI score above 50 indicates expansion, while a score below 50 signifies contraction. With the September figure at 54.2, it suggests that the services sector is experiencing growth, driven…

Chile’s pension system, once hailed as a model for privatization, is now facing significant challenges. With rising life expectancy and a growing number of retirees, the system is struggling to provide adequate financial support. Many Chileans feel insecure about their retirement savings, leading to calls for reform. In this context, tokenization emerges as a promising solution that could revitalize the pension landscape. Tokenization refers to the process of converting assets into digital tokens that can be securely traded on blockchain technology. By applying this innovative approach to pension funds, we could enhance transparency, streamline transactions, and improve investment opportunities for…

In a groundbreaking move for the cryptocurrency landscape, Samsung has announced its partnership with Coinbase, allowing 75 million Galaxy device users to access crypto trading directly from their smartphones. This integration marks a significant step in making digital currencies more accessible to the masses, as Samsung continues to position itself at the forefront of technological innovation. The collaboration between Samsung and Coinbase comes at a time when cryptocurrencies are gaining traction among mainstream consumers. With the increasing popularity of digital assets, Samsung aims to provide its users with a seamless experience for buying, selling, and managing cryptocurrencies. This initiative not…

In the latest CoinDesk 20 performance update, Chainlink ($LINK) has experienced a notable decline, dropping by 3.2%. This downturn not only affects Chainlink itself but also contributes to a broader downward trend in the cryptocurrency index. Chainlink, known for its decentralized oracle network that connects smart contracts with real-world data, has been a significant player in the crypto space, often regarded for its utility and partnerships with various blockchain projects. The recent decline can be attributed to a combination of factors, including market volatility and investor sentiment shifting towards other cryptocurrencies. As the cryptocurrency market is known for its rapid…

As the trading day begins, the U.S. stock market is displaying a mixed bag of performance, reflecting the ongoing volatility in both traditional equities and the cryptocurrency sector. Investors are closely monitoring these fluctuations, especially as they navigate through economic uncertainties and shifting market sentiments. In the stock market, major indices opened with varied results. While some sectors are experiencing gains, others are struggling to maintain momentum. Notably, Ford Motor Company has seen a positive uptick, with shares rising by 1.55%. This increase can be attributed to the company’s recent announcements regarding electric vehicle production and strategic partnerships aimed at…

As the financial world gears up for the next Federal Open Market Committee (FOMC) meeting, Fed Milan has expressed hope that the Federal Reserve will have access to crucial economic data before making any decisions. The FOMC, which meets regularly to discuss monetary policy, plays a pivotal role in shaping the economic landscape of the United States. Decisions made during these meetings can influence interest rates, inflation, and overall economic growth. The importance of timely and accurate data cannot be overstated. Economic indicators such as employment rates, inflation figures, and consumer spending trends provide the Fed with insights into the…

In recent trading sessions, spot gold has shown a notable upward trend, rising by 0.62% intraday. This increase is part of a broader pattern where gold has become a favored asset amid global economic uncertainties. Investors have turned to gold as a safe haven, especially in times of volatility in other markets, such as equities and currencies. Historically, gold has been regarded as a reliable store of value, especially during periods of inflation or geopolitical tension. Current inflationary pressures and concerns over potential economic slowdowns have prompted many to seek refuge in precious metals. As central banks around the world…

In October, Ethereum, the second-largest cryptocurrency by market capitalization, exhibited a notable bullish trend, capturing the attention of investors and analysts alike. This surge can be attributed to several factors, including increased institutional interest, advancements in decentralized finance (DeFi), and the growing adoption of non-fungible tokens (NFTs). As Ethereum continues to evolve, its underlying technology and ecosystem have shown resilience, leading to a positive short-term outlook. Despite this optimistic trend, long-term sentiment surrounding Ethereum remains cautious. Investors are wary of potential regulatory challenges and market volatility that could impact the cryptocurrency landscape. The recent fluctuations in the broader crypto market…

:max_bytes(150000):strip_icc()/GettyImages-2235972392-5d0617c5a38f4c3eb1dfe21ceb36b79a.jpg)