Author: Bpay News

Ferrari is set to introduce the “Token Ferrari499P,” which will facilitate the auction of a Le Mans championship race car through encryption technology. This initiative marks a significant step for the luxury car manufacturer into the digital asset space. The token will allow enthusiasts and collectors to participate in the auction process in a secure and innovative manner. By leveraging encryption, Ferrari aims to enhance the transparency and trustworthiness of the auction. This move reflects the growing interest among automotive brands in integrating blockchain technology into their operations.

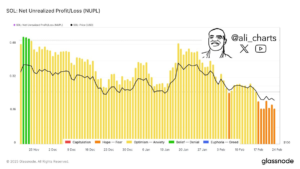

3 Altcoins Crypto Whales Are Buying After US CPI Inflation Report The cryptocurrency market often experiences significant volatility in response to global economic shifts, such as inflation rates. The recent United States Consumer Price Index (CPI) inflation report, which indicated a slowdown in inflation, has similarly impacted crypto investments, shifting investor focus towards alternative coins (altcoins). Crypto whales – investors who hold substantial amounts of digital currencies – have particularly shown interest in specific altcoins following the report. Here, we explore three such altcoins that have been attracting attention. 1. Solana (SOL) Solana has been one of the standout altcoins…

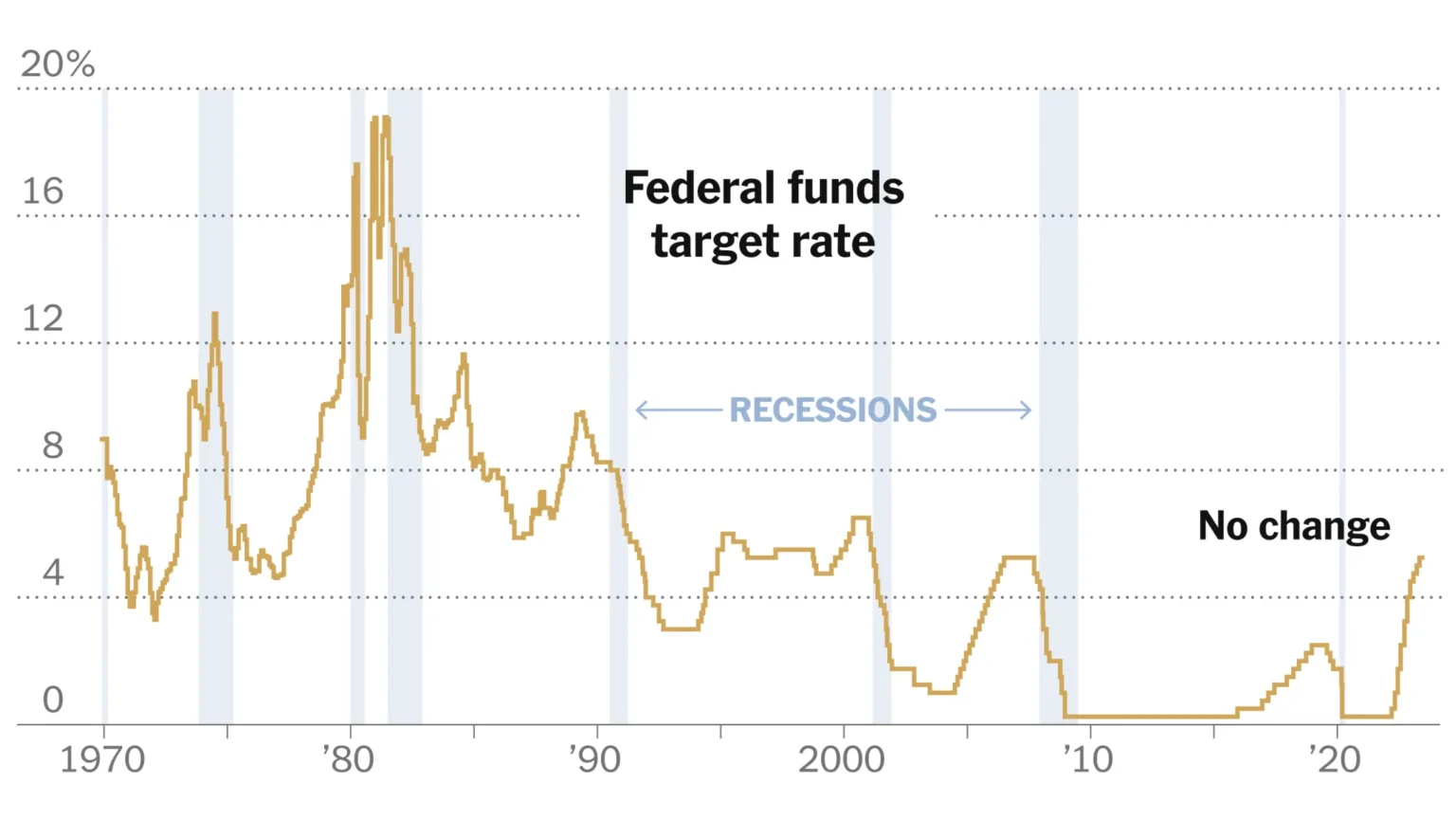

The Federal Reserve is scheduled to announce its interest rate decision on Thursday, followed by a press conference led by Chairman Jerome Powell. This announcement is highly anticipated as it will provide insight into the Fed’s monetary policy direction. Market analysts and investors will closely monitor the outcome for indications of future economic conditions. The press conference will offer Powell an opportunity to clarify the Fed’s rationale behind its decision, addressing potential impacts on financial markets.

Kyrgyzstan has created a national cryptocurrency reserve that features $BNB as part of its holdings. This initiative reflects a growing interest in digital currencies within the region. The reserve aims to bolster the country’s financial infrastructure and adapt to evolving global trends in cryptocurrency. By including $BNB, Kyrgyzstan aligns itself with a prominent cryptocurrency that has gained traction and popularity. The move is seen as a significant step toward integrating cryptocurrency into the national economy.

Kyrgyzstan has created a national cryptocurrency reserve that incorporates $BNB. This move is part of the country’s efforts to engage with digital currencies. The reserve aims to enhance the nation’s financial framework and adapt to the evolving landscape of cryptocurrencies. By including $BNB, Kyrgyzstan is positioning itself within the broader cryptocurrency market, potentially attracting investment and innovation. The establishment of this reserve reflects a growing trend among nations to explore and integrate digital assets into their economies.

