Author: Bpay News

Everlyn AI Token — Binance Alpha and Binance Futures have announced their plans to list the Everlyn AI (LYN) Token. This development marks an important step for the Everlyn AI project, as it will provide greater access and visibility for the token within the cryptocurrency market. By being listed on these prominent trading platforms, Everlyn AI aims to attract a broader audience of investors and traders. The listing is expected to facilitate increased trading activity and engagement with the token, enhancing its overall presence in the digital asset landscape. As the cryptocurrency market continues to evolve, the addition of the…

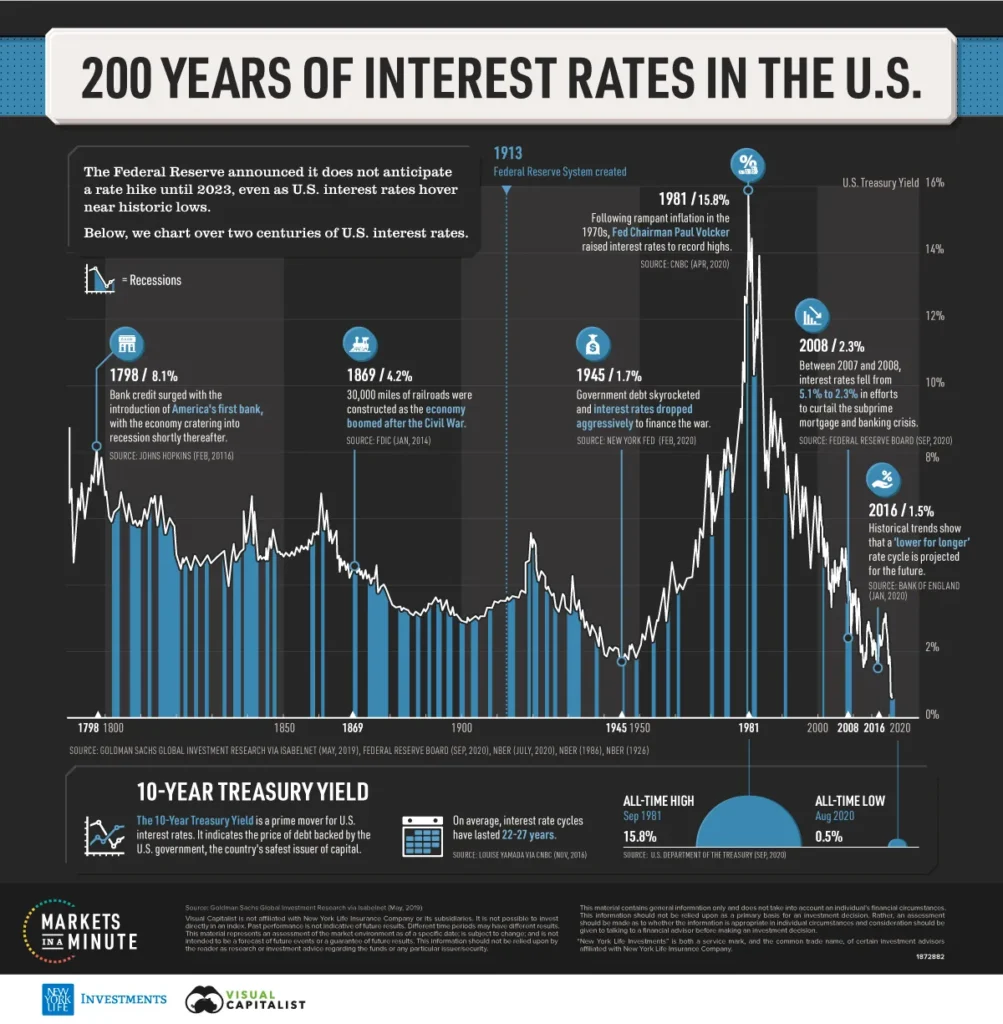

The Federal Reserve’s decision to cut interest rates has significant implications for investment strategies. These rate cuts can influence various asset classes, particularly in fixed income, emerging markets, and municipal bonds. Investors need to carefully assess the potential opportunities that arise from these changes, as well as the associated risks. For instance, lower interest rates may lead to increased demand for fixed-income securities, which can enhance returns for investors. However, it is also essential to recognize the risks involved, such as the possibility of rising inflation or market volatility. By understanding these dynamics, investors can make more informed decisions that…

According to an analyst from Bitunix, MYX has encountered a significant decline of 26.15% within just 24 hours. This sharp drop is attributed to a combination of technical breakdowns and concerns regarding unlocking, which have intensified the selling pressure on the asset. Investors are increasingly wary as these factors contribute to a heightened sense of uncertainty in the market. The situation underscores the volatility that can arise in trading environments, particularly when technical indicators signal potential weaknesses. As the market reacts to these developments, it remains crucial for stakeholders to monitor the evolving landscape closely.

