Author: Bpay News

In a remarkable turn of events, the price of Bitcoin temporarily surged above the $121,000 mark, drawing attention from investors and analysts alike. This spike is particularly significant as it represents a substantial milestone in the cryptocurrency market, which has been characterized by volatility and rapid changes in sentiment over the past year. The recent surge can be attributed to a confluence of factors, including increased institutional adoption, favorable regulatory news, and ongoing inflationary pressures in traditional markets. Major financial institutions have started incorporating Bitcoin into their portfolios, viewing it as a hedge against inflation and a viable store of…

Bitcoin, the leading cryptocurrency, has seen significant price fluctuations over the years, capturing the attention of both investors and the media. Currently, the cryptocurrency is approaching a critical price level of $122,000. Analysts and traders are closely watching this threshold because if Bitcoin breaks through this mark, it could trigger a massive wave of short liquidations across major centralized exchanges (CEXs). Short selling is a strategy where traders bet against an asset, profiting if its price falls. However, if the price rises instead, these traders are forced to cover their positions, often leading to a buying frenzy that can further…

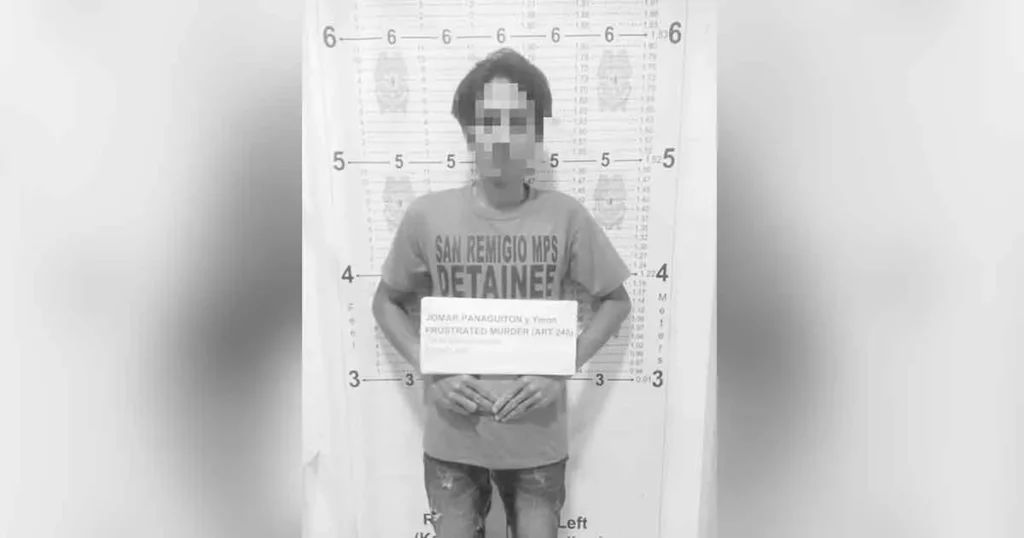

In a significant development in the world of cryptocurrency, authorities have apprehended a suspect linked to a massive $5.8 billion fraud scheme that has sent shockwaves through the financial community. The arrest took place in Bangkok, Thailand, where the suspect was reportedly living under a false identity. This case highlights the growing concerns surrounding cryptocurrency-related crimes, which have surged in recent years as digital currencies gain popularity. The fraudulent scheme primarily involved the manipulation of cryptocurrency investments and credit card transactions, deceiving thousands of unsuspecting individuals and investors. Victims were promised high returns on their investments, only to find that…

