Yen on watch as Tokyo CPI lands; thin holiday liquidity set to amplify FX swings ahead of pivotal BoJ meeting Traders head into Asia’s Friday with Tokyo inflation in focus and the Bank of Japan’s December decision in play. A sharper print could reignite yen volatility and reprice rate-hike odds in a holiday-thinned market where moves can overshoot.

Asia open: Tokyo CPI is the week’s last macro swing factor

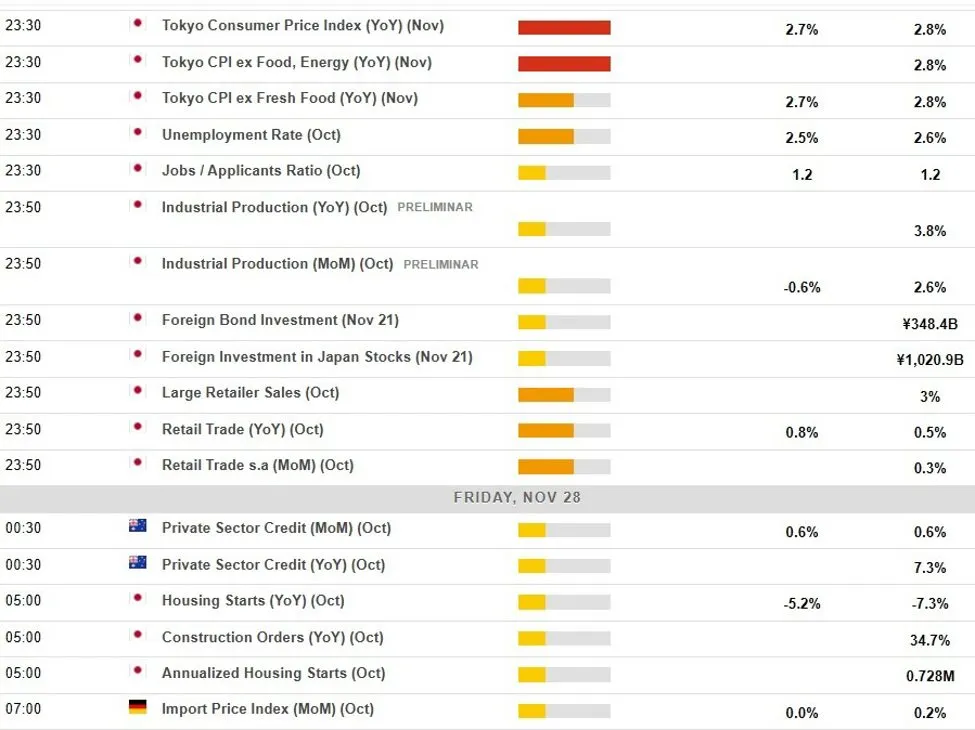

Japan’s capital-city inflation gauge arrives Friday, Nov. 28, 2025, offering the timeliest read on domestic price pressures ahead of the BoJ’s Dec. 18–19 meeting. With policymakers still debating whether to deliver another rate hike this year, Tokyo CPI will set the tone for USD/JPY and JGBs into month-end.

In a liquidity-light session following the U.S. Thanksgiving holiday, even modest surprises can trigger outsized FX moves. Yen crosses remain especially sensitive to any shift in BoJ guidance and to global rate expectations as U.S. Treasury markets partially reopen.

What it means for USD/JPY and JGBs

If Tokyo inflation proves stickier than expected—particularly in services—rate-hike odds for December could firm, providing a tailwind for the yen and tightening conditions across yen funding trades. Conversely, a softer print risks pushing a policy move into 2026, keeping carry supportive and yen on the defensive. Japanese government bond yields will likely react first, with spillover to bank and exporter equities.

Broader macro currents traders are tracking

US consumer prices by proxy: Thanksgiving costs and sentiment

Rising or fluctuating holiday meal costs won’t move the CPI needle by themselves, but they feed into household inflation expectations and spending psychology. Any uptick in near-term expectations can harden the Fed’s “higher-for-longer” narrative, underpin the dollar, and pressure duration-sensitive equities.

UK’s tax squeeze and the pound

Britain’s frozen income tax thresholds are pulling more middle-income earners into higher brackets, eroding disposable income. That dynamic can cool consumption and dampen growth expectations, muddling the policy mix for the Bank of England. For GBP, slower growth with sticky services inflation is an awkward cocktail that can cap rallies and increase sensitivity to wage and retail data.