VanEck has provided an analysis of the crypto market dynamics observed in September 2025. The report emphasizes the performance of various tokens, noting that there have been significant fluctuations in their values. Additionally, it highlights a decline in revenue generated from blockchain activities, indicating potential challenges within the market. Notably, the report also discusses major upgrades that have taken place in the Solana and Ethereum networks, which are crucial developments for these platforms. These upgrades may influence the overall market landscape and the performance of associated tokens moving forward.

In the past 24 hours, the trend of Bitcoin withdrawals has persisted, resulting in a notable net outflow of 5,739.82 $BTC from centralized exchanges (CEX). This movement highlights a significant pattern in the cryptocurrency market, where investors appear to be withdrawing their assets from exchanges. Such behavior may indicate a growing preference for holding Bitcoin in personal wallets rather than keeping it on exchanges, which can be perceived as less secure. The ongoing trend of withdrawals could reflect broader sentiments among investors regarding market stability and security. As the cryptocurrency landscape continues to evolve, monitoring these withdrawal patterns becomes essential…

NVIDIA’s GeForce NOW has announced an exciting expansion for October, introducing a total of 17 new games to its platform. Among these new titles are popular entries such as ‘Battlefield 6’ and ‘Vampire: The Masquerade – Bloodlines 2.’ This significant addition aims to enhance the cloud gaming experience for users, providing them with a wider range of gaming options. By integrating these new games, NVIDIA continues to strengthen its position in the cloud gaming market, appealing to a diverse audience of gamers looking for high-quality experiences. The incorporation of well-known franchises showcases NVIDIA’s commitment to delivering engaging content for all…

The options market for U.S. Treasury securities indicates that a potential government shutdown could extend anywhere from 10 to 29 days. This insight reflects the market’s expectations regarding the duration and impact of the shutdown on government operations. As discussions continue, the uncertainty surrounding this situation may influence investor sentiment and economic stability. The implications of such a shutdown are significant, as they could affect various sectors reliant on government services and funding. The options market serves as a barometer for investor confidence and risk assessment in the face of political developments. Understanding these projections is crucial for stakeholders who…

NVIDIA has introduced the KAI Scheduler, which seamlessly integrates with KubeRay to enhance the management of Ray clusters. This innovative scheduler brings advanced scheduling capabilities that significantly improve the allocation of resources and the prioritization of workloads. By utilizing the KAI Scheduler, organizations can ensure that their Ray clusters operate more efficiently, leading to better performance and resource utilization. The integration of these technologies highlights the importance of effective workload management in today’s data-driven environments, allowing users to maximize their computational resources while minimizing downtime and inefficiencies. The KAI Scheduler represents a crucial step forward in optimizing the functionality of…

In a noteworthy development in the cryptocurrency market, yesterday’s Bitcoin Spot ETF recorded a substantial net inflow of $985 million. This influx of capital highlights the growing interest and participation in Bitcoin investments among investors. Additionally, BlackRock’s BITB also experienced a significant net inflow, amounting to $791 million. These figures reflect a strong appetite for Bitcoin-related investment vehicles, indicating a positive trend in the overall market sentiment towards cryptocurrencies.

In a notable development for the cryptocurrency world, yesterday’s Ethereum Spot ETF in the United States recorded a substantial net inflow of $2.335 billion. This significant influx of capital reflects growing interest and confidence in Ethereum as an investment option. The movement of such a large amount of funds into the ETF signals a potential shift in market dynamics, as investors increasingly look for ways to gain exposure to digital assets through regulated financial products. The strong inflow may also indicate a broader trend toward acceptance and integration of cryptocurrencies within traditional financial frameworks. As the market evolves, the implications…