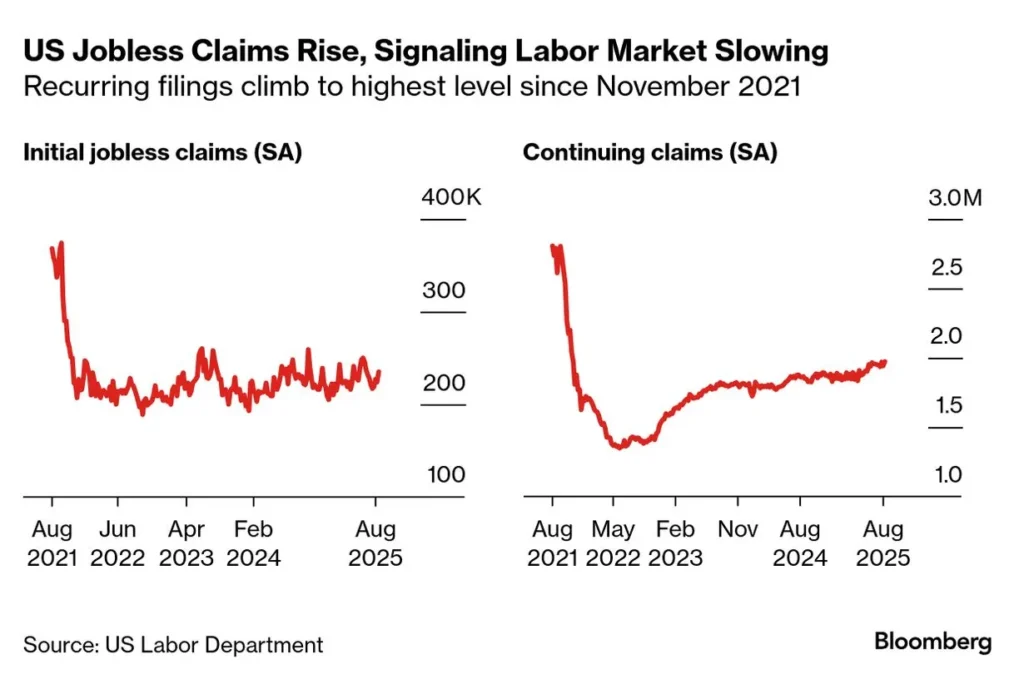

In a recent analysis by Goldman Sachs, the U.S. labor market has shown a slight uptick in initial jobless claims, reaching 224,000. This figure, while still relatively low in historical context, indicates a minor shift in the employment landscape as the economy navigates various challenges. Initial jobless claims are a critical economic indicator, reflecting the number of individuals filing for unemployment benefits for the first time. The increase in claims can be attributed to several factors, including seasonal adjustments and ongoing economic uncertainties. Analysts suggest that this rise, though modest, may signal a cooling labor market as companies reassess their…

In a significant development within the decentralized finance (DeFi) landscape, Pendle Finance has surpassed an impressive $100 million in Total Value Locked (TVL) on its Plasma platform. This milestone reflects the growing trust and adoption of Pendle’s innovative protocol, which allows users to tokenize their yield-generating assets. By separating the ownership of an asset from its yield, Pendle enables investors to maximize their returns in a novel way, making it an attractive option in the competitive DeFi space. Alongside this achievement, Boros, a prominent player in the DeFi ecosystem, has introduced a new feature that promises to enhance user experience…

In a recent statement, former President Donald Trump has issued a stern ultimatum to Hamas, demanding that the militant group agree to a proposed agreement by 6 p.m. EST on Sunday. Failure to comply, he warned, would result in severe consequences, described as “fire and fury.” This declaration underscores the ongoing tensions in the Middle East, particularly regarding the Israeli-Palestinian conflict, where Hamas has been a significant player. The backdrop of this ultimatum is rooted in the complex history of the region, marked by decades of conflict, failed peace negotiations, and intermittent violence. Hamas, which governs the Gaza Strip, has…

In a significant development in the world of financial crime, authorities have arrested a suspect linked to a staggering $580 million cryptocurrency and credit card fraud scheme in Bangkok. This high-profile case has drawn international attention, highlighting the growing concerns surrounding cryptocurrency security and the need for robust regulatory measures. The suspect, whose identity has not yet been disclosed, was apprehended after a months-long investigation that involved collaboration across various law enforcement agencies. Reports suggest that the fraudulent scheme exploited weaknesses in credit card processing and cryptocurrency transactions, deceiving thousands of victims worldwide. With the rise of digital currencies, fraudsters…

In a notable development within the cryptocurrency space, a prominent Bitcoin (BTC) whale, known for their bullish stance on Ethereum (ETH), has deposited a significant amount of 18 BTC to the Kraken exchange. This action has sparked discussions among investors and analysts about the potential implications for the broader market, particularly for Ethereum enthusiasts. Whales, or large holders of cryptocurrency, often have a considerable influence on market trends due to their ability to execute large trades that can sway prices. The recent deposit of 18 BTC is particularly intriguing given the whale’s previous bullish sentiment towards Ethereum. Such movements can…

In a remarkable display of resilience and optimism, the Dow Jones Industrial Average climbed 1% on Tuesday, setting yet another record high. This surge comes amid a backdrop of strong corporate earnings and a recovering economy, which have buoyed investor confidence. The index closed at an impressive 36,000 points, marking a significant milestone that reflects the ongoing recovery from the economic disruptions caused by the COVID-19 pandemic. Investors were particularly encouraged by recent reports showing robust consumer spending and an uptick in manufacturing activity. Major corporations, particularly in the technology and financial sectors, have reported better-than-expected quarterly earnings, further fueling…

The cryptocurrency market is buzzing with activity as Bitcoin futures open interest has soared to an all-time high of $88.7 billion. This surge in open interest signifies the total value of outstanding contracts and is often seen as a barometer of market sentiment and potential price movements. While this milestone indicates robust interest in Bitcoin futures, it also raises alarms among analysts who caution against possible large-scale liquidations. Open interest is a crucial metric that reflects the health and liquidity of the futures market. When it reaches significant levels, it can imply that traders are heavily speculating on price directions.…