A trader who purchased $2,076 worth of GIGGLE 33 days ago has seen profits exceeding $1.7 million. This significant gain highlights the volatility and potential rewards in cryptocurrency trading. The trader’s investment has proven to be exceptionally lucrative, showcasing the rapid changes in value that can occur within a short time frame. Such profits are not typical and reflect the high-risk nature of trading in digital assets. Investors should approach similar opportunities with caution, as the market can fluctuate dramatically.

First US XRP ETF Surpasses $100 Million in Investments Within a Month In a significant milestone for cryptocurrency investment in the United States, the first US-based XRP exchange-traded fund (ETF) has rapidly exceeded $100 million in investments within just a month of its launch. This remarkable achievement underscores the growing investor interest and confidence in digital currencies, specifically XRP, despite the historically volatile nature of the crypto market. A Landmark Event for Ripple and XRP The launch of the ETF not only marks a pivotal moment for Ripple, the company behind XRP, but also represents a broader acceptance and institutionalization…

Bitcoin is currently consolidating above the $111,000 mark while awaiting a new catalyst for a possible breakout. Traders observe this level closely, anticipating future price movements. The current price stability could signal a buildup of momentum, leading to significant activity depending on forthcoming market factors. Analysts suggest that external influences may play a crucial role in determining Bitcoin’s next direction. The cryptocurrency market remains dynamic, with various elements potentially impacting investor sentiment and trading strategies.

A new address has added 276,000 $LINK to its holdings, increasing its total single-asset position to $28.99 million. This accumulation reflects a significant investment in the cryptocurrency. The total amount now held by this address highlights its growing influence in the market. As the value of $LINK fluctuates, the address’s holdings may impact trading dynamics.

Crypto.com has submitted an application for a national trust bank charter from the Office of the Comptroller of the Currency (OCC) to enhance its institutional custody services in the United States. This move aims to strengthen the company’s presence in the U.S. market by offering improved financial services to institutions. The application reflects Crypto.com’s efforts to comply with regulatory frameworks while expanding its product offerings for institutional clients. If granted, the charter would allow Crypto.com to operate as a federally chartered trust bank, potentially increasing its ability to attract institutional investment and enhance its custody capabilities.