Author: Bpay News

Local stablecoins are rapidly gaining traction in the Latin American cryptocurrency landscape, as demonstrated by the innovative strategies employed by exchanges like Ripio.With a focus on stablecoins pegged to local currencies, Ripio is poised to address regional financial instability while embracing broader cryptocurrency trends, such as the integration of tokenized bonds.

The NYSE tokenization plan marks a significant intersection of traditional finance and blockchain innovation, aiming to redefine how trading occurs in financial markets.This ambitious initiative promises to facilitate 24/7 trading and instant settlements, although many analysts have raised concerns about its viability.

Bitcoin payment application Butterfly, recently launched by VerifiedX, is revolutionizing the way we think about cryptocurrency payments.This innovative platform operates as a Layer-1 blockchain and Bitcoin sidechain, providing users with a seamless and user-friendly experience reminiscent of popular services like Venmo.

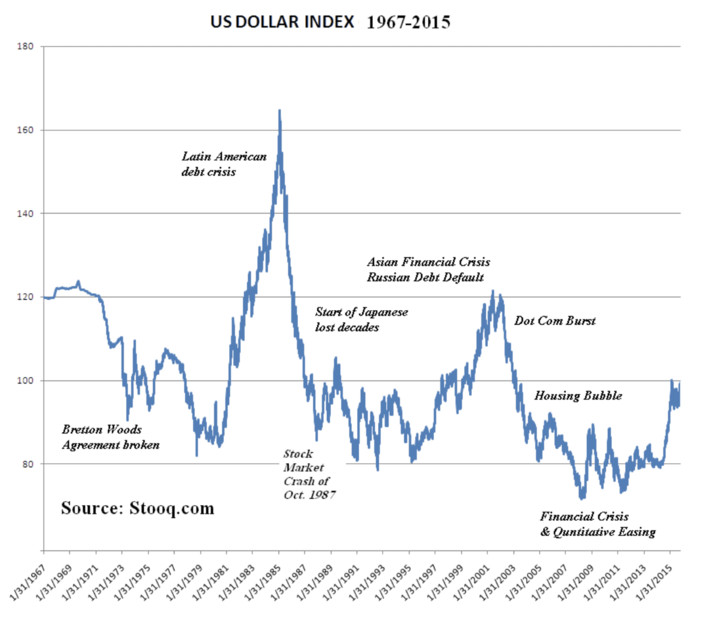

The Dollar Index, often referred to as DXY, is a critical barometer for assessing the strength of the US dollar against a basket of foreign currencies.Recent fluctuations in this index have been notably influenced by various factors, including the recent speech by U.S.

The Bank of Italy’s exploration of stablecoins sheds light on the evolution of digital money within the financial landscape.According to Fabio Panetta, the governor of Banca d’Italia, stablecoins are set to serve a complementary role rather than becoming a cornerstone of monetary stability.

