Aster Value Plunges Toward $1 as Investor Sell-Off Intensifies

In a dramatic turn of events that has caught the eye of Wall Street and investors worldwide, shares of Aster Corporation, once a stalwart in the tech industry, have plummeted towards the $1 mark. The company, known for its innovations in AI and data analytics, has seen its market value erode significantly, punctuating a turbulent period that has been exacerbated by a broad sell-off from investors.

Market Sentiments Turning Sombre

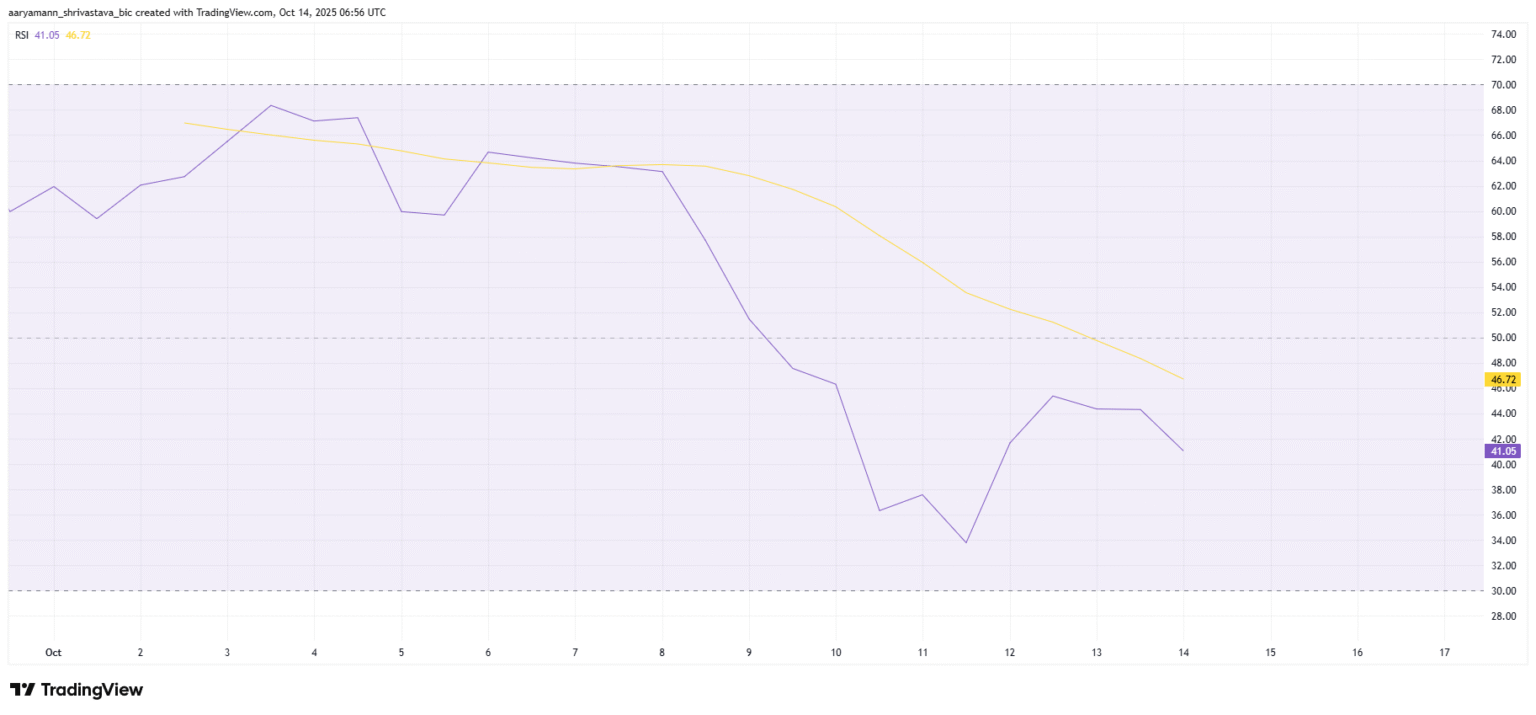

The nosedive in Aster’s stock value, a company that once boasted a robust stock price above $50 a share, reflects a broader sentiment of unease among investors. Market analysts attribute the sell-off to several key factors that include poor financial results, skepticism about the company’s strategic direction, and broader market volatility.

Recent quarterly results from Aster fell short of market expectations, leading to a sharp decline in investor confidence. Revenue growth has stagnated, and the company’s push into new markets has not yielded the anticipated returns. Moreover, internal challenges such as high turnover at the senior management level and layoffs have only fueled concerns about the company’s stability and future prospects.

Technology Sector Facing Headwinds

The decline of Aster Corporation is not occurring in isolation. It underscores a growing trend of investor dissatisfaction within the technology sector, which has faced severe headwinds over the past year. Rising operational costs, aggressive competition, and shifting regulatory landscapes across international markets are pressing issues that many tech firms are grappling with.

Additionally, global economic uncertainties, spurred by issues such as trade tensions and geopolitical changes, have also played a role in the tech sector’s volatility. Investors, increasingly wary of risk, have begun pulling out of stocks perceived as overvalued or unstable, opting instead for safer investment havens or industries displaying more resilience.

Impact on Shareholder Value

For shareholders of Aster Corporation, the plummeting stock price has been a cause for alarm. The erosion of shareholder value has significant repercussions on investment portfolios, particularly for institutional investors who hold substantial stakes in the company. This decline also puts pressure on the company’s board to implement corrective measures to restore investor confidence and stabilize the stock price.

Experts suggest several strategies that Aster might employ to reverse its fortunes, such as restructuring its business model, exploring new technological frontiers like machine learning and cloud computing more aggressively, or even considering merger opportunities. The coming months will be crucial for Aster as it attempts to regain its footing and demonstrate to investors that it can return to profitability and innovation.

The Broader Economic Picture

The situation with Aster Corporation also mirrors a larger economic dialogue that concerns the sustainability of growth within the tech sector. As companies navigate the challenges of rapidly changing technologies and consumer demands, the road ahead requires more than just technological prowess—it demands strategic foresight, operational excellence, and, importantly, the ability to deliver sustained value to investors and customers alike.

As the story of Aster unfolds, it will serve as a case study for other tech companies in managing downturns and recalibrating strategies in times of distress. The dramatic drop in stock value is a sober reminder of the volatile nature of the tech industry and the need for robust financial health and strategic clarity.

Conclusion

The significant drop in the value of Aster’s shares is an unfolding saga that highlights critical lessons for the tech industry and the broader market. It underscores the importance of agility in corporate strategy and responsiveness to market dynamics. For investors and market watchers, Aster’s trajectory will likely offer valuable insights into the parameters of navigating market downturns in a sector that remains at the forefront of modern economy disruptions.