Bitcoin withdrawal is a significant event that can stir the pulse of the cryptocurrency market, especially when such actions involve large sums like the recent 630 bitcoins withdrawn from the Binance exchange. According to Binance news, this transaction, valued at around 44.31 million dollars, has heightened interest among traders and investors alike. As these Bitcoin market actions unfold, many are now pondering the implications for Bitcoin price predictions and trends. The shift in Bitcoin from exchanges to a blockchain address can signal various outcomes, potentially influencing market dynamics. With each Bitcoin withdrawal, new narratives develop around investment strategies and future price movements, making it a vital topic worth exploring.

The act of transferring Bitcoin from an exchange to a personal digital wallet, often referred to as Bitcoin exit or cashing out cryptocurrency, can have profound implications in the crypto landscape. Insights into this particular blockchain movement, involving a substantial withdrawal of 630 bitcoins worth millions, provoke interest and speculation in trading circles. Many market participants are keen to decipher the potential trajectory of these digital assets as they navigate the intricacies of the Bitcoin ecosystem. Understanding these movements can provide valuable clues regarding market liquidity and potential shifts in investor sentiment, which are key components in analyzing Bitcoin price trends. Analyzing such withdrawals helps illuminate broader market patterns, especially amidst evolving narratives shaped by recent Binance news.

| Key Point | Details |

|---|---|

| Withdrawal Amount | 630 bitcoins (approximately $44.31 million) |

| Blockchain Address | 17oiC…fQdZ |

| Exchange Involved | Binance |

| Market Reaction | Widespread attention and curiosity from investors |

| Future Speculations | Investors are analyzing potential future movements of the address |

Summary

Bitcoin withdrawal from exchanges has significant implications for market dynamics. A recent notable event involved a blockchain address withdrawing 630 bitcoins worth approximately $44.31 million from Binance. This action has sparked curiosity among investors regarding the potential future movements of the cryptocurrency associated with this address. Such withdrawals can influence market sentiment and trading strategies, making Bitcoin withdrawal a crucial topic for those involved in the cryptocurrency ecosystem.

Understanding Recent Bitcoin Withdrawals

Bitcoin withdrawals from prominent exchanges like Binance often create ripples across the cryptocurrency market. The recent withdrawal of 630 bitcoins, equivalent to 44.31 million dollars, from a new blockchain address has raised eyebrows among investors and analysts alike. This significant movement is not merely an arbitrary transaction; it reflects broader market actions and sentiments, where traders adjust their strategies based on perceived opportunities. Keeping a close watch on such withdrawals can provide insights into the Bitcoin price predictions and overall market dynamics.

As the popularity of Bitcoin continues to soar, each significant withdrawal is read as a signal of investor sentiment. Coinciding with Binance news, this particular blockchain address has not only attracted attention due to the sheer size of the withdrawal but also because investors are now keenly observing any further transactions made by this address. Understanding this behavior could help clarify the future movements within the market, potentially impacting Bitcoin price trends.

The Impacts of Large Withdrawals on Bitcoin Market Actions

Massive withdrawals from exchanges, such as the recent action from Binance, often imply a shift in market actions for Bitcoin. When a new blockchain address withdraws a large amount of Bitcoin, it typically indicates the holder’s intention to move assets to secure locations, possibly for long-term hold or sale. Such dynamics can influence how other market players perceive Bitcoin, impacting everything from market liquidity to sentiment and driving factors that affect Bitcoin price predictions.

Moreover, large withdrawals can sometimes lead to immediate volatility in the Bitcoin market. Traders often fear that the sudden extraction of significant amounts may precipitate larger sell-offs, causing prices to dip initially. Consequently, observing reactions to such withdrawals can aid investors in making strategic decisions, particularly if they align with recent Binance news about market trends or blockchain innovations that might influence Bitcoin’s value.

