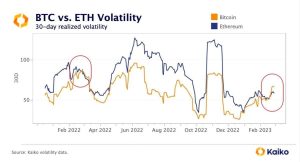

Abnormal volatility in BTC and ETH has become a hot topic among crypto enthusiasts and investors, particularly as the market navigates unpredictable price fluctuations. Recent market data reveals that both BTC and ETH have been experiencing significant swings, with single-minute amplitudes exceeding 3% during peak trading hours. This heightened level of BTC price fluctuations and ETH price volatility raises questions about the underlying factors driving these erratic movements. Analysts suggest that the abnormal volatility could be linked to the trading strategies employed by market makers and the impact of high-frequency trading on price stability. In this rapidly evolving landscape, conducting thorough crypto market analysis is essential for understanding the dynamics at play.

The recent patterns observed in the price dynamics of BTC and ETH highlight an unprecedented level of instability that merits attention. Terms like extreme price swings and erratic trading behaviors characterize the current landscape, as market participants grapple with unusual trends. Notably, such fluctuations not only affect short-term trading strategies but also pose challenges for investors looking for stability. The interplay of different trading strategies, including those of market makers, seems to exacerbate these price movements. As the cryptocurrency space continues to mature, the importance of in-depth market analysis and comprehension of liquidity influences becomes increasingly crucial.

| Key Point | Details |

|---|---|

| Observation Time Frame | Between 00:05 and 00:17 UTC |

| Single-Minute Amplitudes | Multiple instances exceeding 1%, reaching up to 3% |

| Potential Cause | Malfunctions in market makers’ grid trading strategies. |

| Market Impact | High-frequency, continuous short-term fluctuations in BTC and ETH prices. |

| Liquidity Condition | Price volatility occurred during periods of relatively concentrated liquidity. |

Summary

Abnormal volatility in BTC and ETH has been notably evident, particularly between the hours of 00:05 and 00:17 UTC, where significant price fluctuations were observed. The data indicates that there were multiple instances where single-minute amplitudes exceeded 1%, with peaks reaching as much as 3%. This high volatility has been attributed to potential malfunctions in market makers’ trading strategies, specifically grid trading systems, which can exacerbate price changes during concentrated liquidity periods. Understanding these dynamics is crucial for market participants and can guide trading strategies to mitigate risks associated with such abnormal volatility.

Understanding Abnormal Volatility in BTC and ETH

Abnormal volatility in BTC and ETH has become a prominent concern among investors, especially with recent data indicating significant price swings. Reports indicate that between 00:05 and 00:17, single-minute amplitudes of BTC and ETH surged beyond 3% on several occasions. These sudden shifts are not merely random occurrences; rather, they highlight the inherent instability in the cryptocurrency market. Understanding these fluctuations can provide crucial insights into trading strategies and risk management for investors.

This abnormal volatility can be attributed to various factors, including market dynamics and participant behaviors. Market makers, responsible for facilitating liquidity, can sometimes experience errors in their grid trading strategies. As a result, these missteps magnify the price movements of BTC and ETH, increasing the risks associated with high-frequency trading. This has led to a growing demand for sophisticated crypto market analysis to navigate these tumultuous conditions effectively.

The Impact of BTC Price Fluctuations on Investment Strategies

BTC price fluctuations can significantly affect trading strategies and investment decisions in the crypto space. For traders, understanding the potential for rapid changes in price is imperative. Recent spikes have demonstrated that even a minute can yield drastic alterations in value, and these quick shifts present both opportunities and dangers. Investors must adapt their strategies to account for this volatility, employing techniques that respond swiftly to market changes.

High-frequency trading strategies are often employed by market makers to mitigate risks and capitalize on these rapid movements. However, these strategies can unintentionally intensify price volatility, leading to abnormal fluctuations. Consequently, traders need to constantly monitor market signals and prepare for unexpected changes in BTC prices that could impact their investment portfolios.

