Altcoin Season is Cancelled This Year: Alts Fail to Match Last Cycle’s $1.6 Trillion Ceiling

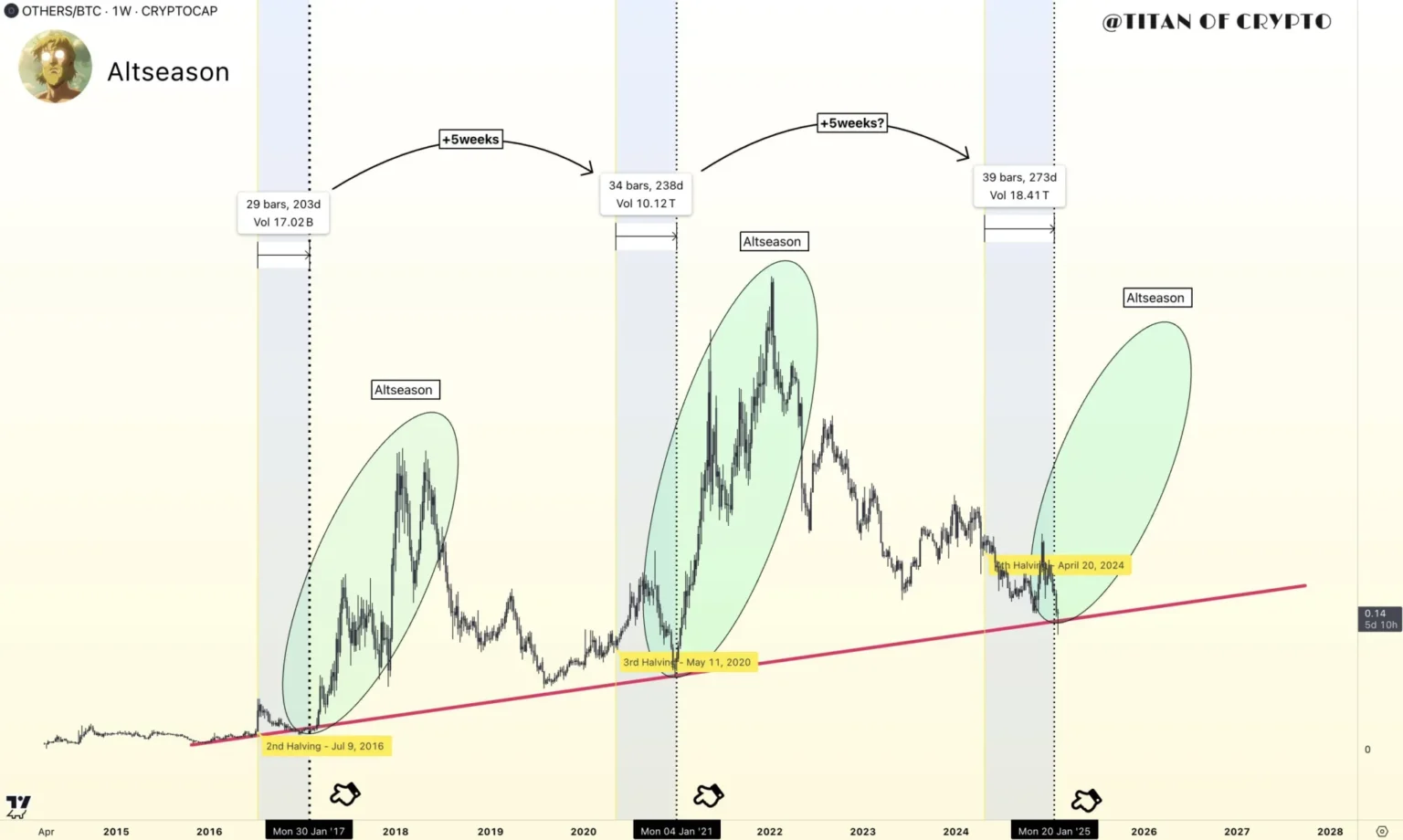

As we pivot past the midpoint of the year, the pulse of the cryptocurrency market is distinctly different from previous years, particularly in contrast to the frenetic pace of 2021. A term once whispered with anticipation and speculative joy among crypto enthusiasts, “Altcoin Season,” now seems to be a chapter from an old fairy tale. This year has revealed a starker reality with these alternative cryptocurrencies failing to match the dizzying heights of the last cycle’s $1.6 trillion market cap ceiling.

Key Takeaways

The Rise and Stall of Altcoins

Historically, altcoins — cryptocurrencies other than Bitcoin — have experienced periods of explosive growth, often outpacing Bitcoin itself. This phenomenon is typically referred to as “Altcoin Season,” a time when investors and traders shift their focus and funds from Bitcoin towards these lesser-known alternatives, driving up their prices and market valuations. During the 2021 cycle, altcoins reached an aggregate market capitalization of approximately $1.6 trillion, a testament to the booming interest and speculative investment these digital assets attracted.

However, this year paints a different picture. Triggered by various macroeconomic factors, regulatory news, and the aftermath of high-profile collapses within the cryptocurrency sphere (like those seen with FTX and Terra/Luna), the enthusiasm for altcoins has significantly dampened. The cumulative market cap of all altcoins has remained stubbornly low, suggesting that the expected seasonal surge is nowhere in sight.

Economic Headwinds and Investor Sentiment

One of the main catalysts derailing the altcoin rally this year is the global economic environment. With rising interest rates aimed at curbing inflation, there is a growing preference for lower-risk investments. Cryptocurrencies, known for their volatility, are often the first to be dropped from investment portfolios during such risk-off phases.

Moreover, the overall investor sentiment has shifted towards caution, particularly in the wake of several cryptocurrency exchanges and lending platforms facing liquidity issues, regulatory challenges, and operational shutdowns. These events have not only led to a direct financial loss for holders and traders but also severely impacted the trust and perception of the entire altcoin market ecosystem.

Technological and Competitive Challenges

Besides economic and regulatory pressures, altcoins face intrinsic challenges such as scalability, interoperability, and technological advancements that are yet to meet market expectations. While the potential of decentralized finance (DeFi) and non-fungible tokens (NFTs) continues to be a talking point, the real-world applications and adoption have lagged the initial excitement and hype.

Furthermore, competition within the altcoin space itself is fiercer than ever. With thousands of altcoins and a myriad of blockchain projects continuously launching, the fight for relevance and survival is real. Newer and technically superior projects are popping up, which dilutes investor attention and capital that was previously more concentrated.

A Shift in Strategy

Instead of chasing speculative gains in lesser-known altcoins, many seasoned investors are now reverting to Bitcoin or exploring emerging areas within the crypto space that offer more stability and potential regulatory clarity. This includes sectors like blockchain infrastructure and enterprise blockchain solutions, which may not provide the meteoric returns of a typical altcoin season but offer a grounding in real-world utility.

Conclusion

While hope is a staple in the diet of many crypto enthusiasts, this year’s market conditions have prompted a reassessment of what “Altcoin Season” could look like moving forward. As the crypto landscape continues to mature and evolve, perhaps the feverish peaks of altcoin markets will become less pronounced, replaced instead by steadier, more sustainable growth trends that reflect broader technological adoption and integration.

As the year progresses, it remains crucial for investors to stay informed and agile, recognizing that in the world of cryptocurrencies, change is the only constant. The days of easy gains through altcoins seem subdued for now, suggesting that a more cautious and strategic approach may define the months ahead.