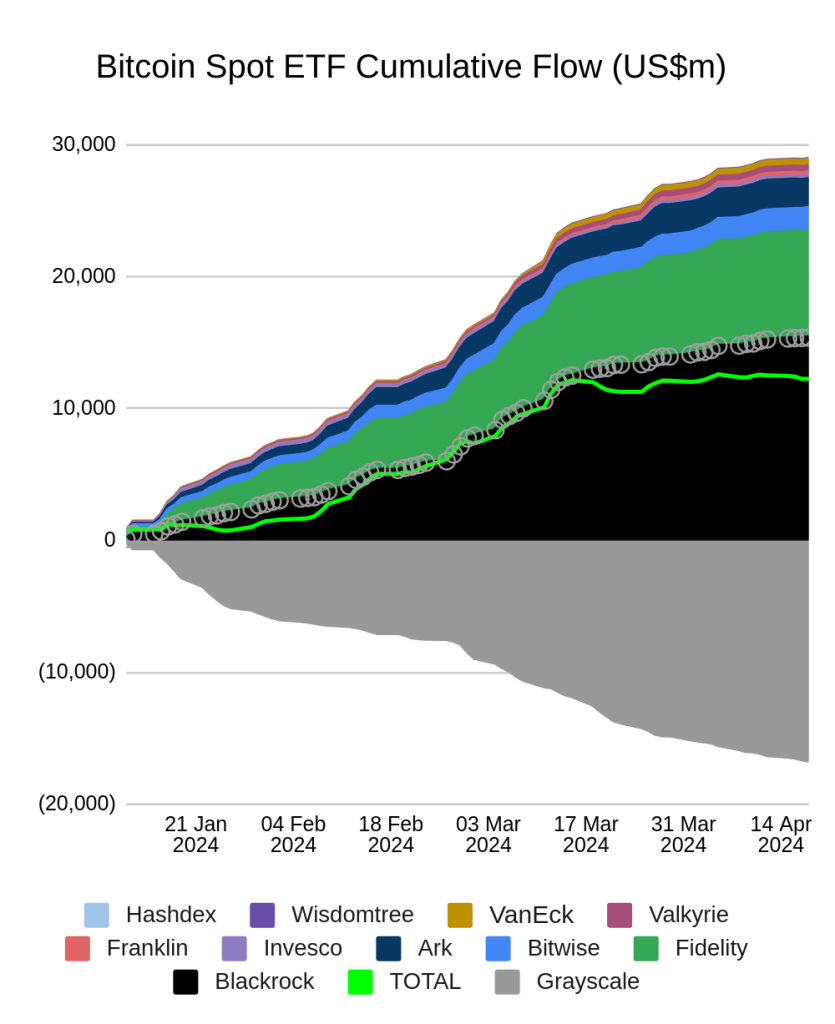

Bitcoin ETF outflows have captured the market’s attention amid ongoing macroeconomic and geopolitical uncertainties, leading to a significant exit of funds from these investment vehicles.On Tuesday alone, spot Bitcoin ETFs recorded outflows totaling $483.4 million, with key players like the Grayscale Bitcoin Trust ETF (GBTC) and Fidelity Wise Origin Bitcoin Fund (FBTC) accounting for major portions of this withdrawal.

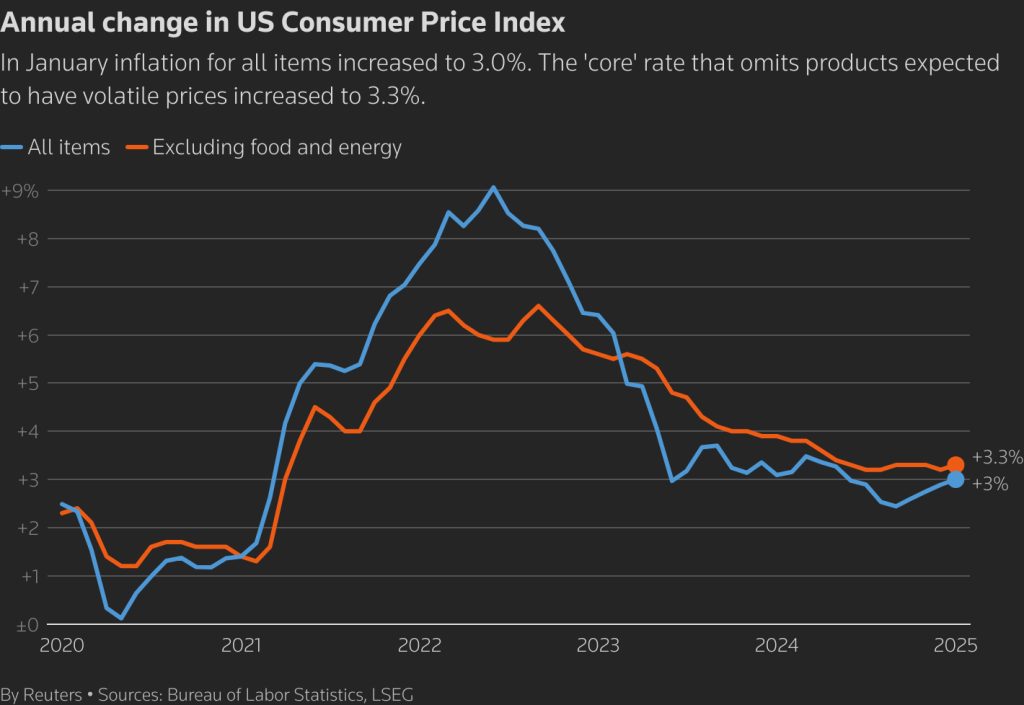

U.S.inflation has taken center stage in recent economic discussions, especially in light of statements made by Trump during his recent speech at Davos.

In his highly anticipated speech at Davos 2023, Trump addressed key issues affecting the global economy, including the current inflation rate in the US, which he stated stands at just 1.5%.He confidently projected strong economic growth predictions, forecasting an impressive 5.4% growth rate for the US economy in the fourth quarter of 2025.

