Author: Bpay News

In a recent discussion, Matt Hougan, the Chief Investment Officer of Bitwise, articulated his perspective on Solana, suggesting that it is emerging as a significant player in the financial landscape, akin to Wall Street. He emphasized the transformative potential of Solana in the realm of finance, highlighting its innovative features and capabilities that set it apart from traditional financial systems. Hougan’s insights reflect a growing recognition of Solana’s role in shaping the future of digital assets and investment strategies. As the cryptocurrency market continues to evolve, the implications of Solana’s rise could be profound, influencing how investors and institutions engage…

The likelihood of the Federal Reserve implementing a 25 basis point interest rate cut in October has seen a decline, now standing at 96.2%. This shift in probability indicates a changing sentiment regarding monetary policy adjustments. The Federal Reserve’s decisions on interest rates are closely monitored, as they have significant implications for the economy, influencing borrowing costs and overall financial conditions. The decrease in the probability of a rate cut suggests that market expectations are evolving, potentially reflecting new economic data or shifts in the Fed’s outlook. Investors and analysts will be watching closely for any further developments or statements…

The Chicago Mercantile Exchange (CME) is set to introduce around-the-clock trading for cryptocurrency derivatives in early 2026, although this initiative is contingent upon receiving the necessary regulatory approval. This move signifies a notable shift in the trading landscape, as the CME aims to cater to the increasing demand for cryptocurrency trading options that are accessible at all hours. By enabling 24/7 trading, the CME hopes to provide traders with greater flexibility and opportunities in the fast-evolving crypto market. The decision to expand its offerings underscores the exchange’s commitment to staying at the forefront of financial innovation while navigating the complexities…

