In recent weeks, AAVE whale accumulation has captured the attention of cryptocurrency enthusiasts and analysts alike. A prominent whale, operating under the address “thiswaysir.eth”, has demonstrated impressive investment behavior by consistently acquiring AAVE tokens, now holding nearly 25,000 of them valued at over 4.1 million dollars. Recent AAVE token news reveals this whale withdrew 4,868 AAVE from Binance, raising eyebrows among the community regarding this strategic accumulation. Consequently, this surge in whale activity reflects shifting dynamics in the AAVE price analysis as traders speculate on potential market trends. Observing such moves can be crucial for anyone crafting an AAVE investment strategy in this volatile market.

The phenomenon of significant holdings in the AAVE ecosystem, often referred to as whale accumulation, has recently become a hot topic among crypto investors. This notable activity from large-scale investors, like the address known as “thiswaysir.eth”, illustrates a growing interest in the AAVE platform, with thousands of tokens being strategically acquired. The withdrawal of AAVE from exchanges, particularly Binance, has raised questions about the implications for market liquidity and price stability. Analyzing these patterns of cryptocurrency whale activity can provide valuable insights for traders looking to navigate the emerging trends in the AAVE market. Such dynamics play a vital role in shaping effective investment strategies for those involved in the world of decentralized finance.