AI data centers and the “valuation-froth” debate

Developers are mapping a potential 245 GW of AI data center capacity, with Texas alone eyed for roughly 67 GW. The capex supercycle boosts power demand, grid build-outs, and metals use—notably copper, aluminum, and transformers—while funneling investor flows toward AI-adjacent equities. Yet mega-project clustering risks distorted capital allocation and richer multiples. That tension is spilling into tech, where short interest and volatility are rising.

Tech shorts and market fragility

Reports that Michael Burry has a large bearish position against marquee AI names including NVIDIA and Palantir—disputed by the companies—spotlight a widening split over AI earnings durability. While specifics are contested, the overarching takeaway for global stocks is that positioning is crowded and narrative-sensitive; shallow liquidity around holidays can magnify swings.

Crypto cross-currents

Vitalik Buterin’s reported ETH donations to privacy-focused projects lit a fire under select tokens, with sharp, momentum-driven rallies even as broader crypto sees episodic profit-taking. For macro traders, crypto volatility is a barometer of risk appetite that can bleed into high-beta equities and EM FX.

Commodities watch: nickel risk and base metals volatility

Trafigura’s ongoing pursuit of an alleged $600 million nickel fraud—denied by the counterparty—keeps attention on due diligence and inventory verification in metals markets. Beyond legal outcomes, the episode reins in risk-taking across physical trading and can widen basis and volatility in nickel and related metals. If AI grid build-outs accelerate, copper’s demand impulse may overshadow idiosyncratic nickel risk, but headline sensitivity remains high.

Key points

- Tokyo CPI is the final major Asian print before the BoJ’s Dec. 18–19 meeting; it could shift rate-hike odds and jolt USD/JPY.

- Holiday-thinned U.S. liquidity heightens FX and rates volatility; watch for exaggerated moves on modest surprises.

- UK tax drag weighs on growth outlook and complicates GBP pricing against sticky services inflation.

- AI data center capex boom supports power and metals demand but fuels equity valuation concerns.

- High-profile tech shorts and crypto spikes underscore fragile risk sentiment and narrative-driven trading.

- Nickel market scrutiny persists amid alleged fraud claims, maintaining a volatility premium across base metals.

Positioning into the print

Given skewed liquidity, many macro desks prefer optionality over outright directional bets into Tokyo CPI—especially in yen crosses and front-end JGBs. A two-way plan helps: fade extremes if the data land near trend; consider chasing if services inflation points to a durable re-acceleration. Month-end rebalancing and U.S. reopen dynamics add another layer of noise, arguing for tight risk control.

Market outlook

Into December, the macro path hinges on Japan’s inflation trajectory, the Fed’s stance as holiday spending data roll in, and how far the AI capex wave can stretch multiples without earnings catch-up. For now, risk appetite looks twitchy, FX volatility elevated, and commodities primed for headline-driven bursts. As ever, watch the yen—when Tokyo prices speak, markets listen, BPayNews notes.

FAQ

Why does Tokyo CPI matter so much for FX?

It’s the earliest look at Japan’s inflation dynamics each month and a leading indicator for national CPI. Because the BoJ sets policy with an eye on sustained inflation, Tokyo CPI can quickly shift rate expectations and drive USD/JPY and JGB yields.

How could holiday-thinned liquidity affect trading?

With fewer participants and reduced depth, modest data surprises can cause outsized price moves. Spreads can widen, slippage increases, and intraday volatility rises, especially in FX and front-end rates.

What’s the GBP risk from the UK’s tax burden?

Frozen thresholds squeeze real incomes and can cool growth, limiting the BoE’s room to keep policy tight. If growth slows faster than inflation, sterling rallies may fade and become more data-dependent.

Will AI data center growth impact commodities?

Yes. Massive power demand and grid expansion support consumption of copper, aluminum, transformers, and potentially natural gas and renewables inputs. That can tighten balances and lift price volatility.

What is the market takeaway from the reported Burry shorts?

Regardless of the disputed specifics, it signals rising skepticism toward AI-linked valuations. That can increase tech volatility and correlation risk across global equities.

How does the Trafigura nickel case affect metals markets?

The alleged fraud heightens due diligence and counterparty risk concerns, which can widen spreads and add a volatility premium in nickel and, by extension, other base metals.

What trading approach fits the Tokyo CPI release?

Consider options or tight stop-losses around the print, avoid oversized positions in thin liquidity, and be ready to fade extremes if the data are close to trend but follow-through if services inflation shows a clear surprise.

Related: More from Market Analysis | Polymarket: Traders Bet $500M on US in Crypto Market | Related Box Test