Author: Bpay News

$SOL — Solana is currently trading at a price of $232.12, reflecting a 1.10% increase over the past 24 hours. This upward movement has allowed Solana to maintain its position above all major moving averages, which is a significant indicator of its market strength. As the cryptocurrency approaches a crucial resistance level at $253.51, traders are closely monitoring this development. The ability to hold above these key moving averages suggests a potential for further upward momentum, making the resistance at $253.51 an important target for bulls in the market.

Cardano’s ADA is currently trading at $0.86, reflecting a modest daily gain of 0.39%. The cryptocurrency is hovering around the 50-day moving average, which is a significant technical indicator for traders. As ADA approaches a critical support zone, technical indicators are signaling a neutral momentum. This situation suggests that a potential breakout could be on the horizon. The performance of ADA in this key technical juncture is important for investors, as it may define the future direction of the cryptocurrency. Observers are closely monitoring these developments to gauge whether Cardano will maintain its position or experience a shift in momentum.

XRP is currently trading at a price of $3.01, reflecting a modest decline of 0.23%. This slight decrease occurs as technical indicators point towards a consolidation phase, with XRP holding steady above critical moving average support levels. The market is observing closely as XRP approaches the significant support level of $3.00. The ability of XRP to maintain its position above these key moving averages is crucial for its stability and potential future movements in the market. Traders and investors alike are watching this situation closely, as the dynamics of the market can shift rapidly.

