Stablecoin regulations are at the forefront of today’s digital finance discourse, as the U.S. Commodity Futures Trading Commission (CFTC) moves to shape a secure and robust framework. Under the GENIUS Act, national trust banks are empowered to issue dollar-pegged tokens, marking a significant evolution in the regulation of stablecoins. This development aims to enhance consumer protection while fostering innovation in the digital currency space. As the regulatory landscape continues to evolve, the importance of a clear stablecoin framework cannot be overstated for both investors and institutions. Keeping abreast of these regulations will be crucial for anyone engaged in the growing realm of digital assets.

The recent changes in the regulatory environment are reshaping how digital currencies are approached in the financial sector. Central to this shift are laws governing digital tokens, specifically those linked to stable values like the U.S. dollar. Recent initiatives aim to establish comprehensive guidelines that facilitate the issuance of these secure assets by accredited financial institutions. As the market for cryptocurrencies expands, the emergence of legislative measures is increasingly vital in ensuring these financial innovations adhere to safety and compliance standards. Understanding these new protocols will be essential for stakeholders navigating this dynamic landscape.

| Key Point | Details |

|---|---|

| Regulatory Body | U.S. Commodity Futures Trading Commission (CFTC) |

| New Regulations | Expansion of stablecoin regulations under the GENIUS Act. |

| Issuer Type | National Trust Banks |

| Token Type | Dollar-pegged tokens |

Summary

Stablecoin regulations are evolving with the U.S. Commodity Futures Trading Commission (CFTC) taking significant steps to accommodate national trust banks in issuing dollar-pegged tokens. This development under the GENIUS Act framework marks an important shift in how stablecoins will be governed, enhancing the regulatory landscape for cryptocurrency and ensuring greater stability and trust in digital financial systems.

Understanding Stablecoin Regulations in the U.S.

Stablecoin regulations are becoming increasingly important as the digital asset ecosystem continues to grow. With the rise of cryptocurrencies, stablecoins provide a bridge between traditional finance and digital currencies, offering users a more stable alternative. The U.S. Commodity Futures Trading Commission (CFTC) is at the forefront of regulating this sector, focusing on creating a safe environment for users and businesses while promoting innovation.

Under the evolving legislative landscape, the CFTC’s key focus is on comprehensive frameworks that incorporate aspects of stablecoin operations. This includes measures that ensure transparency, consumer protection, and the integrity of the financial markets. The introduction of the GENIUS Act aims to specifically address the nuances of stablecoins, setting the stage for enhanced regulatory oversight.

The Role of National Trust Banks in Stablecoin Issuance

National trust banks are expected to play a crucial role in the stablecoin market, particularly under the new regulations introduced by the CFTC. These banks will have the authority to issue dollar-pegged tokens, thus bringing a level of credibility and stability to the market. By leveraging the existing banking infrastructure, national trust banks can facilitate the growth of stablecoins and nurture the development of associated financial products.

The issuance of dollar-pegged tokens by national trust banks is not just about maintaining value stability. It’s also about exploring the potential for these institutions to enhance digital asset accessibility. As they integrate these tokens into their offerings, trust banks could redefine customer experiences in finance, reducing volatility while ensuring users can perform transactions seamlessly with digital currencies.

The Implications of the GENIUS Act on Stablecoins

The GENIUS Act is a landmark piece of legislation that aims to create a coherent framework for stablecoins in the U.S. This act is poised to mitigate the risks associated with issuing and trading digital assets while providing clear guidelines for all market participants. Key provisions may address the operational standards for stablecoin issuers, ensuring they have adequate reserves in place.

As a comprehensive regulatory framework, the GENIUS Act could also pave the way for the potential recognition of stablecoins as viable payment methods, promoting their use in everyday transactions. With regulatory clarity, issuers can confidently enter the market, and consumers may experience enhanced protections when using stablecoins.

CFTC Stablecoin Rules and Their Impact on the Cryptocurrency Market

The CFTC is spearheading the introduction of stablecoin rules aimed at bolstering investor confidence in the cryptocurrency market. By establishing a regulatory framework around stablecoins, the agency aims to ensure that these digital assets comply with existing financial regulations. The rules will focus on maintaining a clear distinction between fiat-backed tokens and other cryptocurrencies, which can be crucial for market participants.

