Author: Bpay News

MERL spot price The spot price of MERL has experienced a significant increase, with futures currently trading at a premium of 45% compared to the spot price. This surge indicates heightened demand and market activity surrounding MERL, reflecting investor interest and potential market trends. Analysts suggest that the disparity between the spot price and futures could result from various market dynamics, including speculation and supply considerations. As the market evolves, the relationship between spot prices and futures trading will be closely monitored by traders and investors alike.

Nevada has issued a cease and desist order against cryptocurrency custodian Fortress Trust. The order comes amid regulatory scrutiny of the company’s operations. The cease and desist order indicates concerns regarding Fortress Trust’s compliance with state regulations. Nevada officials have emphasized the importance of protecting consumers in the cryptocurrency space. This action reflects a growing trend among state regulators to closely monitor and regulate cryptocurrency businesses. Fortress Trust is known for offering custody services for digital assets, which has attracted attention from both investors and regulators. The company’s practices are now under review as part of this enforcement action. Regulatory…

The Limitless (LMTS) token has experienced a significant surge of over 110% within a 24-hour period on the Base Ecosystem Prediction Platform. This dramatic increase highlights the token’s growing popularity and market activity. Investors and analysts are closely monitoring the fluctuations in LMTS as the platform gains traction among users. The rise in value reflects broader trends in the cryptocurrency market, where similar tokens have also seen notable movements. As the Base Ecosystem continues to develop, the performance of LMTS may attract further attention from traders and investors alike.

A mysterious whale has increased its long position by 173.6 $BTC early this morning, raising the total value of its long position to nearly $300 million. This significant move highlights the whale’s ongoing confidence in the market. The increase in the long position suggests a strategic approach to market fluctuations. Investors are closely monitoring this entity’s actions, as it has previously maintained a 100% win rate.