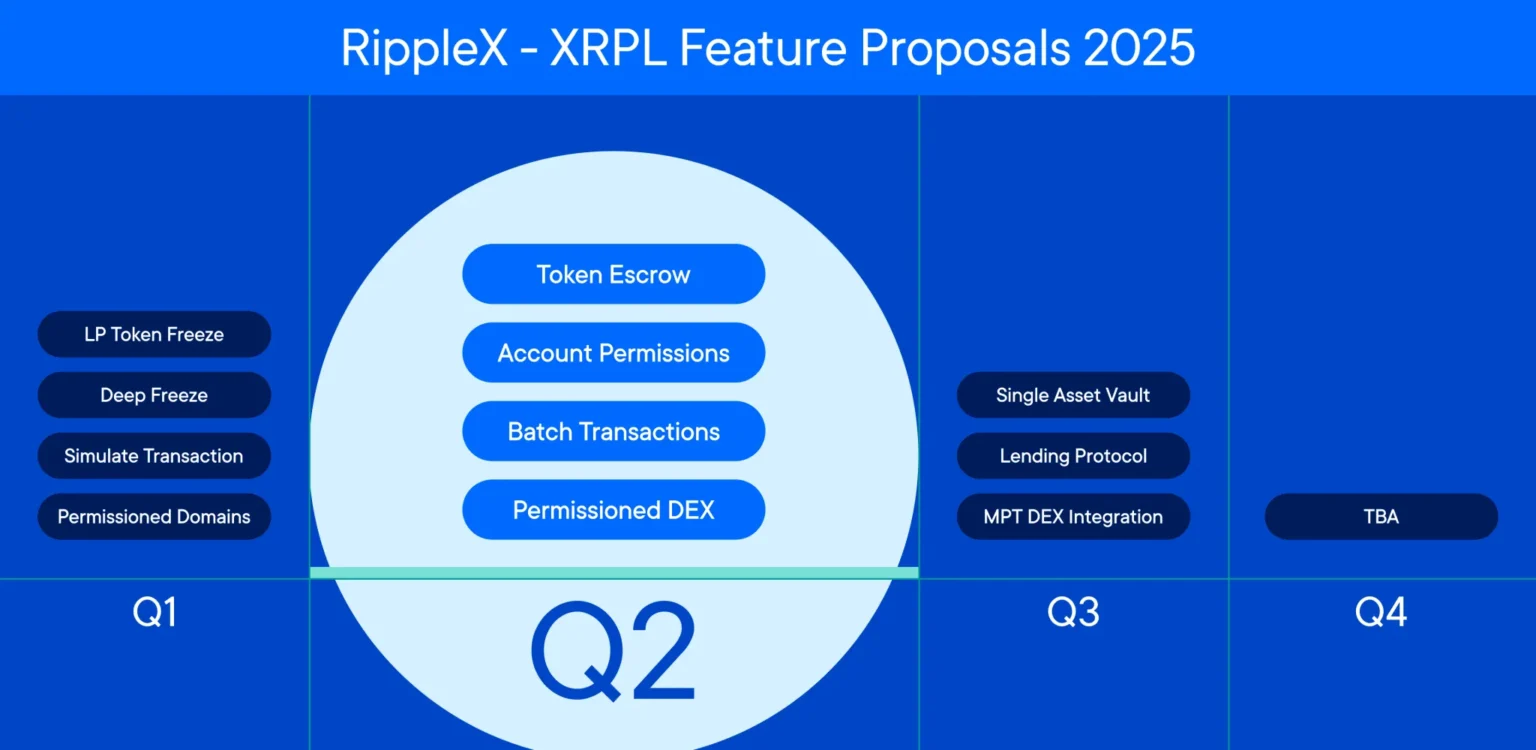

A Ripple engineer has expressed that the XRP Ledger is designed to be the preferred platform for institutions seeking innovation and trust. This assertion underscores the growing significance of the XRP Ledger in the financial landscape, as it aims to cater specifically to the needs of institutional clients. The focus on innovation and reliability is essential, especially as organizations look for robust solutions in an evolving market. By establishing itself as a reliable choice, the XRP Ledger positions itself not just as a cryptocurrency platform but as a vital tool for businesses looking to enhance their operations with cutting-edge technology.…

As the crypto market gears up for what is being referred to as ‘Uptober,’ Brazil’s largest investment bank has made headlines with its crypto division. This arm of the bank has identified five specific tokens that it believes are worthy of investment during this promising month. The selection of these tokens is significant, as it reflects the bank’s confidence in the potential growth and stability of the cryptocurrency market. Investors looking to navigate the complexities of crypto investments may find this guidance particularly valuable, especially in a time when market trends can shift rapidly. The bank’s insights could serve as…

The ongoing state of the cryptocurrency market raises questions about its stability, particularly in the uncertain environment of a potential government shutdown. Investors and stakeholders are keenly interested in understanding what implications could arise if the shutdown persists. The prolonged absence of essential government operations may introduce significant volatility into the cryptocurrency space. Market dynamics could shift dramatically, affecting liquidity and trading volumes, as uncertainty typically leads to cautious behavior among investors. This situation could result in heightened speculation and a potential reevaluation of strategies as crypto enthusiasts and financial institutions navigate these uncharted waters. Additionally, regulatory pauses may hinder…

The entity known as “Pal” has recently decided to increase its long position by an additional 200,000 XPL. This strategic move comes despite the fact that Pal is currently facing an unrealized loss exceeding $11 million. The decision to expand its holdings indicates a strong belief in the potential of XPL, even in the face of significant financial challenges. This situation highlights the complexities and risks involved in trading, particularly in volatile markets. The substantial unrealized loss suggests that Pal is navigating a difficult landscape, yet its commitment to increasing its position may signal confidence in a future recovery or…

In the week ahead, attention will be focused on Federal Reserve Chair Jerome Powell, who is scheduled to deliver an important speech. This address is anticipated to provide insights into the current economic outlook and potential future monetary policy directions. Furthermore, the ongoing situation surrounding a possible US government shutdown continues to unfold, raising concerns about its implications for the economy and public services. Observers will be closely monitoring developments related to both Powell’s remarks and the government shutdown drama, as these events could significantly impact markets and citizen sentiment. The interplay between these two critical issues is expected to…

