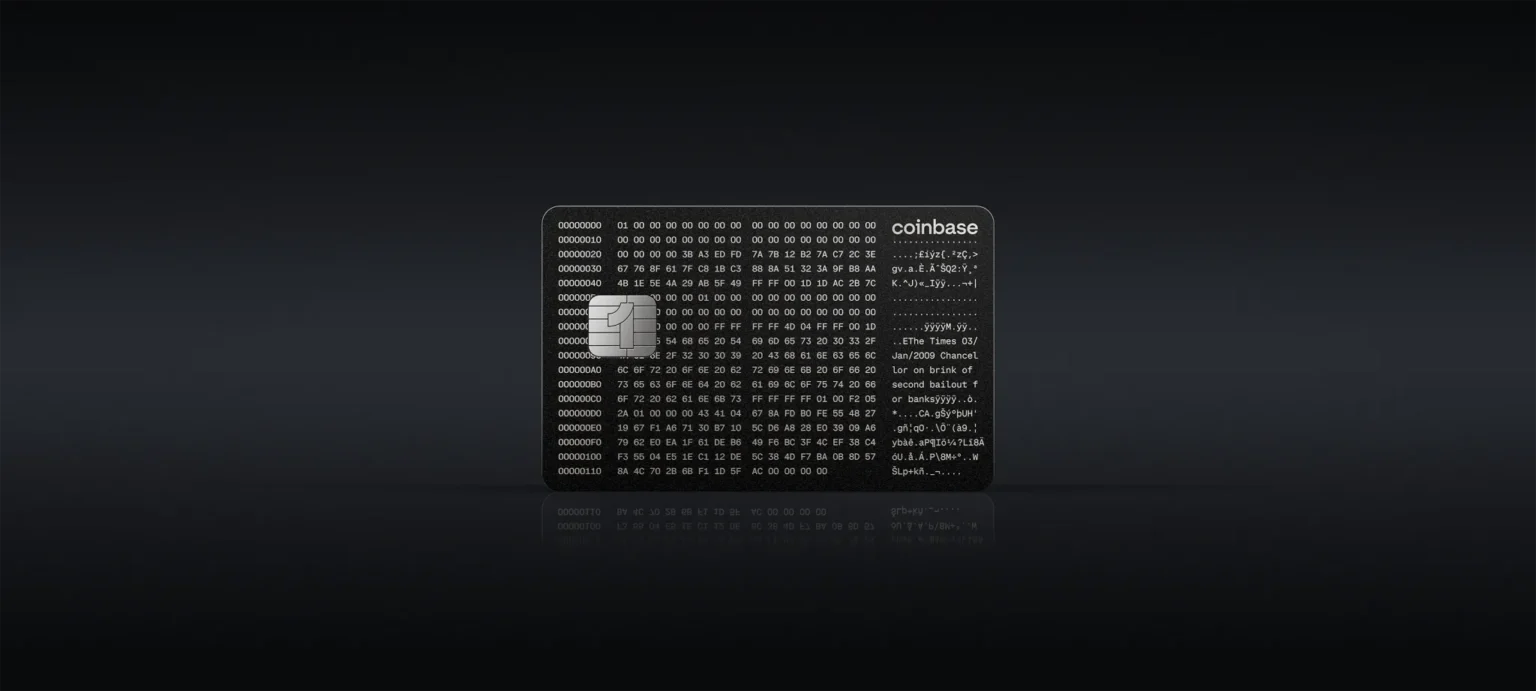

Coinbase One Card Expands to American Users Offering Bitcoin Rewards

In a significant development for cryptocurrency enthusiasts and investors, Coinbase, one of the leading digital currency exchanges, has officially launched the Coinbase One Card to its users in the United States. This move not only broadens the scope for digital currency usage in day-to-day transactions but also incentivizes users with attractive Bitcoin rewards.

Bridging the Gap Between Traditional Finance and Cryptocurrencies

The Coinbase One Card aims to bridge the gap between cryptocurrency and traditional spending by allowing American users to use their digital assets for regular purchases just like any other debit card. This integration into everyday financial activities is seen as a crucial step towards the mainstream acceptance of cryptocurrencies.

Seamless Integration and User-Friendly Features

One of the standout features of the Coinbase One Card is its seamless integration with the existing Coinbase platform. Users can manage their card through the same interface used for trading on Coinbase, which simplifies the user experience significantly. Moreover, the card is compatible with major digital wallets, enhancing its accessibility and convenience for users across a variety of devices.

Earn Bitcoin While You Spend

Perhaps the most appealing feature of the Coinbase One Card is the opportunity to earn Bitcoin rewards. Users can earn back a percentage of their expenditures in Bitcoin, providing a unique way to accumulate this prime cryptocurrency without direct purchasing. This feature serves as an excellent tool for users to incrementally increase their Bitcoin holdings as they engage in day-to-day transactions, potentially leading to significant growth over time.

Security and Control

Security remains a paramount concern whenever financial transactions are involved, and Coinbase has addressed this by providing robust security features with the Coinbase One Card. Users benefit from two-factor authentication, instant card freeze options, and secure encryption technology. Managing security settings directly from the app adds an extra layer of convenience and control, ensuring that users feel safe when using their card.

Economic Implications

The introduction of the Coinbase One Card comes at a time when cryptocurrency is increasingly being seen as a viable component of financial portfolios. By making digital currency a practical option for everyday transactions, Coinbase is pushing the boundaries of how cryptocurrencies are traditionally viewed and used. The Bitcoin rewards program is particularly strategic, as it promotes the acquisition of crypto assets in a manner that is passive and tied to everyday economic activities.

Looking Forward

As the adoption of the Coinbase One Card picks up, it will be interesting to observe how it affects consumer habits regarding both spending and cryptocurrency investment. The ease of merging crypto transactions with everyday purchases could potentially transform the purchasing behaviors of millions, reinforcing the position of cryptocurrencies in the mainstream financial landscape.

In conclusion, the rollout of the Coinbase One Card in the United States symbolizes a significant milestone in the journey of cryptocurrencies from niche investment options to cornerstone financial assets. With its innovative features and user-centric operation, the Coinbase One Card is set not only to transform the way we think about spending digital currencies but also how we accumulate and interact with our investments. As more users begin to adopt this new tool, the path toward universal cryptocurrency integration appears more promising than ever.