The recent AAVE whale purchase has sent ripples through the crypto trading community, as a notable investor acquired 60,000 AAVE tokens for a staggering 10.68 million USD via Galaxy Digital OTC just 9 hours ago. This strategic move highlights the significance of whale activity in influencing the AAVE price, as larger trades often sway market sentiment. Surveillance by Lookonchain reveals that this particular whale, known as 0x7915, has amassed an impressive total of 338,000 AAVE since October 13, culminating in an aggregate investment of 59.93 million USD. Despite a current unrealized loss of 13.8 million USD, the purchase indicates a bullish outlook on AAVE’s potential growth amidst fluctuating market conditions. As crypto investors keep a close eye on such large transactions, the implications for AAVE investment strategies are becoming increasingly relevant in today’s volatile market.

In the evolving landscape of cryptocurrency, an eminent acquisition of AAVE tokens has captured considerable attention, particularly by high-net-worth investors. This significant transaction involved acquiring a substantial amount of AAVE through Galaxy Digital’s OTC services, which highlights the increasing interest from institutional players. The latest whale activity underscores the dynamic nature of crypto investments, especially for tokens like AAVE that can experience rapid price shifts. As this market continues to mature, analyzing such large-scale purchases will offer insights into future pricing trends and investment strategies in the digital asset realm. Ultimately, this AAVE acquisition not only signifies investor confidence but also illustrates the continual interplay between large transactions and market fluctuations.

Significant Whale Purchase of AAVE

In a remarkable move within the cryptocurrency space, a notable whale has made headlines by purchasing 60,000 AAVE tokens through Galaxy Digital OTC. This mammoth transaction, valuing approximately 10.68 million USD, highlights the significant whale activity surrounding the AAVE market. As crypto enthusiasts closely monitor such purchases, it raises questions about the potential impact on AAVE’s price in the near future. Whale purchases can often lead to higher volatility and price movements as larger holders strategically accumulate or offload their assets.

The purchase made by whale 0x7915 is particularly significant given that this is not their first large acquisition of AAVE. Since October 13, this entity has amassed a staggering 338,000 AAVE, investing nearly 59.93 million USD overall. However, despite these substantial investments, the whale is currently facing an unrealized loss of 13.8 million USD, indicating the complexities involved in timing the market when making large-scale investments in cryptocurrency.

The Role of Galaxy Digital OTC in AAVE Transactions

Galaxy Digital OTC plays a crucial role in facilitating large transactions for institutional investors and whales in the crypto market. By providing a platform that mitigates slippage and enhances liquidity, Galaxy Digital enables significant players to execute large trades without significantly impacting the market price of their assets. This is particularly important in a volatile market where large purchases can lead to drastic price fluctuations, making it essential for whales to utilize a trusted and efficient service for their transactions.

Such services become vital as the demand for AAVE continues to grow. Whales often turn to OTC desks like Galaxy Digital to maintain discretion and minimize market disruption. This platform not only allows for seamless transactions but also attracts further investment into AAVE and similarly performing assets. As the market evolves, the role of OTC services expands, indicating a greater reliance on professional trading venues by significant market participants.