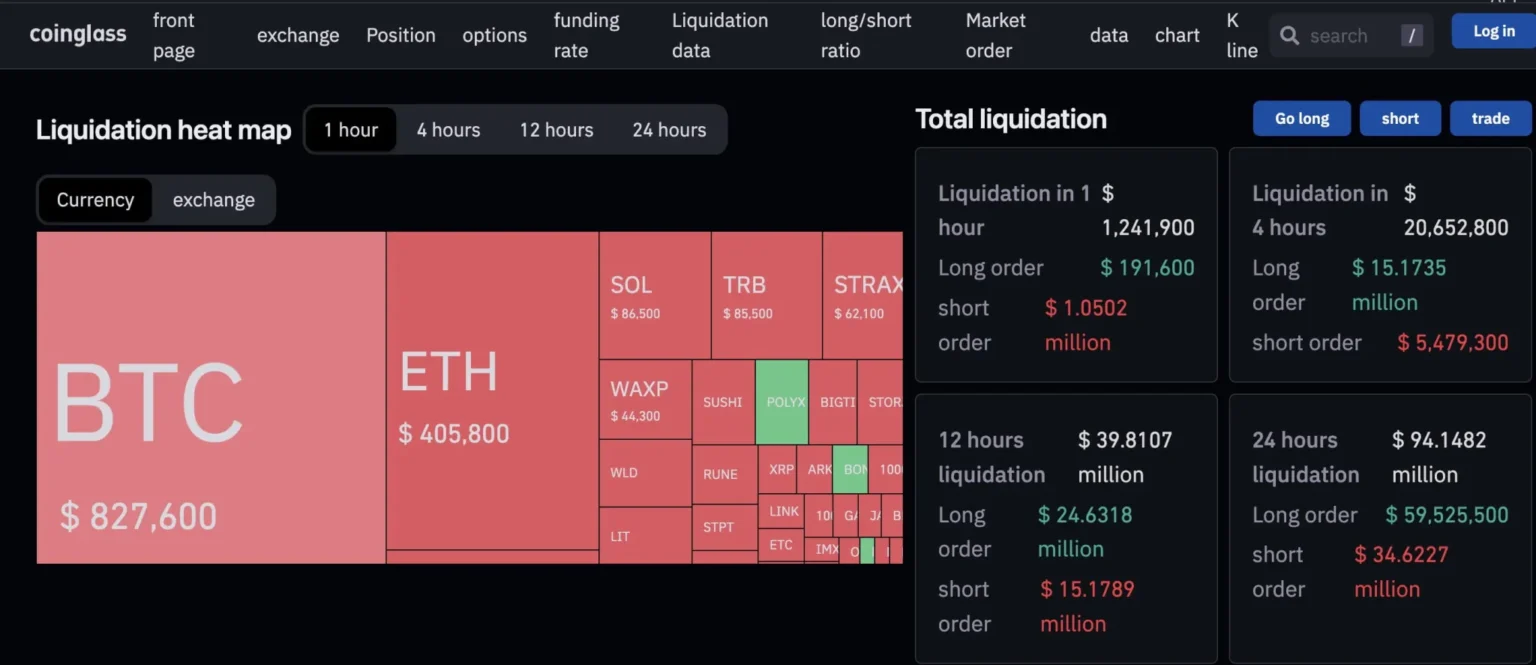

Over the past 24 hours, the entire network has experienced a significant liquidation totaling $436 million. This event has led to both long and short squeezes, impacting traders and investors alike. The large-scale liquidation indicates a notable shift in market dynamics, as positions are forcibly closed, resulting in increased volatility. The repercussions of such a liquidation can be profound, affecting market sentiment and potentially leading to further fluctuations. As traders react to this development, the situation remains fluid, with many closely monitoring the network for any additional changes.

OnePay, a financial application supported by Walmart, is set to enhance its offerings by incorporating trading features for Bitcoin and Ether. This development, reported by CNBC, signifies a notable shift in the app’s capabilities, allowing users to engage in cryptocurrency trading directly through the platform. The addition of these popular digital currencies reflects a growing trend among financial services to embrace cryptocurrency, catering to the increasing demand from consumers interested in investing in this emerging market. By integrating Bitcoin and Ether trading, OnePay aims to provide its users with more diverse financial options, potentially attracting a broader audience. This move…