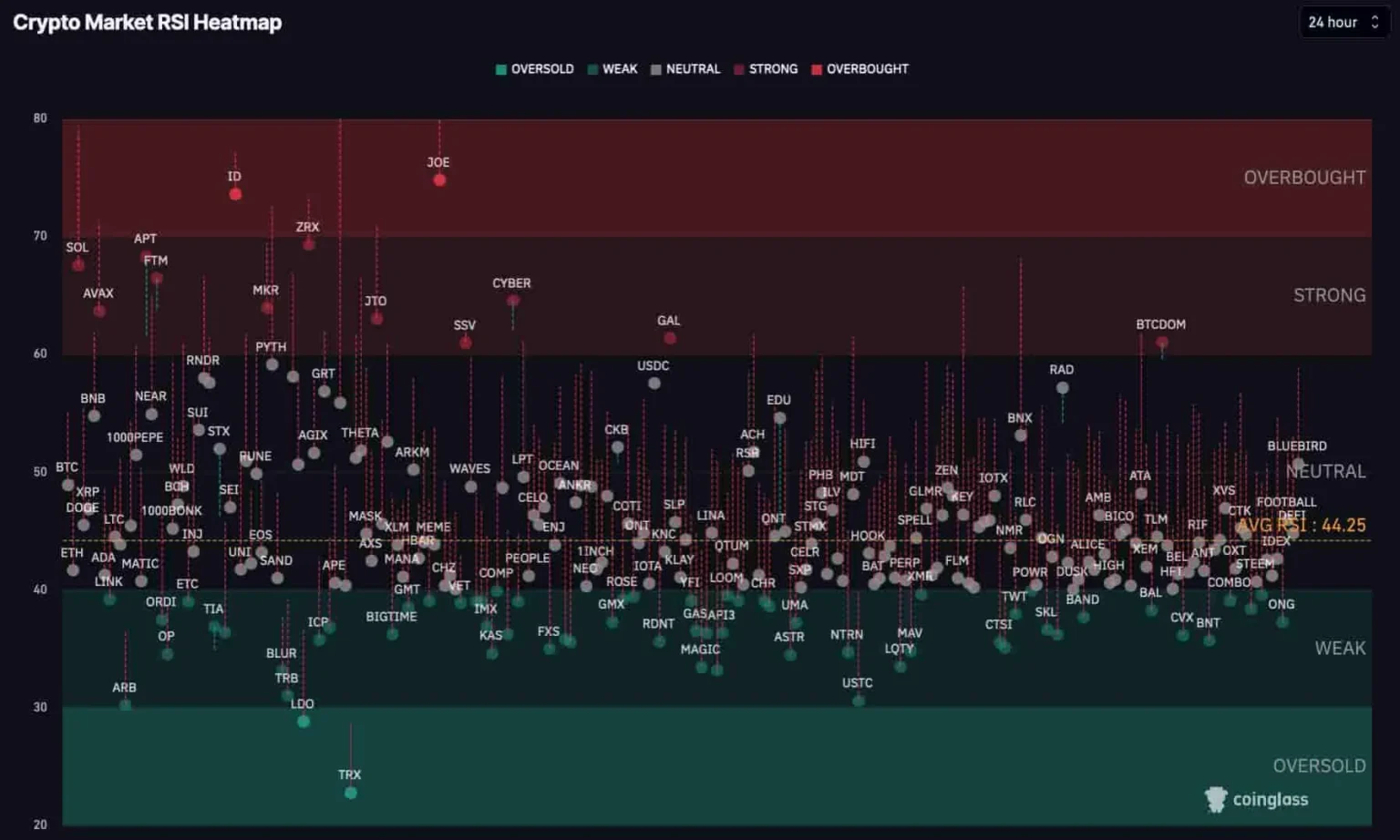

Binance Coin is currently trading in a sideways pattern at a price of $1,170.29. The Relative Strength Index (RSI) has reached a level of 70.7, which suggests that the asset is experiencing overbought conditions. Despite this, Binance Coin continues to hold a robust position above all major moving averages, indicating a strong market presence. The current RSI reading may signal a potential cooling period ahead, prompting traders to monitor the situation closely. The combination of these factors highlights the importance of understanding market dynamics as Binance Coin navigates this critical price point.

The latest indicators regarding funding rates for both centralized exchanges (CEX) and decentralized exchanges (DEX) suggest that the market is currently maintaining a neutral position. This neutrality is significant as it reflects a balance between buying and selling pressures within the cryptocurrency market. Investors and traders often look to these funding rates as a barometer of market sentiment, and the present state indicates that there is no overwhelming inclination toward bullish or bearish trends. By analyzing these rates, market participants can better understand the prevailing dynamics and make more informed decisions. The stability suggested by the current funding rates could…

$4,644 resistance — Ethereum has recently been trading at a price of $4,538, reflecting a modest increase of 1.2% over the course of the day. This upward movement is notable as various technical indicators point towards the possibility of further momentum building in the market. Traders are particularly focused on the significant resistance level set at $4,644, which represents a key point for potential upward movement in Ethereum’s price. The current consolidation above critical support levels suggests that bulls are positioning themselves strategically as they eye this important resistance. As the market develops, observers will be keen to see whether…

Bitcoin has recently surged past the $124,000 mark, coming close to a historic peak. This impressive rise comes on the heels of substantial activity, with $3.2 billion in spot Bitcoin inflows contributing to the cryptocurrency’s momentum. The significant inflow of funds has sparked interest in the market, highlighting an ongoing trend of increasing investment in Bitcoin. As the price continues to climb, it reflects the growing confidence among investors and market participants. The recent developments have many in the financial sphere eager to see if Bitcoin can maintain this upward trajectory and possibly reach new heights.

Bitcoin is currently trading at a price of $123,810, reflecting a 1.26% increase over the past 24 hours. However, the Relative Strength Index (RSI) stands at 71.5, indicating that the cryptocurrency may be entering overbought territory. This situation arises as the price remains significantly above the 200-day moving average, currently 17.2% higher, which suggests that Bitcoin is in a bullish trend. Investors and traders are advised to exercise caution as these technical indicators signal potential risks associated with buying at these elevated levels. The interplay between the current price and key moving averages will be crucial in determining the next…

Vitalik Buterin has initiated a thought-provoking discussion regarding the complexity associated with memory access. He challenges the conventional perspectives by introducing a model that suggests an O(N^⅓) complexity. This new approach could have significant implications for the optimization of algorithms and the design of hardware systems. By proposing this alternative model, Buterin invites a reevaluation of existing methodologies, encouraging researchers and developers to consider how memory access complexity can be understood and utilized in innovative ways. The potential benefits of this revised understanding could lead to advancements in efficiency and performance across various technological applications.

Standard Chartered has expressed optimism regarding Bitcoin’s potential, suggesting that the cryptocurrency is on the verge of achieving new highs in the coming days. The financial institution has reiterated its year-end price target for Bitcoin, setting it at an impressive $200,000. This forecast highlights the bank’s confidence in the cryptocurrency market and its anticipated growth trajectory. As Bitcoin continues to capture the attention of investors and analysts alike, the prospect of reaching such a significant price point underscores the evolving landscape of digital currencies. The insights from Standard Chartered may influence market sentiment and investor strategies as they navigate the…