Implications of Whale Activity on AAVE Price Trends

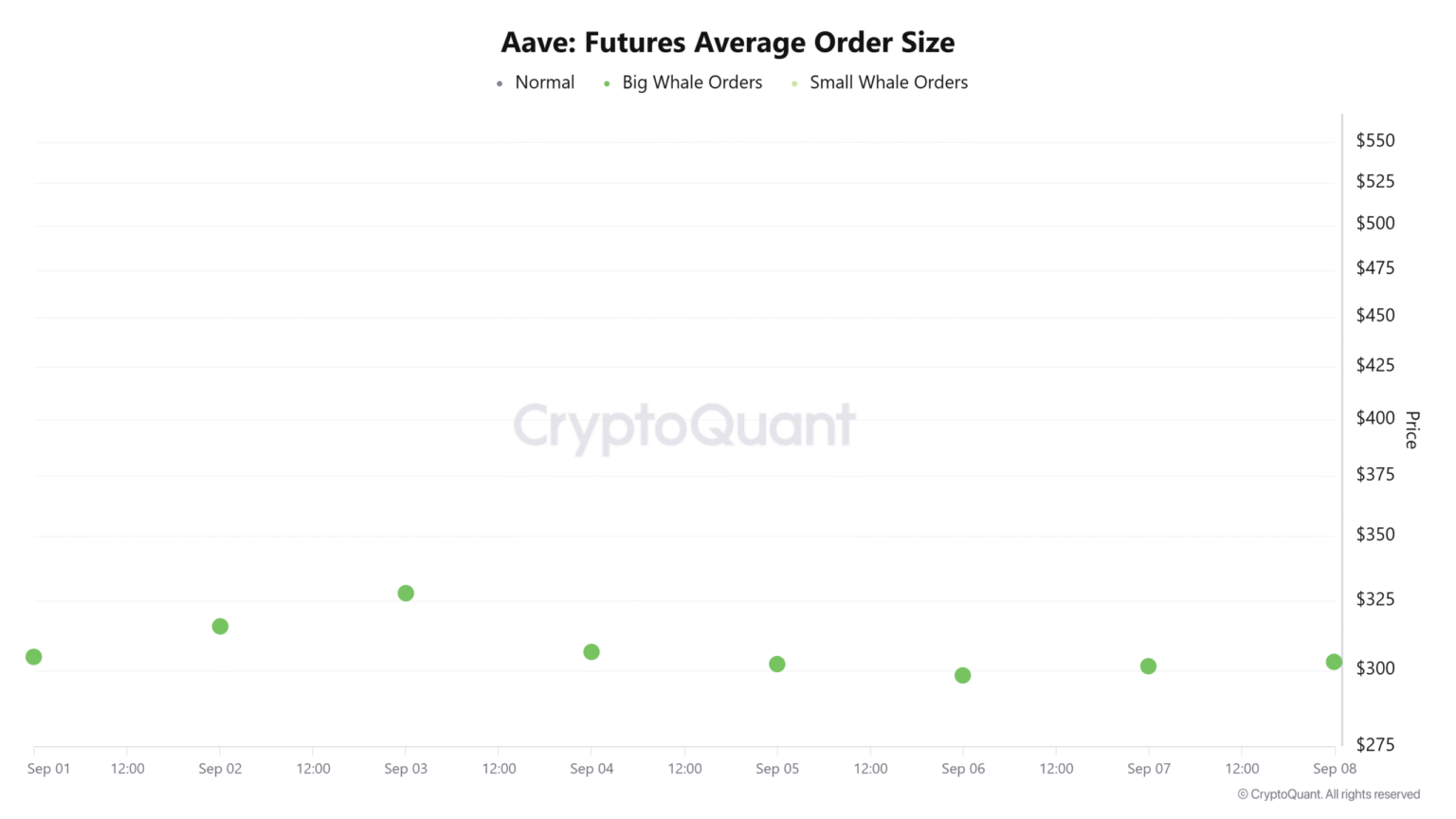

Whale activity, such as the sizable purchase of AAVE by 0x7915, can significantly influence the price trends of the asset. Large holders can dictate market sentiment, making it essential for other investors to keep a keen eye on such transactions. When a whale invests heavily in a particular asset like AAVE, it may signal confidence in the asset’s future performance, potentially drawing more retail investors into the fray. Conversely, an aggressive sell-off by a whale can trigger negative sentiment and downward pressure on the asset’s price.

Moreover, with additional purchases being made at an average price of around 218 USD, retail traders are left wondering how these swings in whale activity might affect their investment strategies. The importance of tracking whale purchases extends beyond immediate price reactions, as it provides deeper insights into the overall market dynamics and investor sentiment surrounding AAVE. This complex interplay can lead to emerging trends that inform both short-term strategies and long-term investment decisions.

AAVE Investment: Strategies for Retail Traders

For retail traders looking to navigate the waters of investing in AAVE, understanding the movements of whales can offer valuable insights. Observing how large purchases influence AAVE’s price can help smaller investors refine their strategies. Utilizing tools that track whale transactions, like the data provided by Lookonchain, can give traders an edge by alerting them to significant market movements that could impact their positions or entry points in the market.

Moreover, diversifying AAVE investments with additional assets in the ecosystem can reduce risks associated with volatility. Traders should consider applying strategies that include dollar-cost averaging or setting stop-loss orders to manage their exposure effectively. By remaining aware of whale activities and market sentiments, retail investors can build a more informed approach to AAVE trading, adapting their tactics to align with the broader trends influenced by these significant players.

Understanding Cryptocurrency Trading Dynamics with AAVE

The dynamics of cryptocurrency trading are intricate and can be influenced heavily by significant transactions, such as those made by whales in the AAVE market. Traders must grasp how factors like whale purchases, overall market sentiment, and economic indicators can impact the trading landscape. The acquisition of large amounts of AAVE can affect not just the asset’s price but also the perception of its market stability, attracting a wave of interest from curious investors.

Furthermore, the knowledge of trading dynamics often leads to more robust trading strategies. Competitors in the cryptocurrency arena utilize various data analytics tools to stay ahead of market trends, particularly those influenced by wallet activity among prominent traders. Understanding how whale purchases correlate with price points and trading volume can empower traders to make more strategic decisions when investing in AAVE or engaging in broader crypto trading.

Market Reactions to AAVE Whale Transactions

Market reactions to significant whale transactions are often immediate and can lead to substantial price adjustments. When a well-known whale draws attention with large purchases of AAVE, the market typically experiences a flurry of buying activity as traders react to the news. This buying momentum can drive the price upward, as perceived confidence from larger players often encourages retail investors to follow suit.