AAVE Whale Accumulation Trends

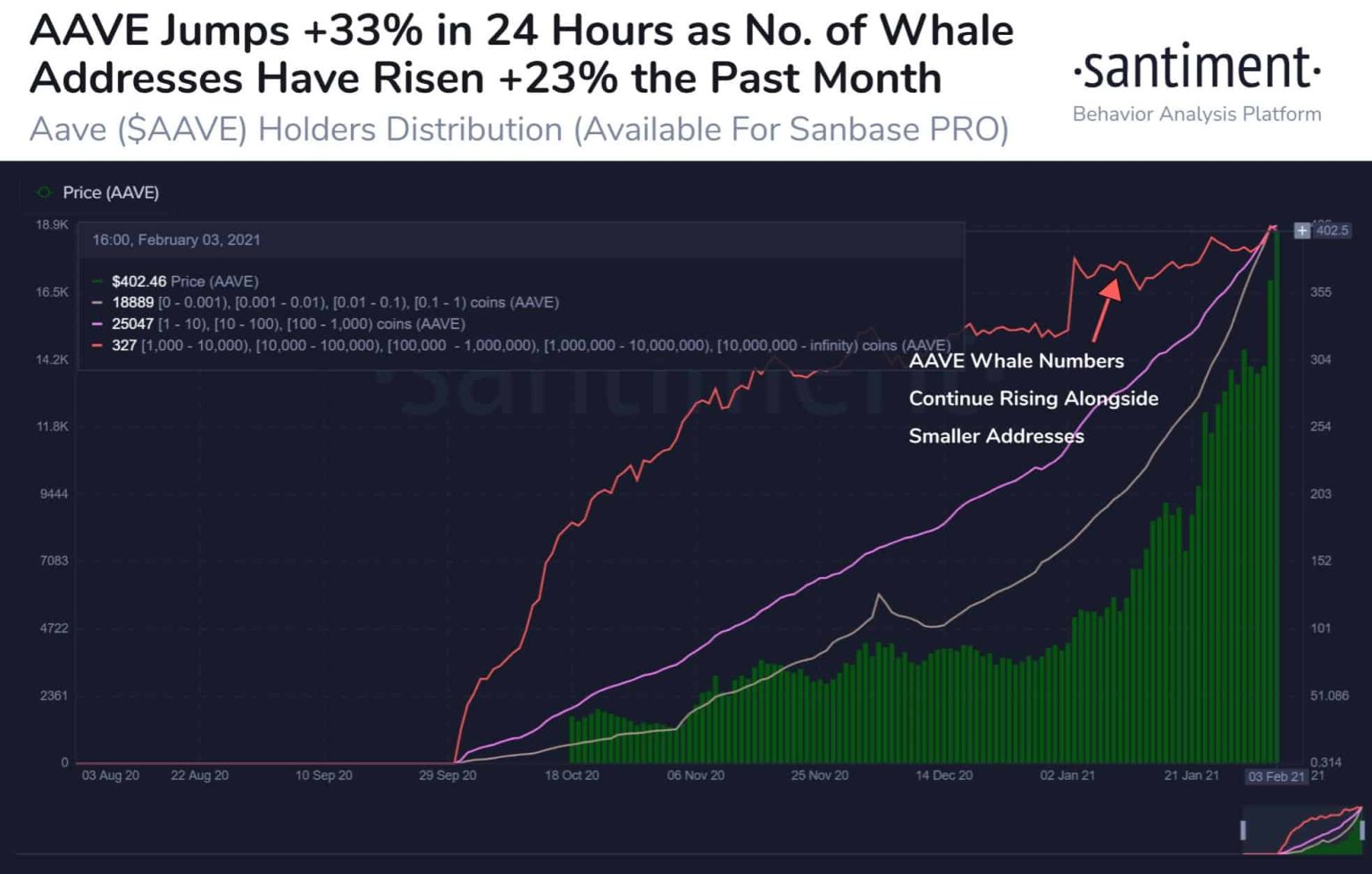

Recent data reveals significant activity surrounding the AAVE token, particularly from major holders known as whales. One noteworthy example is a whale identified as “thiswaysir.eth,” who has accumulated nearly 25,000 AAVE tokens, translating to a staggering valuation of over 4.1 million dollars. This accumulation indicates a robust confidence in the AAVE market, especially as cryptocurrency whale activity often foreshadows price movements and market trends.

Over the last month, the aforementioned whale withdrew approximately 4,868 AAVE from the Binance exchange, revealing a strategic approach to holding and potentially trading this asset. Significant withdrawals made by whales like this can often signal to smaller investors when to expect market fluctuations or price shifts, especially in a volatile cryptocurrency landscape.

Analyzing AAVE Price Movements

The accumulation of AAVE by major holders has sparked conversations regarding the future price movements of this digital asset. Historical data shows that when cryptocurrencies enjoy significant whale accumulation, it often presents a precursor to bullish price trends. Considering the substantial holding of nearly 25,000 AAVE by one address, the implication here is clear—the market could be poised for upward momentum.

Additionally, ongoing monitoring shows that as whales continue their accumulation strategies, analysts are keen on incorporating these insights into their AAVE price analysis. Investors typically keep a watchful eye on crypto whale activities, as they can provide critical information on when might be the right time to invest or re-evaluate their positions in such assets.

Cryptocurrency Whale Activity and Its Impact

Cryptocurrency whale activity plays a pivotal role in shaping market dynamics. The continuous gathering of AAVE tokens by significant wallets reflects a larger trend within the crypto ecosystem. When whales systematically accumulate assets, it could either signal a long-term investment strategy or prepare for a substantial price rally based on anticipated future demand. Such activities are analyzed in real-time as traders seek to leverage these insights.

Moreover, the transaction history associated with major wallets allows analysts to deduce potential price support and resistance levels for AAVE. Following this scrutiny can arm investors with the necessary knowledge to craft a structured investment strategy, capitalizing on the insights derived from whale transactions and overall market health.

The Role of Binance in AAVE Transactions

Transactions on leading exchanges like Binance often set the trend for AAVE’s market performance. The recent withdrawal of AAVE by whales from Binance showcases the exchange’s influence on liquidity and price volatility. As more significant volumes are withdrawn by major holders, it could potentially hinder the availability of tokens for smaller traders, subsequently driving prices higher.

In addition, Binance’s platform serves as a crucial hub for monitoring AAVE’s trading activity. Changes in trading volume, pooling of significant assets, and the general sentiment reflected in price movements here can offer insights into broader market trends. Investors should stay informed about Binance’s operational strategies concerning AAVE, including any updates on deposit and withdrawal policies that could affect the asset’s prices.

Crafting an Effective AAVE Investment Strategy

For investors looking to enter the AAVE market, understanding the intricacies of whale accumulation is vital. As larger entities assert their influence through significant purchases, smaller investors must develop an investment strategy that takes these trends into account. Diversifying one’s crypto portfolio with a keen eye on AAVE can mitigate risks while capitalizing on potential price surges driven by whale activity.

Moreover, a robust investment strategy should encompass continual education about market movements, including keeping tabs on recent cryptocurrency news, like updates concerning AAVE token and its performance metrics. Combining analytical tools with astute market observation will significantly enhance individual investment decisions and lead to a more calculated approach toward engaging with AAVE.

Keeping an Eye on AAVE Token News

Staying updated with the latest AAVE token news is essential for anyone invested in the crypto space. From regulatory developments to partnerships and project upgrades, the news can dramatically influence market perception and investor confidence. Whales actively accumulating AAVE often respond to the motivations structured in this news, which can help predict their subsequent trading behavior.