Analyzing Blockchain Address Movements

The movement of cryptocurrencies through various blockchain addresses provides important insights into market behavior. The recent withdrawal of 630 bitcoins to a newly created address has everyone speculating about the owner’s next move. Such activity can signify confidence in Bitcoin or awareness of upcoming market shifts, driving traders to analyze transaction patterns closely. This behavioral analysis is essential for predicting future transactions and understanding how they may affect Bitcoin’s market value.

Tracking a blockchain address’s movements can be a strategic tool for investors hoping to anticipate market trends. Each transaction gives an indication of investor sentiment, potentially revealing whether the owner is likely to hold or sell in the near future. As the address becomes more active, particularly following Binance news, it will be essential to monitor its activity and the subsequent market actions to gauge broader sentiments in the Bitcoin ecosystem.

Bitcoin Price Predictions in Light of Major Market Movements

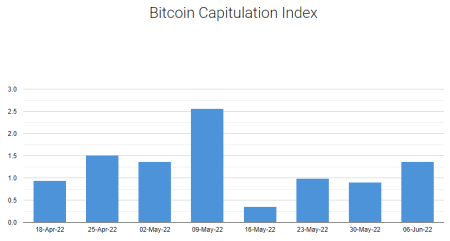

The volatility of Bitcoin makes price predictions a challenging yet fascinating endeavor, especially following substantial market movements such as the recent withdrawal from Binance. When significant amounts of Bitcoin are withdrawn, we often see fluctuations in price as traders recalibrate based on new information. Historical data indicates that such withdrawals can either spark optimism or fear in the market, leading to divergent price trajectories that analysts must navigate.

Incorporating insights from recent events—such as this notable withdrawal—into price prediction models is crucial for investors. Observing how the market reacts to these actions enables a nuanced understanding of potential bullish or bearish trends. As Bitcoin dynamics shift, aggregate analyses—factoring in major withdrawals and broader blockchain activities—will be vital in honing accuracy in future price predictions.

Following Developments in Binance News and Bitcoin Transactions

Staying updated with Binance news is essential for anyone involved in cryptocurrency trading or investment, particularly concerning Bitcoin. News regarding large transactions, policy shifts, or technological advancements can drastically affect market sentiment and trading strategies. The recent withdrawal from Binance has inevitably captured the attention of traders, urging them to reassess their positions and strategies based on the latest developments.

The frequency and scale of transactions coming from platforms like Binance have a direct correlation with market confidence and strategy adaptation among investors. Every piece of information coming from Binance contributes to an overall understanding of market dynamics, emphasizing the need for diligent observation of all related Bitcoin market actions. This knowledge not only aids in reacting to market conditions but also enhances the formulative processes behind investment decisions.

Securing Your Bitcoin: Best Practices After Withdrawals

With the increasing risks associated with cryptocurrency holdings, securing Bitcoin after significant withdrawals is imperative for investors. Following actions like the recent withdrawal from Binance, it’s crucial to take proactive measures in safeguarding digital assets. Best practices include utilizing secure wallets, enabling two-factor authentication, and constantly monitoring account activities to detect any unauthorized access.

Investors should also stay informed about any new security developments related to major exchanges like Binance. As episodes of domain breaches and phishing attacks become more prevalent, understanding the nuances of Bitcoin security can significantly mitigate risks. Keeping abreast of community discussions and crypto security audits can further enhance measures taken to secure holdings post-withdrawal.

Implications of Cryptocurrency Withdrawal Patterns

Studying cryptocurrency withdrawal patterns provides critical insights into market psychology and future trends. The withdrawal of 630 bitcoins from Binance not only represents a noteworthy financial transaction but also reflects the changing behavior among investors. Recognizing patterns of withdrawals can help traders formulate strategies that align with current market sentiments, particularly when anticipating potential pricing shifts in Bitcoin.

Such implications extend beyond individual accounts, affecting the broader community. When large amounts of Bitcoin are withdrawn, it often influences other traders’ confidence and can lead to a collective adjustment in market strategy. Understanding these withdrawal patterns can thus serve as an early warning system for larger shifts in the Bitcoin market, as investors navigate their positions more cautiously.

