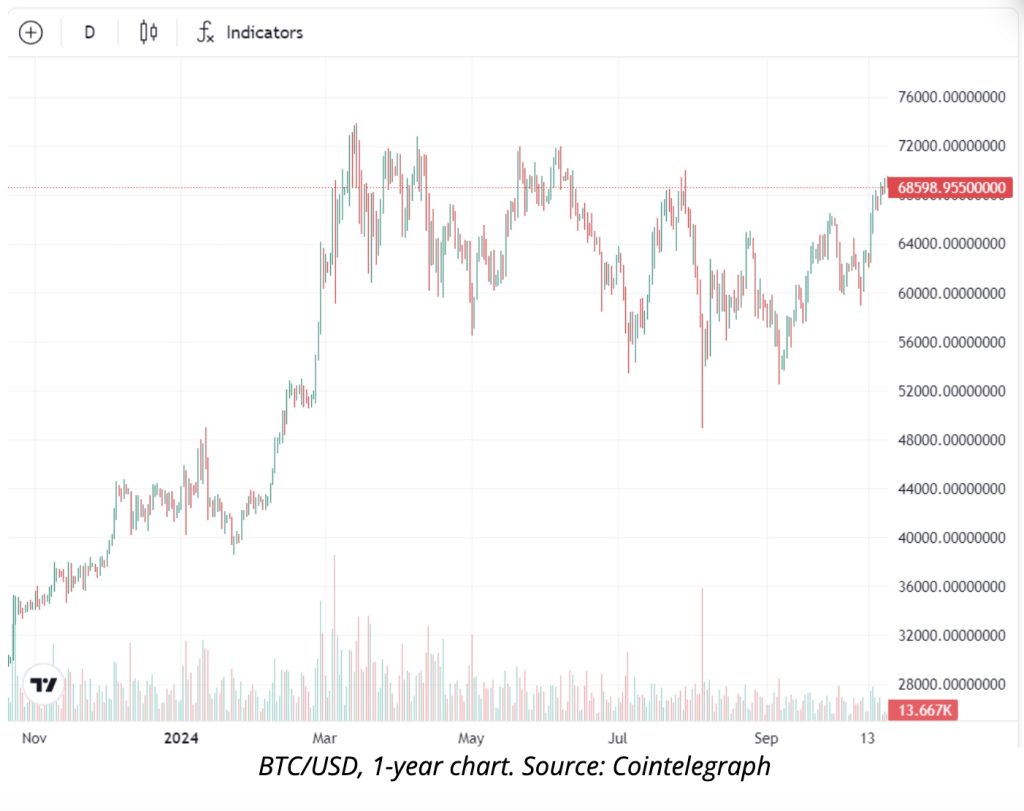

Bitcoin below $70K has captured the attention of both seasoned investors and newcomers alike, especially in light of the recent Bitcoin price analysis. As the leading cryptocurrency continues to navigate a bear market, opinions diverge on its future trajectory, reflecting a mix of uncertainty and opportunity among market participants. Bitwise CEO Hunter Horsley recently highlighted that for institutional investors, this drop represents a renewed chance to invest, contrasting sharply with the anxiety felt by long-time holders. Increased institutional interest in Bitcoin, paired with macroeconomic volatility, suggests that traders are keenly watching these Bitcoin market trends. Thus, as the cryptocurrency hovers under this key psychological barrier of $70,000, the narrative around its potential resurgence evolves with developments in regulatory clarity and market dynamism.

The current state of Bitcoin, trading below the pivotal threshold of $70,000, presents a unique scenario for both individual and institutional investors. With ongoing shifts in market sentiment, the cryptocurrency faces increasing scrutiny amidst a broader analysis of its price fluctuations. Industry leaders, such as Bitwise’s CEO, shed light on how this decline is intermingled with overall trends in macro assets, while acknowledging the rising institutional appetite for Bitcoin. The dynamic surrounding Bitcoin’s valuation signals a significant moment for analysts and investors alike to reconsider their strategies in light of recent market movements. As discussions about the potential recovery gain momentum, many are eyeing the insights from key industry figures regarding the trajectory of Bitcoin amidst these turbulent times.

| Key Point | Details |

|---|---|

| Current Market Situation | Bitcoin is trading below $70,000, reflecting a bear market trend. |

| Investor Sentiment | Long-time holders feel uncertain, while institutions see this decline as a new opportunity. |

| Institutional Inflows | Bitwise has experienced over $100 million in inflows recently, indicating strong institutional interest. |

| Market Correlation | Bitcoin is currently trading alongside other liquid macro assets, with significant trading activities. |

| Regulatory Efforts | There are increasing efforts for regulatory clarity, potentially boosting institutional confidence. |

Summary

Bitcoin below $70K presents a significant opportunity for institutions while causing anxiety for long-term holders. As market conditions fluctuate, the response to Bitcoin’s decline highlights contrasting perspectives between different types of investors. Despite the current bear market and uncertainty, institutional inflows remain strong, suggesting that Bitcoin continues to attract interest from major players who view this as a strategic entry point. This divergence in sentiment underscores the dynamic nature of cryptocurrency investments.

