Author: Bpay News

The Vietnam cryptocurrency tax framework is set to reshape the landscape for digital asset transactions in the country.This new policy, circulated by the Ministry of Finance, aims to align cryptocurrencies with traditional securities trading, creating a structured approach to cryptocurrency taxation in Vietnam.

In a significant move to enhance consumer confidence, Bithumb has unveiled its ambitious plans to establish a 100 Billion Won “Customer Protection Fund.” This initiative comes in the wake of recent issues concerning its operational stability and highlights the platform’s commitment to maintaining integrity within the rapidly evolving crypto trading landscape.Aimed at fortifying customer protection in crypto, the fund will serve as a vital safety net for users against payment errors and other unforeseen circumstances.

Hong Kong digital assets regulation is at the forefront of an evolving financial landscape, with the Hong Kong Securities and Futures Commission (SFC) actively shaping the framework for a burgeoning market.Recently, the third meeting of the Digital Assets Advisory Group convened to strategize on regulatory developments Hong Kong, aimed at enhancing the digital asset ecosystem through collaboration with licensed virtual asset trading platforms.

In the ever-evolving landscape of cryptocurrency, the movements of Bitcoin insider whales often signal major shifts in the market.Recently, the well-known “1011 insider whale” made headlines after depositing a staggering 4,200 BTC into Binance, equating to roughly $285.66 million.

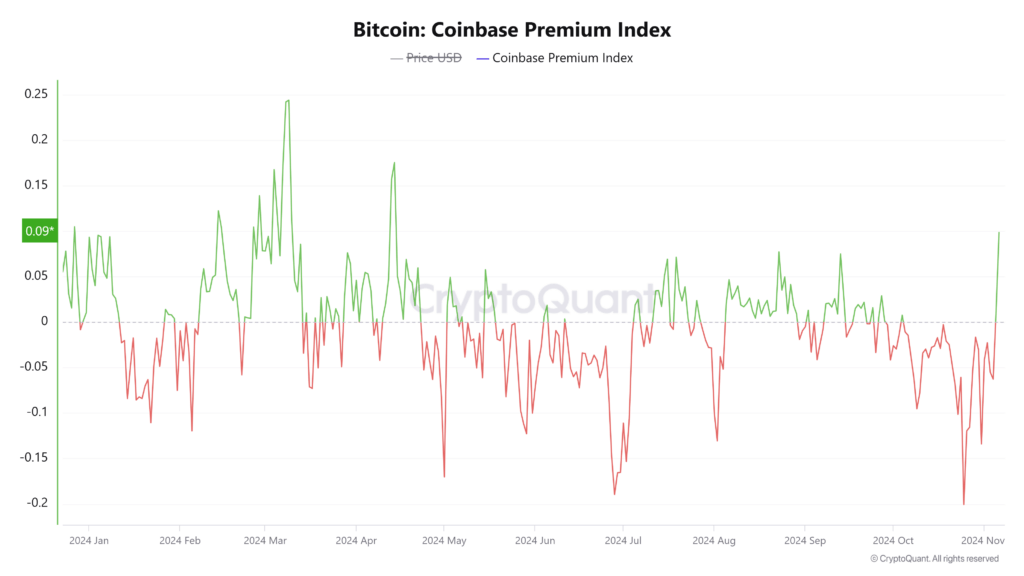

The Coinbase Bitcoin Premium Index has recently garnered attention as it enters its 23rd consecutive day in negative premium, currently recorded at -0.0878%.This notable drop indicates fluctuating Bitcoin prices and highlights a significant shift in market sentiment affecting crypto trading dynamics.

The recent surge of interest in the XRP spot ETF has taken the investment community by storm, with a remarkable total net inflow of $15.16 million recorded in just one day.This robust demand is largely driven by the high-performing Bitwise XRP ETF, which alone attracted $8.29 million, contributing to its impressive total historical inflow of $358 million.