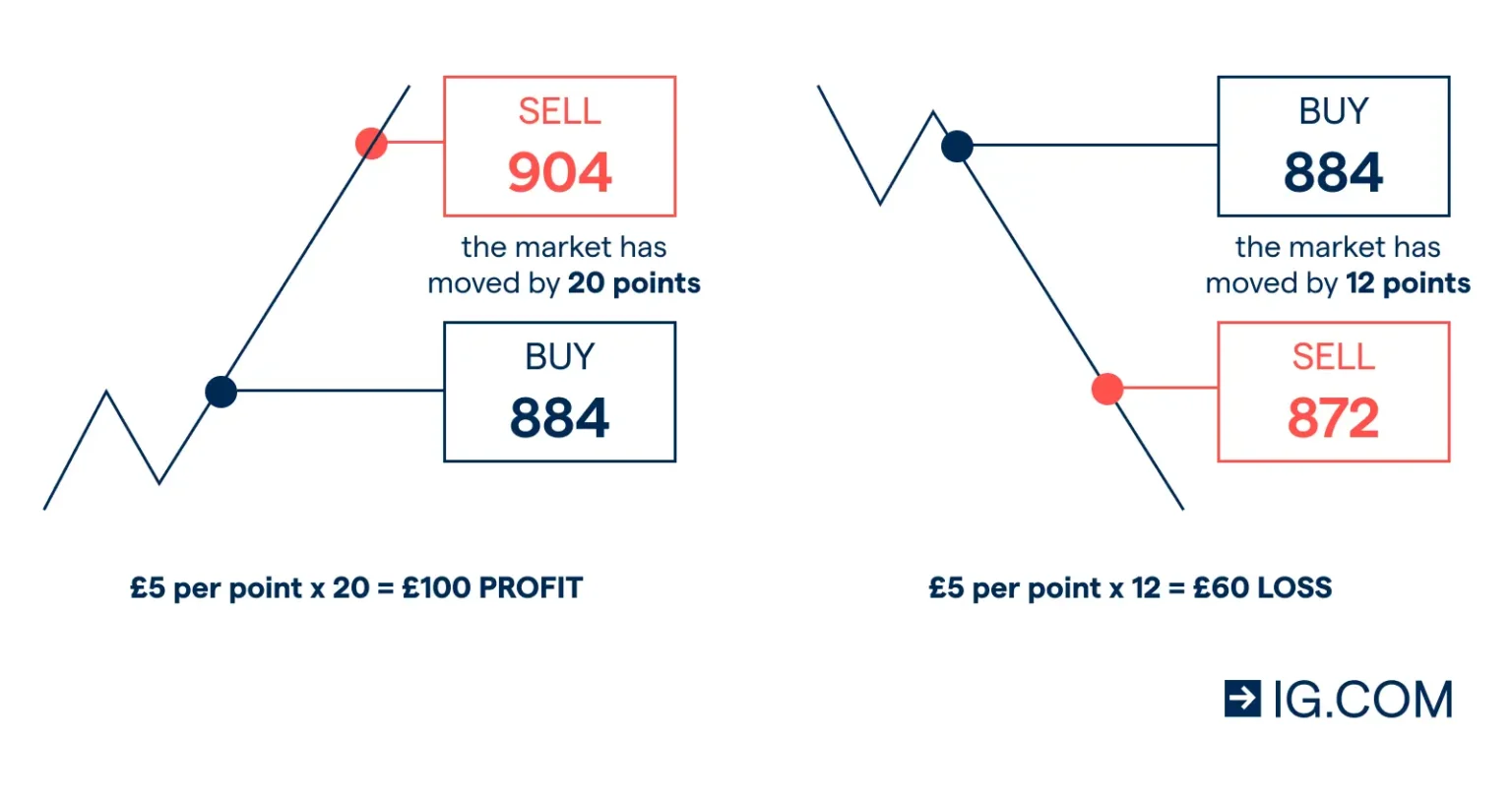

The “Buddy” has contributed $1.85 million to contract trading following the market crash on October 11, but it currently has $1.13 million remaining. This significant influx into contract trading occurred after a noted market downturn, indicating the challenges faced by trading entities during volatile periods. The reported funds suggest that while there was an initial boost in trading capacity, financial resources have since diminished. The current financial standing reveals that the “Buddy” has less than two-thirds of the initial amount added to contract trading, highlighting the impact of market fluctuations.

revenue increase Kraken, a US-based cryptocurrency exchange, experienced a significant 114% increase in revenue in the third quarter compared to the same period last year. The platform also reported a corresponding 106% growth in its total trading volume year-over-year. This substantial rise in both revenue and trading activity reflects increased user engagement and market activity on Kraken’s platform. The exchange’s performance highlights its position within the competitive cryptocurrency market, showcasing the demand for its services among traders. The year-over-year growth figures indicate a robust expansion strategy that may continue to attract more users in the future.

Myriad prediction platform Prediction platform Myriad is reportedly preparing to launch on the Binance Smart Chain (BSC) network. This development has garnered attention within the cryptocurrency community. Binance CEO Changpeng Zhao, commonly known as CZ, has expressed support for Myriad’s potential launch. His endorsement adds credibility to the platform’s anticipated entry into the BSC ecosystem. As the launch approaches, industry watchers are keen to see how Myriad will integrate with the BSC network and what features it may offer.

Binance lobbying Foreign media reports that Binance has employed an ally of Trump to lobby the White House, spending $450,000 for services rendered in January. This move indicates Binance’s strategy to enhance its influence in U.S. policy-making. The firm’s hiring of a political ally underscores its intent to navigate regulatory challenges more effectively. Such efforts reflect the growing intersection of politics and business in the crypto space, as companies seek to strengthen their positions with government institutions.

Giggle Academy has stated that it has never issued any tokens, clarifying that the meme coin GIGGLE remains unaffected by this announcement. The clarification comes amid ongoing discussions within the cryptocurrency community regarding the legitimacy of various tokens. Giggle Academy emphasized that its operations do not involve token issuance and that there is no association with any token sales or distributions. This statement aims to alleviate concerns among users and potential investors regarding the GIGGLE meme coin. The academy’s position is clear: it remains focused on its educational mission without engaging in cryptocurrency transactions.

cryptocurrency regulation bill Ghana is preparing to introduce a bill regulating cryptocurrency by the end of the year. This initiative aims to establish a legal framework for digital currencies in the country. The government recognizes the growing importance of cryptocurrencies and seeks to ensure that the sector operates within a structured environment. Officials believe that regulation will help protect consumers and foster innovation in the financial technology space. The proposed legislation is expected to address various aspects of cryptocurrency use, including compliance and security measures.