However, it is essential for traders to remain cautious about the potential for manipulation. While whale activities can inspire bullish sentiments in the market, they can also lead to dramatic price swings that may leave uninformed investors vulnerable to losses. AAVE traders would do well to analyze these transactions in the context of broader market trends and not simply react impulsively to whale activity to develop a more comprehensive understanding of market movements.

Tracking AAVE Price Movements Post-Whale Purchases

After a whale like 0x7915 makes significant purchases of AAVE, traders should actively track subsequent price movements and trading activity. Utilizing price tracking tools and charting software can provide valuable insights into how the market reacts in the wake of these transactions. This analysis can help identify patterns that may indicate future price behaviors, giving traders better-informed entry and exit points.

Additionally, monitoring market volume during these periods can offer clues about the genuine strength of the price movements. High volume accompanying a spike typically signals strong interest, while low volume may indicate a lack of sustainability in the price increase. Using this data, traders can devise responsive strategies that align with ongoing market conditions following whale activity and additional buying pressure.

The Future of AAVE in the Cryptocurrency Market

The future of AAVE appears promising as it continues to be supported by significant whale activity and growing interest from retail traders. Each whale purchase, especially the substantial transactions brokered through firms like Galaxy Digital OTC, raises AAVE’s profile in the cryptocurrency ecosystem. With institutional investment becoming more prevalent, AAVE’s role as a leading lending protocol positions it favorably among competing assets.

However, the future does come with uncertainties, particularly regarding market volatility and investor sentiment. As more traders enter the space and observe whale behavior, the reactions might lead to unpredictable price movements. Traders should remain vigilant, leverage market analysis tools, and adapt their strategies to navigate the ever-changing environment of crypto trading effectively, especially in relation to AAVE.

Frequently Asked Questions

What is the significance of the recent AAVE whale purchase by 0x7915?

The recent AAVE whale purchase by wallet 0x7915, which involved acquiring 60,000 AAVE through Galaxy Digital OTC for 10.68 million USD, highlights substantial whale activity in the crypto market. This acquisition reflects growing interest in AAVE as an investment, despite the whale currently facing an unrealized loss.

How does whale activity impact AAVE price?

Whale activity, such as the recent purchase of 60,000 AAVE, can significantly influence AAVE price. Large purchases may indicate bullish sentiment, potentially driving the price up, while significant sell-offs can have the opposite effect. Observing such transactions helps investors gauge market trends.

What role does Galaxy Digital OTC play in AAVE investments?

Galaxy Digital OTC facilitates large transactions like the recent whale purchase of 60,000 AAVE. This platform allows investors to buy and sell cryptocurrencies off-exchange, which helps maintain price stability by minimizing immediate market impact.

How much AAVE has the whale 0x7915 accumulated through Galaxy Digital OTC since October 13?

Since October 13, the whale 0x7915 has accumulated a total of 338,000 AAVE through Galaxy Digital OTC, amounting to a total investment of approximately 59.93 million USD.

What does the phrase ‘unrealized loss’ mean in relation to AAVE investments?

An unrealized loss refers to a decline in the market value of an investment that has not yet been sold. In the case of the recent AAVE whale purchase, despite acquiring AAVE at an average price of 218 USD, the current market conditions have resulted in an unrealized loss of 13.8 million USD.

How are whale purchases monitored in the crypto market?

Whale purchases in the crypto market are often monitored through on-chain analytics platforms like Lookonchain. Such monitoring tools track large transactions and wallet activities, providing insights into trading patterns and strategies employed by significant investors.

What are the potential risks of investing in AAVE given recent whale activity?

Investing in AAVE carries risks, especially in light of recent whale activities showcasing large-scale purchases and unrealized losses. Market volatility can impact prices, and while whale purchases may indicate confidence, they also highlight the risks associated with significant investments.

Can the recent increase in whale activity influence future AAVE price trends?

Yes, the recent increase in whale activity, including the significant purchases made through Galaxy Digital OTC, can influence future AAVE price trends. Large investors often have a substantial impact on market sentiment, potentially leading to price fluctuations based on their actions.

| Detail | Value |

|---|---|

| Whale Address | 0x7915 |

| Recent Purchase Amount | 60,000 AAVE |

| Total Value of Recent Purchase | 10.68 million USD |

| Total AAVE Accumulated since Oct 13 | 338,000 AAVE |

| Total Value of Accumulated AAVE | 59.93 million USD |

| Average Purchase Price | 218 USD |

| Unrealized Loss | 13.8 million USD |

Summary

The recent AAVE whale purchase highlights significant accumulation, with a notable transaction of 60,000 AAVE worth 10.68 million USD executed through Galaxy Digital OTC. This move has brought the whale’s total holdings to 338,000 AAVE, demonstrating a robust investment despite an unrealized loss of 13.8 million USD. Investors should closely monitor such large-scale acquisitions, as they can influence market trends and pricing dynamics for AAVE.