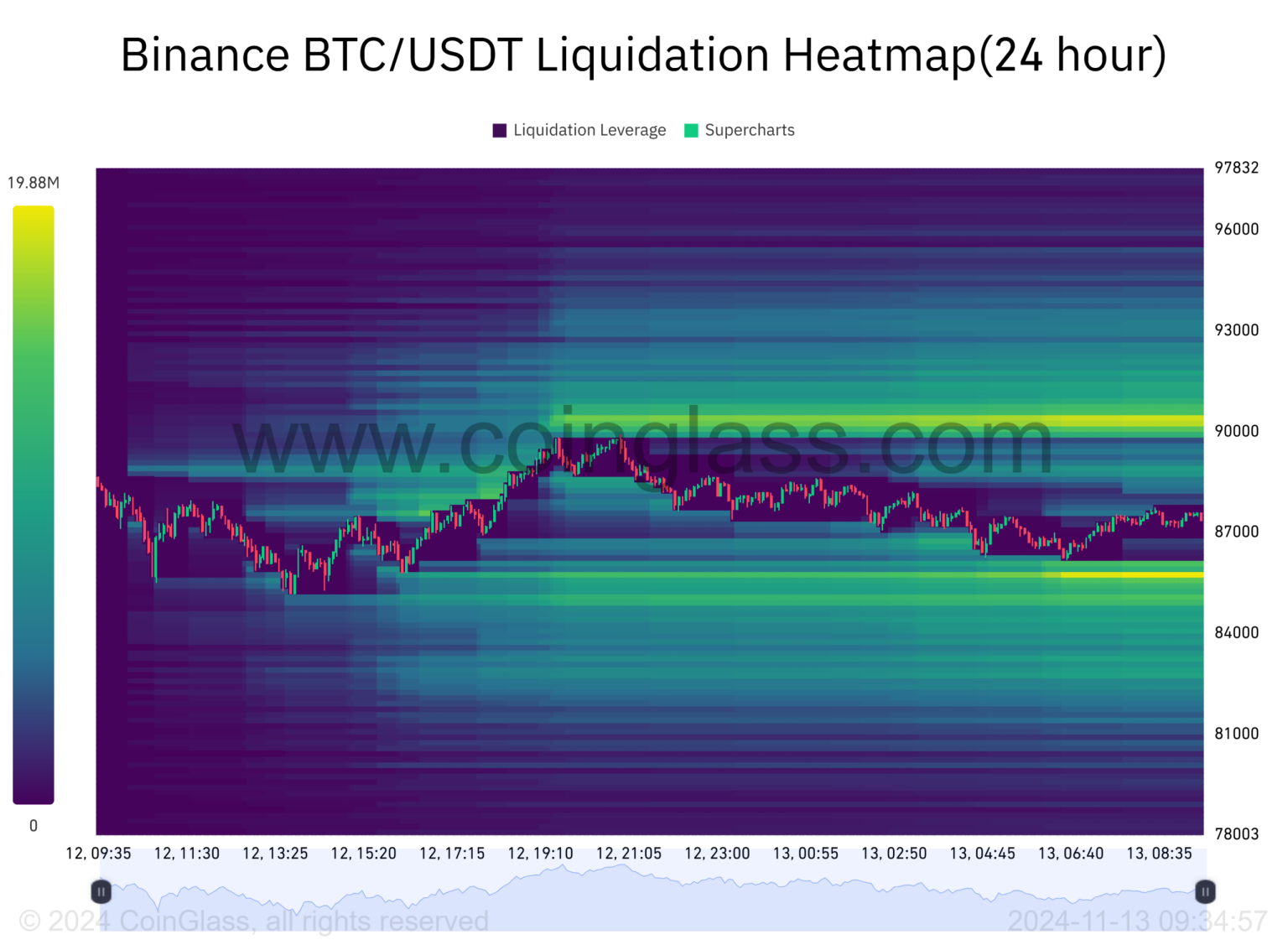

Bitcoin liquidations continue to be a significant trend within the volatile crypto market, reflecting the intense market dynamics at play.In just the past hour, over $80 million was liquidated from various positions, with BTC liquidations alone accounting for a staggering $48.34 million.

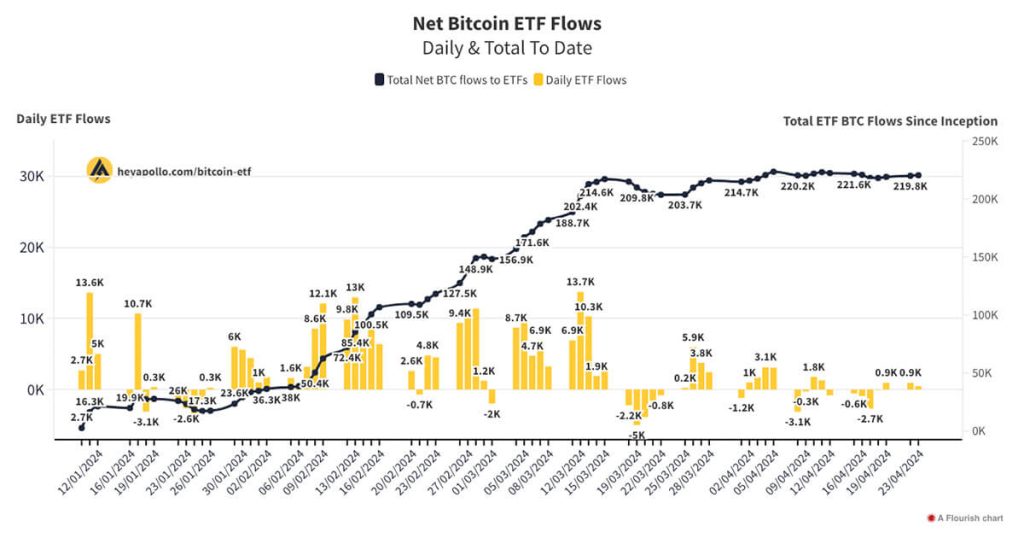

Bitcoin ETF inflows made headlines on Friday as BlackRock’s spot Bitcoin exchange-traded fund (ETF) attracted a remarkable $231.6 million, despite a turbulent week for Bitcoin.This influx marks only the 11th day of net inflows for the fund this year, highlighting a significant deviation from the recent trend of substantial outflows.

The recent movements of a notable BTC insider whale have sent ripples through the cryptocurrency space, particularly in Bitcoin trading news circles.Just reported by Odaily Planet Daily, on-chain data reveals that this influential trader has deposited a staggering 3,401 BTC into Binance, equating to roughly $238.7 million.

In the ever-evolving world of cryptocurrency, Bitcoin price analysis remains a crucial aspect for investors and enthusiasts alike.Recently, BTC experienced a slight drop, falling briefly below 68,000 USDT before stabilizing at 67,986 USDT.