The Role of Investor Sentiment in Bitcoin Withdrawals

Investor sentiment plays a pivotal role in determining the trajectory of cryptocurrency markets, particularly evident in significant movements like the recent Binance withdrawal. When a notable sum is removed from an exchange, it can be construed as a sign of confidence in the long-term value of Bitcoin, suggesting that investors prefer to hold rather than allowing their assets to sit on exchanges vulnerable to risks.

On the other hand, such withdrawals can also evoke concerns among other investors, inciting a rush to speculate about potential market responses. Understanding the nuances of investor sentiment around these actions can inform both long-term and short-term trading strategies, enabling traders to position themselves strategically amidst volatility.

Conclusion: Navigating the Changing Landscape of Bitcoin

As the Bitcoin market continues to evolve, the implications of significant transactions like the recent withdrawal from Binance highlight the importance of awareness and adaptability in trading strategies. Staying attuned to market movements, investor sentiment, and news from major exchanges equips traders with the necessary tools to make informed decisions. The understanding of how withdrawals affect Bitcoin price predictions and market conditions becomes imperative for navigating this dynamic landscape.

In conclusion, the ongoing fluctuations within the Bitcoin ecosystem necessitate a vigilant approach to trading and investment. With knowledge gathered from withdrawal patterns and the broader market context, investors can enhance their strategies and potentially maximize their returns as they navigate the complexities of the Bitcoin market.

Frequently Asked Questions

What should I know about Bitcoin withdrawal from exchanges like Binance?

When withdrawing Bitcoin from exchanges such as Binance, it’s important to ensure that you have a valid blockchain address. This address will receive your Bitcoin, and any errors can lead to loss of funds. Be aware of withdrawal limits and fees imposed by the exchange.

How does a large Bitcoin withdrawal impact the market?

Large Bitcoin withdrawals, such as the recent withdrawal of 630 bitcoins from Binance worth about 44.31 million dollars, can create significant market actions. They often signal investor sentiment and can lead to price fluctuations in the Bitcoin market.

Why is the withdrawal of bitcoins from Binance significant?

The recent withdrawal of 630 bitcoins from Binance has drawn attention due to its size and the potential implications for Bitcoin price predictions. Such moves can indicate investor confidence or market instability, influencing future Bitcoin market dynamics.

What is the process for a Bitcoin withdrawal on Binance?

To withdraw Bitcoin on Binance, you need to navigate to your wallet, select Bitcoin, and initiate a withdrawal. You’ll need to enter the blockchain address where you want to send your bitcoins. Ensure you verify the address for accuracy to avoid any transaction errors.

How do Bitcoin price predictions relate to high-profile withdrawals?

High-profile withdrawals, like the recent one reported for a newly created blockchain address, often lead analysts to adjust their Bitcoin price predictions. Such actions can indicate shifting supply dynamics and investor sentiment, impacting overall Bitcoin market trends.

What are blockchain addresses and their significance in Bitcoin withdrawals?

A blockchain address is a unique identifier where Bitcoin can be sent or received. In the context of Bitcoin withdrawals, it’s crucial to ensure that the address is accurate. Incorrect addresses can result in permanent loss of funds, making their significance paramount in safe transaction practices.

Can frequent Bitcoin withdrawals from exchanges signify market trends?

Yes, frequent Bitcoin withdrawals, particularly significant ones, can signal underlying market trends. Investors often use these metrics, along with Bitcoin price predictions, to gauge market sentiment and make informed decisions.

What are the implications of a sudden large Bitcoin withdrawal from the market?

A sudden large Bitcoin withdrawal from a platform like Binance can lead to increased market volatility. It may create speculation regarding future Bitcoin price predictions and investor behavior, especially if the withdrawal is from an address holding substantial amounts of Bitcoin.