Humans vs AI: Insights from SimpleSwap’s 5-Week Portfolio Battle

In an intriguing experiment that pitted human strategic thinking against the rapid calculation capabilities of artificial intelligence, SimpleSwap, a cryptocurrency exchange platform, conducted a 5-week portfolio battle to assess whether humans or AI could more effectively manage cryptocurrency investments. This event not only sparked the interest of tech enthusiasts and traders but also provided substantial insights into the strengths and limitations of both entities in asset management. Here’s a deep dive into this financial duel.

The Setup

SimpleSwap designed the contest with a simple yet robust format. They selected five human traders, each noted for their prowess and experience in the cryptocurrency domain, and pitched them against an AI-driven trading algorithm developed by leading data scientists. Each participant, human and AI, was given an identical starting budget and allowed to trade across various cryptocurrencies available on the SimpleSwap platform.

The metrics for winning were straightforward—maximum portfolio value at the end of the five weeks. During the competition, all trades and strategies were monitored, and the performance of participants was updated in real-time on a dedicated leaderboard on the SimpleSwap site.

Strategies Employed

The human traders brought diverse strategies to the table. Some opted for a conservative approach, prioritizing stability in the highly volatile crypto market, while others took aggressive stances, aiming to capitalize on short-term price fluctuations. On the other hand, the AI algorithm utilized a combination of historical data analysis, predictive analytics, and probabilistic reasoning to make trades, adapting its strategies based on real-time market conditions.

Weekly Progress and Results

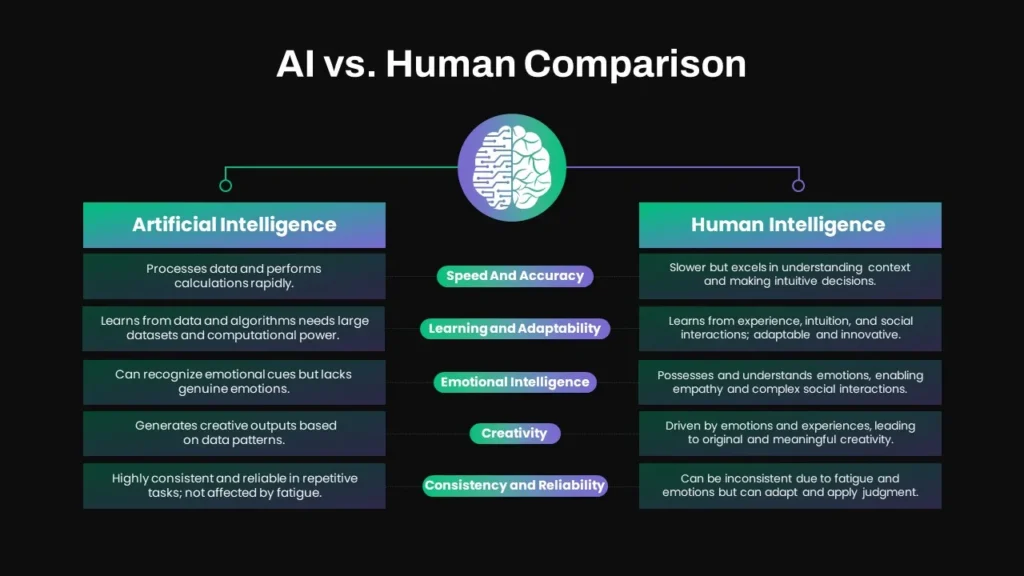

Each week, spectators could see shifts in the leaderboard as some strategies proved to be more effective than others. The AI’s strategy showcased its ability to quickly adjust to market dynamics, often securing profitable trades during short windows of market volatility that many human traders missed.

Human traders, however, demonstrated significant strengths in their intuitive understanding of market sentiment, something the AI, despite its vast data processing capability, struggled to emulate. This intuitive edge allowed human participants to make several unexpected comebacks despite the AI’s calculated approach.

In the final week, the contest came to a nail-biting close. The AI had a slight lead by leveraging fast, data-driven decisions. However, an unexpected market shift happened, influenced by a major geopolitical event, which the human traders quickly interpreted as a bearish signal. Their decision to pull out of riskier positions proved advantageous, something the AI’s algorithm did not predict swiftly enough.

Final Observations and Takeaways

At the conclusion of the 5-week portfolio battle, human traders outperformed the AI, albeit by a narrow margin. This outcome brought several insights:

-

Adaptability: Humans showed a superior ability to adapt to sudden, unforeseen geopolitical or economic news compared to AI.

-

Risk Management: Human experience in risk management under uncertain conditions was evident, as they could more effectively gauge and respond to market sentiment.

-

AI Limitations: The event highlighted current limitations in AI, particularly in processing nuanced and qualitative information that significantly affects the markets.

-

Complementary Strengths: The battle underscored areas where AI and human traders could complement each other. Combining AI’s processing power with human strategic depth and sentiment analysis could enhance decision-making in trading.

- Future Implications: This experiment has broader implications for financial technologies and the integration of artificial intelligence in managing financial portfolios.

Conclusion

SimpleSwap’s 5-week competition was a microcosm of the larger debate surrounding AI’s role in decision-making industries. The close results from this experiment suggest that while AI can significantly enhance operational efficiencies, human insight remains invaluable, particularly in scenarios requiring a deeper understanding of contextual subtleties. The future likely lies not in choosing between AI or human but in leveraging both to maximize strengths and hedge against their respective weaknesses.