Analyzing ETH Price Volatility: Causes and Effects

ETH price volatility is another focal point of concern for traders and market analysts alike. Recent observations suggest that, similar to BTC, the price of ETH has exhibited abnormal swings, particularly during specific trading windows. These fluctuations not only affect individual traders but also influence overall market sentiment, leading to heightened uncertainty. Understanding the causes behind these movements is essential for effective market navigation.

One crucial element contributing to ETH’s volatility is the liquidity position within the market. When liquidity becomes concentrated, price movements can escalate quickly, amplifying fluctuations. Additionally, market makers’ strategies can play a significant role in how ETH is traded; if these strategies malfunction, the resulting impacts can lead to excessive volatility. Thus, an in-depth analysis of both price dynamics and trading strategies is vital for investors engaged in the ETH market.

Market Makers and Their Role in Crypto Volatility

Market makers have a significant influence on the overall volatility observed in the cryptocurrency markets. Their role involves providing liquidity and facilitating trades, which is vital for the smooth functioning of crypto exchanges. However, during periods of abnormal volatility, the effectiveness of market makers’ strategies comes into question. When their grid trading methods fail, we often witness amplified price swings in BTC and ETH.

The presence of market manipulation tactics and rapid, high-frequency trading practices can further complicate the effects of market makers on cryptocurrency volatility. These factors can lead to price distortions, resulting in unpredictable market behavior. Understanding how market makers operate and the potential implications of their trading strategies is crucial for investors looking to make informed decisions in the ever-volatile crypto landscape.

High-Frequency Trading: The Double-Edged Sword of Crypto Markets

High-frequency trading (HFT) is lauded for its potential to increase liquidity in the crypto markets, but it also contributes to the abnormal volatility of BTC and ETH prices. HFT strategies utilize advanced algorithms to execute a large number of orders at incredibly fast speeds. While this can lead to more efficient markets, it also means that small fluctuations can be amplified, resulting in dramatic price movements that can catch traders off guard.

The relationship between HFT and market volatility is complex; although HFT firms aim to capture small profits on the spread, unexpected market conditions can lead them to exacerbate the very volatility they seek to reduce. As a result, market participants must employ robust analytical tools to understand price trends and may need to adjust their strategies on the fly, especially during times of abnormal market movements.

The Necessity of Crypto Market Analysis

In today’s fast-paced cryptocurrency landscape, effective market analysis has never been more crucial. With the continuous fluctuations in BTC and ETH prices, traders and investors need to employ detailed crypto market analysis to inform their decisions. This includes studying past price movements, investor sentiment, and trading volumes to predict potential future trends.

Furthermore, utilizing advanced analytical tools can significantly enhance the ability to navigate these volatile markets. By understanding indicators of abnormal volatility and the behaviors of market participants, traders can better position themselves to react to sudden price changes in BTC and ETH. Implementing thorough market analysis is essential for anyone looking to thrive in today’s cryptocurrency ecosystem.

Risk Management in the Face of Price Volatility

Risk management is a critical component in navigating the choppy waters of cryptocurrency trading. With abnormal volatility in BTC and ETH becoming more pronounced, traders must develop comprehensive strategies that account for rapid price changes. This involves setting appropriate stop-loss levels, diversifying portfolios, and remaining vigilant about market signals that could indicate shifts in price movement.

By applying effective risk management techniques, traders can shield themselves from the adverse effects of sudden fluctuations. Additionally, education on how to interpret market data and apply lessons from recent volatility trends can empower traders to make informed decisions. Ultimately, a robust risk management strategy can be the difference between a profitable trading experience and significant losses in the crypto market.