Central Banks vs Bitcoin has become a pivotal debate in today’s financial landscape, particularly highlighted during the recent World Economic Forum in Davos.The clash between Coinbase CEO Brian Armstrong and the French central bank governor, François Villeroy de Galhau, centered on trust in money and whether it should emanate from centralized institutions or the decentralized realm of Bitcoin.

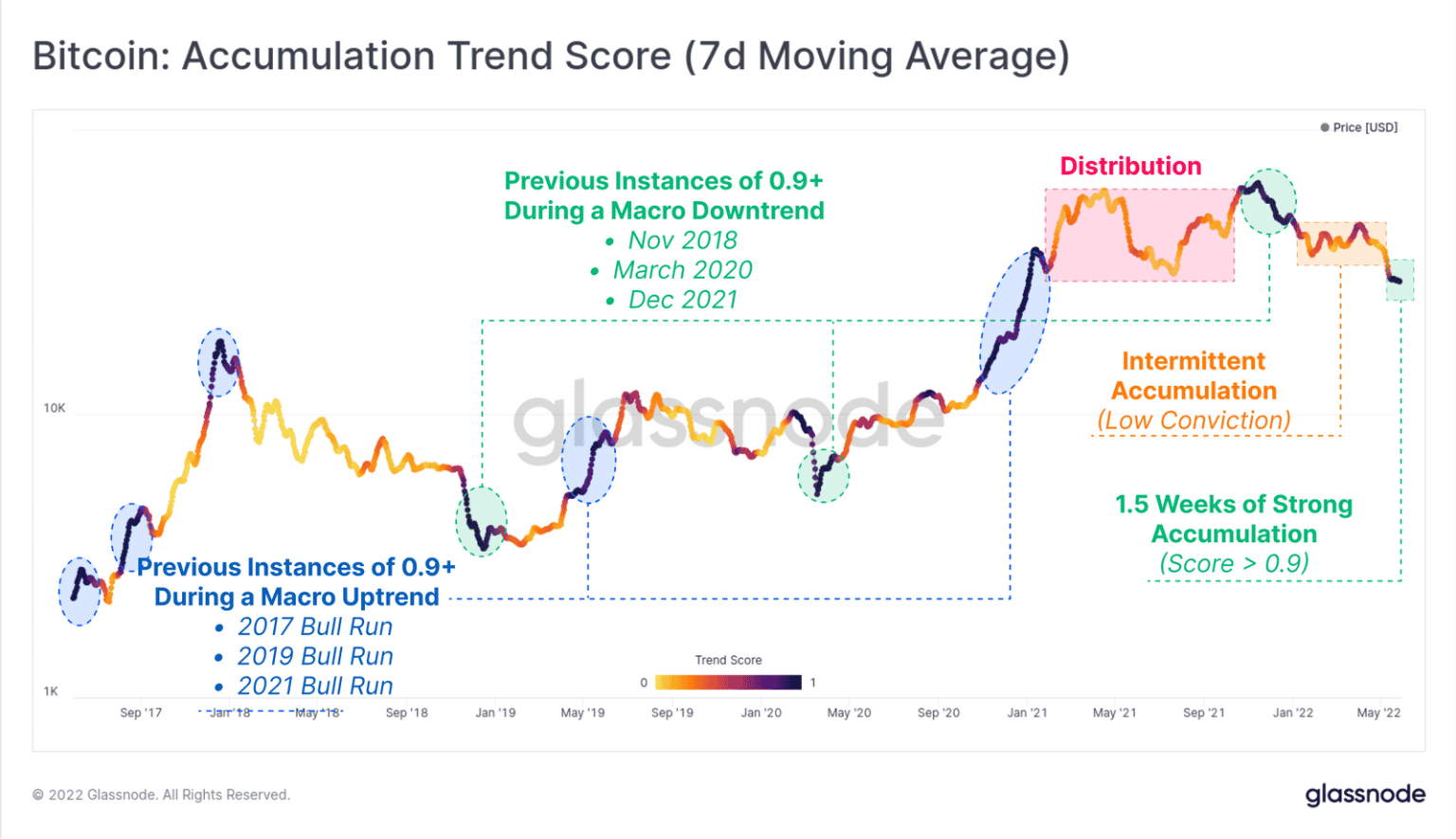

Bitcoin accumulation has emerged as a significant trend among large investors in early 2024, particularly during the ongoing market fluctuations.With Bitcoin’s price recently experiencing a notable drawdown from its all-time highs, many institutional players have seized the opportunity to increase their holdings.