Journalists and analysts continuously report on instances of significant accumulation, such as the case of “thiswaysir.eth” and their vast holdings of AAVE. These stories not only keep the community informed but also help shape the market’s future narrative, influencing investor sentiment, and possibly triggering new waves of accumulation or distribution by both whales and smaller traders alike.

Understanding the Dynamics of AAVE Withdrawals

AAVE withdrawals from exchange platforms like Binance often signal significant strategic moves by whales in the cryptocurrency market. The act of withdrawing AAVE can indicate a temporary hold on investments as whales look to store their assets in safer venues or conduct large-scale transactions free from exchange limitations. This behavior can also create fluctuations in available liquidity, impacting price stability.

Additionally, such withdrawals may serve as a precursor to impending market movements, prompting retail investors to reconsider their positions. As the understanding of these dynamics grows within the cryptocurrency community, both whales and individual investors can better navigate their strategies relative to AAVE, ensuring they are aligned with the current trends dictated by major holder activities.

The Future of AAVE and Investment Potential

The growth potential for AAVE largely hinges on market trends, driven mainly by whale accumulation and strategic movements by significant investors. As the cryptocurrency market continually adapts to new developments, such as decentralized finance innovations and regulatory clarity, AAVE stands to benefit substantially from increased adoption. Observing whale activities could provide crucial insights into the asset’s viability as a long-term investment.

For those considering AAVE as part of their investment strategy, understanding the broader implications of recent market events—coupled with whale phenomenons—can enhance decision-making. Being proactive about trends can help investors not only in maximizing potential returns but also in fostering an awareness of when market corrections may require adjusting or consolidating positions.

Leveraging Market Sentiment for AAVE Investments

Market sentiment plays an essential role in determining the performance of cryptocurrencies like AAVE. The continuous accumulation of tokens by whales can create a ripple effect in investor confidence, often leading to increased buying pressure as sentiments turn bullish. By understanding these psychological factors at play, investors can better gauge when to enter or exit their positions.

Moreover, tools such as sentiment analysis and tracking whale activities can provide vital data points for crafting well-informed investment strategies. Engaging with communities and following reliable news sources allows investors to remain aligned with the prevailing mindset around AAVE, enabling them to capitalize on investment opportunities as sentiment shifts in response to market dynamics.

Frequently Asked Questions

What is the significance of AAVE whale accumulation in the crypto market?

AAVE whale accumulation indicates strong bullish sentiment, as large holders can influence market prices. The ongoing accumulation by a whale, particularly one holding nearly 25,000 AAVE tokens, suggests confidence in the future value of the AAVE token. This activity often attracts attention in cryptocurrency whale activity and can affect AAVE price analysis.

How does whale activity impact AAVE token prices?

Whale activity, such as the recent withdrawal of 4,868 AAVE from Binance, can lead to price fluctuations. Investors often monitor these accumulations closely, as they can indicate potential price increases or declines depending on the whales’ future actions. Recent whale accumulation activity may signify strong support for the AAVE price.

What investment strategy can be derived from observing AAVE whale accumulation?

Investors can consider adopting a strategy that capitalizes on AAVE whale accumulation patterns. By monitoring large transactions and holdings, such as the current 24,910 AAVE tokens held by a whale valued at over 4.1 million dollars, investors can gauge market sentiment and make informed decisions regarding their AAVE investments.

How does the withdrawal of AAVE from exchanges like Binance affect market sentiment?

The withdrawal of AAVE tokens from exchanges like Binance, particularly by whales, often signals a commitment to holding rather than selling, which can lead to increased market confidence. This behavior suggests that whales expect AAVE to appreciate, influencing both buyer sentiment and overall market trends.

What recent news is there regarding AAVE whale accumulation?

Recent reports indicate that a whale identified as

| Key Points |

|---|

| AAVE whale is accumulating tokens continuously |

| Current holdings of the whale: 24,910 AAVE |

| Value of holdings: approximately 4.11 million dollars |

| Recent activity: withdrew 4,868 AAVE from Binance |

| Whale address: thiswaysir.eth |

Summary

AAVE whale accumulation is significantly impacting the market, as one address, thiswaysir.eth, has been on a purchasing spree, lifting nearly 25,000 AAVE tokens valued at over 4.1 million dollars. This accumulation suggests that major investors have bullish sentiments regarding AAVE’s future, and it could potentially influence the overall market trend.