Moreover, the impact of CFTC rules extends beyond regulatory clarity; it also influences the behavior of market participants. As issuers align their products with CFTC compliance, there may be a shift in how consumers perceive stablecoins, potentially leading to increased adoption. This evolution may result in a ripple effect across the broader cryptocurrency landscape, as users begin to prioritize compliance and security.

The Future of Dollar-Pegged Tokens in the Financial Ecosystem

Dollar-pegged tokens represent a significant innovation in the world of finance, blending the advantages of digital assets with the stability of fiat currencies. Their structure allows for a one-to-one value with the U.S. dollar, which can provide users with a familiar understanding of value in an otherwise volatile crypto market. As the demand for such tokens increases, their adoption in various financial sectors is likely to expand.

As financial institutions adapt to this change, we can expect to see dollar-pegged tokens being integrated into payment systems and investment portfolios. This integration could facilitate smoother transactions, international remittances, and even alternative investment vehicles. Innovations in a stablecoin framework will also enhance the functionality of these tokens, making them even more attractive to users.

Navigating the Stablecoin Framework: What to Expect

With the establishment of a stablecoin framework under the CFTC and the GENIUS Act, market participants can anticipate several advancements. The framework may feature guidelines around how stablecoins should be backed, ensuring secure reserves that correlate to their issued quantity. By fostering confidence in the structure of these digital assets, users will likely feel more comfortable engaging in transactions.

Moreover, a comprehensive stablecoin framework is expected to facilitate interoperability among cryptocurrencies and fiat currencies, enhancing market liquidity. As this framework evolves, it may encourage traditional finance institutions to enter the stablecoin space, significantly impacting the overall financial landscape.

Challenges Facing Stablecoin Regulation

While the advancement in stablecoin regulations offers numerous benefits, challenges remain. Lawmakers, including the CFTC, must navigate the complexities of integrating new regulations with existing financial frameworks. The rapidly changing technological environment poses hurdles in keeping regulations relevant and effective, necessitating ongoing dialogue between regulators and industry stakeholders.

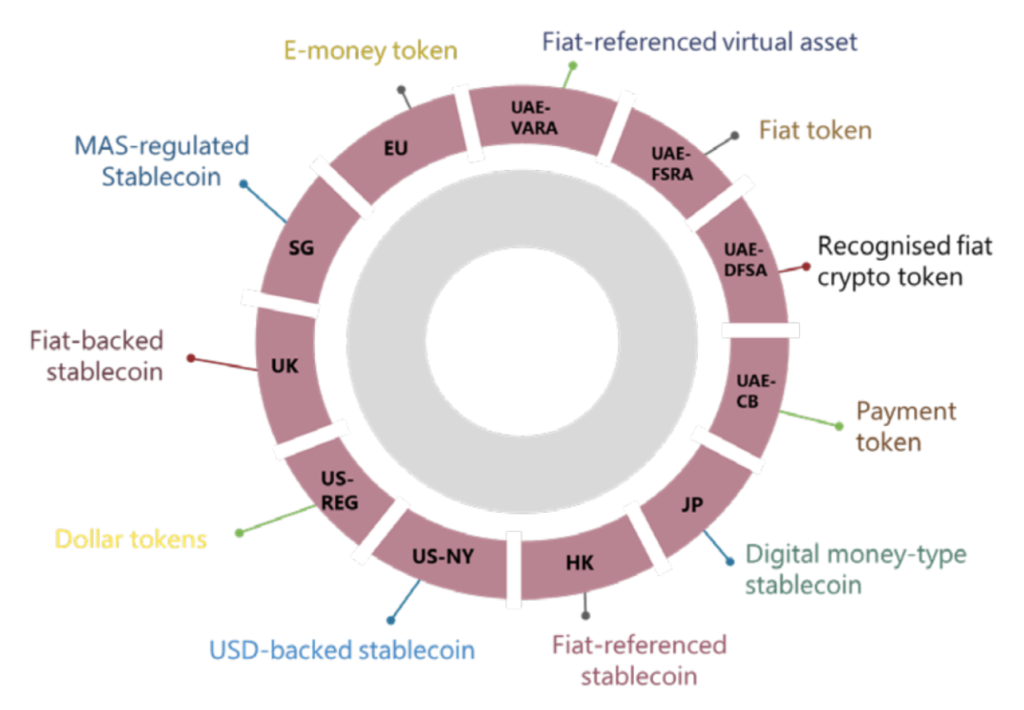

Additionally, the global nature of cryptocurrencies complicates regulatory efforts, as different jurisdictions may have varying approaches to stablecoin governance. Harmonizing these regulations will be critical to ensure user confidence and the successful adoption of stablecoins on a global scale, reflecting the need for cohesive legislative approaches.