Understanding Bitcoin’s Position: Below $70K

The current fall of Bitcoin below $70,000 has garnered significant attention in the cryptocurrency community, particularly among institutional investors. For these entities, this price point represents not just a drop but a potential opportunity to acquire Bitcoin at a lower price, especially as many view this as a cyclical bear market. In contrast, long-term holders face uncertainty, concerned about the future trajectory of Bitcoin amidst ongoing economic volatility. This divergence in sentiment highlights the split between seasoned investors and newcomers entering the space.

While many retail investors may be discouraged by the recent drop, institutional interest in Bitcoin remains strong. Companies like Bitwise are experiencing substantial inflows as investors seek to take advantage of lower prices. This trust from institutional investors may serve as a stabilizing force for Bitcoin as it navigates through market fluctuations. Cumulatively, these developments position Bitcoin as an asset that continues to capture the attention of major financial players in the market.

Current Bitcoin Market Trends amidst Institutional Interest

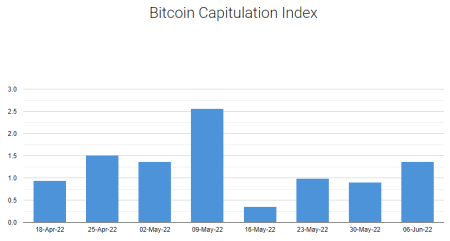

Bitcoin’s recent behavior, particularly its correlation with other macro assets, underscores the shift in how it is perceived in the investment world. As highlighted by Bitwise CEO Hunter Horsley, Bitcoin is caught in a broader market sell-off, making it imperative for investors to analyze its price trends carefully. The 22.60% drop in value over the last month places Bitcoin in a precarious position; however, it may also pave the way for a renewed investment phase for institutions, who are often better positioned to weather such downturns.

Moreover, the interest from institutions has only intensified despite the price downturn. Bitwise reported impressive inflows, signaling a growing confidence in Bitcoin’s long-term viability. Coupled with rising search interest from retail investors as reflected in Google Trends, the current landscape suggests a potential turning point for Bitcoin. Trends indicate that during market corrections, informed investors may capitalize on lower prices, potentially setting the stage for future bull markets.

Bitcoin Bear Market: Challenges and Opportunities

The ongoing bear market poses significant challenges for Bitcoin and its investors. With the price sinking below $70,000, fear and uncertainty have crept in among long-term holders, who may be re-evaluating their positions. The bear market has been characterized by a fluid trading environment, where the liquidity of assets like Bitcoin is being tested. During these testing times, the dynamic between sellers and buyers becomes crucial, as represented by the sentiments of various market participants.

Yet, bear markets also present unique opportunities for strategic investors. Institutional interest remains robust, as cited by Horsley, with massive inflows suggesting that larger investors view the current scenario as a temporary dip rather than a long-term decline. This suggests a broader market understanding that Bitcoin is still a robust asset, capable of bouncing back after corrections. Thus, while the bear market continues to challenge Bitcoin’s value, it also lays the groundwork for future prospects of growth and recovery.

Insights from Bitwise’s CEO on Future Bitcoin Trends

Hunter Horsley of Bitwise has articulated a clear vision regarding the future trajectory of Bitcoin amidst current market conditions. His assertion that institutional investors see the recent decline as a new opportunity reflects a growing maturity in the market. This viewpoint highlights a shift in investment strategies, where long-term potential may take precedence over short-term volatility. By managing over $15 billion in institutional assets, Bitwise serves as a bellwether for market sentiment and investor confidence.

Furthermore, institutional inflows of over $100 million within a short span indicate that large players are ready to capitalize on reduced prices. This influx juxtaposes the hesitance among retail investors, creating a complex market landscape. As institutional interest remains steady, it influences Bitcoin’s market dynamics, and new regulations are expected to provide further clarity, which might stabilize prices in the long run.

Navigating Bitcoin’s Volatile Market Landscape

In light of Bitcoin’s recent fluctuation, the overall market landscape presents both volatility and opportunity for investors. Diversified investment strategies are becoming increasingly essential as the market reacts to various external influences, such as macroeconomic trends and shifts in regulatory approaches to cryptocurrency. For instance, with Bitcoin and other macro assets intertwined, market sensitivity to liquidations and investor sentiments can create sharp price swings, as seen in the past month.

The ability to navigate this volatility is crucial for both institutional and retail investors. By understanding market trends and the factors that contribute to Bitcoin’s price movements, investors can make more informed decisions. The current bear market conditions can serve as a testing ground in which resilient strategies are developed, fortifying participants as they gear up for future market rebounds.

The Impact of Regulatory Clarity on Bitcoin Prices

As Bitcoin continues to grapple with price fluctuations, the topic of regulatory clarity emerges as a critical factor influencing market sentiments. Regulatory developments directly affect institutional interest, as clearer guidelines can mitigate uncertainties surrounding investment in cryptocurrencies. Recent discussions about the regulatory landscape hint at an emerging framework that could benefit Bitcoin’s adoption and legitimacy, potentially impacting its price positively.

