The ADP employment numbers, set to be released tonight, play a crucial role in assessing the health of the job market amid the absence of this week’s non-farm payroll report. As we approach the Federal Reserve’s interest rate meeting next week, these figures may provide invaluable job market insights that could impact monetary policy decisions. With the market currently facing volatility, investors are closely monitoring the ADP data for potential signals regarding employment trends and overall economic stability. This release will be particularly vital in the absence of significant employment data traditionally examined by economists. Thus, the ADP employment numbers could become a lifeline for understanding the current state of the labor market and its influence on future rate adjustments.

In the realm of economic indicators, the upcoming figures from ADP are critical for gauging workforce dynamics. Known informally as the ‘little non-farm’ report, these employment statistics may offer alternative insights into labor trends, especially in the context of an impending interest rate meeting by the Federal Reserve. Investors are keen to analyze this data as it could help clarify the landscape of job opportunities, which remain pivotal in times of market fluctuations. Without the usual summary of employment trends provided by the non-farm payroll report, today’s ADP results may serve as an essential guide for speculating future economic conditions. The spotlight on employment figures emphasizes the significance of this announcement in shaping outlooks for both jobs and inflation.

Understanding the Significance of ADP Employment Numbers

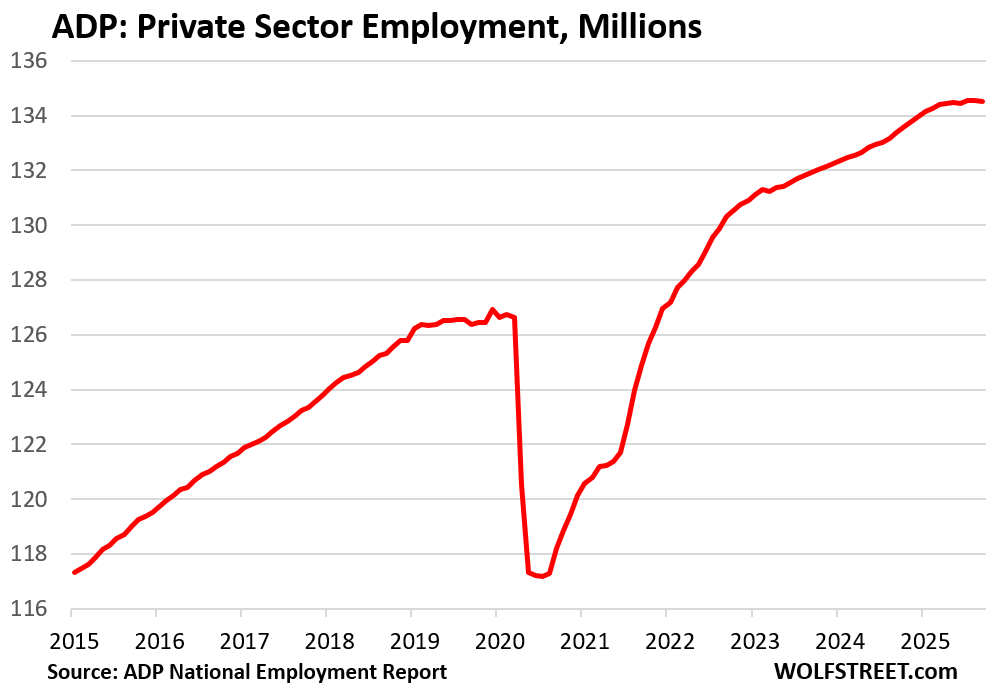

The ADP employment numbers serve as a critical indicator of the American job market, providing insights into how many jobs are being added or lost in a given month. Unlike the official non-farm payroll report, which is more comprehensive, the ADP report focuses primarily on private sector employment, making it a valuable tool for assessing real-time economic conditions. Investors and analysts often look to these numbers as a leading indicator of the direction in which the labor market is heading, especially in periods where official data is sparse.

This month’s ADP employment numbers, set to be released on November 30, 2023, carry added weight due to the lack of the non-farm payroll report this week. As the Federal Reserve prepares for its upcoming interest rate meeting, market participants will scrutinize the ADP data for clues about employment trends and potential shifts in monetary policy. An unexpectedly strong report could bolster predictions for continued economic growth, while weaker numbers might heighten concerns about the health of the job market and lead to increased volatility in markets.

Frequently Asked Questions

What are ADP employment numbers and why are they important?

ADP employment numbers represent an estimate of private sector job growth in the U.S., derived from payroll data. They are crucial as they provide insights into the job market between the official non-farm payroll reports. Investors and economists use these numbers to predict trends in employment and assess potential impacts on interest rates.

How do ADP employment numbers relate to the non-farm payroll report?

ADP employment numbers serve as a precursor to the non-farm payroll report, offering an early glimpse into job market trends. While the non-farm payroll report encompasses all employment sectors, ADP focuses on private sector payrolls, making it an essential indicator leading up to the official data release.

What impact might ADP employment numbers have on interest rate meetings?

ADP employment numbers can significantly influence interest rate meetings held by the Federal Reserve. For example, strong job growth reflected in these numbers may lead the Fed to consider raising interest rates, while weaker growth could result in a more cautious approach. Investors closely analyze these figures to gauge future monetary policy decisions.

Why is the release of ADP employment numbers significant during periods of market volatility?

The ADP employment numbers are particularly significant during market volatility because they provide timely data on economic health when other key reports, such as the non-farm payroll, are absent. This can lead to drastic market reactions as traders adjust their positions based on the latest job market insights reflected in the ADP report.

When are the ADP employment numbers released and how can they be accessed?

ADP employment numbers are typically released on the first Wednesday of each month at 21:15 GMT. They can be accessed through various financial news platforms, ADP’s own website, or economic calendars, providing investors with crucial employment data just prior to upcoming market events.

What can the job market insights from ADP employment numbers tell us about the economy?

Job market insights derived from ADP employment numbers can indicate overall economic conditions. For instance, an increase in jobs typically suggests economic growth, while a decline might indicate contraction. These insights help analysts make informed predictions about future economic performance and consumer spending.

How do analysts interpret unexpected ADP employment numbers?

Unexpected ADP employment numbers, whether significantly above or below forecasts, prompt analysts to reassess economic conditions and trends. Such discrepancies can indicate shifts in hiring practices or business investment strategies and can lead to revisions in predictions regarding the non-farm payroll report and wider economic policies.

| Key Point | Explanation |

|---|---|

| No Non-Farm Payroll Report | The non-farm payroll report is not being released this week. |

| ADP Employment Numbers Release | The ADP employment numbers for November are set to be released tonight at 21:15. |

| Significance for Federal Reserve | With the Fed’s upcoming interest rate meeting, the absence of traditional data means ADP numbers could play a crucial role. |

| Market Volatility | Expect notable market fluctuations following the release of the ADP numbers. |

| Investor Caution | Investors should remain vigilant of market risks tied to employment announcements. |

Summary

The ADP employment numbers are a pivotal indicator for economic health, especially in the context of the current absence of the non-farm payroll report. As we anticipate the release tonight, these numbers may provide the Federal Reserve with essential insights into the labor market ahead of their interest rate meeting. This timing underscores the importance of the ADP employment numbers in guiding both financial markets and monetary policy.