The Importance of Investor Protection in Stablecoin Transactions

As stablecoins gain traction within the cryptocurrency ecosystem, ensuring investor protection becomes paramount. Regulations set forth by the CFTC and initiatives under the GENIUS Act are designed to safeguard users from potential fraud and market manipulation. Transparent operational guidelines will help consumers discern credible stablecoin issuers from those lacking integrity.

Moreover, robust consumer protection measures will likely enhance trust among users, thereby increasing the overall adoption of stablecoins. An environment where users feel protected can lead to greater engagement and use of digital currencies in financial transactions, which is essential for the long-term success of the stablecoin market.

Exploring the Relationship Between Stablecoins and Traditional Banking

The intersection of stablecoins with traditional banking services presents exciting opportunities. With national trust banks paving the way for the issuance of dollar-pegged tokens, a new chapter in banking could emerge. Customers may find it easier to convert between fiat and digital currencies, simplifying their financial operations and potentially enhancing liquidity.

This synergy between stablecoins and traditional banking may also encourage financial institutions to innovate further. Banks could develop new financial instruments and services that leverage stablecoins, catering to a tech-savvy population eager for seamless digital transactions. As these institutions adapt, we may witness a paradigm shift in how banking services are offered.

Frequently Asked Questions

What are the new CFTC stablecoin rules for national trust banks?

The new CFTC stablecoin rules allow national trust banks to issue dollar-pegged tokens, enhancing regulatory measures around stablecoins in the U.S. This framework, part of the GENIUS Act, aims to provide clearer guidelines for stablecoin issuance and management.

How does the GENIUS Act impact stablecoin regulations?

The GENIUS Act significantly impacts stablecoin regulations by establishing a framework that empowers national trust banks to issue stablecoins, specifically dollar-pegged tokens. This regulatory clarity helps ensure safer integration of stablecoins into the financial ecosystem.

What is the stablecoin framework under the GENIUS Act?

The stablecoin framework under the GENIUS Act sets regulations for the issuance and management of stablecoins, allowing national trust banks to create dollar-pegged tokens while ensuring consumer protections and financial stability in the cryptocurrency market.

What are dollar-pegged tokens and how are they regulated?

Dollar-pegged tokens are a type of stablecoin designed to maintain a value equivalent to one U.S. dollar. Under the CFTC stablecoin rules and the GENIUS Act, these tokens are now regulated, allowing national trust banks to issue them in a structured manner, promoting security and transparency.

Why is regulation important for stablecoins like those under the CFTC?

Regulation is crucial for stablecoins to ensure their stability and reliability in the financial system. The CFTC’s approach helps foster trust, protect consumers, and promote a stable economic environment, particularly as national trust banks issue dollar-pegged tokens under the GENIUS Act.

What role do national trust banks play in the new stablecoin regulations?

National trust banks play a pivotal role in the new stablecoin regulations as they are authorized under the CFTC rules to issue dollar-pegged tokens. This role is defined within the GENIUS Act framework, ensuring these institutions adhere to strict regulatory guidelines, thus enhancing trust in stablecoin transactions.

Could you explain the implications of stablecoin regulations on the market?

Stablecoin regulations, particularly those enforced by the CFTC and outlined in the GENIUS Act, can stabilize the market by ensuring that dollar-pegged tokens are issued by credible institutions like national trust banks, fostering consumer confidence and facilitating broader adoption of digital currencies.

What are the benefits of the CFTC’s stablecoin regulations for consumers?

Consumers benefit from the CFTC’s stablecoin regulations as they promote security and transparency in dollar-pegged tokens issued by national trust banks, helping to prevent fraud and ensure that stablecoins maintain their intended value, thus enhancing user confidence in digital transactions.