Investment firms such as Bitwise are keenly observing these changes and positioning themselves accordingly to capitalize on the enhanced interest sparked by favorable regulations. As institutional backers gain clarity, the inflow of capital into the Bitcoin market could increase significantly, helping to restore confidence among investors and thereby influencing Bitcoin prices positively.

Retail vs. Institutional Investors: Diverging Perspectives

The dichotomy between retail and institutional investors becomes apparent in the current Bitcoin climate. While retail investors may respond to market fear with uncertainty, institutional investors are often driven by strategic positioning. The ability to see past short-term fluctuations allows institutions to perceive opportunities where retail investors may only see risk. As discussed by Horsley, this becomes particularly evident in the faces of recent declines below $70,000.

An increase in curiosity from retail investors, however, suggests a growing engagement with cryptocurrency, possibly leading to more informed investment choices. Understanding the motivations and strategies employed by institutional players can provide retail investors with insights into market resilience and future price movements. This evolving relationship between both investor types highlights the importance of education and awareness in navigating the Bitcoin market.

Google Trends and Bitcoin: Correlation with Price Movements

Recent spikes in Google Trends data concerning Bitcoin’s price movements indicate a strong relationship between public interest and market conditions. As Bitcoin saw a substantial drop, retail interest surged, reflected in record search volumes. This trend reveals that significant price drops can sometimes lead to increased scrutiny and curiosity about what is happening within the market.

The uptick in search activity can often precede shifts in market sentiment, as those who may have previously been hesitant to invest in Bitcoin become more inquisitive during downturns. As a result, the correlation between search trends and price movements not only highlights investor behavior but also the potential for market recovery. By staying attuned to these trends, investors can gauge overall sentiment and make timely investment decisions.

Future Outlook for Bitcoin After Price Corrections

Looking ahead, the future outlook for Bitcoin after recent price corrections remains optimistic, especially considering the robust institutional interest fueling demand. The cyclical nature of the market suggests that corrections often precede recovery phases, and institutions appear ready to lead this charge, capitalizing on lower price points for Bitcoin. Their involvement infuses additional liquidity and depth into the market, which may act as a stabilizing force.

Moreover, as awareness and understanding of Bitcoin grow among diverse investor groups, the potential for stronger price recovery increases. If institutions continue to advocate for Bitcoin and support its integration into more traditional financial flows, the asset could emerge from this bear market with renewed vigor. The focus on regulatory clarity and market innovation will play pivotal roles in shaping Bitcoin’s future, making it a fascinating asset to watch.

Frequently Asked Questions

What does Bitcoin below 70K indicate for institutional investors?

Bitcoin below $70K presents a unique opportunity for institutional investors, as highlighted by Bitwise CEO Hunter Horsley. With the recent market fluctuations, institutions view this dip as a chance to accumulate Bitcoin at lower prices, especially during a phase of heightened regulatory clarity.

How is Bitcoin’s current bear market affecting market trends?

Currently, Bitcoin is in a bear market, having fallen by over 22% in the last month. This significant decline has led to Bitcoin trading closely with other macro assets, influencing market trends as investors sell off liquid assets amid economic uncertainty.

What insights does Bitwise CEO have about Bitcoin’s price movements?

Bitwise CEO Hunter Horsley notes that the decline of Bitcoin below $70K has created mixed feelings among long-time holders, while institutions see this as a renewed investment opportunity. His insights indicate a potent mix of buyers and sellers in the market.

How does institutional interest influence Bitcoin price analysis?

Institutional interest plays a critical role in Bitcoin price analysis. As institutions continue to invest in Bitcoin, like Bitwise which manages over $15 billion, their activities can stabilize prices and contribute to market growth, even when Bitcoin trades below key thresholds like $70K.

What are the implications of Bitcoin trading below 70K for retail investors?

For retail investors, the recent drop of Bitcoin below 70K sparks increased curiosity and trading activity. As seen in Google Trends, interest reached a peak when Bitcoin prices fell sharply, indicating a potential for renewed engagement as investors look to capitalize on lower prices.

Why is Bitcoin’s correlation with macro assets significant?

Bitcoin’s correlation with macro assets during its recent price drop is significant because it demonstrates how broader economic factors influence cryptocurrency prices. This relationship indicates that Bitcoin’s performance is affected by global market sentiments, especially in a bear market.

What factors should investors consider when analyzing Bitcoin’s market performance below 70K?

Investors should consider factors such as institutional inflows, regulatory developments, and overall market sentiment when analyzing Bitcoin’s performance below 70K. As noted by Bitwise CEO, the current environment offers unique dynamics that could present favorable buying opportunities.

How does the decline in Bitcoin’s price impact overall digital asset investment sentiment?

The decline of Bitcoin below $70K impacts overall digital asset investment sentiment by causing uncertainty among long-term holders. Conversely, it can lure institutional investors looking for attractive entry points, thus affecting the broader cryptocurrency market’s investment landscape.