Forecasting Future Trends in BTC and ETH Markets

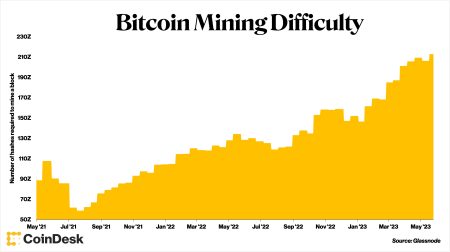

Forecasting future trends in BTC and ETH markets requires a thorough understanding of current price fluctuations and underlying market forces. Given the recent abnormal volatility, analysts are tasked with predicting how these sudden swings will influence long-term prices. Utilizing historical data and advanced algorithms, analysts can create models that potentially forecast price movements, allowing investors to adjust their strategies accordingly.

Additionally, as the cryptocurrency market continues to evolve, external factors such as regulatory changes, technological advancements, and shifts in investor sentiment will play significant roles in shaping future trends. Therefore, staying attuned to developments and engaging in proactive market analysis will be imperative for anyone looking to succeed in trading BTC and ETH.

Leveraging Trading Strategies Against Market Fluctuations

In the face of abnormal volatility in BTC and ETH, traders are increasingly seeking effective trading strategies that can mitigate risks and exploit potential opportunities. Techniques such as swing trading, day trading, and scalping are popular among those looking to capitalize on short-term price movements. Each of these approaches must be tailored to account for the unique fluctuations characteristic of the cryptocurrency market, which can dramatically shift within moments.

Traders can also leverage technology, employing automated trading bots to execute transactions in real-time based on predefined parameters. This can help ensure they remain competitive in a market where price changes are swift and often substantial. Ultimately, refining trading strategies in response to market conditions and price volatility is key to achieving sustainable success in the dynamic world of cryptocurrency.

Frequently Asked Questions

What causes abnormal volatility in BTC and ETH spot prices?

Abnormal volatility in BTC and ETH spot prices is often triggered by abrupt changes in market conditions, which can be influenced by factors such as market makers’ trading strategies, high-frequency trading, sudden liquidity shifts, and speculative trading patterns. These elements create an environment where price fluctuations can exceed 3% in a single minute.

How do BTC price fluctuations impact the overall crypto market?

BTC price fluctuations significantly affect the overall crypto market due to Bitcoin‘s status as the leading cryptocurrency. Abnormal volatility in BTC often leads to increased trading activity and price adjustments in altcoins like ETH, as investors react to rapid changes in market sentiment and liquidity.

What role do market makers play in BTC and ETH price volatility?

Market makers play a crucial role in BTC and ETH price volatility as they provide liquidity and stabilize prices through their trading strategies. However, malfunctions or aggressive strategies can lead to abnormal volatility, as seen recently with sharp price fluctuations during concentrated liquidity periods. This can exacerbate normal price movements.

What is the significance of high-frequency trading in relation to ETH price volatility?

High-frequency trading significantly impacts ETH price volatility by executing numerous trades in milliseconds. This trading strategy can increase the occurrence of abnormal volatility in ETH, especially during times of market stress or when specific pricing levels are approached, leading to swift price reactions.

How can crypto market analysis help investors manage abnormal volatility in BTC and ETH?

Crypto market analysis aids investors in understanding market trends and the potential for abnormal volatility in BTC and ETH. By analyzing price movements, trading volumes, and market sentiment, investors can better position themselves to respond to price fluctuations, mitigating risks associated with high volatility periods.

What indicators can predict abnormal volatility in BTC and ETH?

Indicators that can help predict abnormal volatility in BTC and ETH include trading volume spikes, order book imbalance, volatility indicators, and price action patterns. Monitoring these indicators allows traders to anticipate potential rapid price changes and adjust their strategies accordingly.

What strategies can retailers use to navigate abnormal volatility in BTC and ETH?

Retail traders can navigate abnormal volatility in BTC and ETH by employing strategies such as setting stop-loss orders, using limit orders to avoid slippage, and diversifying their portfolio to protect against drastic price swings. Staying informed through technical analysis can also aid in making timely trading decisions.